Bitcoin miners increase capacity as the surge in transaction fees caused by the inscription cools before being halved.

Cipher Mining and Stronghold Digital kicked off the new year by announcing a major expansion of their Bitcoin mining capabilities, increasing the scale of their operations in response to changing market dynamics. These developments come as Bitcoin miners adapt to an evolving environment where transaction fees, enhanced by new technologies such as Inscriptions, are increasingly important to generating revenue.

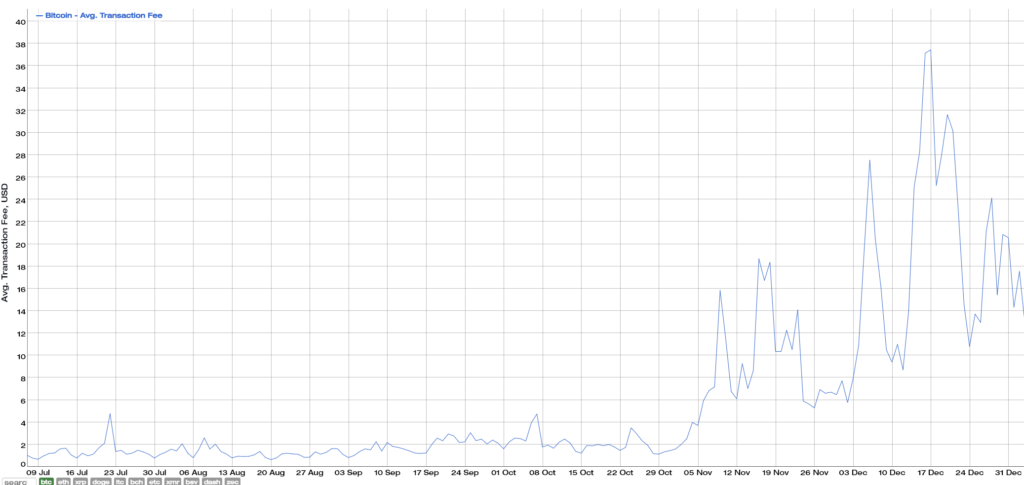

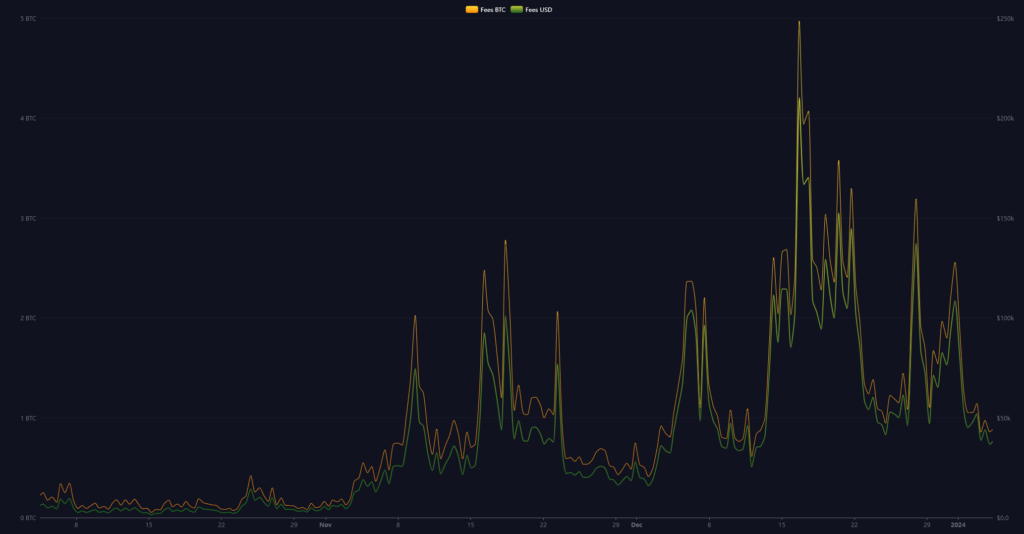

Bitcoin transaction fees peaked at nearly $40 in mid-December, leading to increased profits for miners, indicating a potential haven ahead of the halving in 2024.

Bitcoin miners earn money in two main ways: creating new Bitcoins through mining and collecting transaction fees by processing transactions on the Bitcoin network. Since the Bitcoin protocol is designed to halve mining rewards at certain intervals, the importance of transaction fees as a source of revenue for miners increases over time.

When transaction fees increase, this directly increases miners’ income. For example, high transaction fees have resulted in significant profits for Bitcoin miners. The recent surge in transaction fees has been driven by increased network activity, such as the popularity of Ordinals Bitcoin Inscriptions.

Increasing transaction fees is a response to network congestion. As the mempool size increases and the Bitcoin network becomes more congested due to the size and volume of Ordinals, users are willing to pay higher fees to ensure their transactions are processed and confirmed immediately. This dynamic creates a market where miners can increase their profits by prioritizing transactions with higher fees.

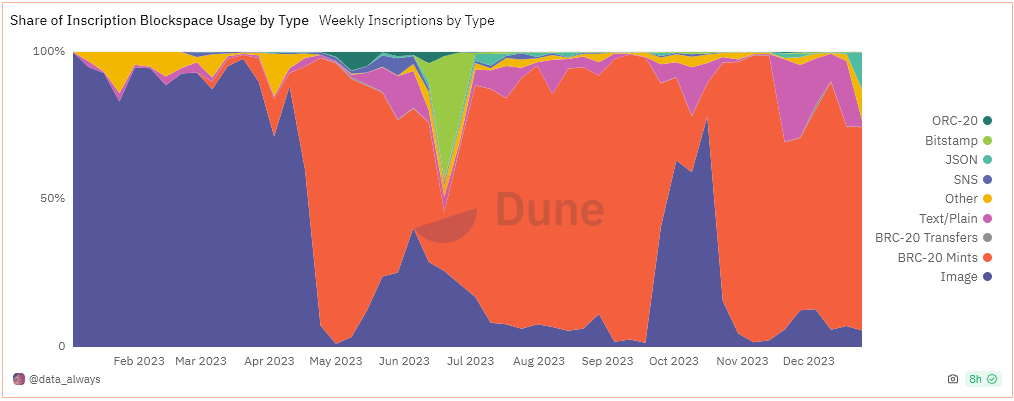

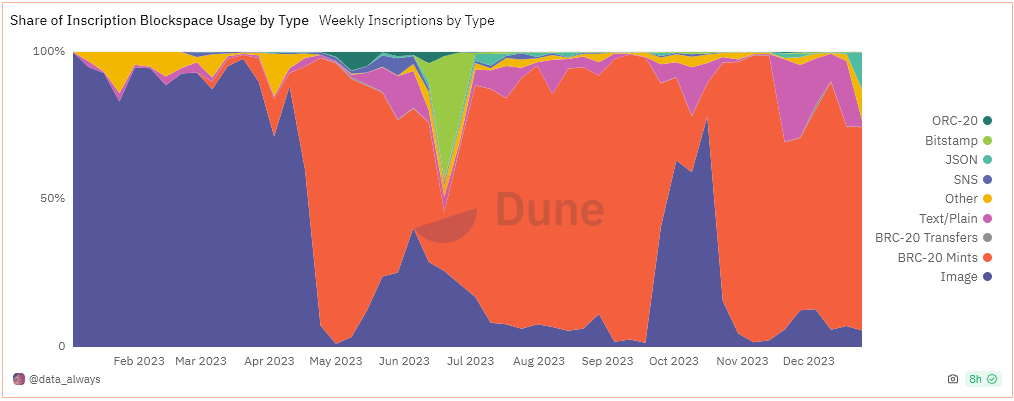

The chart below shows the share of block space occupied by each data type in the inscription, indicating that the BRC-20 token surpassed the image around May 2023. A BRC-20 token uses an average of 60 bytes of space, while a BRC-20 token uses an average of 60 bytes of space. image.

In the long term, as mining rewards continue to decline, transaction fees are expected to become an increasingly important source of revenue for miners. These changes are expected to ensure the long-term economic viability and security of the Bitcoin network.

New mining machine acquisitions from Cipher and Stronghold.

Cipher Mining Inc. announced plans for a 60 MW expansion at its Bear and Chief joint venture data centers and purchased 16,700 new Avalon A1466 miners from Canaan. This increase, scheduled for Q2 2024, will boost Cipher’s own mining capacity to approximately 8.4 EH/s. Cipher CEO Tyler Page emphasized the importance of this expansion for the company’s growth, especially as the industry approaches the Bitcoin halving event in 2024. check page,

“With this purchase, we look forward to adding 2.5 EH/s machines to our joint venture data center in Texas.”

Stronghold Digital Mining Inc. also announced the acquisition of 5,000 Bitcoin miners with the goal of adding nearly 1EH/s to its mining capacity. The additional miners are a mix of Bitmain, MicroBT and Caanan miners, including 2,800 Bitmain S19K Pro miners, 1,100 MicroBT Whastminer M50 miners and 1,100 Avalon A1346 miners. Boasting a hashrate capacity of approximately 600 PH/s and an efficiency of 25 J/T, the miner is scheduled to go live this month. Stronghold’s latest update highlighted a 2% sequential increase in Bitcoin-equivalent production in December 2023, indicating the company’s strong performance amid volatile market conditions.

Singapore-based Canaan has played a pivotal role in this expansion, with new orders totaling more than 17,000 Bitcoin mining machines, highlighting Canaan’s growing influence alongside competitors Bitmain and MicroBT. Nangeng Zhang, CEO of Canaan, expressed enthusiasm about this partnership:

“The Canaan machine we purchased last year is one of our best performing machines, especially during the hot Texas summers.”

The risk-reward of relying on transaction fees.

This strategic expansion of Cipher and Stronghold comes at a time when new technologies such as Inscriptions are reshaping Bitcoin miner revenues, but there is no certainty that fees will sustain at these levels. A recent CryptoSlate Alpha Insight found that transaction fees will skyrocket in 2023, contributing significantly to miners’ revenue streams. Bitcoin halving, in which block rewards are scheduled to be halved, could force miners to increasingly rely on transaction fees as their primary source of revenue.

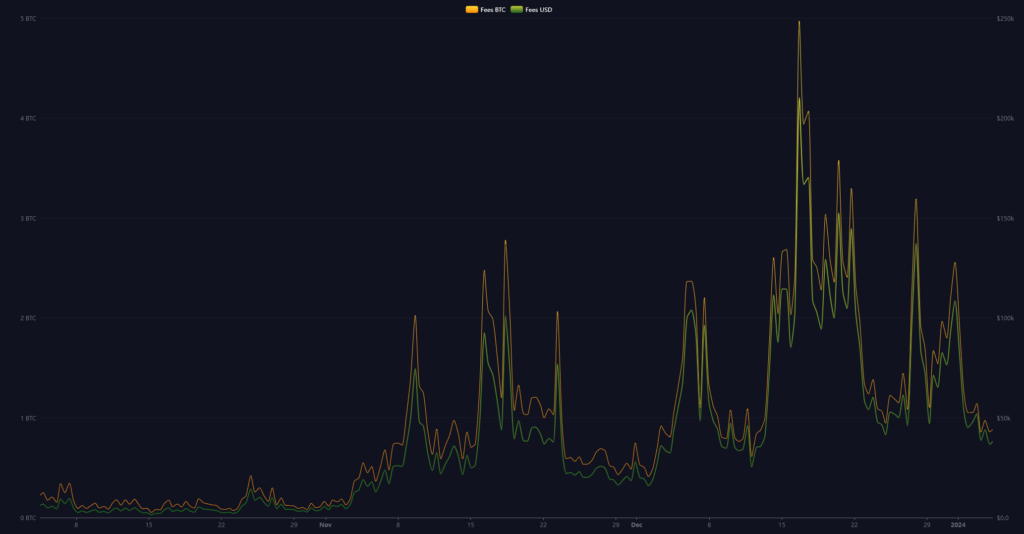

However, as you can see in the chart below, block fees peaked at around $250,000 on December 16 and have since reverted to an average of $38,000. This is still noticeably higher than the $4,700 average in November 2023, but Bitcoin miners may now be gambling that Inscriptions continues to gain traction to offset the impending halving.

These changes represent a significant shift in the mining industry, where technological advancements and market conditions continue to redefine revenue models and operating strategies.