Building Success: Ferguson’s Strategic Market Rise (NYSE:FERG)

Onur round

introduction

As the United States enters a phase of strengthening infrastructure investment, Ferguson Plc.New York Stock Exchange: Pug) is becoming increasingly important. Specializing in the distribution of a variety of plumbing and heating supplies, Ferguson is a critical presence in the supply chain. For infrastructure projects.

The company’s journey from its beginnings in the sheep shearing machinery sector to its current status is marked by strategic transitions and adaptations to evolving market dynamics and industry trends. In the context of America’s ambitions to expand infrastructure, Ferguson’s comprehensive catalog and industry experience position the company as a notable contributor.

In today’s article, we’ll take a look at Ferguson’s business, financial performance, and recent developments. Lastly, I will tell you my opinion on the stock as a long-term investment candidate.

Company overview and quarterly updates

Exploring Ferguson’s evolving strategic adaptability. The market’s journey from manufacturing to major plumbing and heating distribution is noteworthy. The company balances its operations between the non-residential (48%) and residential (52%) segments, with a focus on repairs/remodels (60%) rather than new construction (40%).

It is essential that Ferguson focuses on repairs and remodels rather than new construction. That’s because repairs and remodels are likely to continue even during phases of the economic cycle when new construction may slow or stop. Diversification between residential and commercial further strengthens the business as residential provides stable returns while commercial offers greater upside potential and volatility.

Next, let’s look at the financial and operating details from Ferguson’s most recent earnings call to understand its competitive position.

Revenue and operating profit

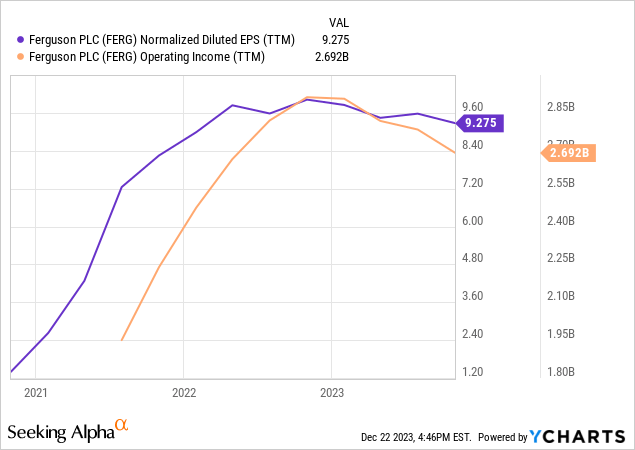

Ferguson’s latest earnings report showed a steady plateau in diluted EPS over the past 12 months, in contrast to the sharp rise it experienced in 2021 following the COVID-19-induced recession. CEO Kevin Murphy highlighted a number of important financial metrics during the call. Notably, the company recorded adjusted operating income of $773 million in the quarter, down 10.5% with an adjusted operating margin of 10%.

This quarter’s numbers indicate a short-term growth slowdown that management is defending.

But Murphy also highlighted Ferguson’s resilience and solid long-term performance. Supporting this claim, the company has achieved remarkable growth over the past three years, including a 43% increase in revenue, a 60% increase in adjusted operating income, and a 74% surge in adjusted diluted earnings per share since fiscal 2021.

The story suggests that while this quarter saw sluggish growth, Ferguson’s overall trend was one of significant, sustained expansion.

Sales and Margins

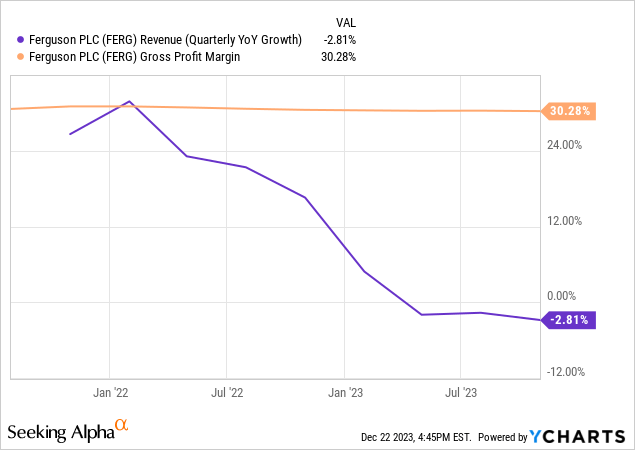

Ferguson saw a modest revenue decline of 2.8%. Murphy attributed the decline to difficult market conditions, but insisted the company achieved solid gross margins.

Later in the earnings call, CFO Bill Brundage dug into the financial details and revealed a lot of details. Net sales for the quarter were down 2.8% and organic revenue was down 4.9%. This included the impact of a +2.2% positive contribution from acquisitions, which are a key part of Ferguson’s long-term strategy. More on that later.

Explaining price dynamics, Brundage pointed to a shift from 1% inflation in the fourth quarter to about 2% deflation in the first quarter. Gross profit margin was reported at 30.2%, down 30 basis points from the previous year, while total costs remained stable year over year.

Looking at sales by region, net sales for the U.S. business decreased by 2.7%, while Canadian business decreased by 5%, indicating the relative strength of the U.S. market.

Brundage reaffirmed its unchanged fiscal 2024 guidance, projecting revenue to be broadly flat this year. I believe that in a difficult year like 2023 for many companies, many companies will be able to easily tolerate flat revenue growth, at least temporarily.

Despite short-term market concerns, including excess profits due to COVID-19 and the impact of the UK delisting, over the longer term Ferguson’s earnings stability, particularly from its repairs and remodeling activities, has provided an important buffer against economic downturns. This is the main advantage of circular industries.

Investor Q&A Insights

I was able to gain various insights through the Q&A session after the call. An analyst at Jefferies questioned the sequential trend in prices, particularly with regard to commodity stability. Management’s response indicated that prices remained stable from the fourth quarter to the first quarter, with some deflation seen in the raw materials sector. Finished product prices are expected to rise moderately, which will benefit future sales.

Another analyst also asked about the performance of the non-residential sector. This time, management’s response highlighted the potential upside for the sector, particularly in data centers, with longer timelines expected for larger projects. Larger projects such as data centers have consistently been reported by management as contributing to gross margins, and in my view, this will be an important business for the company’s future. Given the ongoing demand for data center processing power due to advancements like AI, I think we can expect these kinds of projects to continue.

We also discussed the potential impact of interest rate changes on the market recovery. Management responded that the market was unfolding as expected, with the price environment primarily impacting new home construction but showing signs of stabilization. I think this slowdown highlights the advantage of repair/remodeling exposure.

Ferguson’s M&A strategy

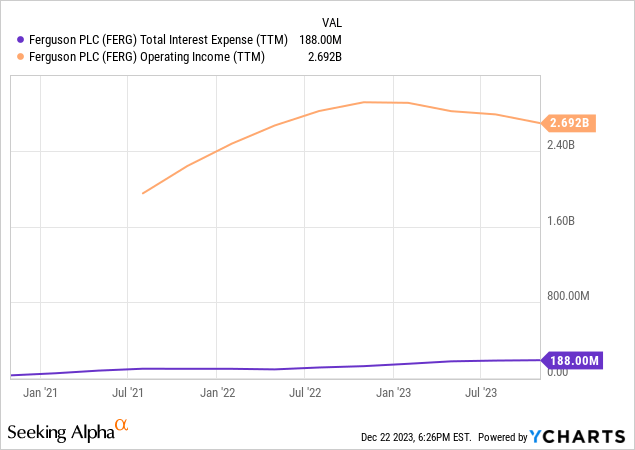

Ferguson’s approach to capital allocation and M&A strategy is strategic and disciplined, with a primary focus on small and mid-sized acquisitions. This methodology is integral to your business model, allowing you to carefully navigate your financial commitments while effectively consolidating your market share.

By targeting smaller companies, Ferguson not only strengthens its portfolio because its interest expenses are very small (7%) compared to the operating profits generated by the business, but it also maintains the important balance between growth and financial stability.

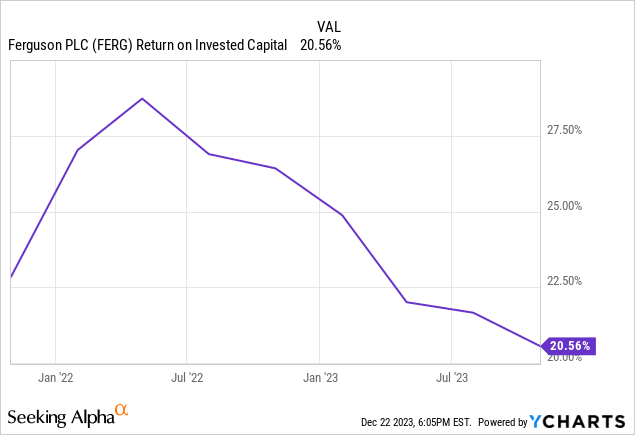

This approach highlights the company’s ability to expand its market presence without overextending its resources. Smaller companies can often be acquired at lower multiples, which has helped contribute to the company’s incredibly strong returns on invested capital (over 20%).

While large M&As can provide rapid expansion, Ferguson prefers smaller deals, which give him more control over the integration and management of new assets.

This tactic isn’t just about increasing market share. It also means diversifying the scope of Ferguson’s operations and gradually entering new areas. Carefully selecting and integrating these acquisitions helps Ferguson strengthen its market position and extend its runway for growth.

Valuation and Risk

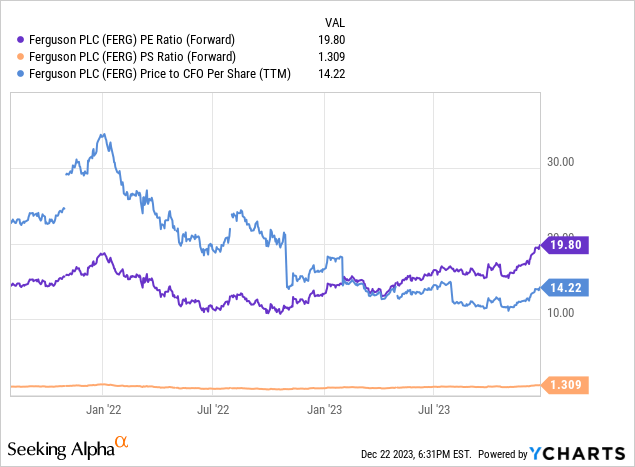

In terms of valuation, Ferguson is reasonably valued. With just 19.8x forward earnings and 14.2x operating cash flow per share, Ferguson trades at a similar valuation to the market as a whole, despite providing an exemplary return on capital and superior future growth prospects compared to the average company.

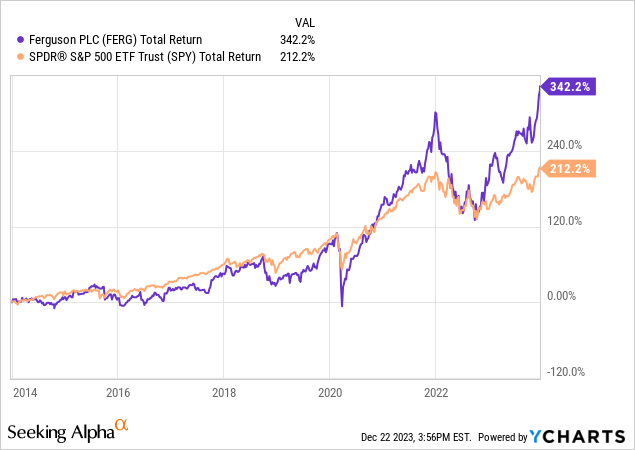

Ferguson’s stock has recently experienced significant price appreciation on the back of an improving macroeconomic backdrop, but such rapid gains can pose risks, especially for short-term traders. However, for long-term investors, the current PER of around 20 times is not considered high at all.

The biggest concern is the potential for near-term price weakness due to the recent surge, despite Ferguson’s promising long-term outlook.

Additionally, the current environment of high volatility in commodity prices, against the backdrop of an ostensibly improving macroeconomic environment, poses a material risk to Ferguson’s margins. Fluctuations in these raw material prices may cause unexpected financial difficulties for the Company that may be difficult to predict.

Another new risk is the growing interest of private equity firms in Ferguson’s operating areas. As these companies become more active in the low interest rate environment to seek acquisition opportunities, Ferguson may compete with these companies for potential acquisition targets.

This increased competition could disrupt Ferguson’s strategic plan, which focuses on acquiring small and medium-sized businesses, which has been a cornerstone of its growth strategy.

conclusion

In conclusion, Ferguson Plc presents a compelling investment case. The company’s strategic focus on the residential and non-residential segments and its emphasis on repair and remodeling activities position it well in the industrial sector.

Despite the challenges of an unstable macroeconomic environment and the near-term risks associated with the recent surge in stock prices, Ferguson’s long-term growth prospects remain strong. The company’s disciplined approach to mergers and acquisitions, prioritizing small and mid-sized targets, has been a significant driver of its success, contributing to solid returns on invested capital.

From a valuation perspective, Ferguson’s current metrics suggest a moderate valuation, with the stock trading at 19.8x forward earnings and 14.2x operating cash flow per share. This, combined with excellent growth prospects and strong returns, makes Ferguson an attractive opportunity for long-term investors.

While near-term price volatility and potential competition from private equity firms in the acquisitions space are notable risks, these risks are outweighed by the company’s solid fundamentals and strategic positioning.

I rate Ferguson as a ‘buy’.