Bitcoin has reached new heights between BlackRock’s success and London approval.

The following is an excerpt from the latest edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be the first to get these insights and other on-chain Bitcoin market analysis delivered to your inbox, Subscribe now.

Bitcoin has entered another period of intense and record-breaking success, driven by positive developments in international business and increasingly large investments in traditional finance.

It’s truly amazing how well Bitcoin performed throughout the first quarter of 2024. The year began with Bitcoin’s value exceeding $40,000, and continued to rise around $60,000 on March 1st. But now Bitcoin has risen to $72,000, the highest value in its entire history. Although “digital gold” is not yet more valuable than gold itself, it has reached a new milestone. In other words, by market capitalization, Bitcoin is currently a more valuable commodity than silver. Considering the enormous role silver has played in world currency for thousands of years, this is certainly a milestone to remember.

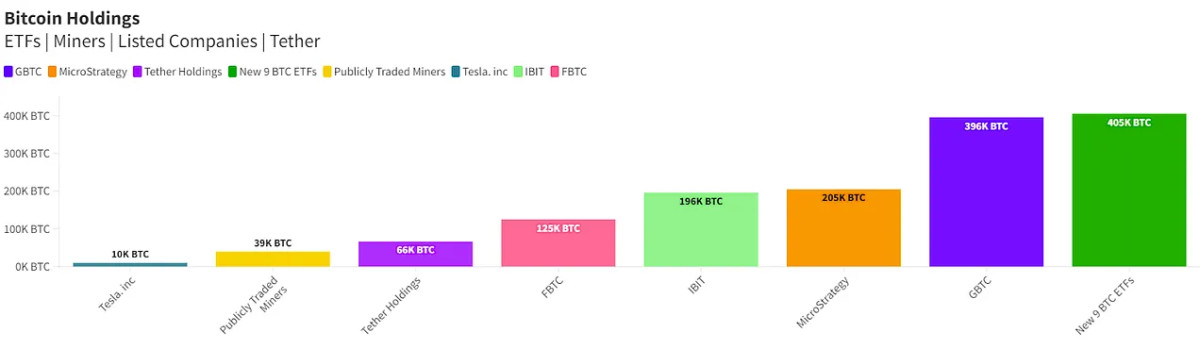

This period of success is particularly noteworthy as it has earned the continued trust of some of the world’s largest financial institutions. For example, on March 10, it was reported that BlackRock, the world’s largest asset manager and prominent issuer of the Bitcoin spot ETF, had finally acquired enough Bitcoin to surpass MicroStrategy’s holdings. This development seemed especially huge considering that its board chairman, Michael Saylor, is a Bitcoin evangelist. But it was even more surprising when Saylor announced the very next day that he would buy enough to regain the lead. Less than 24 hours passed between this initial announcement and MicroStrategy’s purchase of 12,000 Bitcoin, which occurred when Bitcoin was already enjoying prices above $70,000. This acquisition puts MicroStrategy at the forefront of virtually all private Bitcoin inventories, from all publicly traded miners to several major exchanges and ETF issuers.

It is an incredible sign of confidence in Bitcoin that anyone is prepared to make such a large investment at a time when Bitcoin has never been more expensive. The mood among these companies seems to be that today’s all-time highs will seem like paltry sums in just a few years. For example, analysts at ETF issuer Bitwise were confident in their predictions that trillion-dollar companies would begin to increase investments, and Bitwise’s Chief Investment Officer (CIO) made it public: memo On topic. The memo, which claims to have had “serious due diligence” conversations with everyone from hedge funds to large corporations, predicts the second quarter will see significantly more inflows than the first three months of the year. This leaves us with one question. Where does this kind of confidence come from?

The heart of the problem appears to be the enormous success of Bitcoin ETFs, particularly BlackRock’s dominant position over major issuers. I initially struggled with Grayscale, which has some natural advantages. This was a Bitcoin-based company with a huge amount of inventory and was actually a real leader in the legal fight to get SEC approval, and GBTC was the fund that existed before. I switched to ETFs, but there was another trick hidden there. Nonetheless, BlackRock is the ETF that reached $10 billion faster than any other ETF in history, outpacing all of its other Bitcoin competitors and, in fact, all ETFs. Most of this revenue came from users fleeing GBTC’s high fees, and today GBTC looks like a confident industry leader. That success has spilled over to the international stage as Mudrex, an India-based cryptocurrency investment platform, has begun selling the BlackRock ETF to institutional and individual investors in countries with more than a billion people.

This success, especially for BlackRock, has prompted some of its competitors to change their tactical approach. For example, VanEck created: presentation On March 11th they announced that they were waiving all fees on Bitcoin ETFs for one year. This will only continue if the VanEck Bitcoin Trust is below $1.5 billion, but fees after this period will still be at their lowest. Grayscale is also trying to address the issue of high fees by spinning off a “mini version” of its ETF that would offer a portion of Bitcoin as part of GBTC’s fees. BlackRock’s competitors appear unwilling yet to recognize a market with enormous growth potential.

But even though the ETF market has been particularly hot recently, that’s not the only reason to believe Bitcoin is doing so well. ABC NewsFor example, positive developments in the UK are cited as a major factor in the rise in Bitcoin prices. The UK has previously been considered a particularly hostile regulatory environment for Bitcoin, particularly ETFs, lagging behind Western Europe and most of the UK bloc in formal Bitcoin approval. It came as quite a surprise when the London Stock Exchange (LSE) released a new fact sheet on exchange-traded notes (ETNs) and decided to offer this type of financial product on its platform.

ETNs are quite different from ETFs such as the Bitcoin Futures ETF, which are not directly related to Bitcoin itself. ETNs are a type of debt collateral and do not even contain a clue that the issuer actually holds the Bitcoin in question. Nonetheless, they are directly tied to the value of Bitcoin and offer investors a way to gain exposure to the world’s leading digital asset. Considering that these ETNs are subject to strict rules governing securities, it is particularly interesting that the LSE has suddenly changed its stance on Bitcoin-related financial products. That said, the wholesale change in Bitcoin spot ETFs being legal in the US has clearly changed the way companies around the world calculate their accounts. With all these billions of dollars flowing into Bitcoin ETFs, even unfriendly regulators like the UK will need to get in on the bonanza if it is to remain relevant as a leading hub of global finance.

These are just some of the developments taking place in the Bitcoin world as the intersection between decentralized currencies and traditional finance becomes wider and deeper. There are plenty of events ahead to keep the hype going, like the expected halving in April. It can be difficult to predict exactly where the next major developments and price increases will occur, but for now it looks like the faith of some true financial giants is growing. Bitcoin has come an incredibly long way from its days as a complete pariah, and now has well over $1 trillion in the market. With this growth, continuing to bet on Bitcoin is an easy win.