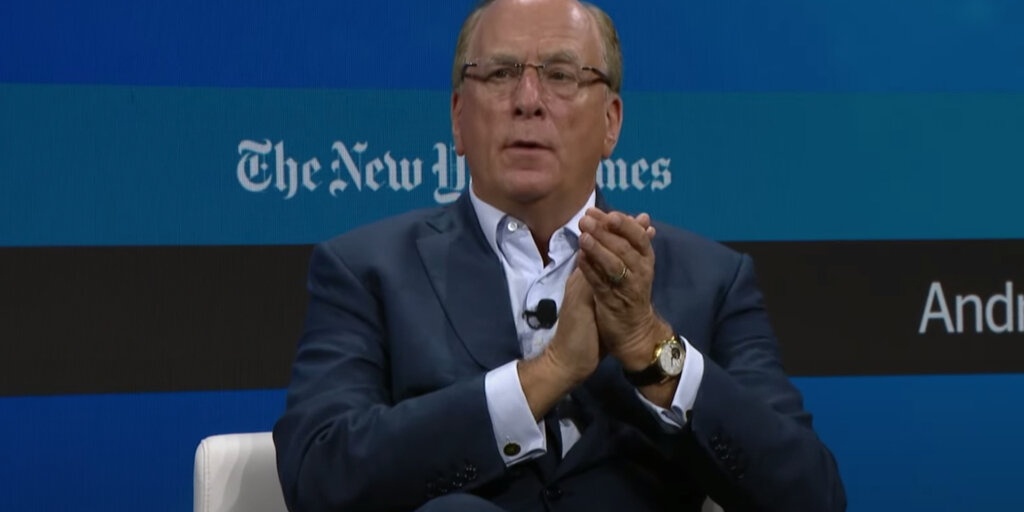

BlackRock CEO Larry Fink today completely shed his shell as a cryptocurrency skeptic and defended Bitcoin as a check on authoritarian governments. During his day-long media tour, Fink stopped by Fox Business to discuss this landmark week in which the SEC approved 11 spot Bitcoin ETFs. Fink hailed Bitcoin as a store of value and a tool to thwart government manipulation of the economy.

“Let me be clear: if you live in a country that is afraid of the government (perhaps this is one of the reasons why China banned it), if you live in a country that is afraid of the future, you are afraid of the government, or if the government “If you are afraid of devaluing your currency through too many deficits, I would say this has great potential to store value over the long term,” he said.

His stance is a far cry from his stance in 2017, when Fink joined JP Morgan CEO and longtime Bitcoin critic Jamie Dimon to speak out against Bitcoin, calling it a “money laundering index.” Yes.

Fink acknowledged that Bitcoin is being used for illicit activities today, but said his views on Bitcoin are starting to change amid the pandemic, telling the broadcaster that there are also many opportunities for Bitcoin.

“I had a different interpretation of that three years ago,” Fink said in an interview with Fox Business anchor Charles Gasparino. “There are a lot of advantages, a lot of opportunities… (Bitcoin) is a great store, and this is a place where we can debate whether this is a good store.”

Fink said that now that there has been a change of heart, the question is whether people will believe that Bitcoin can be an asset that can cross borders.

Despite the collapse of FTX, Bitcoin is becoming more and more legitimate, Fink said.

“I think the emergence of Bitcoin ETFs is an example of us legitimizing this. “We are creating more safety,” he said.

On Wednesday, the U.S. Securities and Exchange Commission approved the first set of spot Bitcoin ETFs, including ETFs from BlackRock, VanEck, Hashdex, Grayscale, and Bitwise.

Bitcoin prices neared $49,000 on Thursday before falling to $43,000 as excitement surrounding the ETF’s approval died down. As of this writing, Bitcoin is hovering just above $42,300, according to CoinMarketCap.

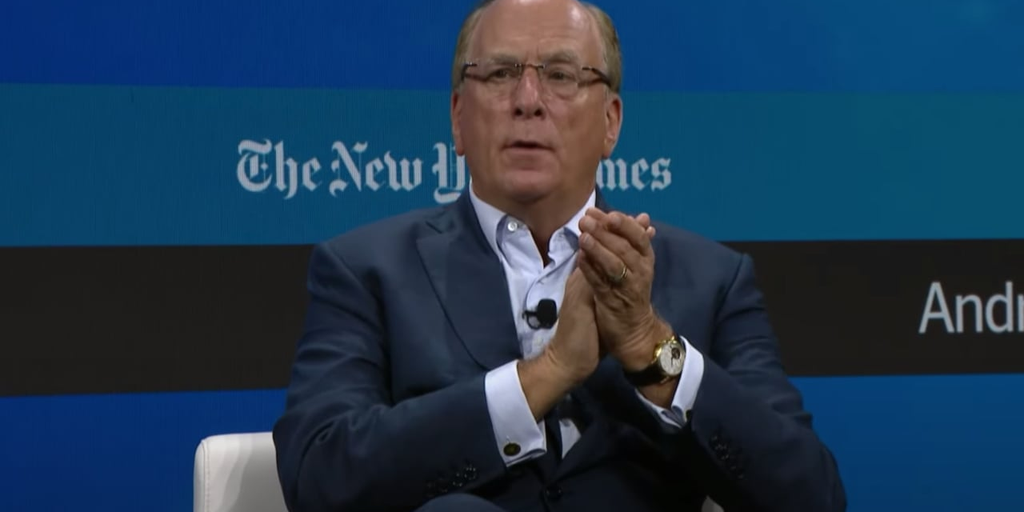

In a separate Friday interview with CNBC’s Andrew Ross Sorkin, Fink said he sees value in an Ethereum ETF.

“I see value in holding an Ethereum ETF,” Fink said. “As I said, this is just a stepping stone towards tokenization.”

However, Fink demurred and declined to comment when asked about future cryptocurrency-based ETFs such as Ethereum and, more specifically, XRP.

“I can’t do it. And you don’t want me to do that,” he said.

Edited by Ryan Ozawa.