Bitcoin Price Prediction: Valkyrie pioneers Bitcoin ETF custody diversification and adds BitGo as investors flock to the 10x opportunity seen in this BTC cloud mining project.

join us telegram A channel to stay up to date on breaking news coverage

The price of Bitcoin has risen 2% over the past 24 hours to trade at $43,016 as of 4:50 a.m. ET, after volume plunged 25%.

This comes as the market continues to digest the disappointment of no interest rate cut this March, a situation made worse by the sale of Grayscale Bitcoin Trust (GBTC) shares.

slight increase $GBTC Spillage range of 200m

This alone cannot cause a major sell-off in the market.

Expected Range Boundary Movement Heading to FOMC https://t.co/rTbbs1bg5d pic.twitter.com/GspUZkzVYf

— Cam – Crypto DeGen (@CryptoNews_eth) January 31, 2024

Meanwhile, according to reports, Valkyrie Funds has become the first Bitcoin ETF issuer to diversify its custody over the funds. The move appears to be a marketing ploy to create confidence among investors as it points out that custody risks are reduced as custody is handled by two institutions.

Very interesting move — @ValkyrieFunds move to use @bitgo for their custody #Bitcoin In ~ $BRRR By submitting today. https://t.co/XWH3hCuQT9 pic.twitter.com/gWsT6lO2cO

— James Seyff (@JSeyff) February 1, 2024

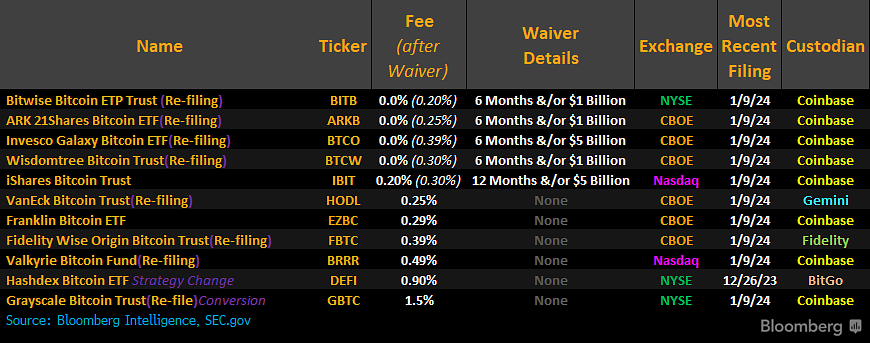

According to the filing, the Valkyrie Bitcoin Fund (BRRR) will henceforth be managed by both BitGo and Coinbase. This is a paradigm shift considering that peers in the spot BTC ETF market only have control over a single company.

Spot BTC ETF Issuer and Custodian

Meanwhile, Coinbase remains the leading custody provider, serving 8 out of 11 (8/11) applications. VanEck, Fidelity, and Hashdex are the only issuers that do not receive custody services from Coinbase. Coinbase’s dominance as the largest exchange in the U.S. is probably why it is so popular among ETF issuers.

More issuers will soon be able to attract more custodians, according to Nate Geraci, founder of ETFStore. “I would be surprised if most companies don’t have multiple custodians in the next quarter,” Geraci said, adding that this could help reduce child support costs.

“I would be surprised if most companies don’t have multiple custodians in the next quarter.”

ETF issuers in talks with BitGo, Gemini, Kraken, etc. to act as secondary custodians for spot BTC ETFs.

You can diversify your risk and lower your storage fees.

through @olgakharif @Yueqi_Yang pic.twitter.com/rCRQwhtp4b

— Nate Geraci (@NateGeraci) February 1, 2024

Meanwhile, recent developments show that BlackRock (IBIT), Fidelity (FBTC), Ark/21Shares (ARKB), and Bitwise (BITB) are the best-performing ETFs, led by BlackRock.

All the new ETFs are doing well, but these four ETFs are doing really well. $GO, $FBTC, $ARKB, $BITB. https://t.co/pvnmU6U3DQ

— James Seyff (@JSeyff) February 1, 2024

Bitcoin Price Outlook With BTC Stuck Below Critical Support Level

Bitcoin price remains below the upward trend line and the Relative Strength Index (RSI) remains stable and moving horizontally. Positions above the 53 signal line are encouraging, but buyers will need to increase their buying power for the market to recover.

MACD (Moving Average Convergence Divergence) and AO (Awesome Oscillator) are in positive territory, increasing the likelihood that upside potential will recover. The histogram bars for both indicators are also blinking green, lending credence to the bullish assumption.

If bulls increase buying momentum, Bitcoin price could expand northward, turning the uptrend line into support above $43,750.

Intensifying buyer momentum could push Bitcoin price up to the $48,000 resistance level or, in very bullish cases, to the psychological $50,000 level. This is a 16% increase from current levels.

TradingView: BTC/USDT 1-day chart

converse case

On the other hand, if bulls show weakness, bears can take over the market. This could send Bitcoin price towards the $40,726 support level. A drop below this buyer stagnation level could extend the decline to the 100-day simple moving average (SMA) of $40,293.

If both of these levels fail to hold support, the Bitcoin price could roll over into the demand area between $38,496 and $39,895. A violation of the center line of this order block at $39,196 could continue the decline in Bitcoin price and send it towards the important support level at $37,800. The cliff beyond here could send BTC to $30,000. A close below this level would invalidate the big picture bullish outlook.

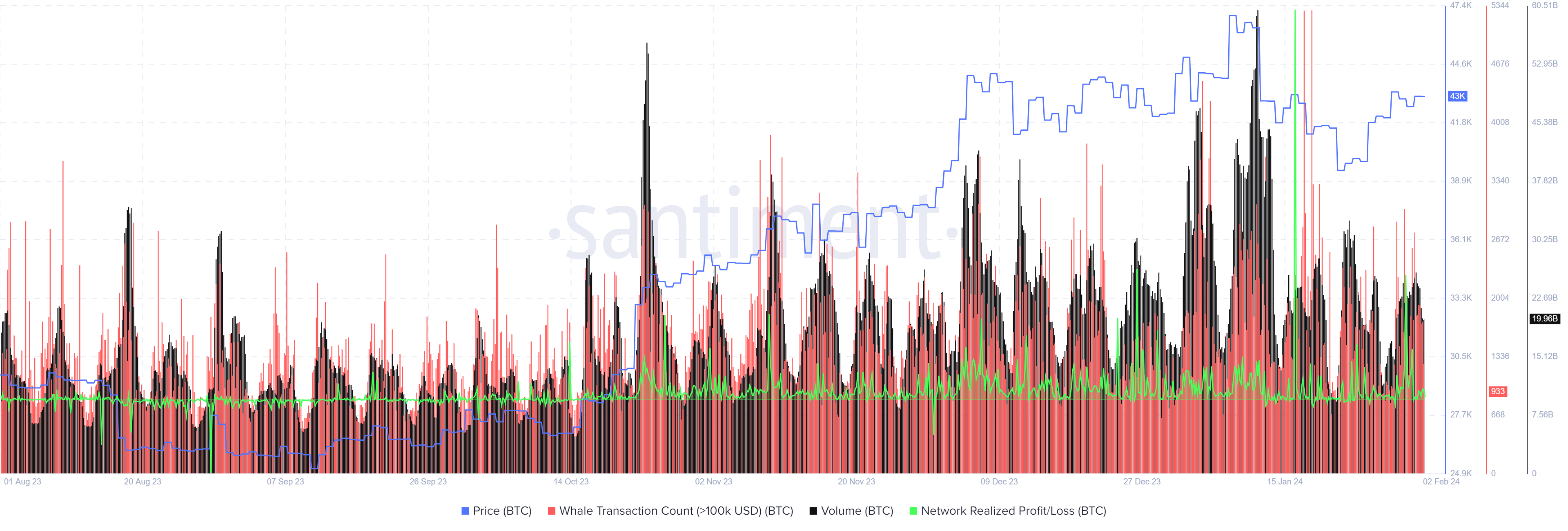

Large holders reducing profit booking could bode well for Bitcoin price

Santiment’s on-chain metrics show that large holders have reduced profit-taking. This shows a decline in whale trades worth more than $100,000 between January 17 and February 1. The same goes for network realized profits/losses, which are even more pronounced with the recent decline in trading volume.

BTC Santiment: Number of Whale Transactions and Network Realized P&L

Elsewhere, investors are racing toward the 10x opportunity analysts see in innovative Bitcoin cloud mining project BTCMTX. One of analysts’ top picks for the best Web3 projects to buy in 2024.

A promising alternative to Bitcoin

BTCMTX is arguably the most promising alternative to Bitcoin. It supports the Bitcoin Minetrix ecosystem, a cloud mining project that makes BTC ownership a reality for everyone. This avoids all the hassle that comes with traditional Bitcoin mining, ensuring community members can enjoy a safe and convenient mining experience.

Identify differences #Bitcoin Metrics And traditional cloud mining! 🌐

Safety & Security: 🛡️#BTCMTX: Empowers users in a decentralized and tradable way. #token.

Traditional cloud mining: requires a cash deposit. pic.twitter.com/hCkOD1UViF

— Bitcoin Minetrix (@bitcoinminetrix) February 1, 2024

The project is in pre-sale and has generated over $10.1 million in sales to date. Investors can purchase BTCMTX for as low as $0.0132 before the price increases within 3 days.

Big announcement! 🎉#Bitcoin Metrics We’ve reached the incredible milestone of raising over $10,000,000! 🪙 pic.twitter.com/toEsT1NvWv

— Bitcoin Minetrix (@bitcoinminetrix) January 31, 2024

Join our social media communities to keep up with all the news and developments about the Bitcoin Minetrix project. This will also give you a first-mover advantage to express your ideas and develop any added value for your project.

Discover #BTCMTX Community use #telegram for updates #Bitcoin mining. 🛠️

Get the latest details, join discussions, and benefit from our experienced knowledge. #BTC Mining expert. 📈

🌐 Join us at https://t.co/jjqYaqOtyv pic.twitter.com/SwvUuZgvdZ

— Bitcoin Minetrix (@bitcoinminetrix) February 2, 2024

Visit Bitcoin Minetrix to buy BTCMTX here.

Also read:

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 100% or more

join us telegram A channel to stay up to date on breaking news coverage