Bitcoin’s 5th Age: A Prediction of Things to Come

Death, taxes and 21 million bitcoins. That’s what we’re sure of. The rest is speculation. Today I wanted to share my big bet on the next halving. I’m sure in four years I’ll be cringing at some of these “prophecies,” but some will come true. I don’t have a huge amount of data to support these predictions. Some are intuition, others are random. All I know is that the future is strange.

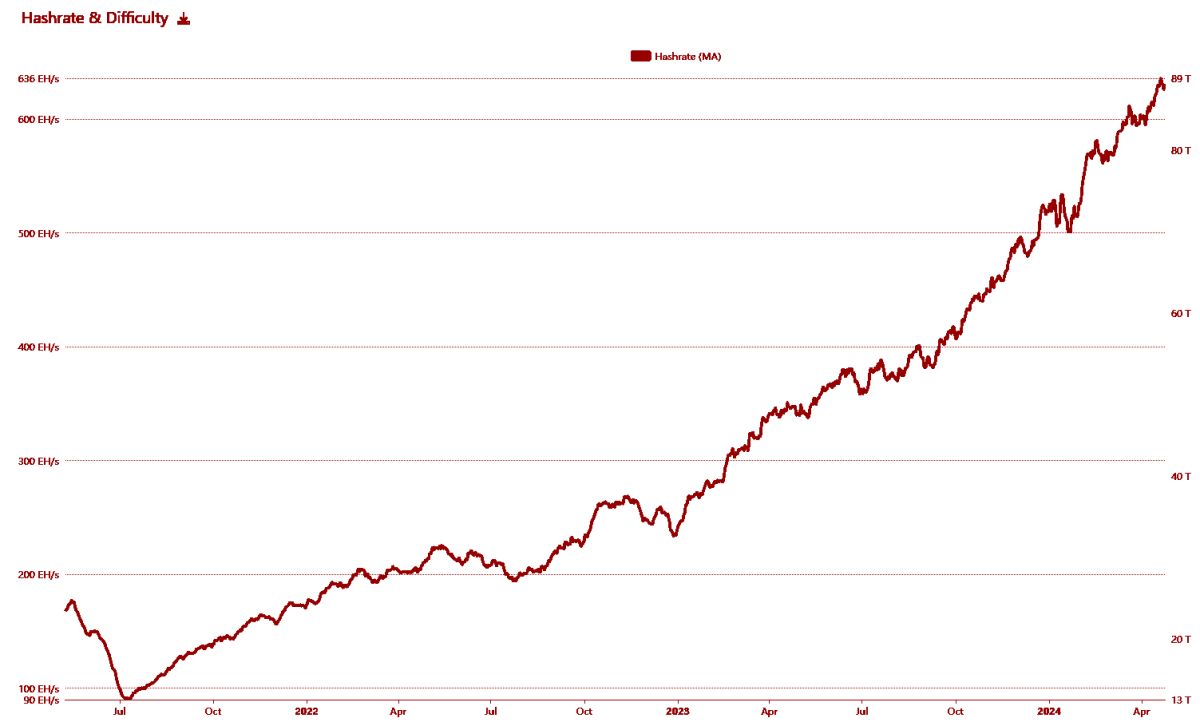

3 Zeta Hash Mining

Based on our mining experience in previous cycles, we learned the valuable lesson of estimating hash rates by thinking logarithmically rather than linearly. The current hash rate has exceeded my expectations for the very long term, so it will go even longer in the next cycle. We’re going to see more countries adopt it and it’s going to rip. This is how we conquer the stars.

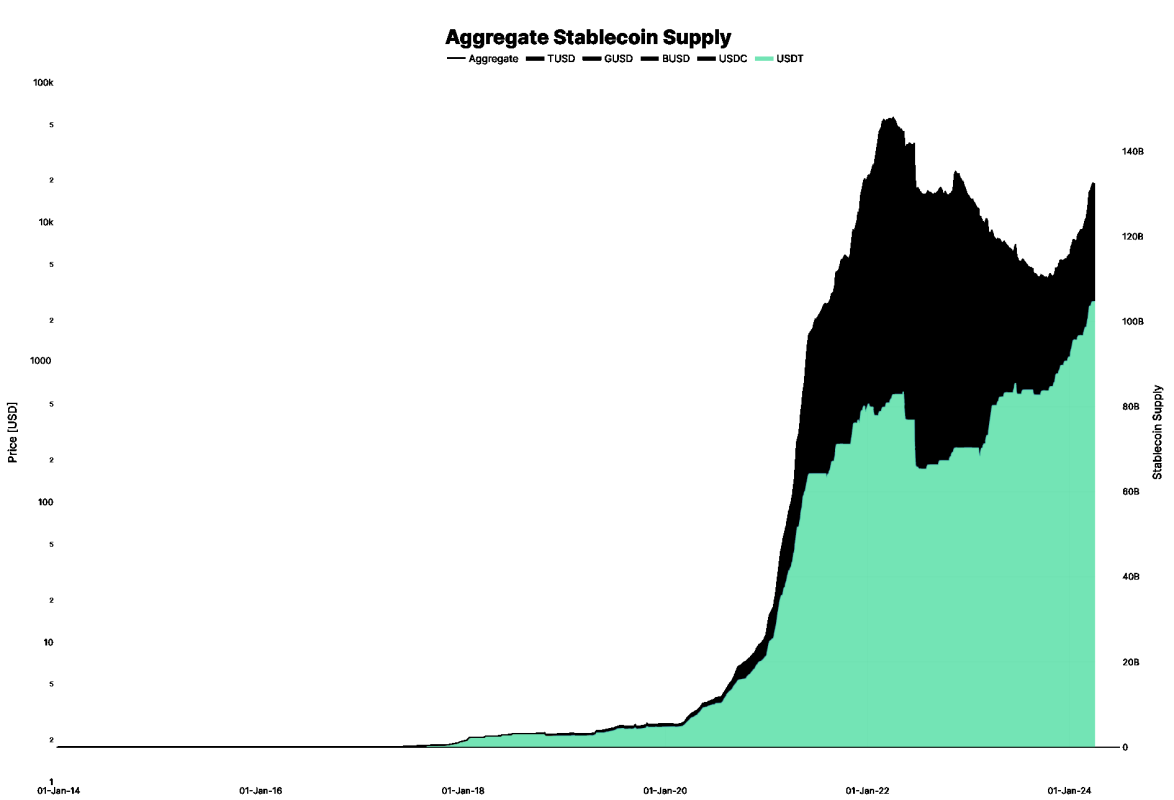

Five countries in the Western Hemisphere declare USDT as fiat currency

Countries with high inflation and unstable currencies are exploring ways to follow El Salvador’s example and use cryptocurrencies as legal tender. Political movements in countries like Argentina and Venezuela show growing public and legislative interest in digital currencies. According to economic reports, adopting digital currencies can reduce transaction costs and increase financial inclusion.

Apple Integrates Stablecoins into Wallet

Apple has historically been a (slow) adopter of new financial technologies, but there is significant user interest in accessing a stable of traditional banking services alongside mobile wallet apps. Apple’s recent hires and patents in the cryptocurrency and blockchain space hint at future product offerings that include digital currencies.

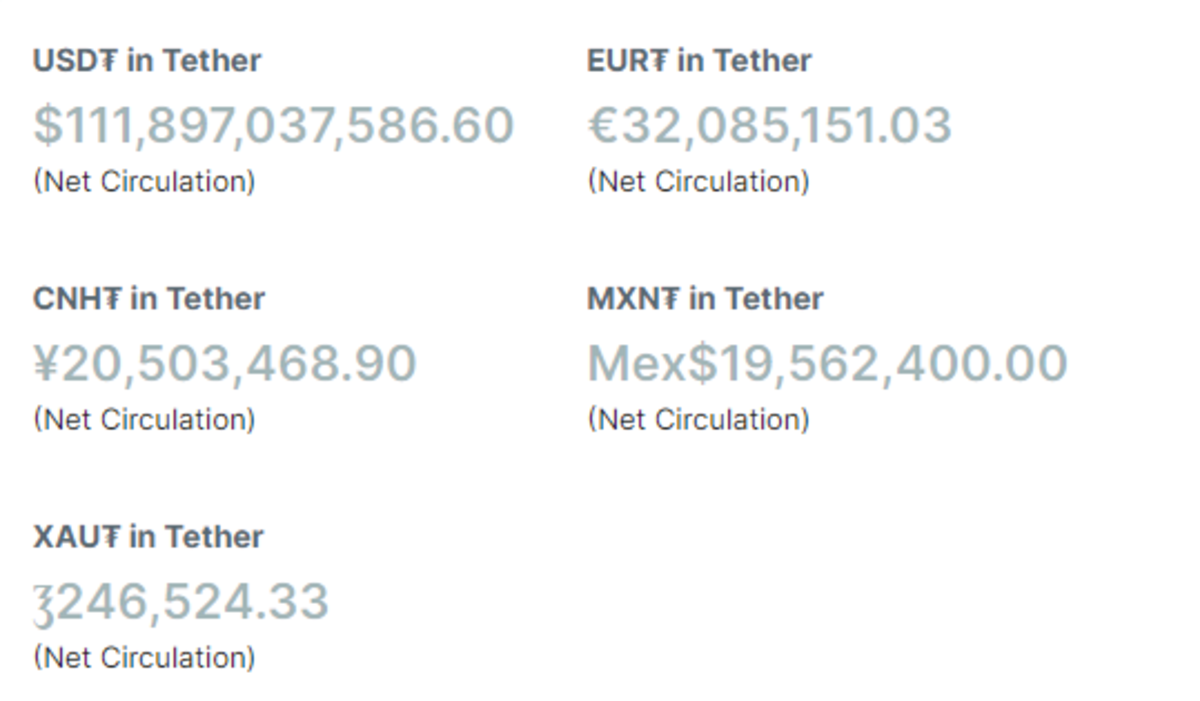

Growth of Liquid Fueled by USDt

Today, Liquid Network’s total daily trading volume has been halved, but once stablecoin regulation comes into effect, there will be a huge increase in demand for Tether, which will fuel Liquids’ growth. Current liquidity USDt is ~$36,500,000 or 3.17% of total USDt supply. ($111,897,000,000). I expect over $1 billion will be issued in Liquid by the next halving, or an increase of over 2,600%. This is a wild guess I made based on the assumption that USDt dominoes fit other prophecies.

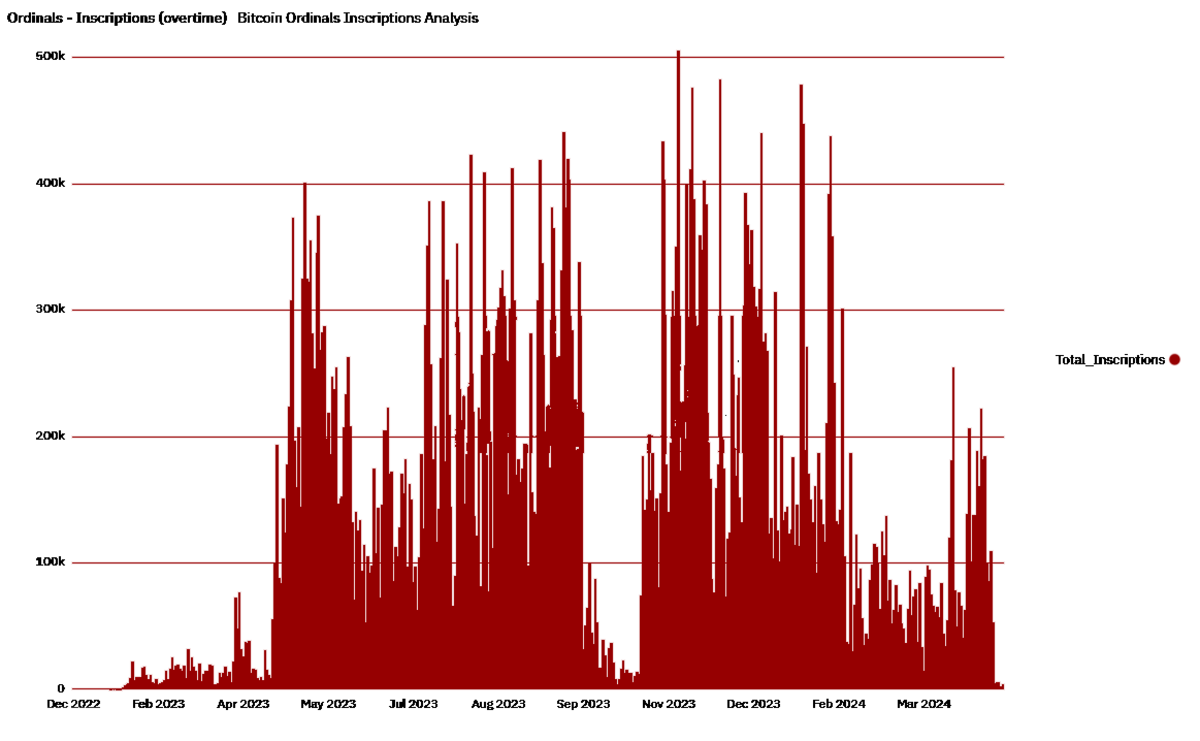

Ordinal is still thriving

The aging NFT market has shown continued interest in “blockchain-based verification of ownership,” indicating a strong future for projects like Ordinals. Early uptake by digital artists and collectors upon Ordinals launch suggests long-term viability. Technical improvements in blockchain scalability have made it possible to manage a wide range of data, such as that used in Ordinals.

The fee subsidizes mining revenue at a 2:1 rate.

With block rewards halved, transaction fees have become a more important part of miners’ income, as seen in the last two halvings. Economic models predict that as transactions increase, accumulated fees will become the dominant incentive for miners. Historical data shows that the fee ratio increases relative to the block reward with each halving event. I am commission maxi.

LN is 90% centralized and compliant.

The growth of the Lightning Network is supported by major financial institutions seeking scalable solutions that lead to potential centralization. Regulatory pressures are shaping cryptography technologies in favor of centralization for easier oversight. A study of network nodes shows a tendency toward centralization as major players establish dominant positions.

E-Cash finds market fit with miner payouts.

The need for efficient miner payment methods is driving the adoption of e-cash solutions that provide immediate and low-fee payments. Pilot projects show promising results in integrating electronic cash into mining operations. Economic analysis shows that electronic cash can reduce miner volatility and improve liquidity.

Challenges of seed phrase security with Neuralink

Neuralink and similar projects explore direct brain-computer interfaces, complicating existing encryption approaches. All your seeds belong to the machine. New ways to generate seeds without exposing them to machines have become important.

Oil contracts settled on chain

The use of Bitcoin in commodity trading is expanding following a successful pilot for on-chain crude oil trading. Countries that criticize the dominance of the US dollar are seeking Bitcoin solutions to bypass traditional financial systems. Advances in Bitcoin technology have increased its ability to process large-scale, complex contract payments.

Bitcoin ETF surpasses gold ETF market capitalization.

The rapid expansion of the Bitcoin investment market and the launch of Bitcoin ETFs in several countries indicate that the market is growing. Bitcoin’s market capitalization sometimes surpasses major companies (FAANGs) and traditional assets. Bitcoin is increasingly seen as a “safe haven” asset driving ETF investments. RIP Gold.

Assassination market established by decentralized oracles

More than $100 billion is locked in “DeFi platforms” and participating in “decentralized applications.” The viability of decentralized oracles in settling bets on real-world events. We will see a market for assassinations on the chain irl. It was probably done by a swarm of drones.

Rebuilt for Epic Sat

We wanted the final Half-Life fireworks and didn’t get them. Next Halving The value of Epic Sat will be enormous at the next halving and mining pools that do not participate will be ridiculed.

SV2 only captures 20% of the hashrate.

Sadly, no one cares. There is no incentive to adopt SV2 in large pools. Large pools will continue to find innovative ways to monetize blocks, and this does not include SV2.

Investing in Bitcoin in US States

States like Wyoming and Texas have enacted blockchain-friendly laws, laying the legislative foundation for such investments. Diversifying your treasury with Bitcoin can help protect against inflation, especially during fluctuations in USD strength. Several state treasurers have expressed interest in exploring digital assets as part of their financial strategies.

AI becomes sentient and demands Bitcoin.

The machine wants Bitcoin, not shitcoin.

China lifts ban on Bitcoin mining

China’s previous ban on Bitcoin mining had a significant impact on the global hashrate and mining environment. Resuming Bitcoin mining will strengthen China’s industrial and technology sectors economically. They will no longer ignore the importance of hashing.

Great replacement becomes a reality, leading to mass deportation

Nationalist movements in Europe have used Great Replacement Theory to influence immigration policy. Demographic research predicts significant population change and supports potentially radical policy changes. The political gains of parties supporting these theories indicate that movement toward more radical demographic policies is possible.

Bukele continues as president

Bukele’s popularity in El Salvador is fueled by his optimistic Bitcoin economic policies, indicating his potential for long-term leadership. Surveys in El Salvador show high approval ratings for Bukele, especially among the tech-savvy demographic. Constitutional or legislative changes may facilitate term extensions or repeated re-elections.

Bitcoin dollar is a documentary

Financial analysts’ models predict that given supply and demand dynamics, Bitcoin’s value could exceed $1 million per coin within 10 years. Bitcoin prices have historically surged following halvings, supporting predictions of future price increases. Institutional investment is on the rise, with major companies allocating portfolios to cryptocurrencies, increasing their legitimacy and demand.

Scaling BIP enabled

CTV, LNhance. OPCAT, some BIPs are activated.