Bitcoin Price Prediction: BTC surges 4% as Bernstein and InvestAnswers predict massive Bitcoin rally and booming ICO Bitcoin Minetrix rockets past $10.5 million.

join us telegram A channel to stay up to date on breaking news coverage

The price of Bitcoin has surged 4% over the past 24 hours, trading at $46,717 as of 6:30 a.m. ET, with trading volume surging 20%.

This comes as BTC bulls broke a multi-week consolidation, trading horizontally between January 27 and February 6. The strength seen in the Bitcoin price is further evidenced by the BTC ETF (Exchange Traded Fund). It is attractive compared to alternatives in China, Europe and Canada.

“As global funds lag, the next wave of U.S. ETF strength is coming from abroad, with Chinese investors as well as locals in Europe and Canada rushing to buy U.S.-focused ETFs,” said Eric Balchunas, Bloomberg Intelligence ETF analyst. said. “In most regions, flow rates are much higher than aum (assets under management) rates.”

Next wave of US ETF strength overseas as global funds lag – Chinese investors, as well as locals in Europe and Canada, are rushing to buy US-focused ETFs as flow % is much higher than asset % in most regions. Take notes from today @psarofagis & @RebeccaSin_SK pic.twitter.com/fsP1tfGTBI

— Eric Balchunas (@EricBalchunas) February 8, 2024

In the case of China, with the economy limited, investors are withdrawing from the local market.

China has won so much that the US hits an all-time high and then I think adding a premium could end in tears for local Chinese investors as they go on steroids to sell low and buy high.

— Eric Balchunas (@EricBalchunas) February 6, 2024

The same is true in Europe and Canada, where investment in U.S.-focused ETFs has surged due to the slump in global funds. This led to a surge in the total volume of ETFs traded in the region.

Meanwhile, Bernstein and InvestAnswers predicted a massive rise in the price of Bitcoin.

Bitcoin Price Target According to Bernstein and InvestAnswers

Renowned cryptocurrency analyst InvestAnswers said Bitcoin price could surge 190% in 165 days. Analysts attribute this ambitious goal to history.

“By my estimates… there are 165 days left until July 16, 2024, at $80,000 Bitcoin or $130,000 Bitcoin, and somewhere in between,” says InvestAnswers. “Assume history, assume math, assume supply, assume money flow.”

The analyst also highlights that any action on Bitcoin price will occur 90 days before the halving. In their opinion, this is the territory we are in. After that, the outlook could be relatively flat, analysts say.

Elsewhere, a Bernstein report suggests Bitcoin prices could explode to all-time highs in an ETF-fueled rally. Big Wall Street brokerage analysts Gautam Chhugani and Mahika Sapra said BTC will surge to the $70,000 range by the end of 2024.

#Bitcoin update 🚀 Analysts at Bernstein expect the Bitcoin price to reach $70,000 this year, noting that there are no major obstacles. Due to positive macroeconomic conditions, increased demand for ETFs, and a possible change in SEC leadership, they expect a 65% surge.

— Block Voyager (@BlockVoyagerAIO) February 6, 2024

Analysts admit that this prediction is due to the impact of the recently approved spot BTC ETF. In a separate analysis, Markus Thielen of 10X Research said the price of Bitcoin could reach $48,000 as soon as the Lunar New Year holiday and rise to $52,000 by mid-March before peaking in 2025.

#Bitcoin $48,000 Could Be Reached in Few Days, Driven by Historic Chinese New Year Gains: 10X Research

Markus Thielen of 10X said the cryptocurrency has risen by an average of 11% each time around the Chinese New Year festival over the past nine years.#Bitcoin #Cryptocurrency #blockchain

— Blockchain News (@chain55058) February 9, 2024

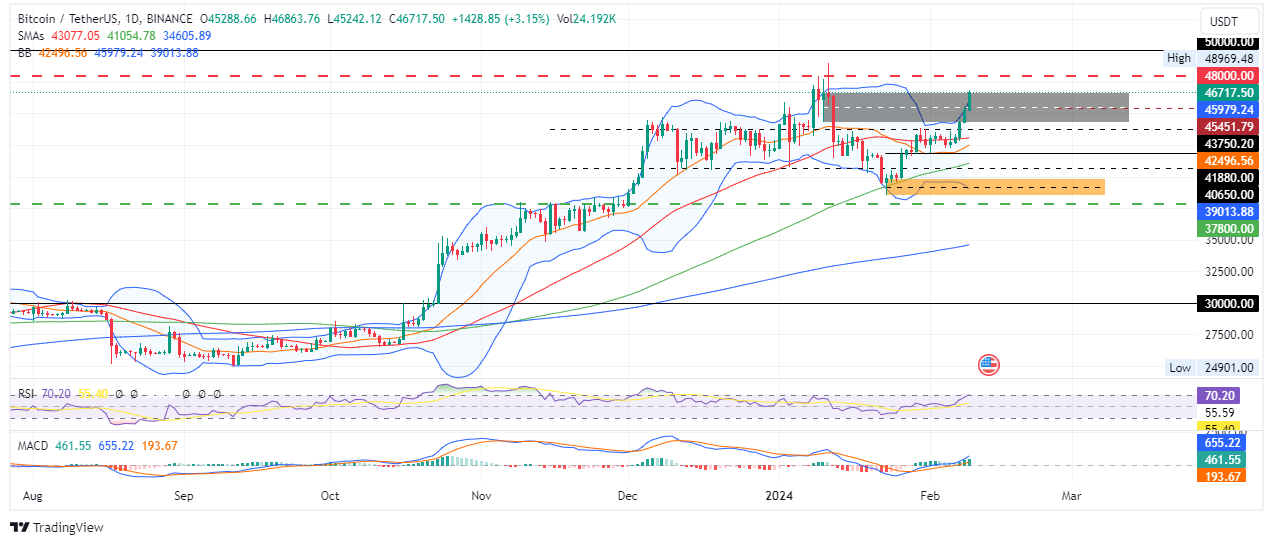

Meanwhile, Bitcoin price continues to trade within a supply zone between $44,235 and $46,715. A confirmed move north would require a candlestick above the midline of this order block at $45,451.

This could extend Thielen’s $48,000 target or, if he’s very optimistic, pave the way for him to reach the $50,000 psychological level. This represents a 6% increase over current levels.

The Relative Strength Index (RSI) indicates upward momentum in a northward direction. This, combined with the green histogram bar for Moving Average Convergence Divergence (MACD), adds credence to the bullish thesis.

TradingView: BTC/USDT 1-day chart

converse case

The upward trend for Bitcoin price may be shortened once profit booking begins. Also, seeing that the RSI is at 70, BTC is already overbought and caution is needed. This is especially for investors looking to take new long positions in BTC. Those currently holding long positions should keep them open as the upside potential is still alive.

With a southward bias, traders should only worry if Bitcoin price records a candlestick below the midline of the supply zone. This move could suggest that the supply zone will remain resistance, increasing the likelihood of a decline.

A correction could allow BTC to test the $37,800 level. However, the Bitcoin price would need to fall below $30,000 for the bullish outlook to be invalidated.

Investors looking to take advantage of other Bitcoin-related opportunities should consider BTCMTX, a fast-growing ICO that analysts predict will yield exponential gains in 2024.

A promising alternative to Bitcoin

Ranked as one of the top five cryptocurrencies to invest in this year, BTCMTX is the token that powers the cloud mining ecosystem Bitcoin Minetrix. Here, community members can mine BTC in a decentralized manner.

#Bitcoin Metrics It is a cutting-edge cloud mining platform that allows users to participate in decentralized mining. $BTC mining.

It gives users full command over their mining activities by eradicating the risks associated with third-party cloud mining scams. 🔒 pic.twitter.com/MWZnuafYih

— Bitcoin Minetrix (@bitcoinminetrix) January 18, 2024

This project changes the narrative of traditional BTC mining approaches. This allows investors to avoid the hassle of expensive hardware costs and large space requirements. Additionally, investors can save on the high cost of purchasing BTC.

mining #Bitcoin vs buy $BTC? 🤔

💡 Contributes greatly to network expansion.

🔐 Gain more control over your acquisition process.

🛠️ Deepen your understanding of technical complexities. pic.twitter.com/O0asQryARd

— Bitcoin Minetrix (@bitcoinminetrix) February 5, 2024

Investors who want to purchase BTCMTX can do so for $0.0133 on the official website. The price list will remain in place for approximately 19 hours before another price increase occurs. To date, presales have reached $10.564 million of the $11.21 million target.

#Bitcoin Metrics Another amazing milestone achieved!

It exceeded $10,400,000. 💰 pic.twitter.com/6WaHtJCB4m

— Bitcoin Minetrix (@bitcoinminetrix) February 9, 2024

Visit Bitcoin Minetrix to buy BTCMTX here.

Also read:

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 50% or more

join us telegram A channel to stay up to date on breaking news coverage