Bitcoin Price Prediction: Former Goldman Sachs Executive Sees ‘Crazy’ Potential for BTC to $500,000 as Bitcoin Cloud Mining Platform Closes at $10 Million

join us telegram A channel to stay up to date on breaking news coverage

The price of Bitcoin has risen 3% over the past 24 hours, trading at $43,380 as of 1:05 a.m. ET, with trading volume surging 45%.

This is part of an ongoing recovery rally after Bitcoin prices fell in the aftermath of the Grayscale Bitcoin Trust (GBTC) buyback. Bitcoin prices have fallen nearly 12% since the local high of $48,969 on January 11 as investors sold BTC to cash out GBTC shares.

Meanwhile, Raoul Pal, a former executive at US investment bank Goldman Sachs, said the Bitcoin price could repeat the same “bubble” price pattern witnessed in the 2011-2013 cycle, citing the crypto Updated currency market cycle forecast. In his opinion, this could push the king of cryptocurrencies to $500,000.

Raoul Pal predicts Bitcoin price likely to hit $500,000.

In an interview with Pomp Investments founder Anthony Pompliano, Pal said there was “a 60% chance that this is a relatively normal cycle” of BTC hitting $150,000. Nonetheless, he says, “there’s a 20% chance that this is actually a preemption cycle, as the spot BTC ETF and other things are likely to get it to $150,000 sooner and then disappear.” In his view, this could hurt many people who expect these rallies to continue until 2025.

Pal also maintains a 20% chance of becoming a bubble cycle. ““It’s similar to 2011, 2012, and 2013.”

Despite Pal’s ambitious goals, Bitcoin price is still below a significant barrier. If it can flip to support, investors are probably safe. In the meantime, this week is very important for cryptocurrency, with several events scheduled.

This includes the Federal Open Market Committee (FOMC) meeting, a portion of S&P 500 profits, unlocking the supply of some altcoins, and the launch of JUP, the native token of the Jupiter decentralized exchange.

This week is a very important one for crypto…

We have.

– FOMC

– $JUP start

– A portion of S&P 500 profits

– Unlock supply from select AltcoinsI’m discussing all of this and more on my show now… https://t.co/X7YitKVuVq pic.twitter.com/Hd6ldHDA5f

— Ran Neuner (@cryptomanran) January 29, 2024

Bitcoin Price Outlook As BTC Faces Critical Barricades

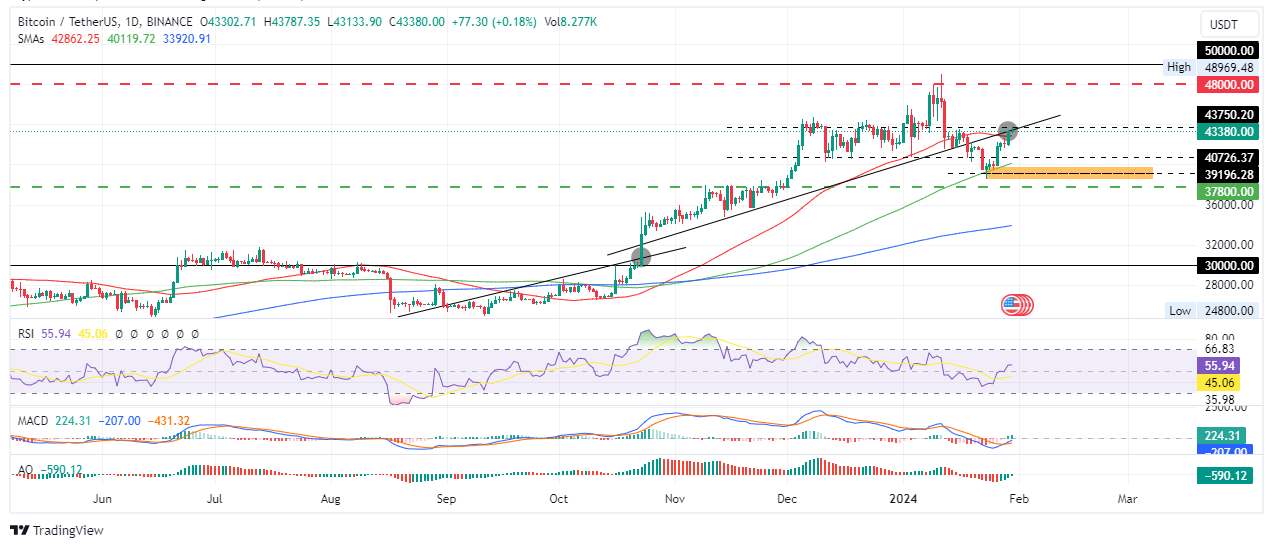

Bitcoin price is facing important resistance at $43,750, and this blockage has been reversed, putting BTC above the upward trend line. But before that, the king of cryptocurrencies must overcome resistance posed by the 50-day simple moving average (SMA) of $42,860.

Further north, the price of Bitcoin could rise to the psychological level of $48,000 or, in a very bullish case, to $50,000, 15% above current levels.

In particular, BTC has seen similar price movements since September, consolidating below an upward trend line. When it finally broke through on October 23rd, it was up almost 65% to its January 11th high. This can be seen on the BTC/USDT daily chart below.

TradingView: BTC/USDT 1-day chart

Conversely, if the uptrend line holds as resistance, Bitcoin price could head south and test the 100-day SMA at $40,119. In severe cases, it could slide into demand territory in the $38,496 to $39,895 range. A break and close below the midline of this order block at $39,196 will confirm the continuation of the downtrend, with Bitcoin price likely to extend the decline towards the important support at $37,800.

Passing this level of buyer congestion, Bitcoin price may roll over to the $30,000 psychological level, 30% below this level. A close below this level invalidates the bullish argument.

Elsewhere, forward-thinking investors are already calculating the date when the BTC halving in April will likely kick off the next bull cycle. This is causing investors to turn to an innovative BTC cloud mining project called Bitcoin Minetrx (BTCMTX).

A promising alternative to Bitcoin

BTCMTX is the ticker of the Bitcoin Minetrix ecosystem and has been ranked as one of analysts’ top picks for penny cryptocurrencies with explosive growth potential. The project operates as a tokenized cloud mining platform that allows community members to mine BTC in a decentralized manner.

#Bitcoin Metrics It is a cutting-edge cloud mining platform that allows users to participate in decentralized mining. $BTC mining.

It gives users full command over their mining activities by eradicating the risks associated with third-party cloud mining scams. 🔒 pic.twitter.com/MWZnuafYih

— Bitcoin Minetrix (@bitcoinminetrix) January 18, 2024

Bitcoin Minetrix allows investors to escape the high hardware costs and deceptive fraud issues that plague BTC mining. It also ensures that you don’t have to go through the heat, space requirements, and all the other hassles that come with traditional BTC mining.

knowing the benefits #Bitcoin Metrics:

Easy access for your convenience. 🌐

Simplified cost structure for increased efficiency. 💲

Enjoy peace of mind without worrying about resale value. 🔄 pic.twitter.com/hx3zJLXTfN

— Bitcoin Minetrix (@bitcoinminetrix) January 18, 2024

The Bitcoin Minetrix presale raised more than $9.8 million of its $10.326 million target. Investors who want to purchase BTCMTX can do so on the website where each token is sold for $0.0131.

2024 presents both challenges and opportunities. #Bitcoin Miners: Halving reduces profits but promotes global hash redistribution. 🚀💰

🌍 North America may lose dominance while new markets emerge. Transaction fees and mergers offer hope.#Bitcoin Metrics Also achieved… pic.twitter.com/urLNMF5xZ7

— Bitcoin Minetrix (@bitcoinminetrix) January 29, 2024

A price increase is expected within 24 hours, so secure your tokens from this project before it’s too late.

Visit Bitcoin Minetrix to buy BTCMTX in the pre-sale here.

Also read:

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 100% or more

join us telegram A channel to stay up to date on breaking news coverage