Bitcoin Cash Price Prediction Today September 3 – BCH Technical Analysis

Join us telegram Stay up to date with the latest news coverage by subscribing to our channels.

Bitcoin Cash price prediction shows that BCH may head towards the lower boundary of the channel and then settle into consolidation.

Bitcoin Cash Prediction Statistics Data:

- Bitcoin Cash Current Price – $313

- Bitcoin Cash Market Cap – $6.17 billion

- Bitcoin Cash Circulation – 19.75 million

- Bitcoin Cash Total Supply – 19.75 million

- Bitcoin Cash Coinmarketcap Ranking – #15

Evaluating the potential of a cryptocurrency often benefits from early investment. For example, Bitcoin Cash (BCH), which currently has a 24-hour low of $311.42 and a high of $325.87, has seen dramatic volatility over time. It reached an all-time high of $4,355.62 on December 20, 2017, down 92.82% from that peak. Conversely, it reached an all-time low of $75.08 on December 15, 2018, but has since surged more than 316% from that low. This historical performance highlights both the token’s volatility and its significant recovery potential.

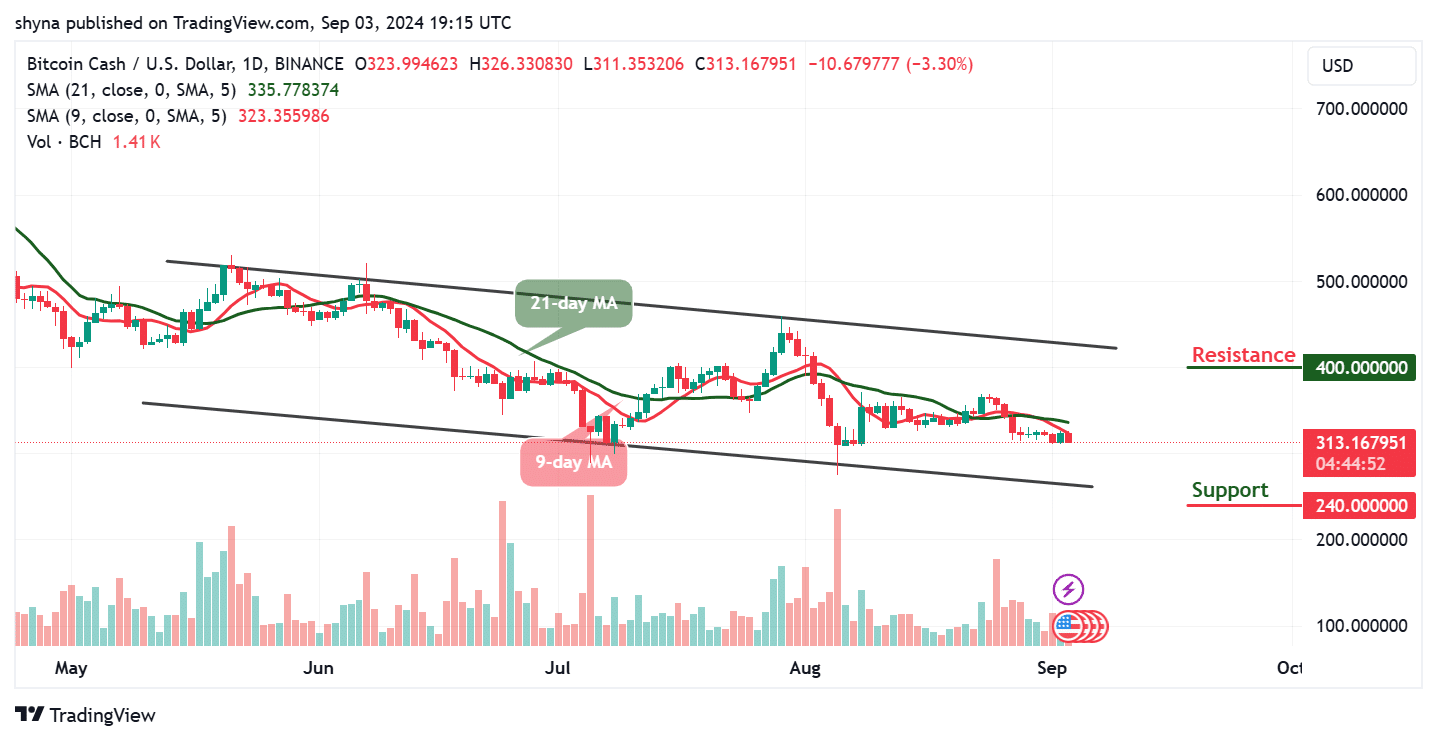

BCH/USD Market

Main levels:

Resistance Levels: $400, $420, $440

Support Levels: $240, $220, $200

BCH/USD is trading within a descending channel and has encountered significant resistance at $313. This level has historically acted as both support and resistance, making it a crucial barrier for BCH. The strength of this resistance was highlighted when the price recently attempted to break out of the moving average but was rejected at the $326 level.

Bitcoin Cash Price Prediction: BCH Price May Consolidate Below Moving Averages

Despite the recent rejection, Bitcoin Cash price has formed several bullish patterns, including a breakout from a long-term falling wedge. This pattern suggests a possible uptrend, but the price is currently testing the $311 level, which has provided strong support. However, this support is important, as a breakdown could trigger further declines, potentially testing the lower support of the channel around $250. A further downtrend could hit the important support levels of $240, $220, and $200.

However, if BCH manages to break out of the current descending channel, the next important resistance level to watch could be around $360. A breakout of this level could start a rally towards this target, providing significant upside potential for traders. Meanwhile, if buying pressure increases, the price could break out towards the channel and reach the $380 resistance level. While trading at this level, a bullish continuation could reach the $400, $420, and $440 resistance levels respectively.

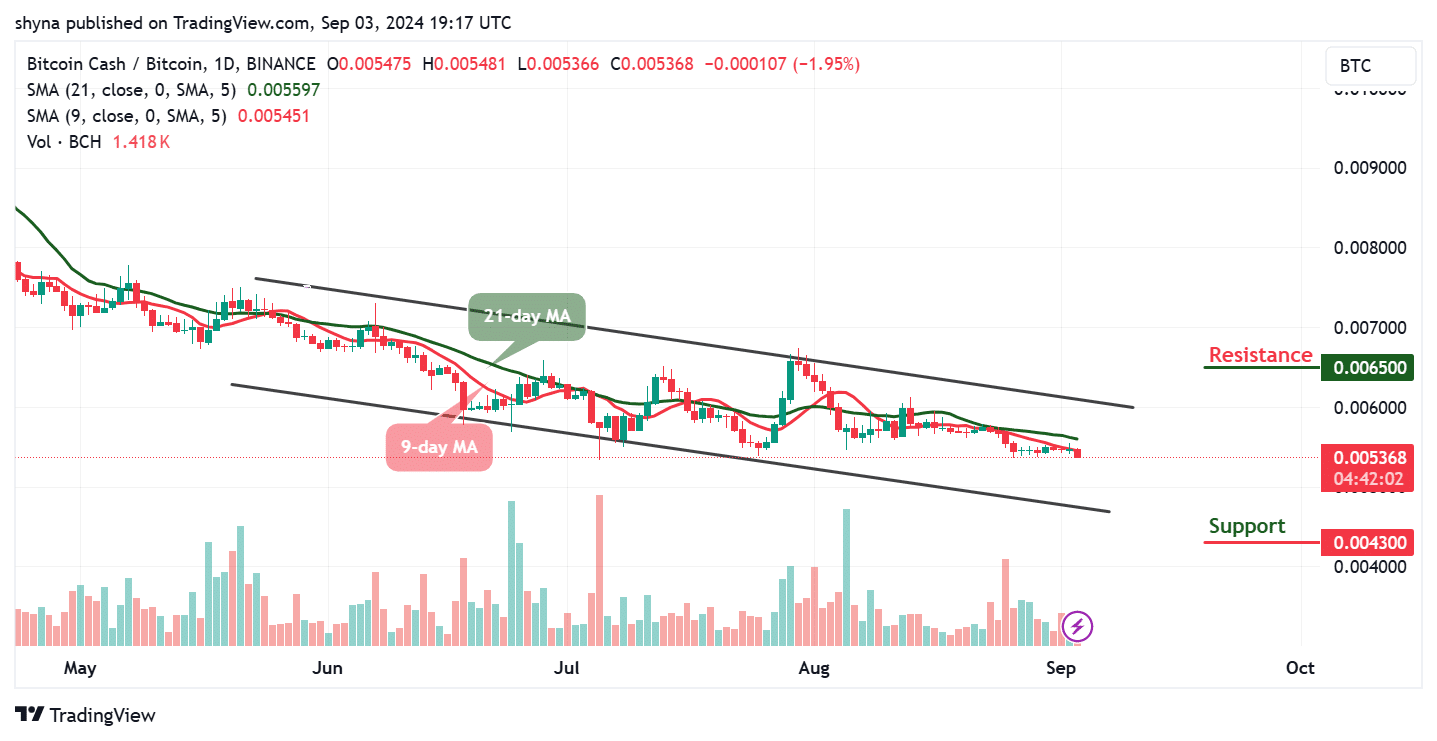

BCH/BTC continues to decline

Regarding Bitcoin, Bitcoin Cash is likely to continue its bearish move as bears continue to show serious will within the market. Based on recent negative signals, the bearish trend could continue as long as buyers fail to push the price above the 9-day and 21-day moving averages.

However, the 9-day moving average remains below the 21-day moving average, confirming the downtrend. Therefore, further downtrends could reach support levels below 4300 SAT, but a bullish cross above the upper boundary of the channel could push the price to resistance levels above 6500 SAT.

Meanwhile, in late August, @HBVT8375 provided an update to his followers on X (formerly Twitter) on the future of $BCH. He noted that if $BCH were to close the month above $400, similar to last month, it could signal the start of a significant bull market. However, if it fails to reach that level, he advised accumulating more $BCH in preparation for a future rally. This strategic outlook highlights the importance of the $400 level as a key indicator of potential bullish momentum in the market.

August is coming to an end. $Bitcoin This month, like last month, it closes above $400. If so, it will be a big bull market. $Bitcoin You are ahead. Otherwise, buy more. pic.twitter.com/mhkCchqtW4

— LEO68 (@HBVT8375) August 30, 2024

Alternatives to Bitcoin Cash

Bitcoin Cash is at a critical juncture, and could see significant price action depending on its ability to break the major resistance level of $350 and maintain uptrend support. At the same time, Pepe Unchained is attracting significant market interest, with recent inflows of over $150,000, setting it apart from other meme coins such as Shiba Inu and Dogecoin. With a low market cap, strong investor confidence, and having raised over $11.7 million in its presale, Pepe Unchained presents a promising investment opportunity.

Pepe Unchained This is a must-have meme coin. Here’s why:

Having raised over $11.7 million and attracted significant daily inflows, Pepe Unchained is emerging as a prominent player in the crypto market. The advanced Layer 2 blockchain offers fast transaction speeds, low fees, and a dedicated block explorer. With the potential to grow 100x by 2025 and an annualized staking yield of 193%, $PEPU presents an attractive investment opportunity. The strong market interest and positive outlook make now a good time to invest in Pepe Unchained and establish it as a promising asset in your investment portfolio.

Visit Pepe Unchained

Related News

Most Searched Crypto Launch – Pepe Unchained

- Layer 2 Meme Coin Ecosystem

- Featured on Cointelegraph

- SolidProof and Coinsult audited

- Staking Rewards – pepeunchained.com

- ICO Raises Over $10 Million – Closing Soon

Join us telegram Stay up to date with the latest news coverage by subscribing to our channels.