Bitcoin Focus on Sub-$60K Levels After Daily Liquidation of Crypto Close to $300M

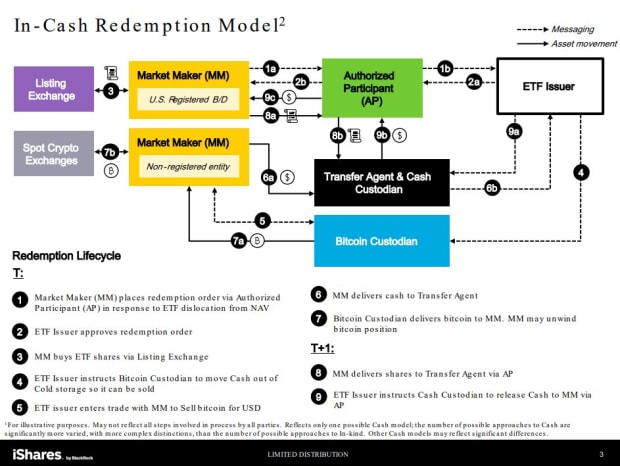

Bitcoin (BTC) hit a two-week low around the Wall Street open on April 30, amid disappointing results from new cash exchange-traded funds (ETFs).

BTC price suddenly changed to target $60,000.

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD fell sharply after the Asian trading session, with the pair losing support at $61,000.

Liquidations occurred quickly across cryptocurrencies, totaling $275 million in 24 hours, per data from monitoring resource CoinGlass.

The already cautious mood turned decidedly bearish after it was revealed that the first day of trading volume for Hong Kong’s new Bitcoin ETF was significantly lower than expected.

The new product brought in $12.4 million, still impressive given the size of the local market, according to Bloomberg Intelligence analyst Eric Balchunas.

in reaction On X (formerly Twitter), Balchunas left a distinctly positive impression about the first day’s performance.

“East vs. West: America had $740 million in assets and $4.6 billion in trade. This is much lower than that, but when you size up the market it’s a different story. That’s equivalent to over $25 billion and $1.6 billion respectively,” one post read.

“For context, China AMC’s Bitcoin ETF was already in the top 20% of the largest in that market after one day.”

Balchunas also added that the timing of the Hong Kong launch, at a time when US trading volumes are turning “slightly negative,” will contribute to overall spot ETF flows.

The latest data from sources including UK-based investment firm Farside shows four consecutive days of net outflows from US ETFs through April 29.

Bitcoin futures short selling concerns

Considering where the current BTC price weakness could reverse, market participants have their eyes set on both $60,000 and points just below.

Related: What will be the worst month since the 2022 bear market? 5 things you need to know about Bitcoin this week

“The 50-day EMA has potential support and the $60,000 level looks like a solid bottom of the current consolidation range, extending up to $74,000,” said Yann Allemann and Jan Happel, co-founders of on-chain analytics firm Glassnode. assert Part of this day’s X post.

“Optimism continues with the market favoring a ‘buy when it dips’ approach. However, a violation of the $60,000 support could further increase the stability of the $52,000 level, historically attracting buyers and strengthening the uptrend.”

Allemann and Happel mentioned the 50-day exponential moving average (EMA), while popular trader Wolf looked at the 21-day equivalent. Both trend lines were hovering around the $64,500 level at the time of writing, with the daily candle expected to lag well behind.

Fellow trader Axel Adler added that Bitcoin futures were selling off, raising doubts about nearby support.

This article does not contain investment advice or recommendations. All investment and trading activities involve risk and readers should conduct their own research when making any decisions.