Bitcoin Funding Rate Flips Negatively as NASDAQ Futures Tank 700 Points

Bitcoin (BTC) market sentiment turned bearish with Wall Street’s technical-heavy NASDAQ futures trading down 700 points. Risk aversion is driven by concerns that cost-effective Chinese artificial intelligence startup DeepSeek could significantly challenge U.S. technological dominance.

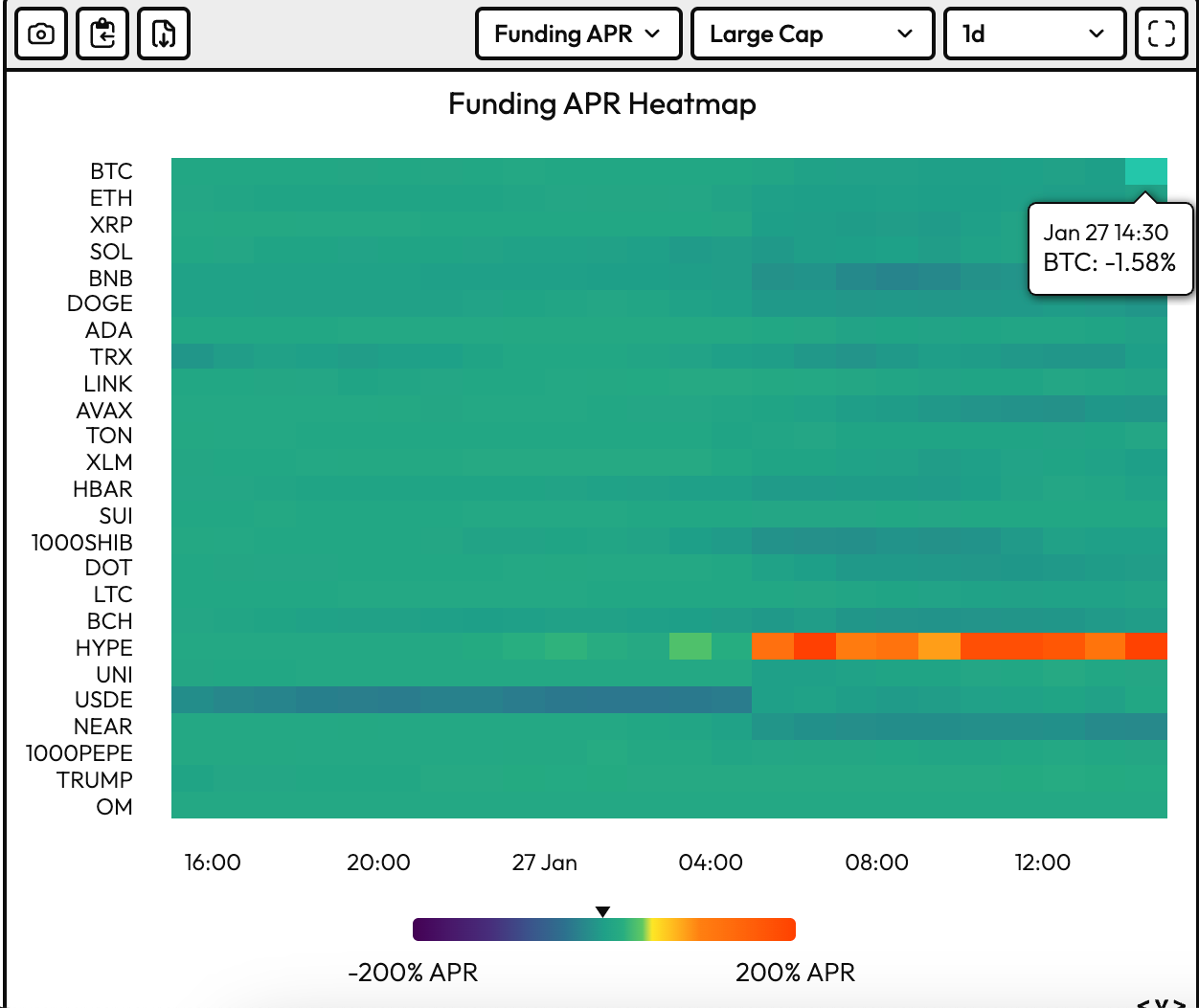

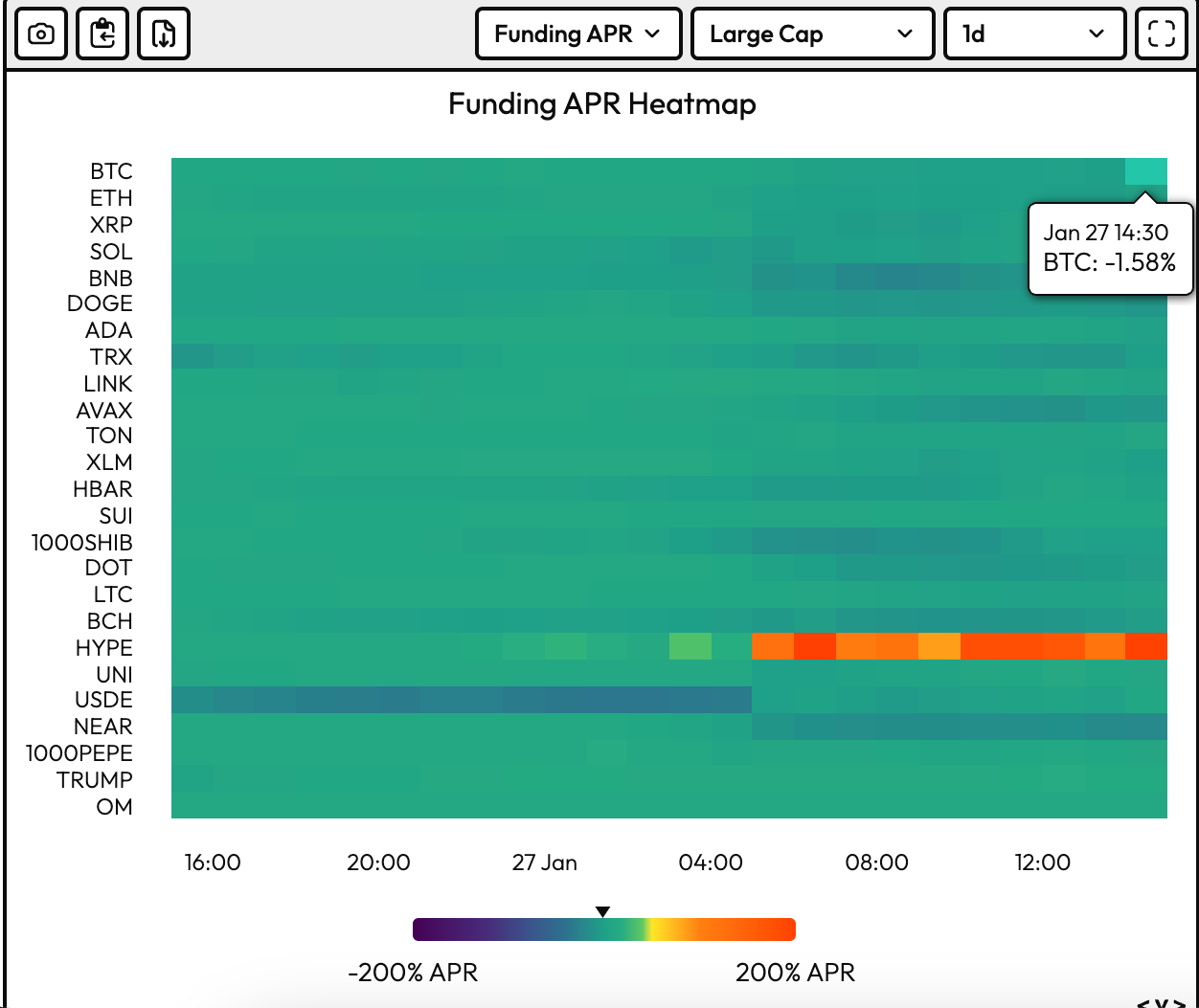

Bitcoin’s perpetual futures funding rates, periodic payments between long and short positions in perpetual futures contracts, have yielded negative results, according to data from data source Velo. It is a sign of further bearish sentiment in the market. Traders are chasing short positions in anticipation of low prices.

The leading cryptocurrency by market cap has fallen more than 3% since early Asian hours, reaching a low of less than $98,000 at one point, according to Coindesk data. Futures tied to the NASDAQ were down more than 3.5%, while Nvidia fell 10% in pre-market trading, Belivia on All Things AI.

“Today’s selloff fails to confirm that the US will set up a Bitcoin sanctuary after President Donald Trump gave the green light to a working group on crypto policy last week. Meanwhile, the co-founder and CEO of Chinese artificial intelligence startup DeepSeek Mercuryo PETR KOZYAKOV said by email.

However, historically negative flips in financing rates have tended to mark a bottom in local prices. Besides, there is always the risk that the bears will throw in the towel and chase away bets, causing a rise in the price. In other words, the funding ratio was narrowly weak. This means that it is too early to call short BTC in overcrowded trade.