Bitcoin fluctuates amid growing institutional acceptance.

The following is an excerpt from the latest edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be the first to get these insights and other on-chain Bitcoin market analysis delivered to your inbox, Subscribe now.

Bitcoin has seen a slight reversal in its ongoing bull run in the final months of 2023. Nonetheless, these price movements could signal an upcoming bull market as the asset finds new backers.

Throughout its entire history, Bitcoin has been a volatile asset. In the nearly 15 years since the Genesis block was mined, the greatest values have always been the result of dramatic spikes, and the declines from those highs have always been steep. Nonetheless, there has always been an uncanny tendency to end up in a better situation once the dust settles. This volatile nature has even been seen as a positive in many ways because it reinforces the core truth of Bitcoin. Bitcoin is ultimately a currency with a new vision of how economic relationships should work in society. Although it has benefited greatly from people who want to treat Bitcoin purely as an investment asset, these people cannot form the core of the community.

That said, the price of Bitcoin fell on December 11 after a bull market that lasted several months. Fueled by generally positive rumors that a Bitcoin ETF has received federal regulatory approval, prices have continued to rise despite challenges such as a CEO change at Binance, the industry’s largest exchange. This new rally looked like it could withstand significant shocks a year ago, but its invincibility could not last, with prices down nearly 6% since midnight Sunday, at the time of this writing. With the price hovering around the $41,000 range, a notable development is the apparent lack of fear everywhere in the Bitcoin world.

Bitcoin Magazine Pro is a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

For the most bullish Bitcoin investors, it may seem fairly standard to view every price drop as a “healthy correction” or a pause in an “overheated” market. Barons “The tea leaves of cryptocurrency derivatives still point to a bullish animal spirit,” he argued. Speaking primarily about a series of potential catalysts, the highly regarded weekly publication seemed to point to only minor reasons for these setbacks. In particular, it quotes FxPro analyst Alex Kuptsikevich as saying: “A wave of profit-taking hit the cryptocurrency market on Monday morning… There was a massive exodus from long positions with low liquidity… “Strong demand for risk assets in traditional markets will push the market back to its previous growth trajectory.”

In particular, these long positions are at the heart of the recent economic downturn. After several months of success, indirect investors have shown particular interest in risky bets involving Bitcoin. These investors showed greater interest in entering futures contracts in highly leveraged positions. Bets like these are easier to set and make money without a higher start-up capital, but they are automatically liquidated if Bitcoin suddenly falls. The sudden price drop resulted in a loss of around $330 million on this bet, a figure that rose to $500 million the next day. These leveraged positions appear to have suffered the most from the price decline yet.

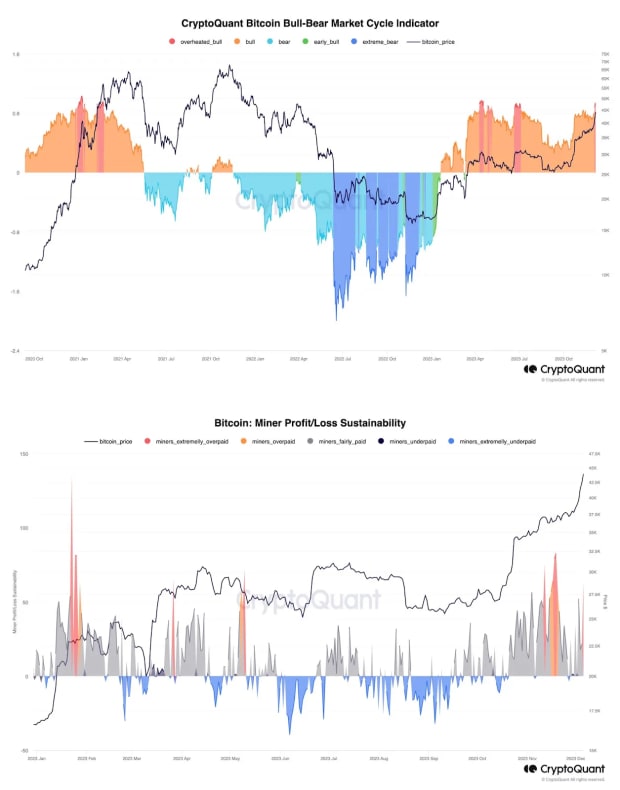

In other words, as analysts were quick to point out, the market was too hot. A series of numbers lend support to the argument that Bitcoin’s success encouraged these risky bets. Not only has the bull market entered a historically unstable pace for the first time since the previous bull market, but other factors, such as mining difficulty, act as canaries in the coals. Mine. As the next halving becomes increasingly imminent, miners cannot expect a sustained scenario where mining rewards increase faster than mining difficulty. But that’s exactly the scenario that has played out so far.

So, although some experts argue that this cooling off period could last a month or more, the overwhelming consensus is that the Bitcoin price will be stronger than ever for the foreseeable future. But why is this like this? Of course, Bitcoin’s small setback doesn’t seem to hurt anyone other than heavily leveraged futures traders, but as CNBC puts it, it wouldn’t justify the actual belief that “there’s a lot of momentum left in the current Bitcoin uptrend.” What can you do? The answer comes from the same thing that created this momentum: genuine belief in the Spot Bitcoin ETF.

Last week, rumors that major ETF applicants were nearing a breakthrough in negotiations with the SEC gave way to new negotiations. Notably, BlackRock extended a new invitation to big Wall Street banks to join the action. In its proposal, BlackRock requested changes to the ETF protocol to allow certain authorized participants to invest using cash instead of Bitcoin. Considering that some large banks are prohibited from holding Bitcoin or other digital assets directly, this change opens the door directly to some of the industry’s largest players. Offers like this seem to further suggest that BlackRock’s talks with the SEC have settled to a new level.

Additionally, Google updated its advertising policies, quietly making the change to a platform that has historically been highly skeptical of Bitcoin-related products. With a few caveats, Google will now allow ads for “cryptocurrency coin trusts” to users in the United States, specifically asserting that financial assets representing real-world digital currencies are fair game. Additionally, Google has relaxed its enforcement strategy for these types of violations, turning immediate suspensions into seven-day warnings. Changes like this seem to suggest that the search engine giant is expecting approval soon.

That said, these setbacks are just a natural part of Bitcoin’s life cycle, and Bitcoin investors appreciate them. Sometimes Bitcoin’s massive success attracts newcomers who do not fully understand that Bitcoin’s volatility reduces both. Traders saw heavily leveraged positions as a cheap way to potentially make a lot of cash from Bitcoin’s rising price, and now the temporary setback has seen hundreds of millions of dollars evaporate. But this is nothing new. A stagnation phase like this prevents the market from growing unsustainably for too long and ensures that anyone interested in Bitcoin for a long time will enjoy more than just a quick profit opportunity. Bitcoin’s ability to achieve rapid rises is what draws people in, and rapid falls are what tempers their expectations. All of these moves further increase Bitcoin’s power.