Breakout potential for both GLD and SLV, especially SLV

Andrey Zhuravlev/iStock via Getty Images

Technical signal for a breakout

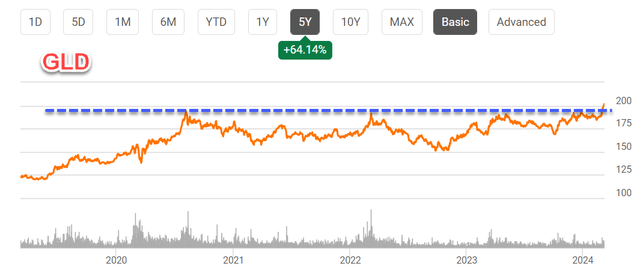

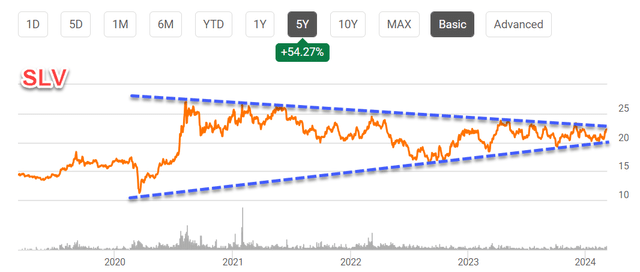

SPDR Gold Trust ETF (GLD) and iShares Silver Trust ETF (SLV) have delivered significant returns over the past few years. As you can see in the next two parts According to the chart, the price of GLD is up over 64% (top figure) and SLV is up over 54% (bottom figure) over the past five years.

But on a more macro scale, the prices of both metals have been trending sideways over the past four years. As you can see in this chart, GLD has been trading largely sideways, maintaining defined support and resistance levels ($150-$200 respectively). And recently prices have started to move out of this range. SLV is trading in a narrow wedge. As consolidation progresses, as we can now see, the wedge becomes very tight and breakaways tend to occur frequently. Moreover, my past experience has shown that the integration period is longer ( When this finally occurs (about four years of consolidation in this case), it could lead to more explosive exodus.

Find alpha data Find alpha data

In the remainder of this article, I will discuss that in addition to the technical signals above, there are other fundamental catalysts that could support a breakout. My main argument is the attractiveness of silver given central banks’ preference for gold and the gold-silver price and silver production.

GLD and SLV: A Quick Introduction

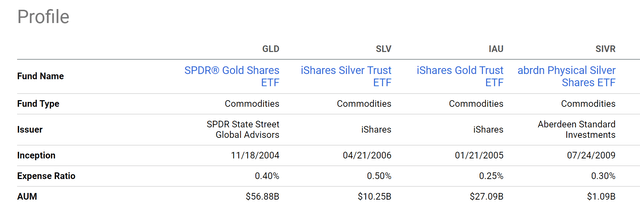

Before going into more detail, I will briefly introduce these two ETFs based on the chart below in case you are new to these two ETFs. GLD and SLV are both ETFs that invest in physical precious metals. As the names suggest, GLD invests in gold while SLV invests in silver. GLD’s expense ratio is 0.40%, while SLV’s expense ratio is 0.50%. These fees are relatively higher than competing funds such as IAU and SIVR. However, the higher fees are offset by larger assets under management (“AUM”) and consequently better trading possibilities. As you can see in the chart, GLD has AUM of $56.88 billion, making it by far the largest gold ETF. And SLV has AUM of $10.25 billion, almost 10 times larger than SIVR.

Find alpha data

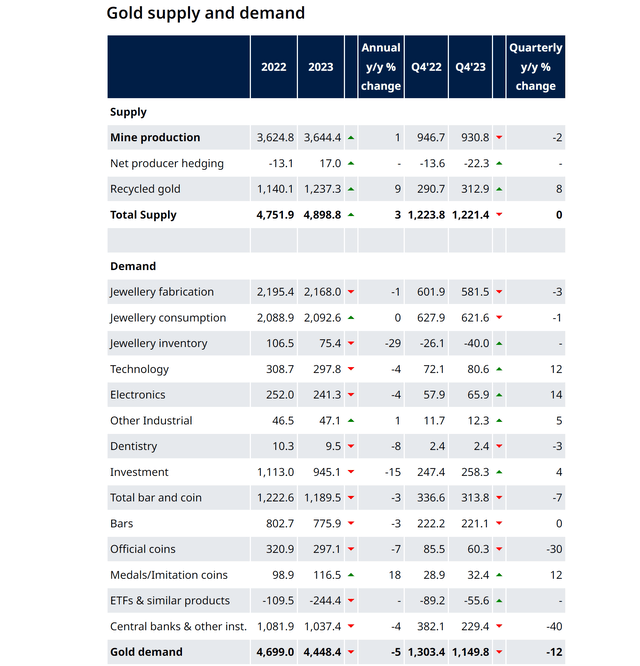

Central banks prefer gold

Now let’s return to the first fundamental reason that could support a breakout: central banks’ preference for gold. The World Gold Council recently released its latest ‘2023 Global Gold Demand Trends Report’, which shows that global central banks purchased 1,037 tonnes of gold last year, the second highest in history in 2022. This is only 45 tons less than last year (see next chart below). ). Given that global gold demand last year amounted to about 4,448 tons, it is worth noting that the 1,037 tons of gold reserves purchased by central banks accounted for about a quarter of global gold demand.

World Gold Council

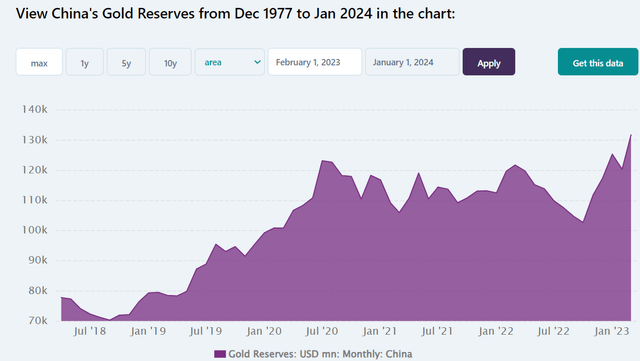

Going forward, we believe there are good reasons for global central banks to continue to be enthusiastic about purchasing gold. Let’s take China, the second largest economy, as an example. Based on BullionByPost data,

As of the end of January 2024, China’s official gold reserves were 2,191.53 tons. China has seen a significant increase in its reported gold reserves in recent years, adding 243.22 tonnes since the summer of 2022 alone. Despite the increase in reported numbers, many analysts believe the actual figure for China’s gold reserves is likely much higher.

To better anchor these numbers, the following chart, taken from CEIC’s economic database, provides a visual representation of China’s sharp gold reserves. And to provide broader context, China is “only” one of six countries.Day The largest country in terms of gold reserves. The top five are the United States, Germany, Italy, France, and Russia. In my opinion, gold’s role as a safe haven asset has not changed at all and has only been emphasized in times of uncertainty such as ours. Several regional wars are ongoing and many countries are trying to diversify their central bank foreign exchange reserves away from the rest of the world. US dollars.

CEIC’s Economic Database

Silver: Demand Outlook and Production Costs

I am more bullish on SLV than GLD for a few reasons. Compared to GLD, SLV more clearly exhibits the dual nature of being a precious metal and an industrial metal.

As a precious metal, silver, like gold, is considered a store of value and a hedge against inflation/uncertainty. However, compared to gold, silver has more industrial uses. There are several reasons why demand for silver could surge quickly, especially with the advent of new technologies in the future. The biggest factor is the growth of green technology. Silver is a key component in many green technologies, especially solar panels and electric vehicles. Silver’s excellent conductivity makes it irreplaceable in these applications. In addition to green technology, silver has several other growing industrial applications, including 5G infrastructure, consumer electronics, and brazing and soldering.

Despite the expected surge in demand, the current silver price is believed to be significantly compressed compared to production costs. It is difficult to pin down the cost of silver production to a single, fixed number because costs can vary greatly depending on many factors such as mine location, efficiency, ore grade, by-products vs. primary metals, etc. With these changes in mind, some miners quote that the 2024 Total Cost of Sustaining (“AISC”) will be in the $22-$23 range (per ounce of silver). This compares to the current silver price of $24.7. Eagle.

Other Risks and Final Thoughts

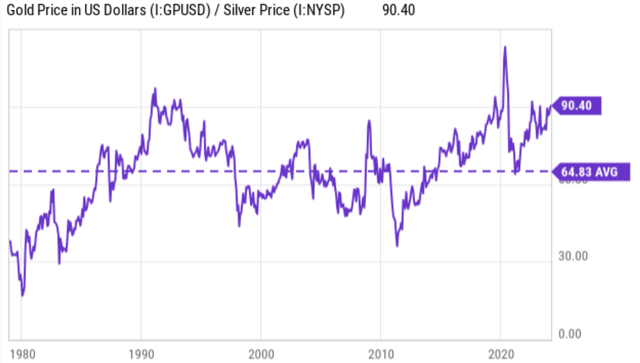

Before concluding, it is worth mentioning a few other risks in both the upside and downside directions. For silver, another bullish factor to consider is the mintage rate, which favors gold-silver trading. The concept is explained in detail in a previous article and the main points are:

The transaction simply involves selling a certain amount of gold to buy silver when the price of silver looks more attractive compared to the price of gold and vice versa. The main measure for assessing which metal has a more attractive price is the so-called mintage ratio or gold-silver price ratio (“GSPR”).

The long-term mint rate is shown in the chart below. As you can see, the average over the past 50 years or so has been ~64.8. Currently, this ratio is approximately 90.4 times, which is the highest level since at least 1980.

Find alpha data

In terms of downside risks, GLD and SLV face all the risks typical of commodities. These risks include a lack of active cash flow (i.e. GLD and SLV do not generate revenue on their own), extreme price volatility, and the relatively high expense ratios and tax consequences mentioned earlier. Aside from these general risks, holding GLD and SLV is different from holding physical bars (even though they are backed by physical bars). Holding these ETFs involves counterparty risk, including:

Essentially, investors do not directly own the physical metal. Instead, investors own shares of GLD or SLV, which are claims on the underlying physical bars. Therefore, there is always a risk that the ETF sponsor or custodian may default and fail to honor investors’ claims.

Taken together, this article argued a bullish case for GLD and SLV. Technically, I see strong signs that they are coming out of a consolidation period that has lasted about four years.

These technical signals are backed by fundamental forces at work in my mind. The biggest force, in my opinion, is the recent geopolitical conflict and the potential surge in demand for silver as several new technologies (e.g. EVs, solar panels, 5G) begin to enter a phase of exponential growth, leading central banks to push back on gold. It’s a preference.