Bitcoin Price Prediction: VanEck’s Bitcoin ETF Trading Volume Soars 1,400% as Experts Say This BTC Cloud Mining Token Could Be the Best Altcoin to Buy Right Now.

join us telegram A channel to stay up to date on breaking news coverage

The price of Bitcoin fell slightly to trade at $51,871 as of 1:25 a.m. ET, despite a 45% surge in trading volume over the past 24 hours.

As things stand, the Bitcoin price is 23% off its all-time high of $69,000 recorded on November 10, 2021.

#Bitcoin Price drop in ATH – now -23%. pic.twitter.com/upAGrYmgHG

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) February 20, 2024

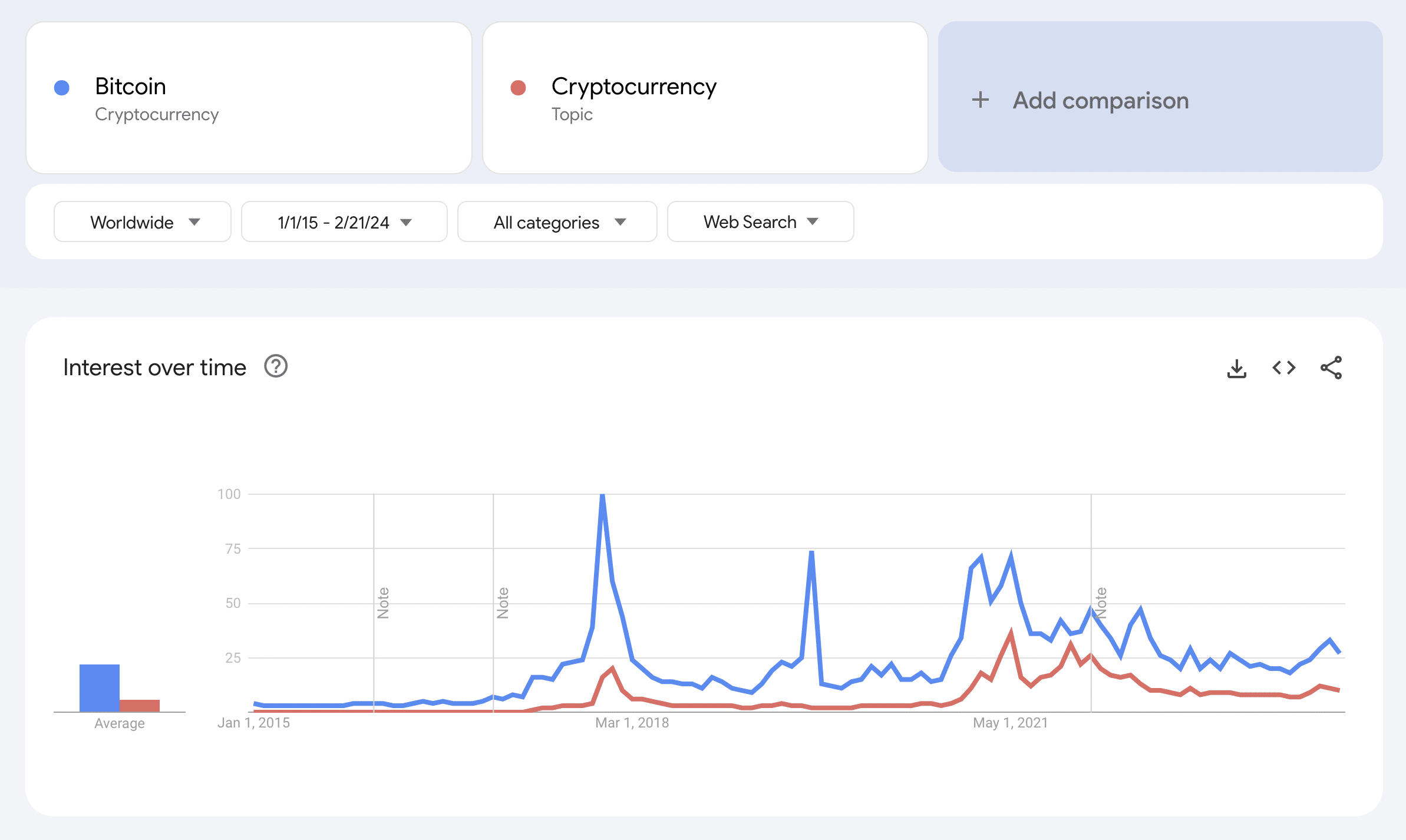

Still, despite BTC rising 242% over the past 15 months, retail investors appear to be absent. This is unusual considering that retail has been the main driver of previous bull markets so far. To put this in perspective, Google Trends searches show that interest in this cycle is low.

Meanwhile, VanEck’s HODL, the company’s spot BTC exchange-traded fund (ETF) product, has seen a notable increase in trading volume, according to the report. The spike occurred less than a week after VanEck said it would cut fees, but the massive spike was still surprising.

$HODL It’s going crazy today with an average daily trading volume of $258 million. This is 14 times higher than the daily average. That’s not one big investor (which makes sense), but 32,000 individual trades, an average of 60x. I don’t know how to explain it. Maybe it was added to the platform via wknd. pic.twitter.com/VTkjboS0ff

— Eric Balchunas (@EricBalchunas) February 20, 2024

Trading volume soared 14-fold to $258 million, driven by 32,000 individual transactions. “This is 60 times the average,” Balchunas said, adding that other ETFs including WisdomTree’s BTCW and Blackrock’s IBIT have performed well.

BTCW recorded trading volume of $154 million, a 12-fold increase over the average investment product. Additionally, assets increased 25x from 23,000 individual transactions. This is also unusual considering that BTCW only posted 221 transactions on Friday.

More interesting things: $BTCW Additionally, 23,000 individual transactions resulted in $154 million in transactions, 12x average and 25x equity. For context, there were only 221 transactions on Friday. at the same time $ goes The volume gets higher, but not to this crazy level. what? The unsolved mystery of ETFs will continue even after… pic.twitter.com/IXQmCKuCWl

— Eric Balchunas (@EricBalchunas) February 20, 2024

Additionally, BlackRock’s IBIT also saw a significant surge in trading volume, which Balchunas described as an “unsolved mystery.”

Bitcoin Price Prediction Amid Soaring BTC ETF Trading Volume

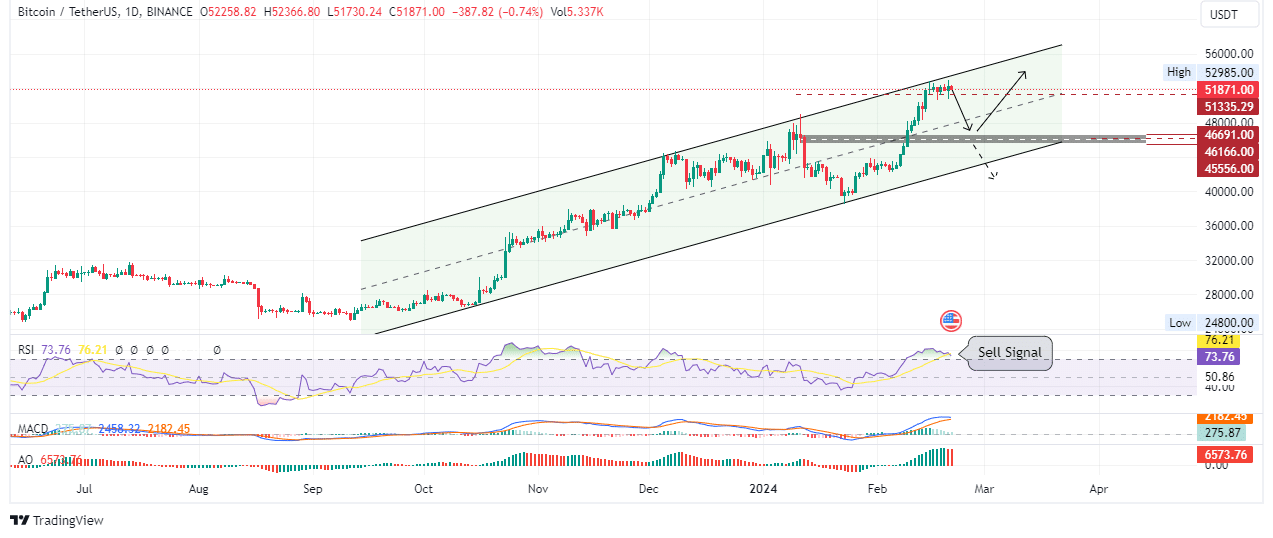

Bitcoin price horizontal consolidation continues, with immediate support at $51,335. If a decisive candle closes below this buyer stagnation level, a downtrend may begin. This could see BTC fall below the channel midline to test the supply zone turning into a bullish breaker between $45,556 and $46,691.

A bearish trend could push Bitcoin price below the $46,166 order block midline (average threshold). A close below this level on the daily time frame would confirm the continuation of the downtrend.

However, if the supply zone holds as support, it could provide a good entry point for left out and late investors before Bitcoin price rises to the next level. In such a turn of events, the most logical move would be to clear the range high of $52,985 and focus on the $56,000 milestone.

In a severe case, Bitcoin price could extend its decline below the lower limit of the rising channel to the psychological $40,000 level.

The Relative Strength Index (RSI) has already triggered a sell signal crossing below the signal line (yellow band). Additionally, the histogram bar of the Awesome Oscillator (AO) is blinking red, showing that the bearish trend is rising. This condition is reinforced by the fading histogram bars of the Moving Average Convergence Divergence (MACD) indicator. These features highlight bearish assumptions.

TradingView: BTC/USDT 1-day chart

converse case

On the other hand, if buyer momentum increases at the current rate, Bitcoin price could break or break beyond the limits of the rising parallel channel. This could set the pace for BTC to target the $55,000 milestone or, if we are very bullish, extend gains to the $60,000 psychological level.

Bitcoin price from an on-chain perspective

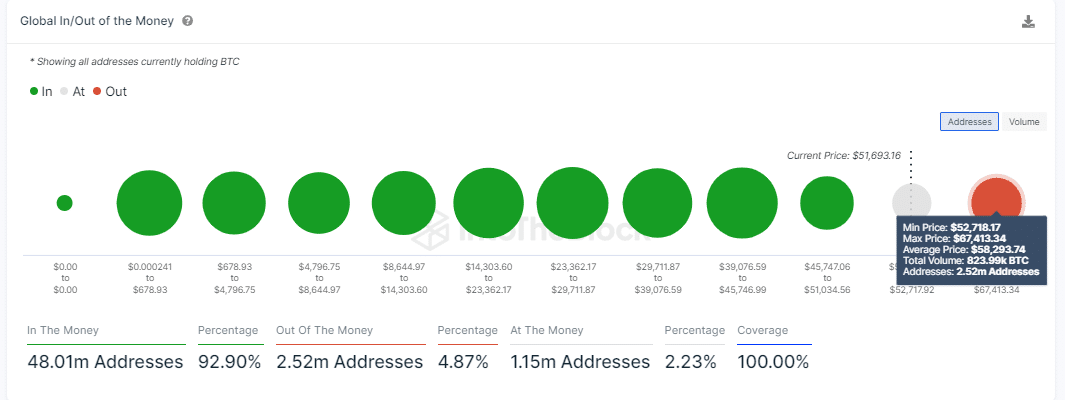

IntoTheBlock, an on-chain collection tool, exposes major obstacles and significant support bases for Bitcoin price. The Global In/Out of the Money (GIOM) indicator shows that BTC has strong support on the downside, while the area between $52,718 and $67,413 could provide significant opposition to BTC’s upside potential. Here, approximately 2.52 million addresses holding approximately 823,990 BTC tokens are expected to sell at a break-even price of $58,293.74.

BTC GIOM

Additionally, 92.9% of BTC holders are currently enjoying unrealized profits (cash). This is about 4.87% suffering unrealized losses (out of money). Meanwhile, only about 2.23% reach the break-even point.

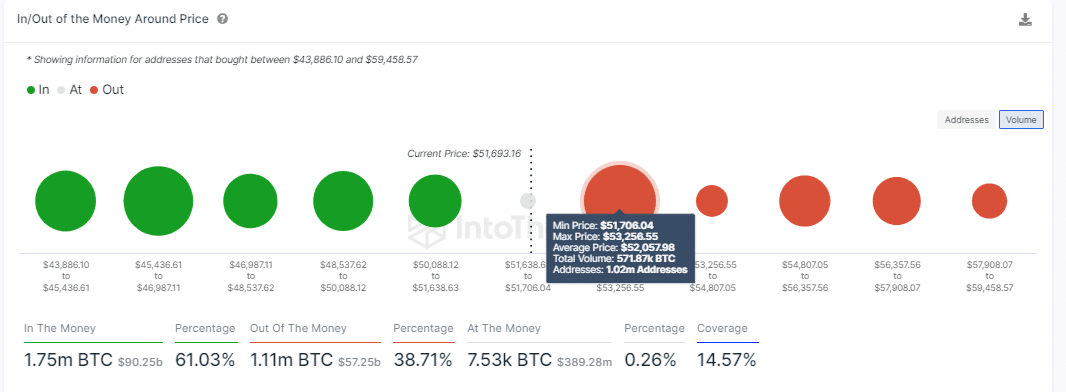

On the other hand, the In/Out of the Money Around Price (IOMAP) model places initial resistance slightly lower, between $51,706 and $53,256. Here, 1.02 million addresses hold approximately 571,870 BTC tokens purchased at an average price of $52,057.98.

BTC IOMAP

Meanwhile, while the Bitcoin price continues to consolidate, investors are looking forward to the halving, which is expected to solidify BTC’s next directional bias. Through this, active traders are purchasing BTCMTX, a project that allows them to easily enter the BTC market. The project has been a huge success in pre-sales, with analysts including YouTuber Jacob Bury predicting 10x growth potential.

A promising alternative to Bitcoin

Ranked as one of analysts’ top picks for the 5 Best Cryptocurrencies to Buy in 2024, BTCMTX is a powerful token from the Bitcoin Minetrix project that allows investors to mine BTC by staking their holdings.

Appreciate simplicity #Bitcoin Metrics 🔄#BTCMTX: Empowers users with secure funds and tradable tokens that they manage.

Traditional cloud mining: Stuck in complex contracts and terms. 📝 pic.twitter.com/rS4J2h6du0

— Bitcoin Minetrix (@bitcoinminetrix) February 20, 2024

Specifically, BTCMTX token holders stake their holdings for mining credits, which they then exchange for mining hash power or burn. Through this, the entire process was decentralized and tokenized to increase convenience for community members.

Considering the contrast between mining #Bitcoin and buy $BTC? 💭

💡 Plays an important role in network expansion.

🔒 Gain more control over your acquisition process.

🔧 Deepen your understanding of technical complexities. pic.twitter.com/yJNEtUNY2K

— Bitcoin Minetrix (@bitcoinminetrix) February 19, 2024

This project revolutionized Bitcoin mining as we know it, eliminating all third-party risk. Other advantages include, among other things, no hassles related to heat, space or cost.

A new era in cloud mining begins. #BTCMTX! 🚀

Users manage their mining technology by collecting staking credits.#Ethereum The network’s smart contracts ensure automatic distributed allocation, ensuring a safe and reliable mining experience. 🔗⛏️ pic.twitter.com/1SpVeCK2DN

— Bitcoin Minetrix (@bitcoinminetrix) February 18, 2024

Bitcoin Minetrix is in the pre-sale phase where each token is selling for $0.0136. Investors can purchase BTCMTX on the official website, and the pre-sale has currently reached $11.259 million out of the target target of $12.178 million.

Interesting news about #Cryptocurrency mine! 🚀#Polaris technology Unveiled plans for a $100 million, 200 MW data center in Muskogee, Oklahoma.

What opportunities do you think this development will bring to the community?#Bitcoin Metrics We successfully raised more money… pic.twitter.com/m6jQ29WJ1D

— Bitcoin Minetrix (@bitcoinminetrix) February 20, 2024

Visit Bitcoin Minetrix to buy BTC MTX here.

Also read:

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 50% or more

join us telegram A channel to stay up to date on breaking news coverage