Bitcoin Halving Postmortem: Insights from Hashrate Index’s Q1 2024 Report

introduction:

Luxor Technology’s latest Q1 2024 Hash Rate Index report takes a closer look at the performance of the Bitcoin mining sector following the fourth Bitcoin halving. The report provides important insights on key indicators such as Bitcoin hashrate, hash price, hashrate delivery and Bitcoin mining stocks, thereby predicting the adaptability of the Bitcoin mining industry and mining in the 3.125 BTC block subsidy world. Highlights the challenges those will face.

Bitcoin hash price and hash rate changes

Now that the fourth halving has passed, Bitcoin miners are paying particular attention to two indicators: hash price and network hash rate.

The hash price is a measure of how much profit a miner can make per day when hashing into a full-pay per week mining pool. All else being equal, we should expect the hash price to be cut in half by the halving, which halves the Bitcoin block subsidy.

But this did not happen immediately. Hash prices experienced extreme volatility just before and after the halving. At the time of the halving, the price of hash fell to $74/PH/day, but immediately rose to a high of $183/PH/day as trading fees surged due to rune trading activity. The hype for Rune was short-lived, and hash prices soon fell to an all-time low of $44/PH/day before stabilizing at current levels of $50/PH/day. The previous all-time low for hash prices of $55/PH/day occurred in 2022 in the aftermath of the FTX incident, and the new hash price reality highlights the brutal economic conditions miners are currently facing.

This brings us to the next key indicator that halving affects: hashrate. During the first quarter of 2024, Bitcoin’s seven-day average hash rate increased 19% to 611 EH/s, and in April it increased another 6% to an all-time high of 650 EH/s. As things calmed down after the halving, Bitcoin’s hash rate fell 10% from its all-time high to 580EH/s.

Given that mining margins are compressing and summer is approaching (which will likely require industrial-scale mining farms like Texas to reduce power consumption, which is a headwind for hashrate growth), Bitcoin’s hashrate is expected to increase slightly this year. You should.

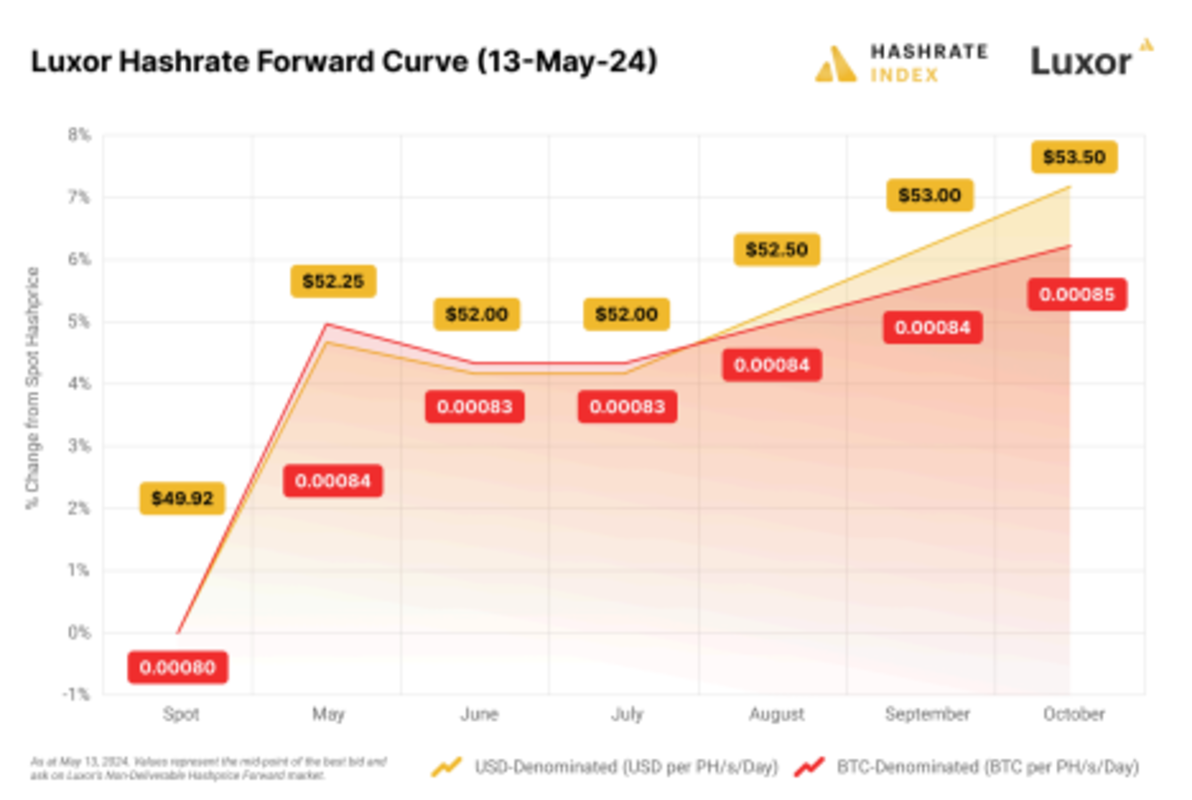

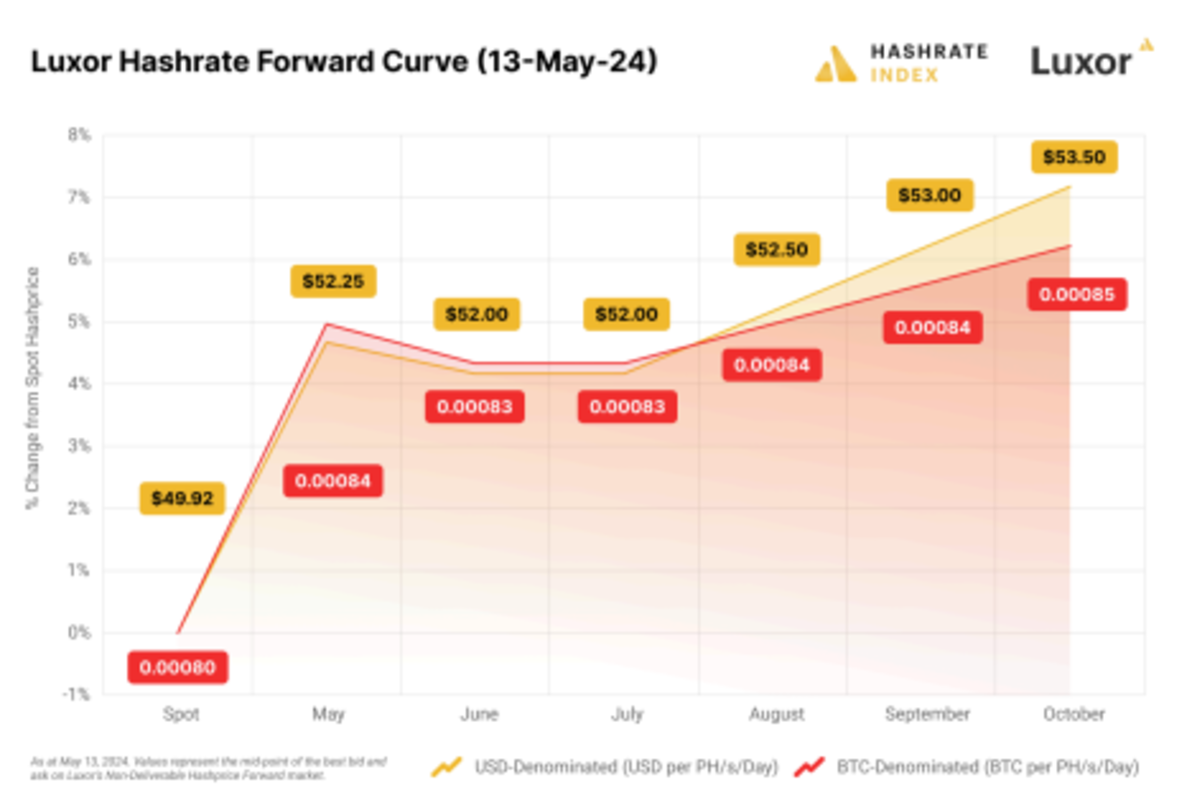

Hash price is trading in contango

In particular, traders in the hashrate market believe that the hash price is bottoming (at least for now).

Luxor’s Hashrate Forwards, a Bitcoin mining derivative that allows miners and other participants to buy and sell hashrate at a fixed price at a future date, is trading in contango. This means that hashrate traders expect hashrate to be higher than the current spot price in the coming months. . This suggests optimistic sentiment among Hashrate Forwards traders who expect hash prices to potentially rise due to rising transaction fees or reduced mining difficulty.

As mentioned in the last section, the shrinking of mining hotspots like Texas could temporarily take hash prices offline, improving hash prices and mining margins.

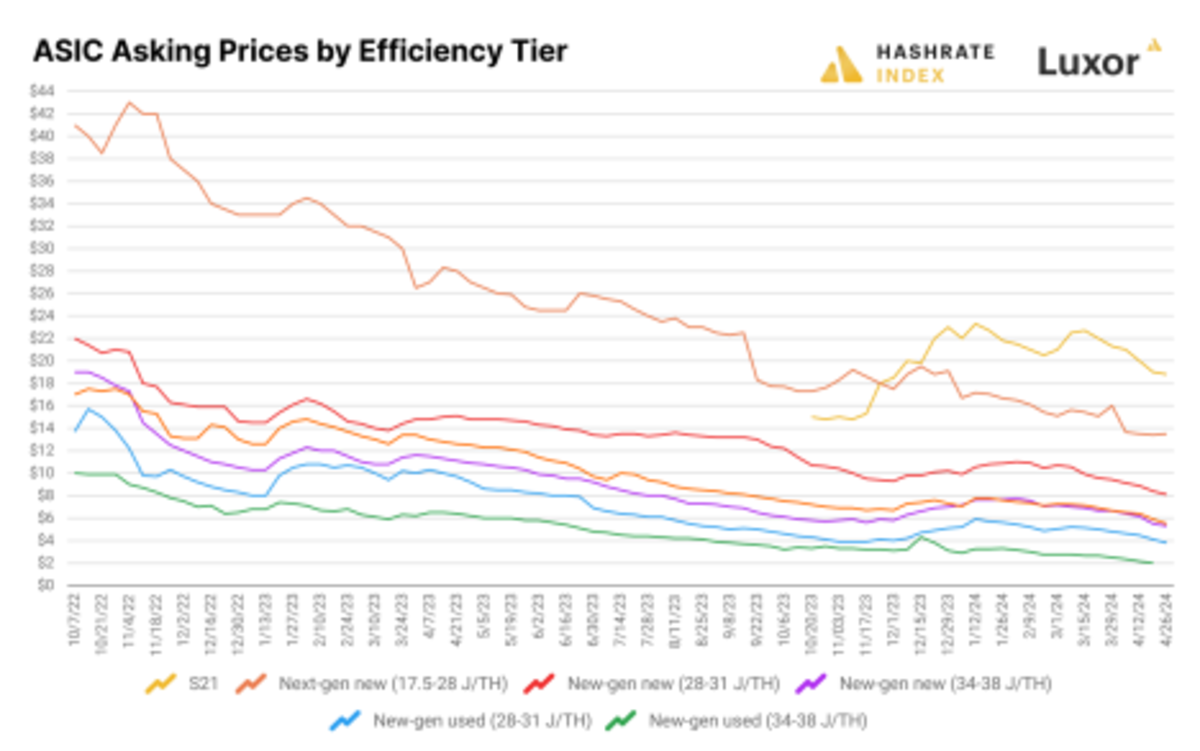

ASIC market is experiencing price discovery

The ASIC market has seen a significant slowdown as the halving approaches, with various models experiencing notable price declines despite higher average hash prices in Q1 2024. Naturally, the price premium of the Antminer S21 compared to other models has increased. This signals a strategic shift among Bitcoin miners to more efficient hardware to mitigate post-halving revenue declines.

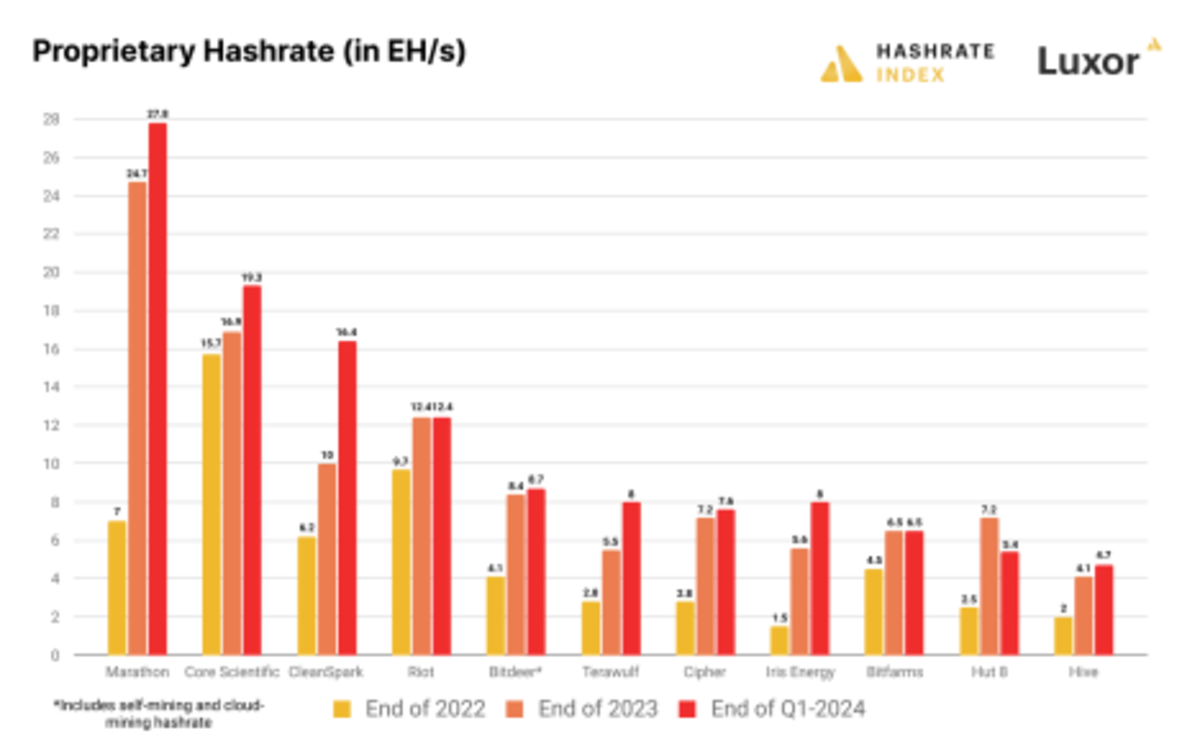

Bitcoin mining stocks are in a race against hash rate and efficiency.

All major public Bitcoin miners increased their hash rates throughout 2023, but some miners took more aggressive steps to increase their hash rates in early 2024. Now that block subsidies have been halved, it is essential for miners to equip their ASIC fleets with the latest technology. Hardware to remain competitive in the hashrate arms race and lower operating costs per hashrate unit.

Forecasts and outlook after 2024

Barring a significant rise in the price of Bitcoin and/or rising transaction fees, 2024 will be a difficult year for Bitcoin miners. Now more than ever, transaction fees will play a significant role in miners’ profits.

In terms of coping with the new normal, businesses that fail to do so in 2023 will need to get creative with their operating strategies. In addition to optimizing your vehicle’s power efficiency and securing more favorable power contracts with the latest ASIC models, alternative revenue streams or venues to optimize your ASICs using aftermarket firmware, adopt more sophisticated hedging strategies, and reduce operating costs. You can find .

Consolidation through mergers and acquisitions is expected in the United States and Canada as companies take advantage of discounted pricing for ASICs and mining facilities. As the mining sector continues to mature, mining will become more entrenched and integrated into the energy system. We believe the current halving era will accelerate this consolidation as miners flock towards power generation sources to take advantage of the lowest possible power costs. .

This is a guest post by Alessandro Cecere and Colin Harper. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.