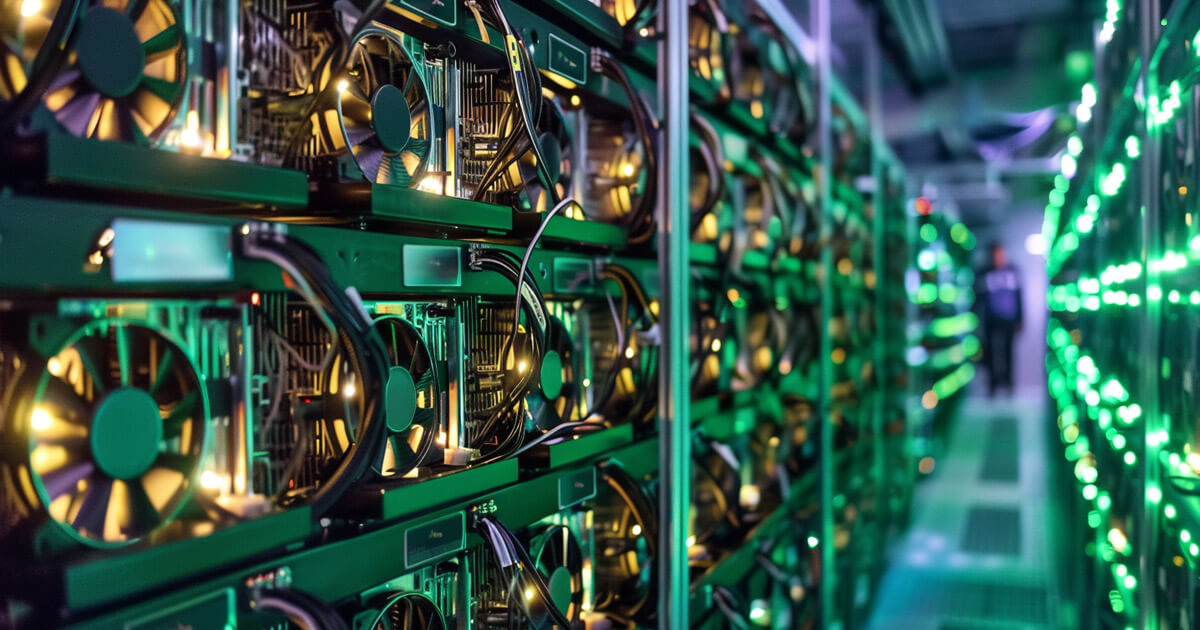

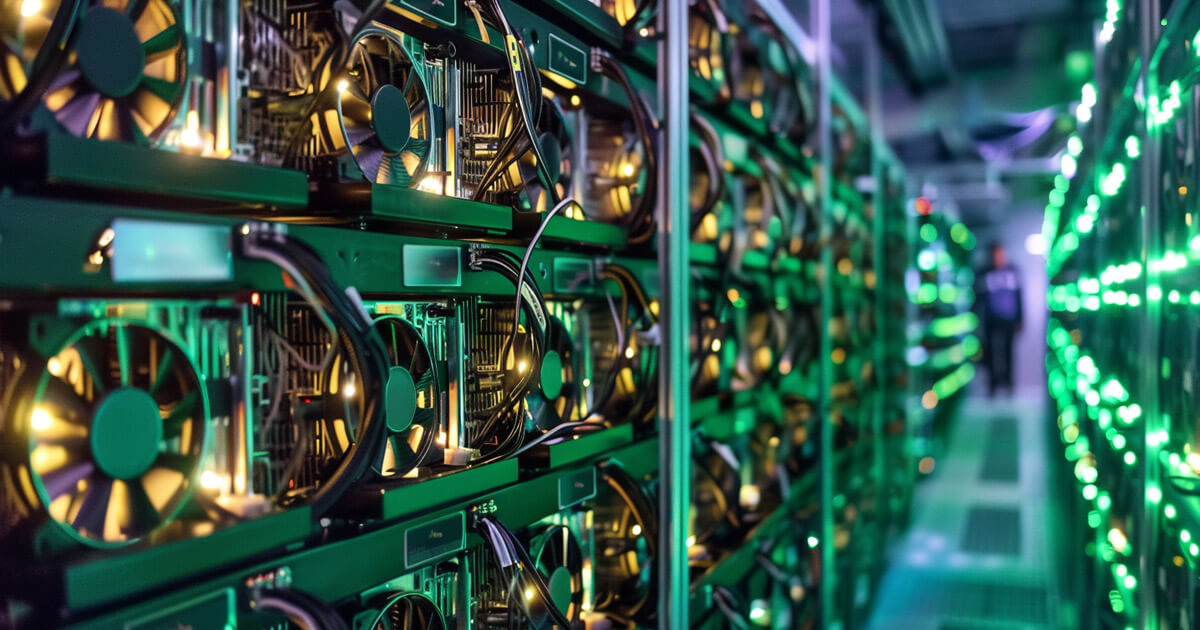

Bitcoin halving reduces production, reduces profits for top miners

Stronghold Digital Mining reported a 47.1% decline in monthly Bitcoin mining production in May.

The company mined 82 BTC in the first month after the halving, compared to 155 BTC in April.

Meanwhile, sales this month were $5.2 million, down 46% from the previous month.

Stronghold explicitly states that this drop has been halved. The company said:

“The primary reason for the decline was due to operations in the first month after the halving.”

The company also reported that the average hash price in May was $0.052 per TH/s, down from 0.095 in April. This was due to the halving and block reward reduction, a 0.8% drop in Bitcoin price, and transaction fees falling from 25.3% in April to 7.4% in May.

This partially offset the trend by observing a network hash rate of 1.2%.

Overall production decline

Likewise, Cipher Mining reported that it mined 166 BTC in May compared to 296 BTC in April, a 43.9% decrease from the previous month.

The company acknowledged the impact of the Bitcoin halving, but emphasized that it has maintained positive cash flow and expanded its inventory and operating sites.

Marathon Digital fared slightly better, reporting that it produced 616 BTC in May, down 27.5% from 850 BTC in April. The company said it mitigated the decline by increasing the number of mined blocks it acquired in May to 170, up from 129 in April.

Marathon said it held 17,857 BTC at the end of May and sold 390 BTC during May. The active hash rate is reported to be 29.3EH/s and the installed hash rate is 30.6EH/s.

SCleanspark, Riot Platforms, and Bitfarms also reported similar declines in BTC production.

Bitcoin halving occurred on April 20, 2024, reducing the block reward from 6.250 to 3.125. This event also affected mining difficulty.