Bitcoin prices are ready to soar? 2025 Aims to be the highest ever

This article is based on the research and analysis presented by Matt Crosby. Bitcoin magazine Pro.

Bitcoin has made waves in recent weeks, and Bitcoin prices have fallen $ 95,000 due to few months of lack of performance. For many merchants and investors, this change represents the profit of the bull market for a long time. Questions about the hearts of everyone: Can Bitcoin finally break the maximum of $ 108,000 before?

In this article, we discuss the extensive macroeconomic context to review the factors that lead Bitcoin’s recent momentum, enter the technology and warm chain data, and measure whether the major cryptocurrency can maintain a strong strength.

Fast recoil: Bitcoin’s recent surge

The price of Bitcoin has previously experienced a significant number of more than 30%, and has fallen from $ 100,000+to $ 70,000. But after the period of uncertainty, the king of cryptocurrency regained the footsteps and surged to $ 90,000. This price recovery occurs after several months of integration, and many have seen as a weak market structure. However, according to the recent development, Bitcoin can be in a couple of major brake outs, and supports a new wave of the Bitcoin price prediction model.

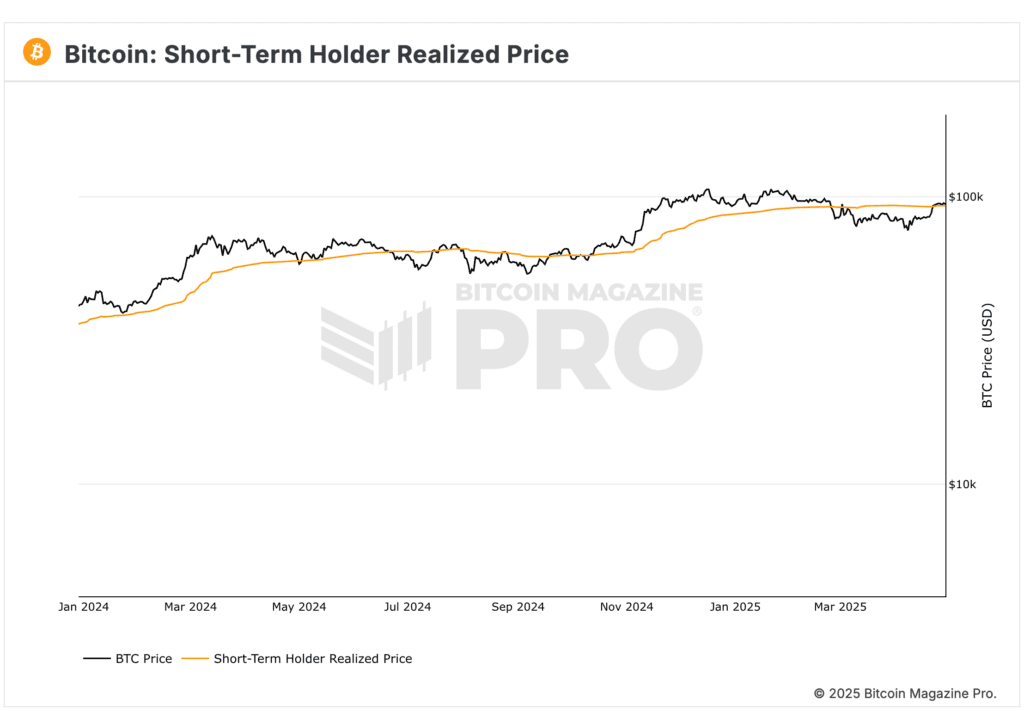

Bitcoin’s price measures have recent some major levels, including the recent prices of short -term holders (STH realization). This is often considered a major signal of market intensity. Historically, in the bull market, short -term holders have realized that the price plays a support level. When this metrics are reversed with support from the resistance, it usually represents a powerful foundation for additional upward exercises.

In the last few weeks, BTC (Bitcoin Price) has recovered from about $ 93,000 to $ 95,000, suggesting that the market can start for a significant rally. After reclaiming the major price levels, when the previous bull -san had similar behavior, many people began to feel more and more strong for the newest potential in 2025.

Thermal data: Signs of optimism of market intensity

When analyzing Bitcoin, it is not an important price measure but a chain data. This data understands the behavior of market participants and provides insight into the health of the network. The recent change in the supply of long -term holders is one of those indicators pointing out the prospect of strengthening Bitcoin.

In the last few months, Bitcoin has experienced an unusual pattern for long -term holders (who have Bitcoin for more than a year) and potentially abolish their profits. This caused many people to worry that the price of Bitcoin was closer to the highest point. But recent data shows reversal in this trend. Long -term holders have begun to accumulate again, which is often a strong signal in the Bitcoin market cycle. Historically, when long -term holders move to accumulation mode, they usually indicate the beginning of a new bull stage.

In addition, the presence of ETF inflows further strengthens these optimistic prospects. In the last few weeks, Bitcoin ETF has seen hundreds of millions of dollars flowing to them. This indicates that institutional trust in Bitcoin is growing. This inflow occurs in traditional markets such as S & P 500, but Bitcoin has maintained evidence and even meets despite wider market correction.

The role of market basic: Why this movement is different

Currently, fundamental changes are taking place in the Bitcoin market. This suggests that this is not another simple rally. Bitcoin’s current rising exercise seems to be led by spot driving purchases rather than excessive transactions. If the price of Bitcoin rises due to an increase in spot demand, not excessive leverage, movements are usually sustainable and less rapidly reversed.

One of the main drivers of this organic rise pressure at Bitcoin prices are the decrease in the US dollar robbery index (DXY). In the last few weeks, DXY has fallen to announce the decline in demand for dollars. This trend has made risky assets such as Bitcoin more attractive. As global liquidity increases due to various monetary policy measures, Bitcoin can benefit from this extensive market trend. Reducing the strength of the dollar also suggests potential changes in investor emotions, and more capital flows into an asset that can be excellent in performance in a weak dollar environment.

In addition, Bitcoin’s traditional stock market, especially S & P 500, was a key element of monitoring. In 2023, Bitcoin showed a strong positive correlation with the stock market. This means that Bitcoin tends to be appropriate when the S & P 500 rally. According to recent price measures, Bitcoin has been based on Bitcoin despite the temporary dip in the stock market, and that Bitcoin’s optimistic feelings can be continued, especially if traditional markets continue to rebound.

Macro factors: Global liquidity status

A wider economic situation cannot be ignored. The central bank has injected mass liquidity into the global market from 2020 to 2022. This liquidity was initially leading asset inflation in all markets, but is currently a significant sign of a positive impact on Bitcoin.

Bitcoin has historically related to global liquidity trends, and recently, the increase in liquidity in financial systems has finally begun to affect the cryptocurrency market. Bitcoin’s recent survivor coincides with this increase in liquidity, further strengthening the extended stages of the strongest stage.

But there are still important factors to consider. The potential to affect the state of global stocks and the price of Bitcoin. The S & P 500 has a strong reaction, but still faces resistance at the main level. The price of Bitcoin is closely related to the extensive achievements of the stock, and if the stock market faces more turbulence, Bitcoin’s prospects can be alleviated.

Bitcoin’s next step: What is over $ 100,000?

The $ 100,000 level is an immediate goal of Bitcoin price, but the actual question is as follows. The recent level of regeneration, such as the realization of short -term holders and the moving average (100 days, 200 days, 365 days), shows that Bitcoin is in a powerful position to test $ 100,000 again.

From a technical point of view, Bitcoin is currently defined. If you can maintain more than $ 90,000- $ 95,000 and continue to build support, the road toward the new all-time high is becoming more and more possible. The next big resistance will be about $ 108,000. This is the highest ever. If Bitcoin can penetrate that level, we can see that we move faster to higher levels.

But there is a possibility of always going back. If Bitcoin does not maintain support levels or the global market is weak, the price can return to the $ 80,000 range. If you can’t regain your support, you can set more important shortcomings, so the weak re -test will be an important moment for the market.

Conclusion: The prospect of strong optimism

All signs refer to potential Bitcoin rally with positive emotions in powerful warm chain data, favorable macro environment and derivatives markets. However, the key to maintaining this strong momentum is to maintain Bitcoin’s current support level and explore potential market correction. A strong correlation with the S & P 500 remains an important factor to watch because the fall of stocks can affect Bitcoin’s price behavior.

In the next few weeks, all the eyes are the ability to regain $ 100,000 and set a stage for the best of the new history. Although there is plenty of optimism, traders must keep their boundaries and prepare for potential volatility. As always, the key to success in the crypto market is to maintain data -centered and adjust the market conditions as the market situation develops.

Visit BitcoinMagazinepro.com to explore live data and maintain the latest analysis.

Indemnity: This article is for the purpose of providing information and should not be considered financial advice. Always do your own research before making an investment decision.