Bitcoin surge sparks miner sell-off

The role of Bitcoin miners goes beyond block verification and is essential to making markets through BTC balances. Historically, these balances have been closely tied to Bitcoin’s price movements, making them a key indicator for market analysis.

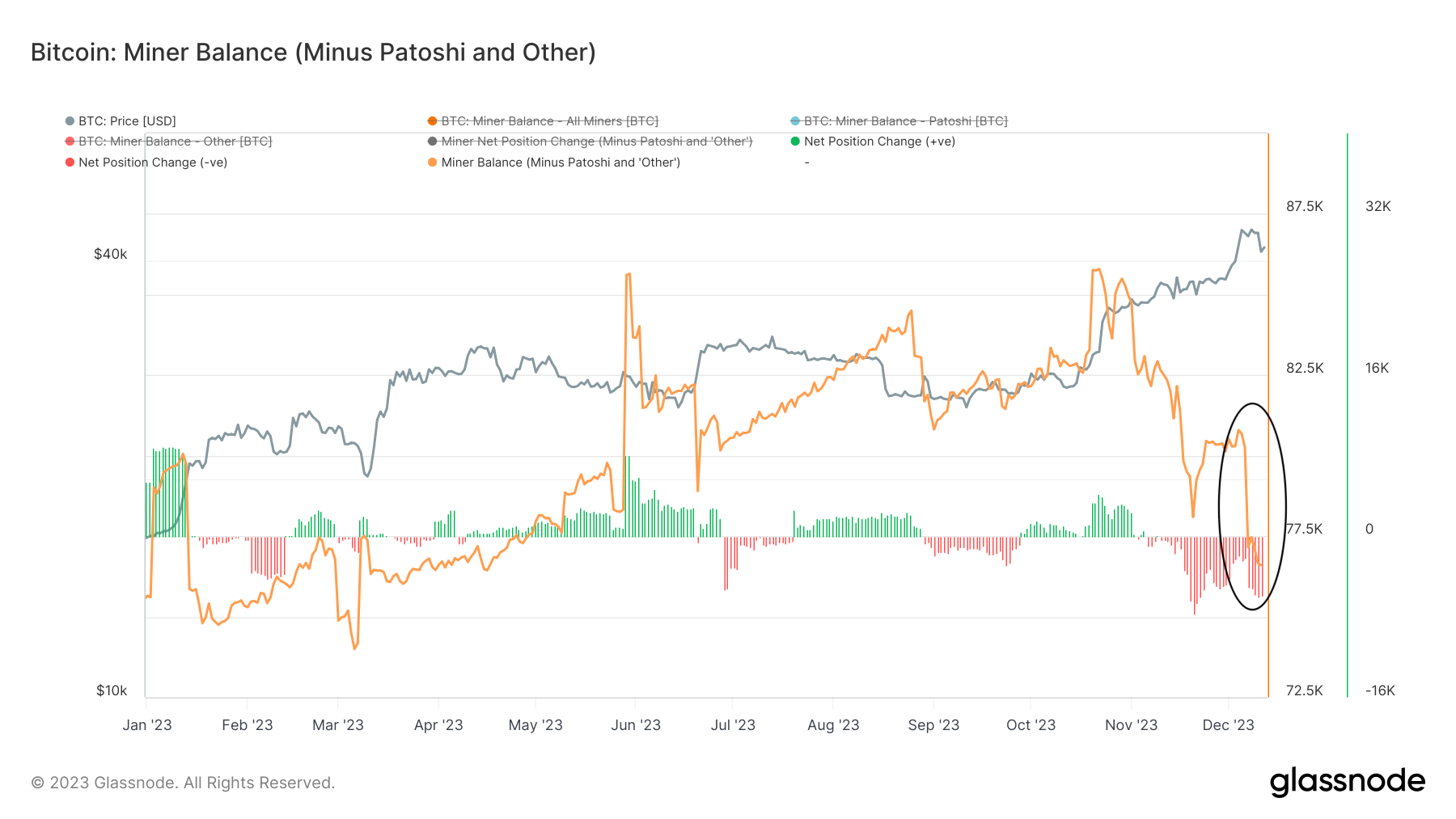

Bitcoin’s recent surge past $40,000 has seen significant action from miners. In early December, the Bitcoin price was $38,680. It rose to a high of $44,200 on December 8 and consolidated around $41,200 on December 11. Despite this consolidation, an increase of almost 8% in 10 days indicates that the market is showing strength.

As the price of Bitcoin rose, miner balances decreased noticeably. The balance decreased from 80,520 BTC on December 1 to 76,602 BTC on December 11, reaching its lowest point since April. A decline of 3,918 BTC (about 4.86%) suggests a strategic response from miners, who are likely aiming to take advantage of the price rise by selling their holdings.

There are many reasons why miners reduce their balances, but operating costs are often the most important. The recent negative mining difficulty adjustment may have provided miners with a golden moment to secure profits amid rising prices.

Fluctuations in miner balances reflect the adaptive nature of the Bitcoin mining sector. During bear markets, miners tend to accumulate profits from block rewards and fees, betting on a future price recovery. However, in bull markets, holdings are often liquidated with the goal of maximizing operating profits.

The current trend of rising Bitcoin prices along with decreasing miner balances points to a market phase characterized by miners’ confidence in price stability or expectations of further growth. However, this decline in miner balances also raises warning signs. Significant selling by miners could increase market supply, potentially putting downward pressure on prices if not balanced by adequate demand.

As miners react to market conditions, their actions provide valuable insight into the state of the market and its future trajectory. This is a reminder that various on-chain metrics must be continuously monitored to fully understand the evolving landscape of the Bitcoin market.

In current market conditions, miners appear cautiously optimistic, which is likely indicative of positive sentiment in the broader market. However, the potential impact of increased supply from miner divestitures should not be underestimated.

The post Bitcoin Surge Causes Miner Selloff appeared first on CryptoSlate