Bitcoin Mining and ERCOT – Data Tells the Story

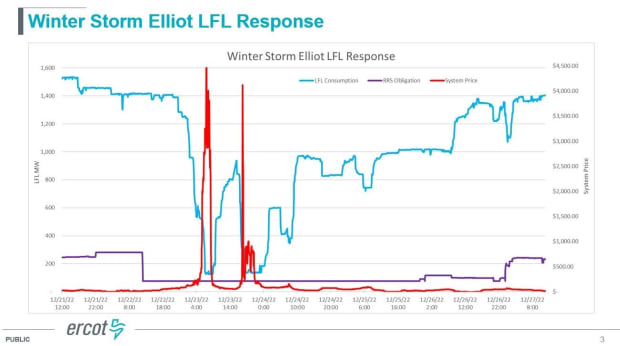

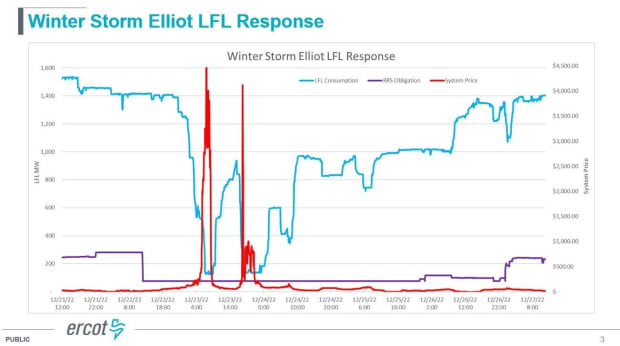

Several recent headlines have described a 25% decrease in Bitcoin network difficulty during Winter Storm Finn in January. Most attributed this decline to downsizing activity in Texas. Texas accounts for 17% of the global Bitcoin hashrate, but some of the curtailment activity has been driven by a combination of high prices and “good grid citizenship,” according to ERCOT data. At ERCOT, prices are the best proxy for grid stress. There are other proxies, such as Physical Reaction Capacity (PRC), but price is a better measure in most situations. Therefore, in order to prevent price fluctuations and create more difficult grid conditions, the optimal environment is an environment in which prices do not fluctuate significantly. However, price volatility occurs frequently in ERCOT, as evidenced by Winter Storm Elliot in December 2022 (see graph below).

Bitcoin miners are economically perfect consumers of electricity. This does not mean that Bitcoin miners consume electricity in an altruistic way, but rather that Bitcoin miners’ margins are particularly sensitive to electricity prices, so that they have an economic incentive to reduce consumption when electricity prices exceed the breakeven point. (current break-even point). For most miners, this ranges from $100 to $200 per MWh. That is, it consumes electricity when the price is below the break-even point and turns off when the price is above it. There are some operational and practical exceptions to this, for example, if the miner has a data center colocation agreement that stipulates or guarantees uptime.

Texans should want Bitcoin miners to be turned on whenever power is plentiful. This is because the continued consumption of Bitcoin miners encourages an increase in further generation. And, less intuitively, when prices are high and the grid is stressed, Bitcoin miners naturally want to scale back mining.

This marks the start of the January 2024 Winter Event for the week of January 15th. Looking at the headlines, you’d think Texas grid is stressed again and Bitcoin miners are shrinking as a result. The truth is much more subtle. During the worst three days of the storm, the average settlement price in the ERCOT wholesale power market was $100.76 per MWh, and prices never exceeded $600 per MWh. Depending on your situation, the price can be up to $5,000 per MWh. As wholesale prices suggest, the grid overall weathered the storm well, with ample reserves.

ERCOT did indeed issue a conservation alert, but it was more of a precautionary message for power consumers who don’t monitor power prices every minute of every day like Bitcoin miners do.

We’ve seen some economic contraction. This means long-term scaling back of miners’ power usage based on price signals, with some brief periods when prices exceed 200 MWh. However, because generation reserves were more abundant across the grid, this activity was less pronounced than previous winter events or summer heat waves. It is possible that some Bitcoin miners will scale back their operations for long periods of time to express good “grid citizenship” and demonstrate their commitment to a stable grid, but this is difficult to quantify.

All of this evidence suggests that a more nuanced explanation is needed for last week’s difficulty drop. Most of that was a result of drawdowns in Texas, but after evaluating ERCOT pricing data, we come to believe that a significant portion of the drawdowns also came from other ISOs in North America. In short, anyone with an opinion on Bitcoin mining scaling back would be well advised to watch ERCOT settlements and LMP prices. Data and economics must form the backbone of all future analytics.

This is a guest post by Lee Bratcher. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.