Bristol Meyers Squibb: This Dividend Contender Is a Steal Right Now (NYSE:BMY)

PM Images/DigitalVision via Getty Images

introduction

Bristol Myers Squibb Company (New York Stock Exchange: BMY) Over the past few years, you have probably not been happy with your comeback. Pharmaceutical companies are considered controversial and this can often lead to big problems. If you are not careful, you will incur losses. But on the other hand, you can also earn significant capital gains. Case in point: BMY’s colleague Pfizer Inc. (PFE), whose stock price has soared during the pandemic but is down more than 50% in the past year alone. Bristol Myers has also seen price increases during COVID-19, but nowhere near the price declines PFE has seen over the same period, which speaks to its quality.

One thing to consider about large pharmaceutical companies is that they tend to make frequent large acquisitions to maintain growth over the long term. Shareholders often have concerns about: These companies overpay for those costs, which can cause prices to drop significantly. However, these significant price drops can lead to great buying opportunities, especially if the inventory is high quality. In this article, co-author and co-author of The Gaming Dividend explores why BMY is currently a bargain for long-term dividend investors.

This article was written in collaboration with The Gaming Dividend.

The stock is a steal at its current price

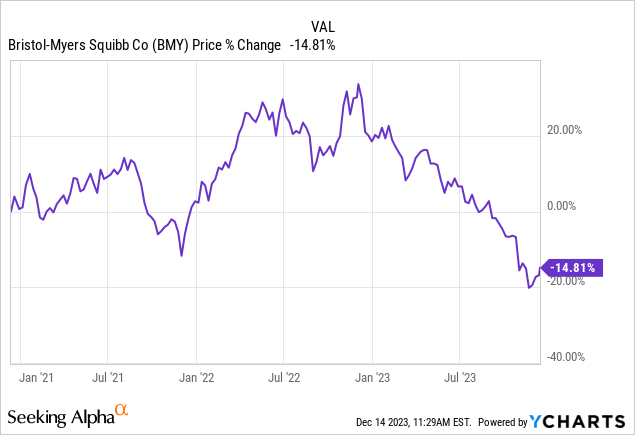

Sometimes, for one reason or another, high-quality businesses get sold. As investors, we know that these typically trade at a larger premium than others. The stock has fallen nearly 15% over the past three years and currently trades for less than 15 times earnings. I bring this up because Benjamin Graham, the father of value investing, said you should never pay more than 15 times your net income for a stock. BMY’s forward P/E Non-GAAP of 6.88x is lower than its five-year average of 9.57x, indicating that it is undervalued. If you use and believe in the dividend yield theory, then according to that metric, the stock is also a sign that it is undervalued.

BMY recently announced an $8.4 billion deal with SystImmune, the U.S. arm of Chinese pharmaceutical company Sichuan Biokin Pharmaceutical. They also announced last October an agreement to acquire Mirati Therapeutics, Inc. (MRTX), a biotechnology company developing treatments to treat cancer. This is expected to be completed by the first half of 2024. Since then, the stock price has fallen further, from around $56 at the time of this writing to the current $50.60.

The pharmaceutical giant reported third-quarter earnings on Oct. 26, and while revenue was in-line and beat analysts’ EPS estimates, it cut its revenue forecast for next year from $3.9 billion to $3.2 billion. Moreover, they reported their fifth straight quarterly revenue loss due to the drug’s significant decline in Revlimid when it became generic earlier this year. They now expect $10 billion in 2026, compared to $10 to $13 billion previously. When patents expire, there is volatility in the profits of pharmaceutical companies. Fellow analyst Thomas Potter detailed the potential patent losses in an article about BMY published in November. But despite this, the company’s quarter was solid.

EPS of $2.00 beat estimates by $0.23 and revenue of $10.97 billion was flat. EPS was up from $1.75 in the second quarter, but revenue was down slightly from $11.2 billion. Revenue also declined nearly 4% compared to $11.41 billion in the fourth quarter of 2022. During the quarter, management increased the midpoint of its non-GAAP EPS guidance and narrowed the range to $7.50 to $7.65. The problem for pharmaceutical companies is that adoption sometimes takes longer than expected.

Companies like BMY and their peers invest in these products for their long-term potential, but for some, success takes time. This happens, for example, during drug development and testing. Sometimes a product isn’t successful, forcing the business to pivot for continued growth. All of these combined can be considered negative and can put downward pressure on stock prices, sometimes for an extended period of time. But this is why we believe that things like safe payout ratios, strong balance sheets, and good management are important.

Dividends are well guaranteed

The good thing about dividend investing is that even if the stock price falls, if the dividend is well covered (dividend) payments are sustainable over the long term. You could still lose money if the stock falls significantly, but collecting dividends helps alleviate some of the short-term pain. BMY recently announced a 5.3% increase in its dividend to $0.60 per share. They also increased operating cash by 153% and 30% quarter-over-quarter and year-over-year, respectively, which is impressive in the current environment.

As you can see in the chart below, BMY’s operating cash declined steadily before rebounding by more than doubling last quarter. This brings the total to $9.7 billion YTD. With CAPEX of $879 million YTD and dividends of nearly $3.6 billion, it offers a very safe payout ratio of about 41%, well below the pharmaceutical company’s margins of 60%.

Create author

Return of capital to shareholders

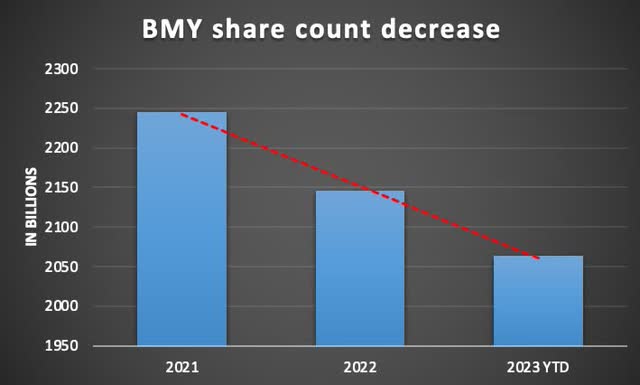

Bristol Myers initially announced a $2 billion stock repurchase program but decided to increase it by an additional $3 billion. The decision further reflects the pharmaceutical giant’s commitment to rewarding shareholders. What we like about this program is that it is flexible and the company can suspend or discontinue it at a moment’s notice.

While many companies have a set schedule for their share repurchase programs, this flexibility allows BMY to allocate capital prudently when stocks become too expensive or when attractive investment opportunities emerge. Moreover, the company has been purchasing significant amounts of shares over the past two years, reducing its share count from $2.245 billion in ’21 to $2.064 billion YTD. And with its current cheap valuation, management expects this to continue for the foreseeable future.

Create author

Double-digit upside potential

As previously mentioned, sometimes high-quality companies come up for sale, opening the door to attractive entry points. We already noted that BMY’s forward P/E non-GAAP of 6.88x is below its five-year average of 9.57x, but we can also use other valuation methods to confirm that these levels warrant an attractive entry. Additionally, using a discounted cash flow model, we can conclude that BMY is undervalued.

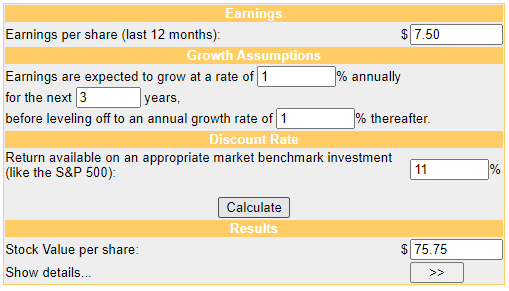

As previously mentioned, management expects EPS guidance to be between $7.50 and $7.65. Using conservative projections, we can use the lower bound of this range in our model. Revenues are expected to grow at a slower pace. It will initially decrease by 2% until 2024, but then increase by 2.73% until 2025. To average this out, we use an expected growth rate of 1%. Using these inputs, the estimated fair value is $75.75 per share. At current price levels, this represents a potential upside of nearly 50% compared to fair value.

Money Chimp

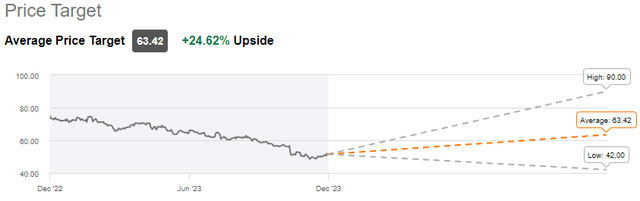

If you need more convincing, the sector average P/E Non-GAAP is down about 19x. For what it’s worth, Wall Street’s target price range is also optimistic. The highest price target expects BMY to reach $90 per share in the future, while the average price target of $63.42 still represents a healthy upside of about 25%. This undervaluation, combined with a historically higher dividend yield of 4.7%, reinforces that Bristol Myers presents an attractive buying opportunity.

pursue alpha

danger

The biggest risk here is the story we just witnessed: drug shelf life. Over the next few years, BMY will need to actively pursue agreements to diversify its product portfolio and mitigate potential revenue losses from patent expirations, as we saw with the Revlimid expiration. A similar expiration issue is looming for the blood thinner Eliquis, which is scheduled to expire in 2026. The generic version will be available in April 2028. In 2028, the same challenge will occur once again with Opdivo, an immunotherapy drug. medicine.

Both of these products are now significant contributors to BMY’s revenue. Understanding the strategic moves BMY is taking in response to these challenges can provide valuable insight into how the company navigates uncertainty and prepares for the future. BMY’s proactive actions to sign new contracts, seek innovative collaborations, and invest in research and development may signal BMY’s commitment to maintaining a strong product portfolio despite patent expiration. This adaptability is critical to maintaining revenue streams and keeping companies competitive in the pharmaceutical industry.

Although the potential risks associated with patent expiration are significant, BMY’s current financial position provides some comfort. The company’s deep cash reserves and resources of more than $7 billion provide a cushion, giving us the time and flexibility to address future challenges. This financial strength enhances BMY’s ability to invest in new opportunities, research and development initiatives, ultimately mitigating the impact of patent expirations on its overall financial performance.

takeout

Bristol Myers Squibb Company (BMY) is emerging as an attractive purchase opportunity, with several factors pointing to its potential as a solid long-term candidate. BMY is currently trading at an attractive valuation, so investors with a long-term outlook get not only double-digit upside, but the potential for a safe, growing dividend that will help them sleep better at night. This undervaluation is further supported by the discounted cash flow model, which suggests a 50% increase in fair value is likely.

The challenges posed by impending drug patent expirations, as exemplified by Revlimid, Eliquis, Opdivo, and others, require strategic maneuver. But deals with SystImmune and Mirati Therapeutics demonstrate the company’s adaptability. This, along with sufficient cash reserves, mitigates the risks associated with these expirations.

Considering risks and opportunities, BMY makes a compelling case for investors seeking high-quality, undervalued stocks with solid dividend yields. Moreover, management has recently increased its stock repurchase program, which not only demonstrates its financial strength, but also plans to continue growing profits while rewarding shareholders. The company’s aggressive actions and growth potential make it a stock worth considering for those looking to capitalize on the pharma giant’s long-term prospects.

The Dividend Collectuh and The Gaming Dividend are individual investors with a strong interest in dividend investing. Both are independently published here on Seeking Alpha.