Bitcoin Remains Price Elastic Despite Increased Miner Sales

As facilitators of network security and transaction confirmation processes, Bitcoin miners have significant influence over the supply of BTC in the market.

This is why no market analysis can be complete without analyzing changes in miners’ balances and activities. First, changes in miner balance and activity provide insight into the economic health and operational stability of the sector. Second, miners’ decisions to sell or hold BTC may reflect confidence in its future value and indicate changes in market sentiment. Moreover, because miners are the primary source of new BTC entering the market, their selling and holding patterns can directly impact Bitcoin’s price volatility and liquidity.

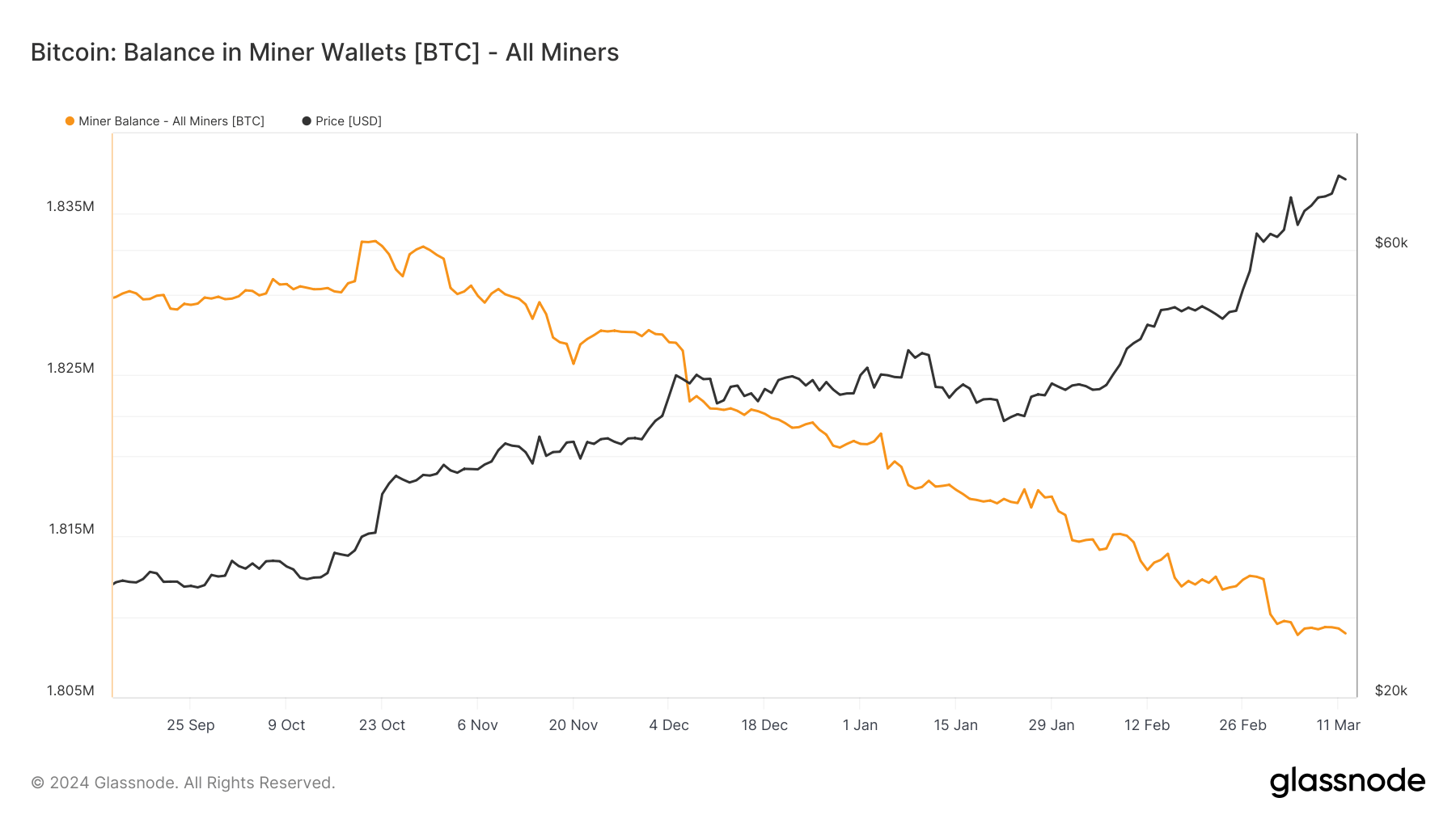

Data from Glassnode shows a gradual decline in BTC balances held in miners’ wallets starting in the fall of 2023. The balance decreased from 18.33 million BTC on October 22, 2023 to 18.08 million BTC on March 12.

Since the beginning of March, over 4,000 BTC has been left in miner balances. The decline, which appears to have accelerated significantly this month, shows continued selling pressure from miners looking to reduce reserves to cover operating costs or take advantage of price increases.

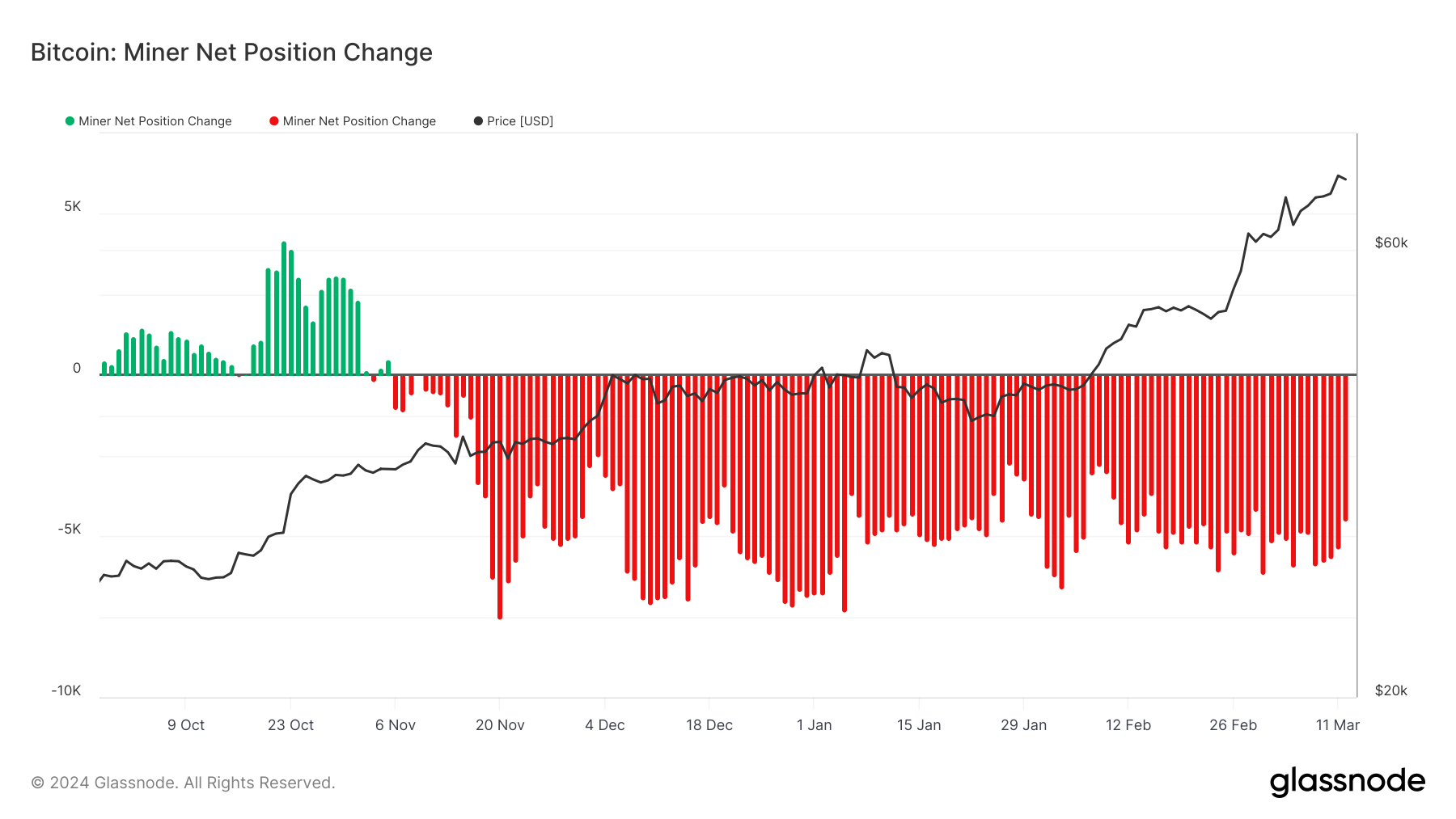

The net change in miner balances, which has been consistently negative since November 2023, shows the depth of this selling trend. The largest outflow of 7,310 BTC was recorded on January 5, and another large outflow of 6,165 BTC was recorded on March 1.

These outflows come ahead of important market events, including the launch of a spot Bitcoin ETF in the U.S. and an aggressive rally that pushed Bitcoin prices above $70,000 and show that miners are anticipating major market moves.

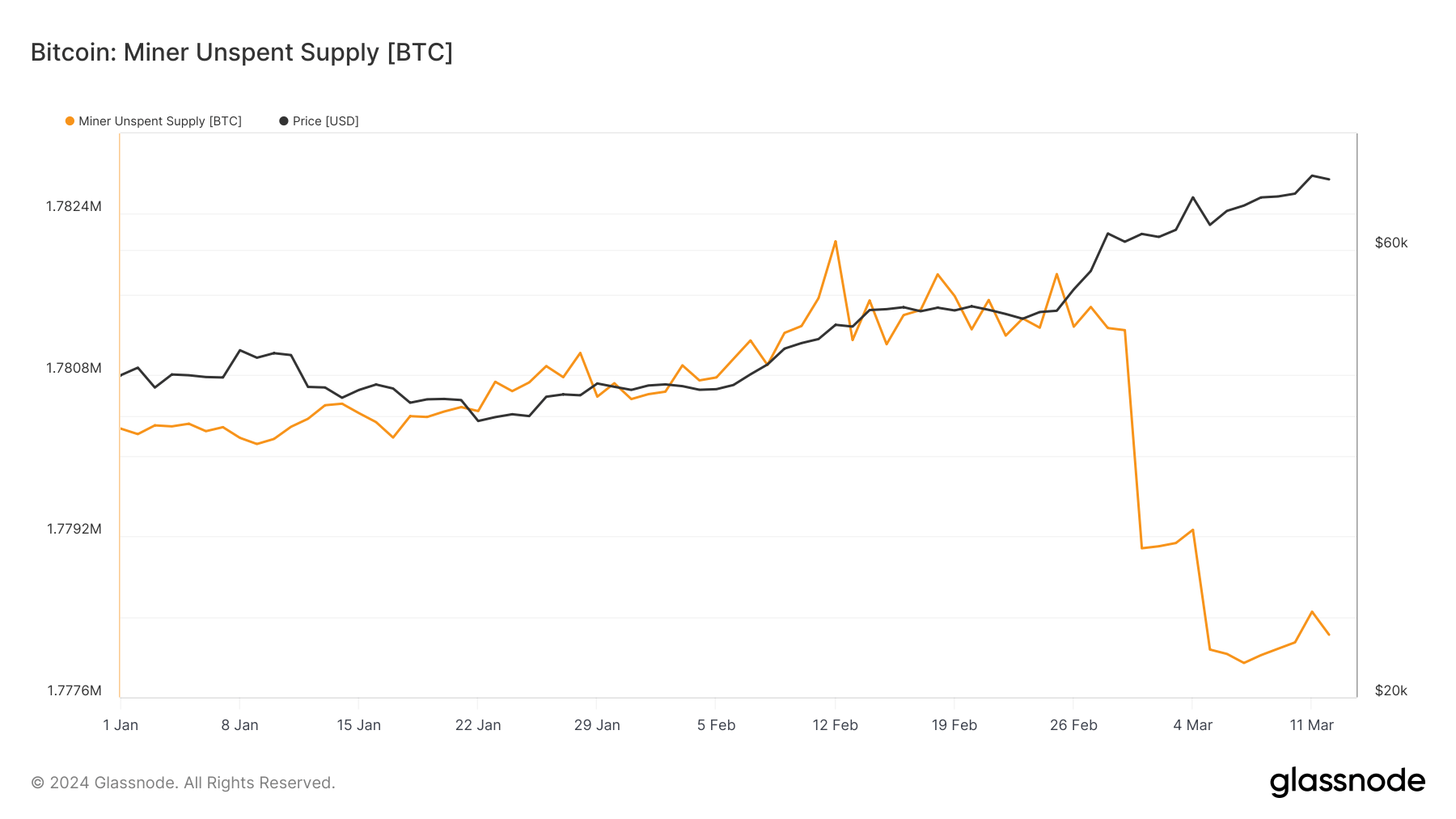

Interestingly, despite the sell-off, miner unused supply (BTC that miners have mined but not yet sold) has shown relative stability, fluctuating slightly from 1.78 million BTC at the start of the year to 17.78 million BTC on March 12th. This means that while miners are selling, the rate of new BTC mined and held is roughly in balance with the rate of BTC sold.

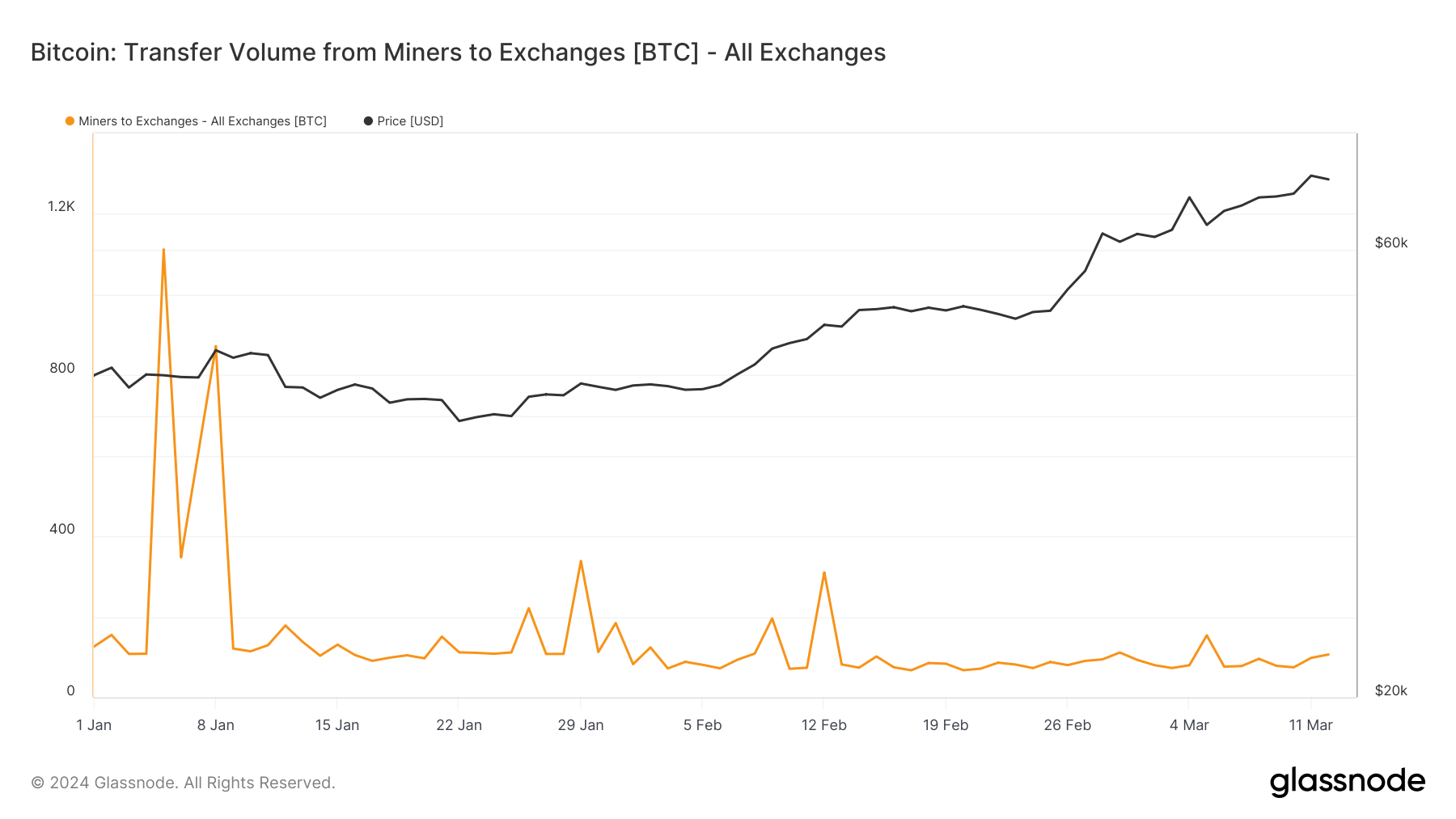

The movement of coins from miners to exchange wallets particularly peaked around the launch of spot Bitcoin ETFs, showing miners exploiting opportunities or managing liquidity needs.

With average trading volumes in the first quarter of 2024 ranging between 67 BTC and 150 BTC, and reaching a peak of 106 BTC on March 12, it is clear that miners are actively managing their holdings, but not at a scale that would suggest mass liquidations.

Bitcoin miners have been net sellers over the past six months, but the introduction and adoption of spot ETFs in the US has injected significant liquidity and buying pressure into the market. The selling by miners, although significant, was absorbed by the market without derailing the bullish momentum established since the start of the year.

The post Bitcoin maintains price elasticity despite increased miner sales appeared first on CryptoSlate.