Blue Chip REIT Battle: Prologue to Real Estate Income

timandtim

REITs to Consider

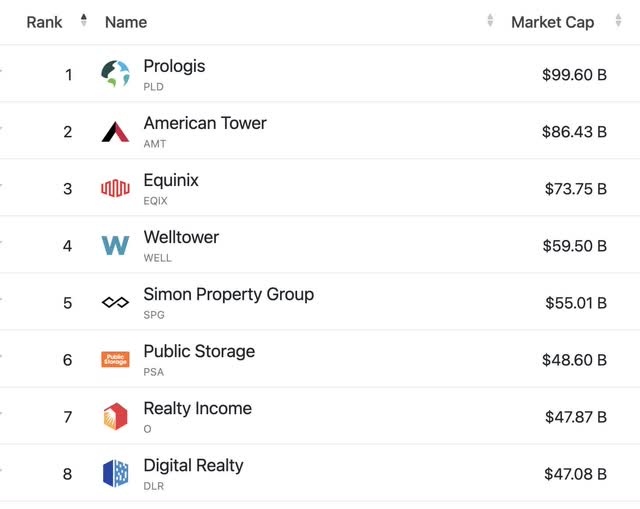

Two of what I consider the “blue chips” of the REIT industry have collapsed following subsequent interest rate hikes in 2022. polar Retail – Opposite of Commerce Real estate spectrum. One supports e-commerce and the other Traditional brick and mortar. Both have their pros and cons, and both are in the top 10 holdings of most REIT index funds.

EnterpriseMarketCap.com

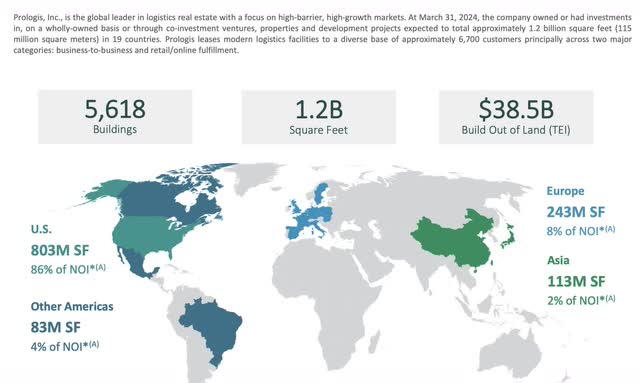

Prologis Co., Ltd.PLD), It is currently the largest REIT by market capitalization. Real estate income (o) has seen some fluctuations over the past few years, but is currently under Digital Realty (DLR).

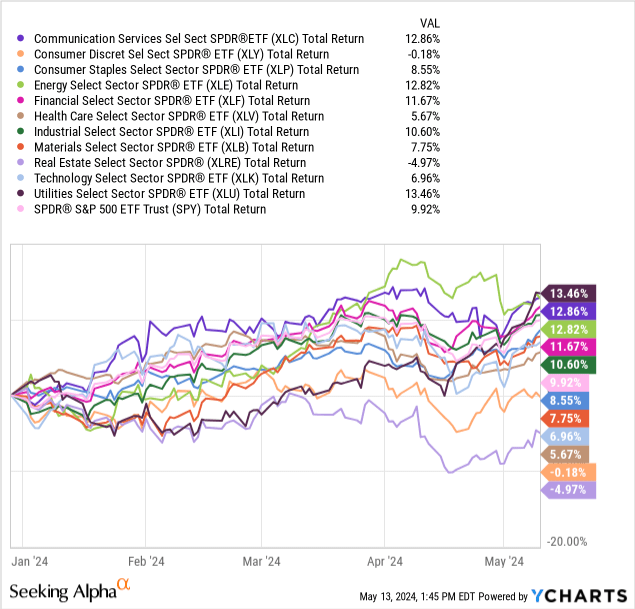

Performance by sector

Let’s take a look at the year-to-date rankings for all 11 categories. as expressed by very cool Looking at the arrangement of SPDR sector ETFs: The REIT sector was the worst performer. this It is a total return versus price return indicator. That means this paltry rate of return. Includes: Large dividends offered by the REIT sector. Although this has disappointed some long-term REIT investors, I think there is an opportunity. A decline of nearly 5% year to date due to inevitable rate cuts could be a stroke of luck for buyers at these levels.

high discount rate

Prologis has been boasting a higher FFO multiple for some time. this It occurred due to ~. growth of the company It happened in conjunction with the e-commerce explosion in the ‘everything at home’ era. We work from home, shop from home, and order from home.At home, etc… Combined with the convenience of remote battery-powered surveillance cameras, we can now all live in our own little fortresses of solitude like a modern-day Batman or Lex Luthor, whoever we want to be.

Realty Income has recently shifted into new types of commercial real estate, such as casinos, which are growing slowly and haven’t always been part of the company’s strategy.

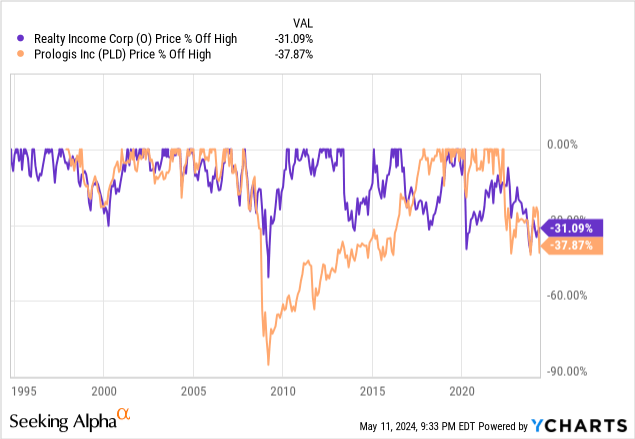

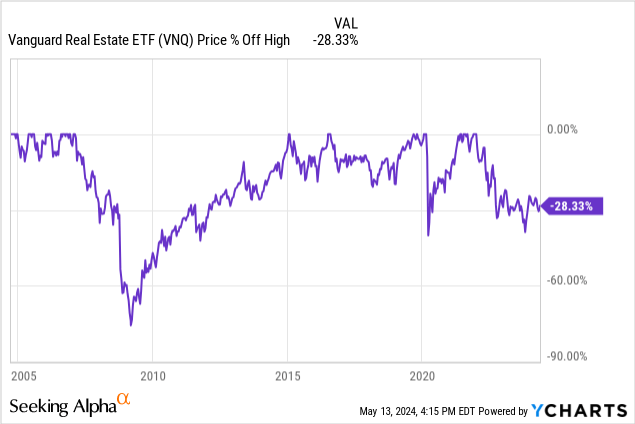

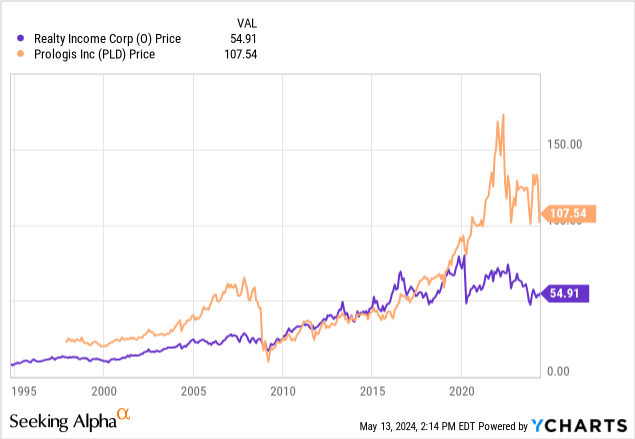

As with the REIT sector generally, both are down more than -30% from their all-time highs.

Both of these names are surpassing the average destruction in their sectors, with (VNQ) ETF fell only -28.33%. This is because two of the biggest names in the REIT sector are offering better discounts to ATH than average. good Time to take a look at both names.

Growth, dilution and balance sheet management

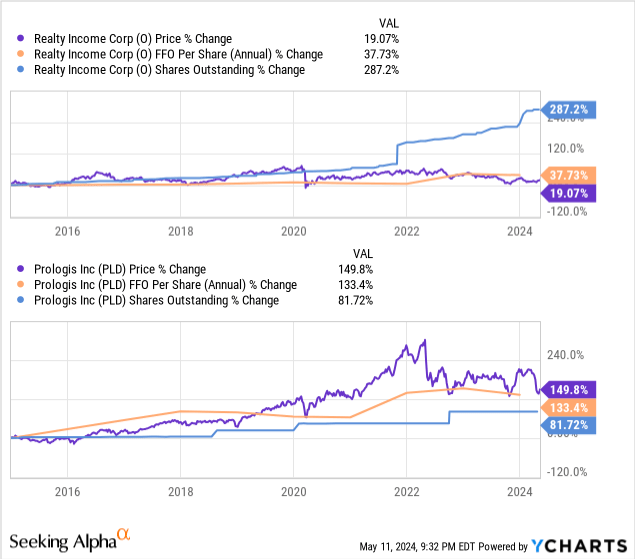

One of the common complaints about REITs in general is their dilutiveness. With more than 90% of operating funds paid out, REIT managers can only finance growth through debt financing or new stock market launches.

Over the past decade, Prologis has shined in this space, with much less dilution and higher FFO per share growth. Therefore, the multiples commanded by the company are higher.

balance sheet

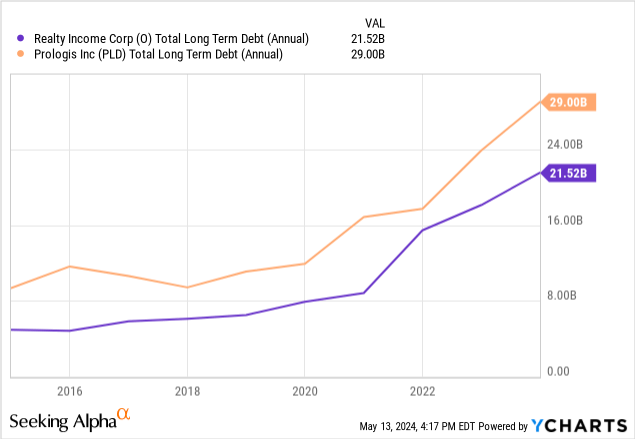

On the other hand, Prologis have Over 10 years, it has about $6 billion more in long-term debt accumulation than Realty Income Corp. Let’s take a rough look at the current interest rates both companies are paying on their debt.

preface:

- TTM interest expense: $698.6 million

- TTM long-term debt: $29.45 billion

- Expected interest rate: 2.97%

Real Estate Income:

- TTM interest expense: $816.9 million

- TTM long-term debt: $24.76 billion

- Expected Interest Rate: 3.29%

So Prologis appears to have been better at timing its loans than Realty Income, despite both holding Moody’s A3 credit ratings.

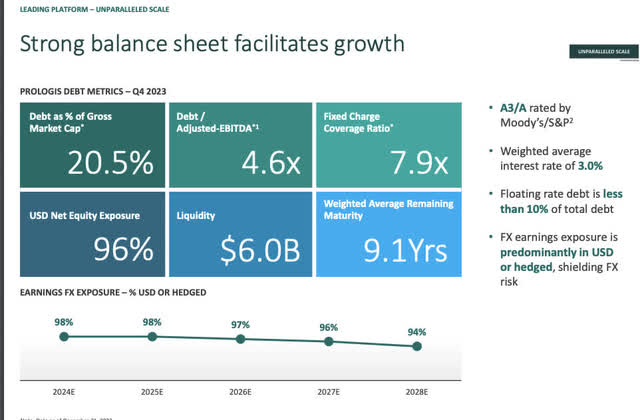

Prologis has a long debt runway

Prologis Investor Relations

What’s even more impressive than Prologis’ weighted average interest rate is less than 3%. The weighted average time to maturity is 9.1 years. With inflation rising above 2.97%, there are virtually 10 years left to borrow “free money.”

FFO per share analysts expect growth

Data courtesy of Seeking Alpha:

Real Estate Income Corporation

| Fiscal 2024 FFO/share | 4.23 |

| FY 2025 FFO/share | 4.37 |

- Expected growth rate in FFO/share 3.3%

Prologis Co., Ltd.

| Fiscal 2024 FFO/share | 5.44 |

| FY 2025 FFO/share | 6.11 |

- Expected growth rate in FFO/share 12.3%

Next, let’s take a look at what analysts are predicting for FFO growth. we can see From saturated Years expected through 2024 saturated expected year 2025, real estate income Only predicted Increases FFO per share by 3.3% compared to 12.3% for Prologis. This is a pretty big difference that separates the two companies in the REIT sector in terms of growth vs. value.

Adjusted PEG ratio, which is FWD FFO/stock multiple divided by expected growth rate.

- Real Estate Income PEG FWD = 3.17

- Prologis PEG FWD= 1.43

Prologue Form Rental

Prologis Investor Relations

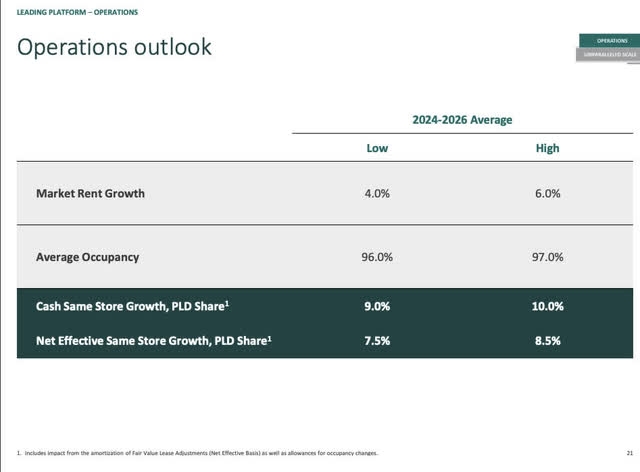

According to Prologis, the company expects organic rental growth in the range of 4-6% per year in 2024-2025. Almost 100% occupancy is expected. These numbers suggest that logistics is one of the healthiest subsectors in the REIT sector.

graham number

| inventory | book price | FFO/Share | graham number |

| real estate income | $44.77 | $4.23 | 65.27 |

| prologue | $57.39 | $5.44 | 83.81 |

We consider fair value using modified Graham numbers, substituting FFO/shares instead of EPS. formula Square root of (EPS“, We can see that Realty Income is the cheaper of the two. Many would argue that the book value of many REITs is: not inaccurate measureAs interest rates rise, that much The value of these assets is getting closer to cost by the day.

I would argue that Realty Income’s assets are more likely to fetch market value than cost due to their central locations in expensive metropolitan areas. Typically, distribution centers located in off-the-beaten-path locations that don’t compete for square footage with more expensive residential real estate will have lower appreciation rates than strip malls in Los Angeles. In ~ my opinionand Prices in the commercial market are continually being re-evaluated; Market value is increasingly becoming a matter of opinion.

the trajectory of the sectors they serve;

prologue

Prologis Investor Relations

The way Prologis makes money is a little different from Realty Income. both leasedWe manage and operate funds with partial or majority ownership of warehouse sales and operations. thus In ~ In some ways this is both a catalyst and a risk. For warehouses where Prologis collects operating revenue through contracts, a recession could be even more detrimental. You won’t want to evict yourself right?

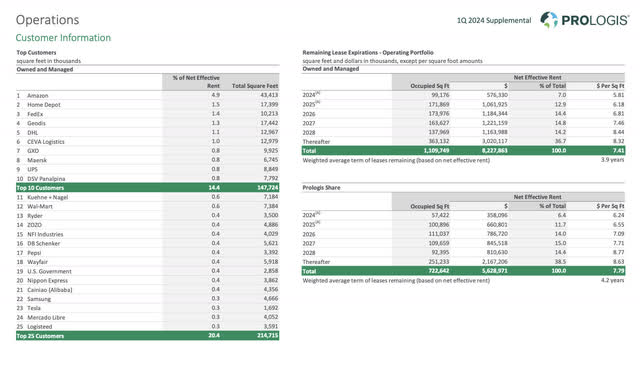

Prologis Investor Relations

When it comes to tenants, the top 10 tenants Prologis serves are experts in e-commerce and delivery. With Amazon, Home Depot, and FedEx among the top three, the tenant list looks much more attractive than Realty Income’s current tenant list. any It contains Dollar Stores, Walgreens and CVS, all of which are overbuilt and shrinking square footage.

real estate income

Real Estate Income Investor Relations

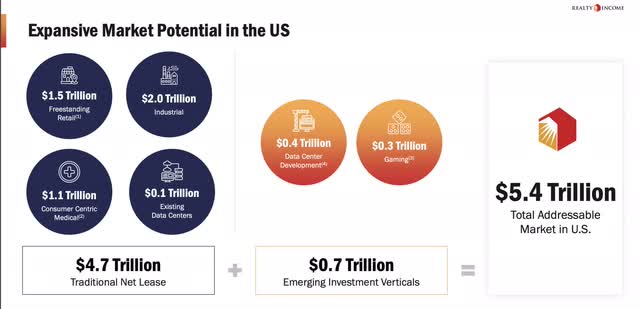

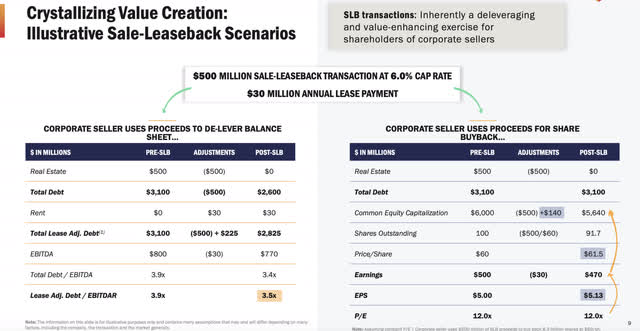

real estate income biggest Consumer Defensive/Essentials-Focused Offline Retail REIT, Growth Outlook located in the center TAM and around the market they Don’t control it yet. As the company now expands its objectives to include industrial, consumer-focused healthcare and data centers, the company touts the strength of its balance sheet to make and anticipate strategic sale lease purchases of properties that may be distressed.

Real Estate Income Investor Relations

this is further emphasized In our most recent investor relations presentation: any We emphasize once again how you can make cash by selling your property on Realty Income.

- weakening the balance sheet;

- Use the proceeds to buy back shares and boost your earnings metrics.

The presentation is both There’s a growth estimate and a mailer that says, “We’re buying a house for cash.” We would like to inform REITs or companies that own a lot of real estate. that Realty Income is here for you to trade. The target for a company’s assets other than a REIT is clear from its P/E ratio. yes This is not the P/FFO example in the graphic on the right.

dividend growth

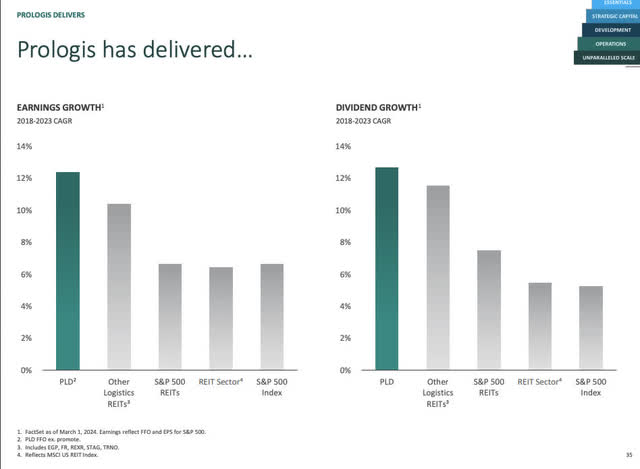

Prologis Investor Relations

Prologis shines not only in the REIT sector in terms of earnings and dividend growth, but also in the average of all sectors of the S&P 500 Index over the past five years. In fact, logistics REITs have typically outperformed the average in both earnings and dividend growth rates.

pursue alpha

In my opinion, this match is a draw. Yes, there are over 200 basis points additional basis points to the current dividend yield for Realty Income, but the past dividend CAGR has been 5 For Prologis, it’s about three times better. If the If this continues, the return on cost at the time of this purchase will be higher for Prologis in about 5.5 years, assuming a 12.63% vs. 3.55% dividend CAGR. Funny how that works.

Prologis 2009 dividend cut

From a 2008 Reuters article:

NEW YORK, Nov 12 (Reuters) – ProLogis, the world’s No. 1 owner and operator of warehouses and distribution centers, announced the resignation of Chief Executive Officer Jeffrey Schwartz, cut jobs and dividends and announced a new plan to strengthen its business. It was announced that development would be put on hold. balance sheet.

The company’s stock price fell 47.3% to an all-time low of $3.62.

Company officials did not immediately return a call seeking comment on Schwarz’s sudden resignation and proposed job cuts.

Shares of ProLogis closed at $4.47 on the New York Stock Exchange, down $2.40, or nearly 35%. Smaller rival AMB Property fell 30%, or $5.70, to $13.25.

Since the beginning of the year, ProLogis stock has lost 93% of its value.

As we can see, some value of Dividends from Realty Income It’s in Resilience. The shrinking REIT industry, which is part stock and part bond/fixed income proxy.It’s a “death sentence”. Because the logistics center is far away With less accurate component and channel identification, transitions in the warehouse industry can sneak up on us without warning.

If you believe that e-commerce will happen now Reign supreme here from now on Without the risk of overbuilding, this 2008-09 dividend cut case could look like this: easily It was shiny. But I will continue to keep an eye on overcapacity.

Drilling down on the orange line, you can see: Prologis suffered destruction In 2008, when investment theory was not yet fully mature.

danger

we are Are you at the bottom of a REIT? It’s hard to say. 2008 part REIT’s Huge Fall include prologue that We can never ignore it. but this seems In the future, This is a great time to start adding these names to your portfolio, especially if the CRE fallout follows. sincerely Isolated into office segments. Expect more stable performance until some concerns about maturing CRE loans are resolved. I don’t expect a quick reward herethis It’s a long-term bet.

summary

prologue In ~ near Terms Demonstrated better management of balance sheet and FFO growth prospects. Their top tenant appears to be expansion versus contraction. From total area guidelines.

They could have rented at a better time like This can be seen by looking at the percentage of interest expense on LT debt. and Issue fewer new shares. I think both are buys at this level, but if I had to choose between the two, I think Prologis would be the better choice. with From the end of 2024-2025, FFO growth is expected to be over 12%. sector overall All other sectors underperformed as the negative stigma around commercial real estate persisted.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.