Bitwise CIO: Ethereum ETF to Surge to Record High Above $5,000

As the launch of the much-anticipated spot Ethereum ETF approaches, Matt Hougan, Chief Investment Officer at crypto asset manager Bitwise, has highlighted the potential of such an ETF. ETF inflow It has pushed the price of Ethereum to an all-time high.

In a recent client note, Hougan highlighted the significant impact that ETF flows could have on the Ethereum price, an impact that would surpass that seen in the U.S. spot Bitcoin ETF market.

Will an Ethereum ETF Surpass Bitcoin’s Power?

Hogan said confidently predict He warns that the introduction of a spot Ethereum ETF could see a surge in the value of ETH, potentially reaching an all-time high of over $5,000. However, he warns that the first few weeks after the ETF launch could be volatile, as money could flow out of the existing $11 billion Grayscale Ethereum Trust (ETHE) after it is converted to an ETF.

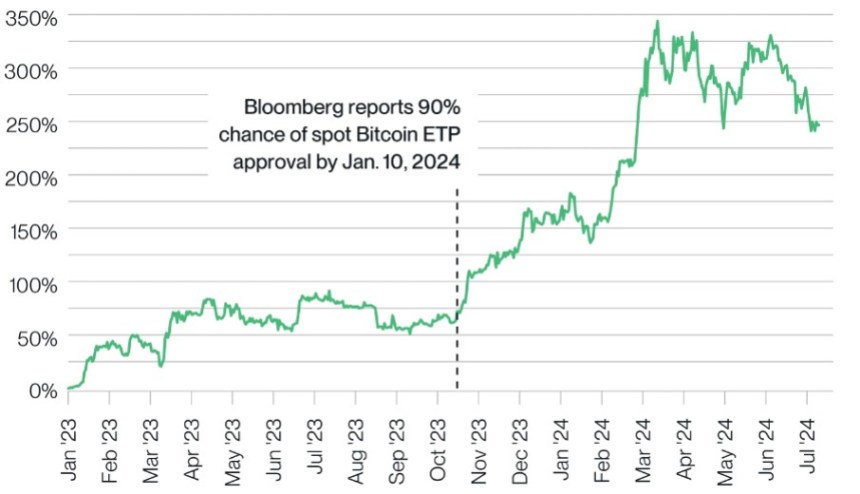

This could be similar to the case of Grayscale Bitcoin Trust (GBTC), which saw significant outflows of over $17 billion. Bitcoin ETF The market was approved in January, and the first inflows were recorded five months later, on May 3.

Nonetheless, Hogan expects Ethereum to hit record highs by the end of the year after the market stabilizes in the long term and the initial outflows subside, and he compared the key indicators to Bitcoin to understand his theory.

References

For example, a Bitcoin ETF contributed to the 25% increase by purchasing more than twice as much Bitcoin as miners produced during the same period. The price of Bitcoin The ETF has risen 110% since its launch, and has risen 110% since the market priced its launch in October 2023.

Nonetheless, Hogan believes the impact on Ethereum could be much greater, and outlines three structural reasons why Ethereum ETF inflows could have a greater impact than Bitcoin.

Reduce inflation, gain advantage, scarcity

The first reason Bitwise’s CIO highlights is that Ethereum’s short-term price is low. Inflation rateWhen the Bitcoin ETF launched, Bitcoin’s inflation rate was 1.7%, but over the past year, Ethereum’s inflation rate has been 0%.

The second reason lies in the difference between Bitcoin miners and Ethereum stakers. Because of the costs associated with mining, Bitcoin miners Typically, they sell most of the Bitcoin they acquire to cover operating costs.

Ethereum, on the other hand, relies on a proof-of-stake (PoS) system, where users stake ETH as collateral to ensure that transactions are processed correctly. With no high direct costs, ETH stakers are not obligated to sell their earned ETH. As a result, Hogan suggests that Ethereum’s daily forced selling pressure is lower than Bitcoin’s.

References

The third reason is that a significant portion of ETH is staked and cannot be sold. Currently, 28% of all ETH is staked and 13% is locked in smart contracts, effectively removing it from the market.

This leaves about 40% of all ETH unsellable, leaving a significant lack And ultimately, we favor a potential price rally for the second-largest cryptocurrency on the market, which will depend on the recorded outflows and inflows. Hougan concluded:

As mentioned above, I expect the new Ethereum ETP to be successful and raise $15 billion in new assets in the first 18 months of its existence… If the ETP is as successful as I expect, and considering the dynamics above, it is hard to imagine that ETH will not challenge its previous record.

ETH is trading at $3,460, up 1.5% over the last 24 hours and about 12% over the last seven days.

Featured image for DALL-E, charts from TradingView.com