Bristol-Myers Squibb stock is a speculative buy (Technical Analysis) (NYSE:BMY)

you

Bristol-Myers Squibb, Inc.New York Stock Exchange: BMY) is engaged in the healthcare sector and pharmaceutical industry. Although not a factor in the company’s analysis, BMY is expected to have annual revenue of $45.85 billion and annual earnings per share in 2024. $6.83. BMY also yields a safe 4.43%. In this article, I will briefly explain why I think BMY is a speculative buy at this price. As I will outline in the article, this is just a guess as my preferred parameters are not all in place yet. My investment thesis will be formed by analyzing the price action, momentum, volume and relative strength of BMY over two different time frames.

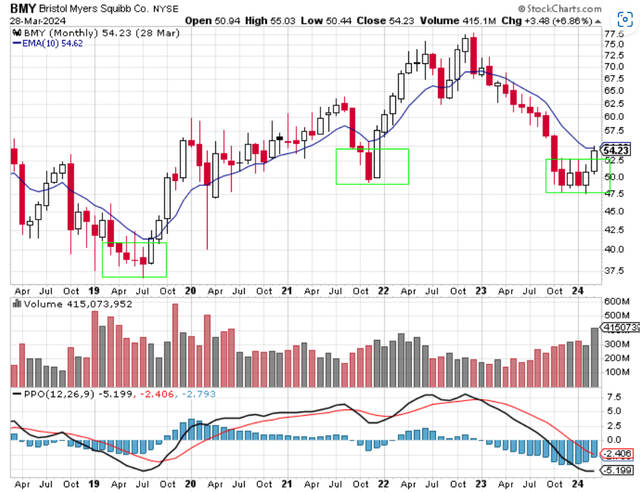

Chart 1 – Monthly BMY with 10-month EMA, volume and percentage price oscillator.

www.stockcharts.com

Chart 1 above shows the big picture of BMY’s monthly price movements. Six years. A simple method I use to decide if I should buy a stock is whether the stock is above its 10-month exponential moving average (EMA), shown in blue. It is generally considered bullish price action when a stock is above its 10-month EMA, which signals good things to come. On the other hand, if the stock price is below the 10-month EMA, it signals a bad situation and is considered bearish price action. What catches my eye in chart 1 is the price action over the past five months. BMY is consolidating below the 10-month EMA from November 2023 to February 2024. This consolidation is a critical step that a stock must take before it can move higher meaningfully. This consolidation phase is considered the phase where institutional investors accumulate shares ahead of the expected upside. We can see that this pattern of consolidation has occurred previously when BMY was below its 10-month EMA. Take a look at the green box showing recent consolidation patterns. This is equivalent to the price movements that occurred in the fall of 2021 and from April to August 2019. In this case, BMY fell below the 10-month EMA and declined significantly. The price then moved sideways for several months in a consolidation pattern. The stock then made a big rally towards the 10-month EMA. In the 2019 and 2021 cases, the price was able to close above the 10-month EMA on a large bullish candle indicating a clear buy signal. In the current example, we currently consider BMY a speculative buy since there is no clear close above the 10-month EMA.

Looking at volume, the large volume bars in March are encouraging. This means that while prices are rising, institutional investors, or smart money, are accumulating stocks. When technical traders like me analyze volume charts, we see large volume bars as evidence of institutional or smart money investors because these investors have the capital to purchase millions of shares. Retail traders like you do not have enough capital to generate large volume bars. Going back to institutions or smart money, the only reason they are buying the stock is because they believe BMY is undervalued at this price. I think large volume bars are a bullish confirmation signal.

Momentum on the monthly chart is starting to turn bullish. The bottom pane of Chart 1 displays the Percentage Price Oscillator (PPO), a momentum indicator. Momentum is displayed in two different ways. When the black PPO line is below the red signal line, it is considered short-term bearish momentum. If the black signal line is below the center line or zero line of the chart, this is considered a sign of long-term bearish momentum. We say it is long-term because the black PPO line does not oscillate above or below the center line or zero level of the chart too often compared to the number of times it crosses above or below the red signal line. Momentum is currently weak both in the short term and long term. That’s not a situation I want to invest in, so I consider BMY a speculative buy. The only bullish sign for PPO is that the black PPO line begins to curve upwards. It’s a start in the right direction.

Now I want to zoom in on the weekly chart using the same indicator to see if there are more reasons to be bullish on BMY.

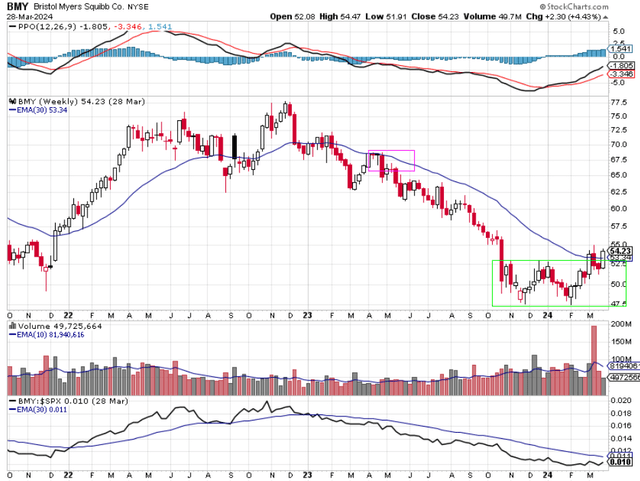

Chart 2 – BMY weekly including 30-week EMA, momentum, volume and relative strength.

www.stockcharts.com

Chart 2 shows a weekly chart, which is my preferred time frame. This allows you to escape the day-to-day noise and focus on medium- to long-term price action. You can do this with the 30-week EMA. I prefer to buy stocks above the 30-week EMA. BMY fits the bill. The green box shows the integration period mentioned earlier, which is 5 months. The price formed a double bottom on the weekly chart and is now above the 30-week EMA. The 30-week EMA itself has flattened. I would feel better about an immediate price increase for BMY if the 30-week EMA was trending upward rather than flat. This is another reason why I consider BMY a speculative buy.

If you look at the volume, you will notice a large red bar and it looks bearish. However, as mentioned earlier, it was an institutional activity, and the price did not fall even after that. Additionally, this is clearly part of the large bullish volume bullish bar mentioned in Chart 1. I think the volume in chart 2 is strong.

Momentum is displayed in the first window of Chart 2. If you zoom in on the weekly chart, you can see the short-term bullish momentum displayed by PPO. Obviously, trends in price action and momentum first change in lower time frames before changing in monthly time frames. I would prefer to see a black PPO line above the chart center line to show long-term bullish momentum on a weekly basis, but that is not currently the case. Therefore, I would like to say that BMY is a speculative buy at this point.

The bottom pane of Chart 2 displays the relative strength of BMY against the SP 500 Index. If you’re like me and want to outperform the SP 500 Index, you need to own stocks that outperform the SP 500 Index. Relative strength charts help you do this. The charts are easy to read. The black line is the ratio of the BMY price to the SP 500 index price. When the black line falls, it means BMY is underperforming the SP 500 Index. A rising black line means BMY is outperforming the SP 500 Index. I want to own stocks that outperform major indices. Since the end of January 2024, BMY has been in line with or slightly ahead of the SP 500 Index. I would feel better if the relative strength line moved significantly higher, and that could happen soon, but that is not the case at the moment. There is also another reason to say that BMY is a speculative buy in this situation.

In summary, BMY is a stock with a good current yield that is considered safe, with a slightly higher 2024 earnings outlook and a slightly lower 2024 earnings outlook. BMY has declined significantly and appears to have consolidated similarly to the following over the past few months. How they behaved before the price rise in 2019 and 2012. Trading volume shows signs of institutional accumulation. Momentum has a thing to do on monthly charts and weekly charts show short-term bullish momentum. Finally, the relative strength is the same as the SP 500 index over the past few months and could go higher. All of this leads me to believe that BMY is a speculative buy. Speculative buying means you can enter a small position and add to it if price action, momentum and relative strength continue to improve. For example, if the price continues to rise and the 30-week EMA is trending higher, I would view that as a signal to add more shares. That price level could be $57-$60, but that’s just a guess. As always, I’ll have to refer to the price list. If the weekly PPO line crosses above the zero or center line, it would be a signal to add more stock. When I see that happening, I would consider BMY a conviction buy and not a speculative buy like BMY is now. If price and momentum improve as just described, I wouldn’t be at all surprised to see a retest of the 2022 high of $77. But that’s not my prediction. This is just an observation of where prices can go under reasonable circumstances. I realize that my analysis may be inaccurate for a number of reasons. Earnings and earnings reports may disappoint, economic growth may decline, interest rates may rise higher, or there may be a geopolitical event that sends the overall market down. All of that was out of my control. What I can control is the amount of my starting position. That’s why I start with small positions and am willing to take small losses if things don’t move in a positive direction. For example, a failed move in a bullish situation would be a close below the 30-week EMA or a 10% decline in the price from the entry price. If you look at it that way, it is better to take a small loss and re-evaluate the paper rather than remain in the position of a loser who suffers a large decline. You can always return to BMY if price action, momentum, volume and relative strength improve. To me, it’s okay to be wrong in stock analysis, but it’s not okay to be wrong all the time.