BTC price hits 19-month high amid ‘choreographed’ Bitcoin whale move

Bitcoin (BTC) returned above $42,000 on December 5 as analysis suggested market manipulation.

Analysis: New Bitcoin Bidding Is Not “Organic”

BTC prices rebounded, pushing BTC/USD to a high of $42,498 on Bitstamp, according to data from Cointelegraph Markets Pro and TradingView.

This pushed it past the 19-month high set the previous day, and the retracement was short-lived amid general excitement across cryptocurrencies.

However, as Bitcoin continues to regain lost ground in mid-2022, warnings about the sustainability of the rally continue to flow in. It centered around the actions of large traders, also known as whales.

in dedicated thread Commenting on the phenomenon of

The more liquidity there is near the intended selling point, the better value a large sale can yield.

“We have seen this exact game played for a week at $35,000 with a $50M buywall and it has often been successful. Now we have $50 million stacked at $38.5K,” Material Indicators noted, calling the current order book action a “strategically planned distribution game.”

The analysis determined that while a return to $38,500 is unlikely, the new bid liquidity block, including $41,500, is not “organic.”

In other words, a continued upward trend could easily become the norm next year as expectations for macroeconomic changes and the approval of the first Bitcoin spot price exchange-traded fund (ETF) in the United States set the tone.

“This rally is likely to expand as BTC liquidity moves strategically around the game board,” Material Indicators predicted.

“Optimism about the December FED rate decision and the January ETF decision could push things higher and create euphoria, so be prepared for what happens after that.”

$48,000 forms the next bullish BTC price target.

Other market commentators have similarly noted bullish short-term BTC price signals.

Related: Bitcoin Short-Holder Sales Approach $5 Billion as 2021 Mimicking Monetization

Popular trader Daan Crypto Trades noted that open interest decreased during the consolidation phase ahead of Wall Street’s opening day.

#Bitcoin Consolidation into open interest is also decreasing.

Perhaps some buying is taking profits here.

It currently has a decent-sized wall to support it at just under $41,000. pic.twitter.com/OunDBN6EPa

— Daan Cryptocurrency Trading (@DaanCrypto) December 5, 2023

For trader, analyst, and podcaster Scott Melker, the 4-hour chart says it all.

“Bitcoin has consistently broken out of its ‘bearish’ bull market pattern. And this is currently being re-tested for support,” is part of his X commentary on the graphic.

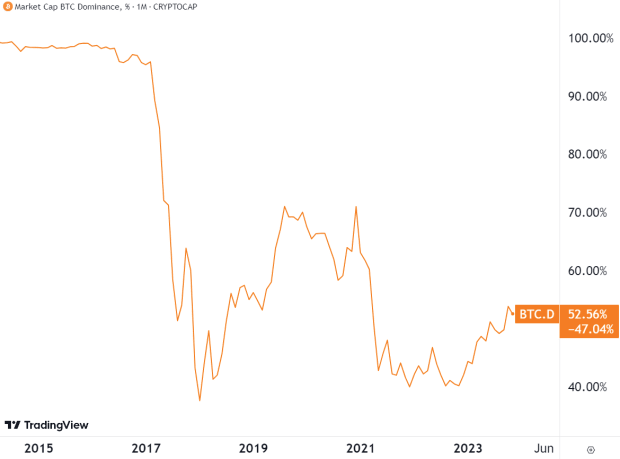

Taking a closer look, a popular social media commentator known as Mustache has determined that there is no reason for the current bull market to be any different from previous bull markets in terms of BTC price patterns.

“$48,000 is inevitable. If this breaks, I think Bitcoin will reach ~$60,000 in the near future,” he said. assert It is displayed with a chart showing the price steps divided into waves.

“In the past, BTC always returned as a (B) wave. Why should it be any different this time?”

This article does not contain investment advice or recommendations. All investment and trading activities involve risk and readers should conduct their own research when making any decisions.