Business Terms Monthly February 2024

Jerome Morris

Peter C. Earl

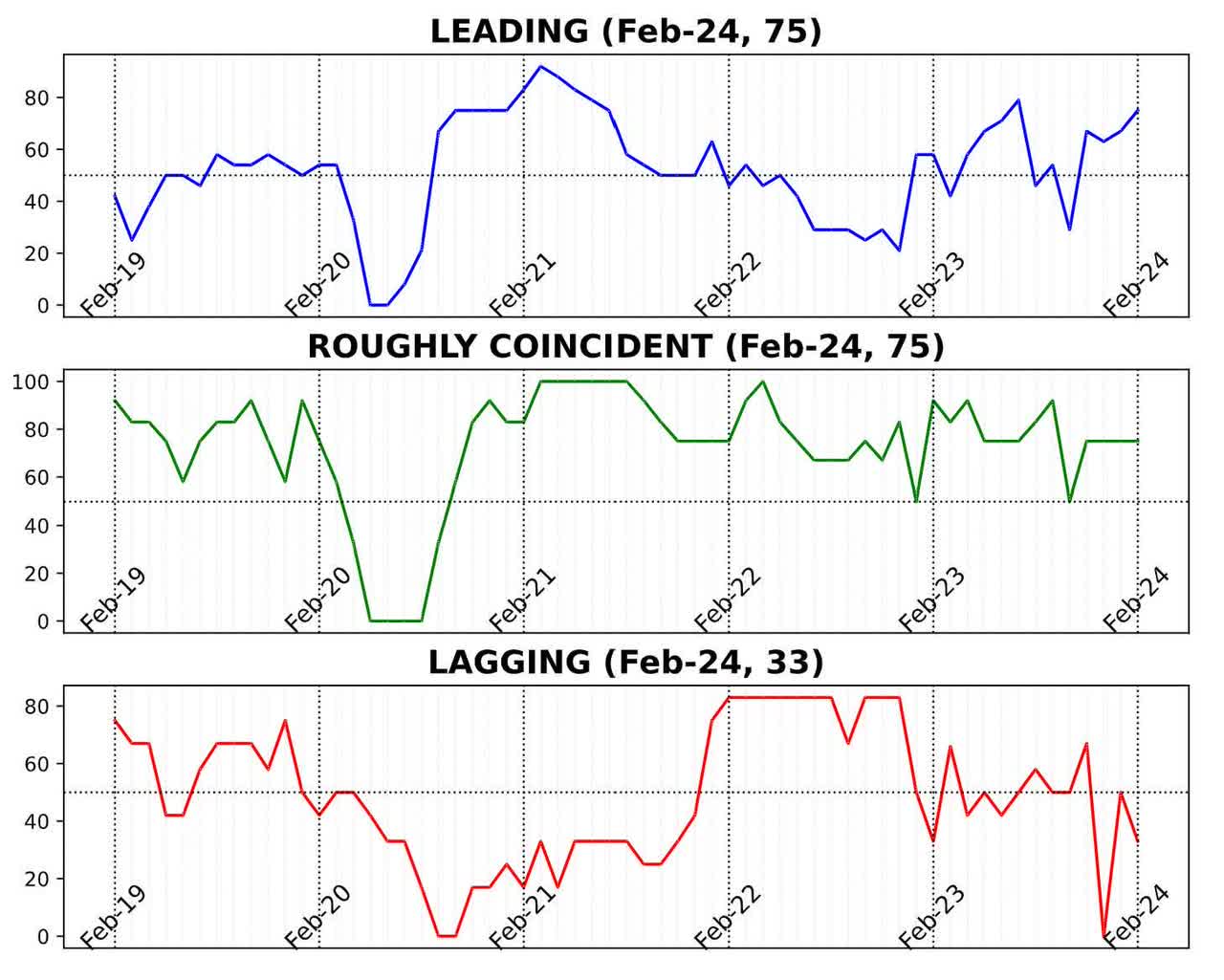

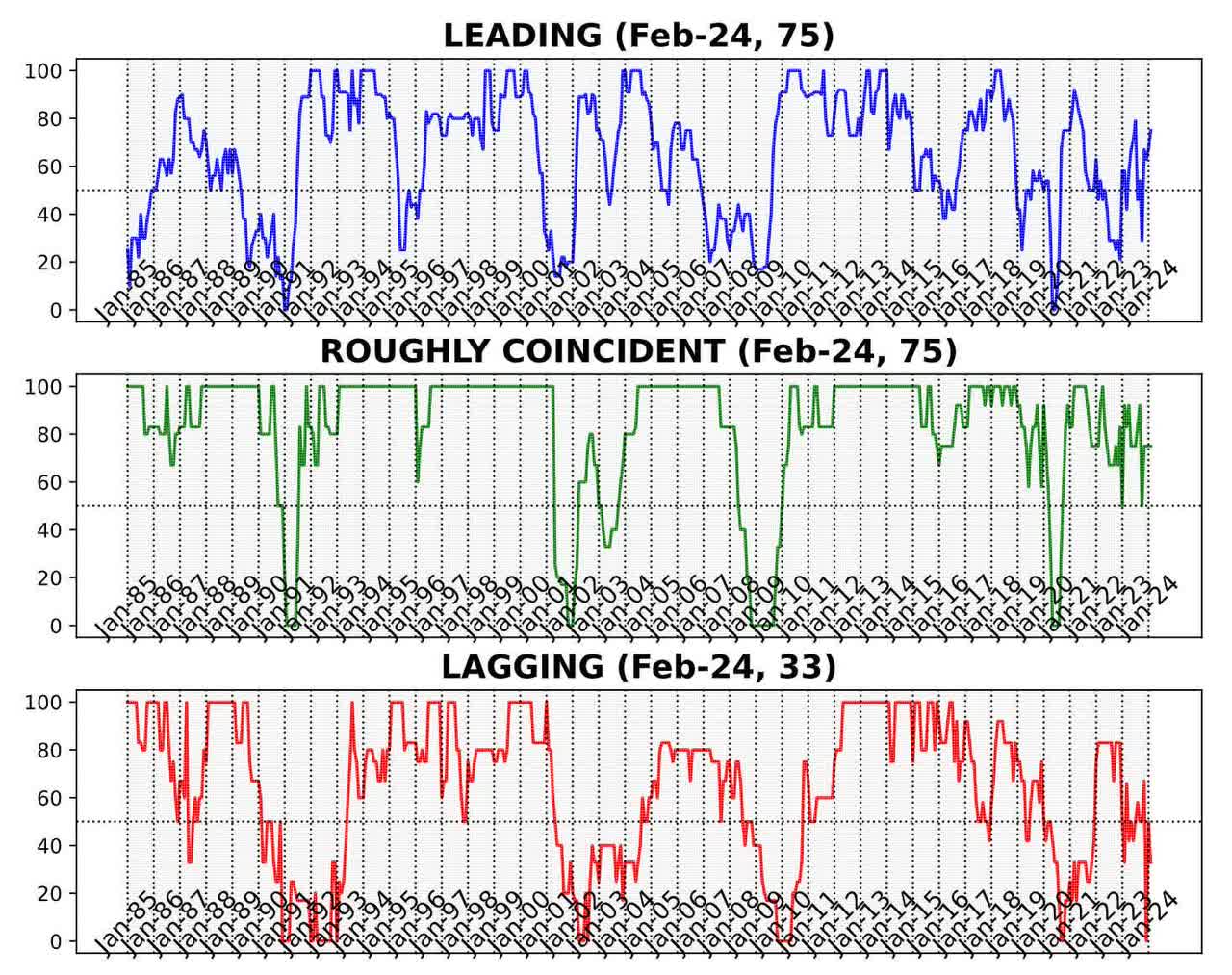

AIER Business Conditions Monthly for February 2023 showed another signal. The leading indicator rose from 67 to 75 and the roughly coincident indicator has remained at the 75 level for four months. Lagging Indicator It fell to 0 in December 2023, rebounded to 50 in January, and then fell to 33 again.

Leading indicators (75)

Of the 12 components of the leading indicator, seven rose and five declined.

Up in February 2023 are new privately owned residential units in the United States launched by Structure Total SAAR (12.7%), FINRA Client Debit Balances in Margin Accounts (5.9%), and Conference Board US Leading Index Stock Prices 500 Common Stock (4.3%) . Retail and Food Service Sales Total SA (0.9%), Conference Board U.S. Manufacturers New Orders Non-Defense Capital Good Ex Aircraft (0.6%), U.S. Average Weekly Workweek All Employees Manufacturing (0.5%), and Conference Board US Key indices Manuf New Orders Consumer Goods and Materials (0.1%). The five components of the decline were inventory/sales ratio: total business (-0.7%), U.S. heavy truck sales SAAR (-1.6%), University of Michigan Consumer Expectations Index (-2.5%), and U.S. initial unemployment claims (-5.3) ) percent), the 1-10 year U.S. Treasury spread (-6.4%).

The Leading Index (75) suggests continued moderate growth levels, maintaining a consistent trend within the above-neutral performance range observed over the past year.

Closely matched indicator (75) and lagging indicator (33)

Of the six components of the roughly coincident indicator, four were up, one was neutral and one was down. U.S. Industrial Production (0.4%), Council Concurrent Personal Earned Income Tax Transfer Payments (0.2%), Council Concurrent Manufacturing and Trade Sales (0.2%), and U.S. Employees on Nonfarm payrolls (0.2%) increased. The U.S. labor force participation rate was unchanged, and the Conference Board Consumer Confidence Current Situation SA 1985=100 decreased 4.8%.

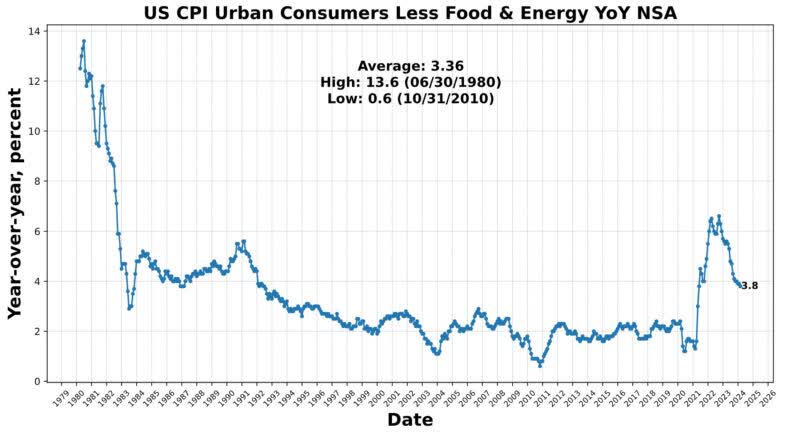

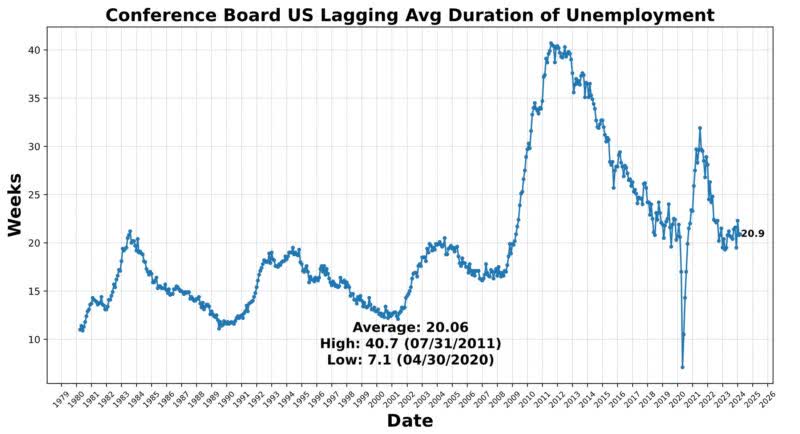

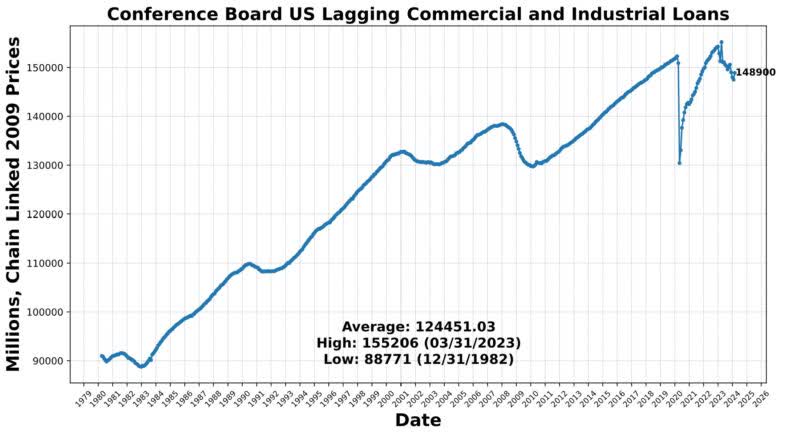

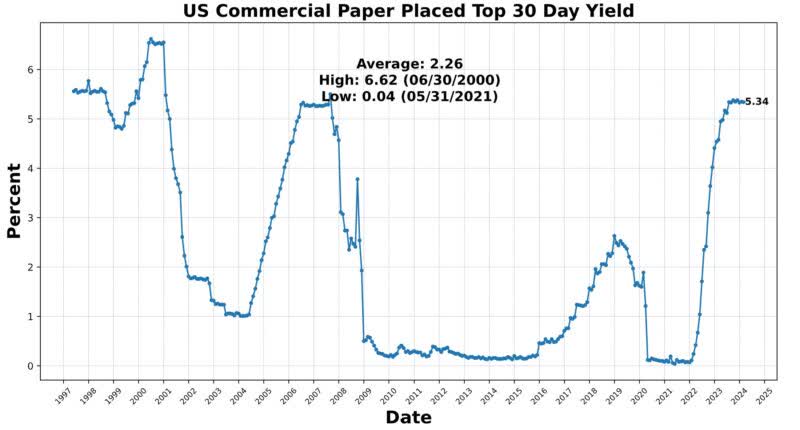

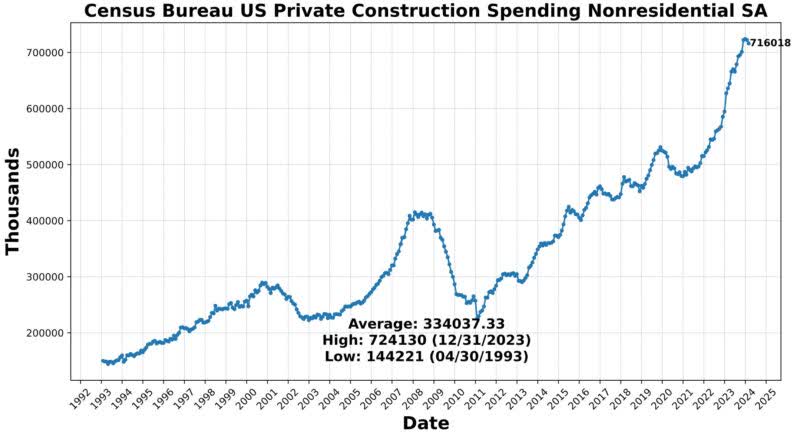

A lagging indicator has three rising and three falling components. The first category included Conference Board US Delayed Commercial and Industrial Loans (0.9%), Conference Board US Delayed Average Unemployment Duration (0.5%), and Total US Manufacturing and Trade Inventories (0.5%). The top 30-day yield on U.S. commercial paper fell 0.2%, as did the Census Bureau’s U.S. Private Construction Spending Nonresidential (-0.9%) and U.S. CPI Urban Consumers Decline Food and Energy (-2.7%). The roughly consistent indicator, currently at the 75 level for four months, suggests relative stability of moderate growth. In contrast, lagging indicators suggest a moderate contraction, with a pattern of significant monthly fluctuations continuing.

Argument

The Federal Reserve’s Beige Book release on April 17, 2024 provided insight into economic conditions in various regions of the United States. The first quarter of 2024 was characterized by ‘slight’ expansion, consistent with previous accounts of subdued activity. Ten Federal Reserve districts reported growth compared to eight in February, but consumer spending showed a slight increase, a contrast to recent retail sales figures. Among other trends mentioned were increased price sensitivity and decreased discretionary spending. Federal Reserve survey respondents expressed cautious optimism about growth, but employment growth remained modest in certain sectors due to ongoing labor shortages. Wage pressures continued to ease and inflation remained stable, but some regions reported increased pressure on margins due to difficulties in delivering price increases, posing a potential upside risk.

The March industrial production report showed a surprising rise that exceeded initial expectations. In particular, manufacturing production showed unexpected strength, with February’s figures being revised upward, raising the standard for measuring monthly growth rates. The surge in production comes as consumer demand for cars and fuel, traditionally interest-sensitive sectors, rises. Resilient consumer demand and survey data indicating strengthening conditions may have pushed U.S. industrial production past previous lows. Not only did March deadline industrial production rise in line with consensus and expectations, but the February figure was also revised sharply upward, from 0.1% to 0.4%. In particular, manufacturing production exceeded expectations, rising 0.5% during the month, exceeding both survey expectations and consensus estimates. Increased production of consumer goods, particularly in the automobile and parts sectors, has contributed significantly to this growth. Durable goods manufacturing and non-durable goods production also contributed significantly to the monthly increase in industrial production.

The employment environment in the Bureau of Labor Statistics’ Establishment Survey (a survey of approximately 144,000 businesses) and the Household Survey (a survey of approximately 60,000 households) has changed significantly in recent years, revealing contrasting economic realities. Sectors boosted by spending by means-tested beneficiaries (leisure, hotels, healthcare, etc.) are seeing strong increases in employment, while demand is falling in other sectors. The latter tend to be associated with low-income consumers and are experiencing slowing growth and limited employment. These differences are likely to continue to exacerbate interpretation difficulties.

Recent strength in nonfarm payrolls data has exceeded expectations, with the economy adding about 250,000 new jobs per month on average. That’s more than double the Fed’s estimate of a steady-state rate of 100,000 per month. The prevailing theory attributes the robust growth to the incredible surge in immigration over the past few years, and suggests that new, higher neutral employment rates could reach 150,000 to 250,000 per month.

However, there is skepticism about the accuracy of nonfarm payrolls in arresting undocumented workers. Household surveys are likely to reflect labor market health more accurately than establishment surveys. Despite the consensus, household surveys show the labor market is cooling, challenging the notion that employment will continue to be robust amid the influx of immigrants. Methodological differences between establishment and household surveys underpin the discrepancy, with household surveys potentially being more effective in recording the employment of undocumented workers. While enterprise surveys capture jobs that are more vulnerable to procyclical fluctuations, such as temporary work and “gig economy” work, household surveys provide a more comprehensive picture of labor market dynamics.

As a result, policymakers may need to reassess their assessments of the economy’s capacity to absorb significant inflows of low-skilled immigrants amid a downturn in the labor market. Recent policy changes, such as California’s significant minimum wage increase, are further impacting employment dynamics and deepening labor market weakness. Despite strong non-farm employment, household survey data shows employment growth is slowing, reflecting a cooling labor market.

Consumer price index (CPI) data for March presented worrying signs of the ongoing fight against inflation, especially given the favorable seasonal pattern that is typically conducive to disinflation during this period. Both headline and core CPI were unchanged from February, with numbers up slightly compared to the previous year. Particularly noteworthy is the continued momentum in core CPI over various time periods, which suggests that the disinflationary progress may have stalled or virtually halted. In particular, energy prices and housing costs continue to be key drivers of inflation, while gasoline prices and rents contribute significantly to headline CPI growth. Moreover, core services, particularly transportation services, are experiencing notable inflationary pressures, reflecting the ongoing impact of rising new and used vehicle prices.

Despite some encouraging signs of disinflation in certain categories such as core commodities, the spread of disinflation remains uneven. The effectiveness of monetary policy in suppressing inflationary pressures appears to be improving, as evidenced by reduced price pressures in some interest-sensitive spending categories. However, the proportion of key spending categories experiencing outright deflation remains relatively high, indicating ongoing difficulties in achieving widespread disinflation.

In light of these developments, and statements made by Federal Reserve officials in recent weeks, policymakers are reassessing the inflation outlook and resulting policy trajectory. It is very likely that the Fed’s interest rate adjustment schedule will be delayed. The market implied policy interest rate market, which expected 5 to 6 interest rate cuts in 2024 at the end of 2023, lowered its forecast twice.

Even amid mixed economic data reminiscent of much of the past two years, there are some areas of strength driven by inflation concerns and speculation about monetary policy action in the next quarter or two. As the labor market cools, uncertainty surrounding the trajectory of the U.S. economy is increasing. In particular, spot gold prices and the S&P 500 index have hit consecutive record highs several times over the past month, easily reflecting the uncertainty expressed by the market about the economic outlook. Although the likelihood of a marked economic contraction appears to be decreasing, classic recession indicators continue to signal strong signs that the recession will continue within the next 12 months. Since there is no identifiable path, it is better to objectively present factual data and trends without bias or prediction.

key indicators

Indicators that almost match

lagging indicator

capital market performance

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.