Bitcoin Price Prediction: BTC falls 4% to below $40,000, but Bitcoin Minetrix presale exceeds $9 million.

join us telegram A channel to stay up to date on breaking news coverage

The price of Bitcoin plunged nearly 4% to $40,033 as of 1:05 a.m. ET, but trading volume surged 125%.

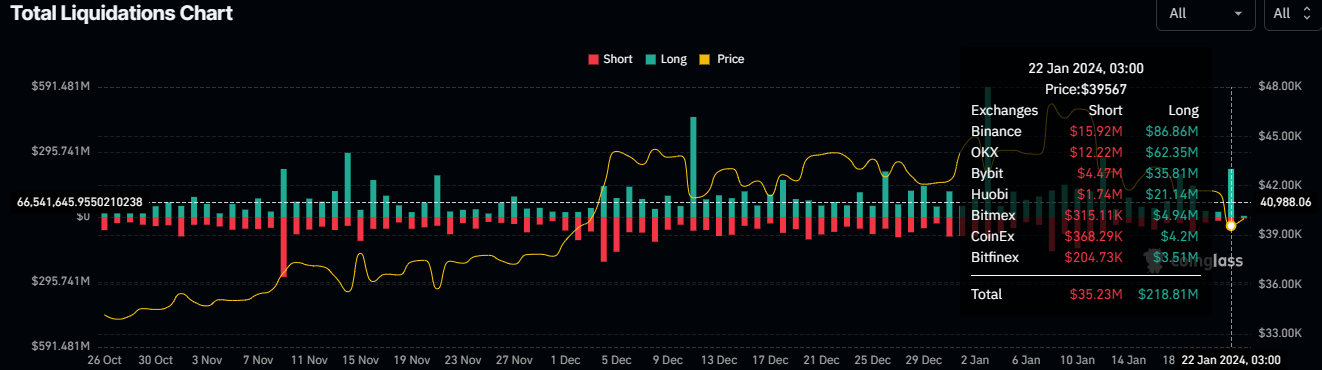

This move resulted in the liquidation of over $218 million in long positions and $35.23 million in short positions.

BTC liquidation

The move caused open interest to increase from $16.79 billion to $16.31 billion from January 22-23, taking up to $480 million off the market.

BTC Open Interest

The drop comes amid heightened market volatility, with altcoins also struggling in the aftermath of the Bitcoin price crash.

The surging volatility may extend until the market becomes clear that the price of Bitcoin has bottomed. Some analysts say the surging volatility is due to “big players” in the BTC market, which began with the landmark approval of a spot Bitcoin exchange-traded fund (ETF) application on January 10.

BTC drops 3% and everyone panics.

You’ll probably want ETFs later, right?

Didn’t you know that you were letting the world’s best market manipulators into your private BTC house?

What did you expect to happen?

I predict WAYY more volatility. Now the big… https://t.co/Cdhr8ixXA1

— FranksRevenge🐸.Eth ✝️🐸🟪 (@FrankClientele) January 22, 2024

Elsewhere, some traders say the decline was a healthy correction, sending Bitcoin price to rally buy-side liquidity below the $40,726 level.

Disadvantage: Liquidity is secured.

The current pullback is -20%, on par with previous revisions this cycle.

Today has been strong and I am confident that a bottom has formed. #Bitcoin pic.twitter.com/tQTTdLR8WV

— Jelle (@CryptoJelleNL) January 22, 2024

The sound correction thesis may be correct, as Bitcoin price is fueling a recovery rally. A green candle is recorded after several red Japanese candles.

Bitcoin price could face near-term pressure

Elsewhere, investors have pulled billions of dollars worth of Bitcoin out of the Grayscale Spot ETF (GBTC) since the BTC exchange-traded fund (ETF) began trading on January 11.

The majority of these outflows came from the sale by FTX liquidators of 22 million shares, according to a Coindesk report citing people close to the matter. This is worth nearly $1 billion and reduces FTX’s ownership of GBTC to zero.

ladle: @FTX_Official sold for approximately $1 billion @Grayscale‘S $GBTC from #Bitcoin ETF Acknowledgment – Accounts for a large part of the leak.@IanAllison123 Report https://t.co/9t04mPvFhT

— CoinDesk (@CoinDesk) January 22, 2024

Since this sale represents up to a third of total GBTC outflows, the report claims that FTX has completed selling off significant holdings and therefore may no longer have GBTC to sell. According to Crypto Banter founder Ran Neuner, this means easing selling pressure, which could fuel a rebound in Bitcoin prices.

Wait a minute, if $1 billion of GBTC sales were FTX LIQUIDATORS as reported, then that would be 1/3 of the total outflow. Then the whole picture changes!!!! The sale is now complete.

We could actually get a bounce, which could trigger a short squeeze.

— Ran Neuner (@cryptomanran) January 22, 2024

With this, Crypto Banter management says a short squeeze may be underway. To the average person, a short squeeze is an unusual situation that causes a rapid rise in asset prices. This is the result of a surge in short selling.

This means many investors are betting on asset prices falling. This begins when the price unexpectedly moves higher and gains momentum as numerous short sellers decide to cut their losses and liquidate their positions.

Bitcoin Price Outlook As Analysts Expect Short-Term Stress

Bitcoin price is attempting a recovery, considering the Relative Strength Index (RSI) is tilting northwards to show upward momentum. If investors buy the dip, the resulting buying pressure could push Bitcoin price north to reclaim the important support level at $40,726.

Further north, Bitcoin price could cross the $43,750 support and re-enter the channel, extending gains. This could provide a starting point for BTC to target the psychological level of $48,000.

In a very optimistic case, the Bitcoin price could rise to $50,000, a psychological level last tested in December 2021. This is a 25% increase from current levels.

TradingView: BTC/USDT 1-day chart

converse case

On the other hand, weak price strength, such as RSI below 50, cannot be ignored. This is exacerbated by the Moving Average Convergence Divergence (MACD) indicator which continues to move below the signal line (orange band). . MACD is also in negative territory, adding credibility to the downtrend.

Increasing selling pressure could extend the downtrend that could lead Bitcoin price to test the $37,800 support. A break and close below this level could push BTC over a cliff, potentially sending the king of cryptos down to the psychological level of $30,000. A close below this level would invalidate the big picture bullish outlook.

Meanwhile, cryptocurrency enthusiasts and BTC enthusiasts continue to focus on the halving event, which will see mining rewards cut in half. The event, which is expected to kick off the next bull market, has investors lining up for BTC ownership, but the pioneering cryptocurrency isn’t cheap for the average person. However, Bitcoin Minetrix offers a solution.

A promising alternative to Bitcoin

To participate in the Bitcoin Minetrix ecosystem, investors must purchase BTCMTX, the token that supports the project. Token holders stake their holdings for credits and then redeem these credits with mining hash power.

In doing so, the project lowers standards and eliminates the hassles of traditional mining by eliminating fraud risks, heat issues, noise, space and cost issues.

#Bitcoin Metrics vs. Traditional cloud mining

Comparison of participation costs: 💰#BTCMTX = Cheap admission is possible with a fixed contract period.#Existing cloud mining = A significant initial deposit is required. pic.twitter.com/5DhQ7ebHCL

— Bitcoin Minetrix (@bitcoinminetrix) January 22, 2024

Bitcoin Minetrix is at 21.castle This is the pre-sale phase where each token is sold for $0.013. Even as pre-sales surge toward its $9.906 million target, the price tag will remain in place for less than three days. To date, pre-sales have reached $9.1 million.

Major announcement! 🌐#Bitcoin Metrics We’ve reached the incredible milestone of raising over $9,000,000! pic.twitter.com/9rUOkm7Hb7

— Bitcoin Minetrix (@bitcoinminetrix) January 22, 2024

Purchase the Bitcoin Minetrix ecosystem for an early opportunity to participate in the BTC halving rally. With an easy path to Bitcoin mining and subsequent BTC ownership, the environment has never been like this, with a level playing field for both the wealthy and the general public to get in on the action.

#Bitcoin Metrics Enables a cloud mining environment by integrating stake holdings and cloud mining.

Leading the way in tokenized cloud mining with a focus on transparency, autonomy, and security. #BTCMTX We do our best to provide you with a reliable route. $BTC Mining enthusiast. 🌐⚒️ pic.twitter.com/Mrxv0Hnrst

— Bitcoin Minetrix (@bitcoinminetrix) January 22, 2024

Visit Bitcoin Minetrix to buy BTCMTX here.

Also read:

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 100% or more

join us telegram A channel to stay up to date on breaking news coverage