Bitcoin miners have recorded their highest profits in 19 months as the halving approaches.

Monitoring miner revenue is essential to understand the health and sustainability of the Bitcoin network. Miner revenue, a combination of block rewards and transaction fees, provides a window into the economic viability of Bitcoin mining. In the context of the upcoming halving, when block rewards will be halved, miner revenue analysis becomes even more relevant.

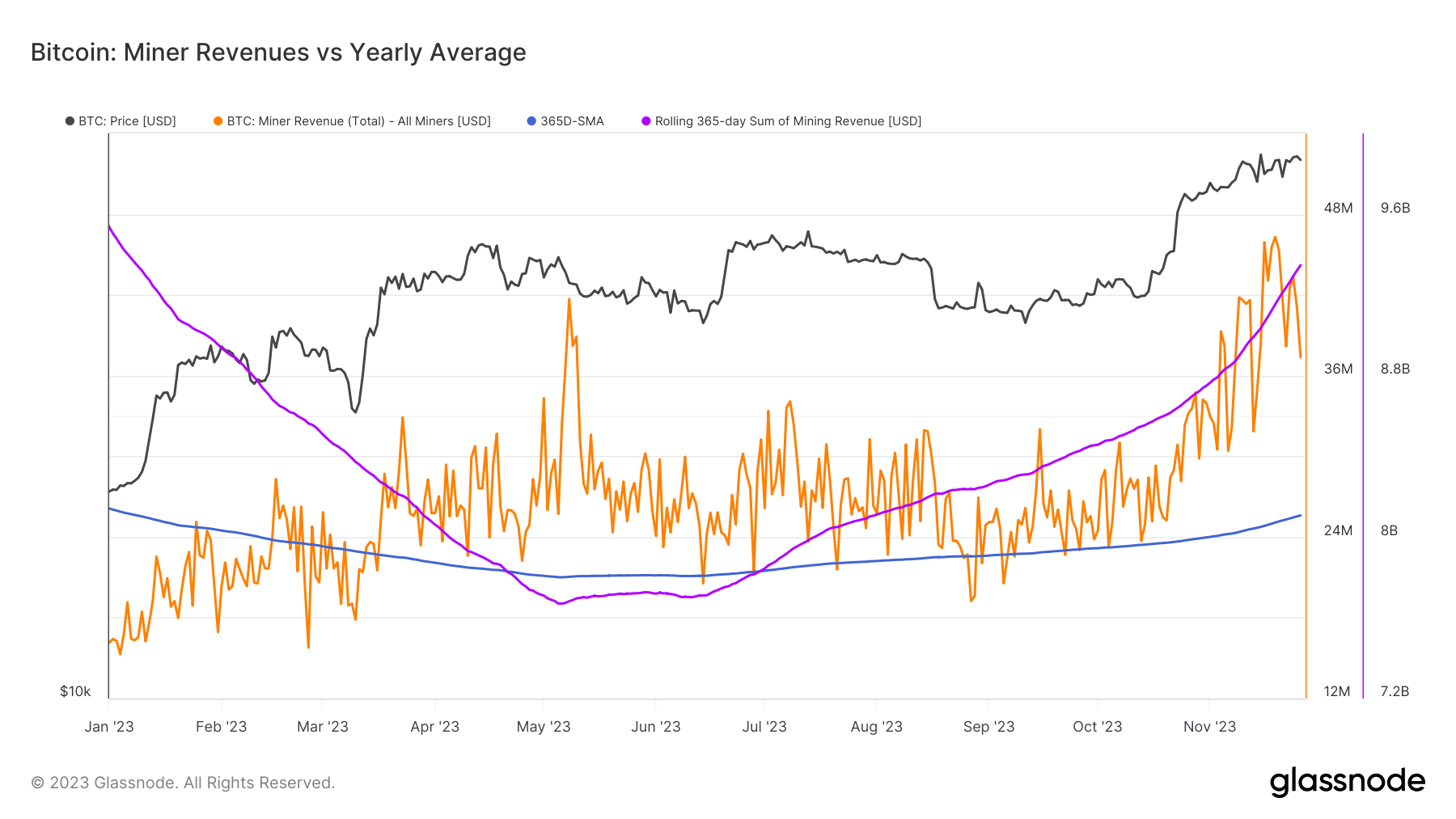

The 365-day simple moving average (SMA) and 365-day rolling sum are important indicators in this analysis. The 365-day SMA smoothes out daily profit fluctuations to provide insight into long-term trends, while the 365-day rolling total provides a cumulative view of miner profits over a year. These indicators provide a comprehensive understanding of miner revenue trends, which is important for predicting future market movements.

From January to June 2023, the cumulative total of miner revenue decreased from $9.53 billion to $7.7 billion, representing a period of declining revenue. This could be caused by a drop in the price of Bitcoin, an increase in mining difficulty, or a decrease in transaction fees. However, the increase to $9.34 billion by November signals a recovery in mining revenues. These fluctuations reflect the volatile nature of the mining industry and its sensitivity to broader market trends.

In contrast, the 365-day SMA of miner profits shows a more gradual improvement. This increase, from $22.12 million in January to $25.6 million in November, represents more revenue for miners in recent months despite the nearly constant rolling totals. These trends highlight the stabilizing effect of the SMA indicator, providing a more nuanced view of the mining environment.

Total daily USD revenue paid out to miners has increased significantly this year, hitting a 19-month high of $46.3 million in November. This high, caused by a combination of high Bitcoin prices and increased trading volume, suggests a profitable period for miners. The volatility of daily returns compared to the more stable SMAs and rolling sums reflects the inherent unpredictability of the mining sector.

The close connection between mining revenue and Bitcoin price is clear. As prices rise, mining profitability also increases, which affects miner sentiment. Reaching the highest revenue in 19 months signals optimistic sentiment among miners and could potentially lead to increased investment in mining infrastructure.

As the next Bitcoin halving approaches, the surge in Bitcoin hash rate signals the unwavering resolve of miners. This increased computational power for transaction processing and block creation represents a robust and secure network. However, this also means increased competition and potential difficulties for individual miners.

Additionally, high transaction fees within the Bitcoin mempool indicate increased network activity and potential congestion. These increases in fees and network usage may impact Bitcoin’s market position and thus influence user behavior.

Post-Bitcoin miners have recorded their highest profits in 19 months at CryptoSlate as the halving approaches.