Buy BAE Systems Stock: Here’s Why (OTCMKTS:BAESF)

KGrif/iStock Editorial via Getty Images

Aerospace and defense companies are performing well, some doing well due to positive trends in commercial aircraft production and utilization, while others are performing very well due to increased demand for defense equipment. And service. In my opinion, European aerospace companies have been undervalued compared to their US aerospace counterparts, so there is significant upside. One name that I think could get significant space is BAE Systems (OTCPK: BAESF, OTCPK:BAESY), and Buy ratings from BAE Systems It has performed very well, with a 74% price-to-earnings return compared to the S&P 500’s 28% return. In this report, I revisit BAE Systems to discuss whether there is room for further upside for the stock, as well as its latest performance and outlook.

BAE Systems revenue growth, expected margins Extension remains absent

BAE Systems

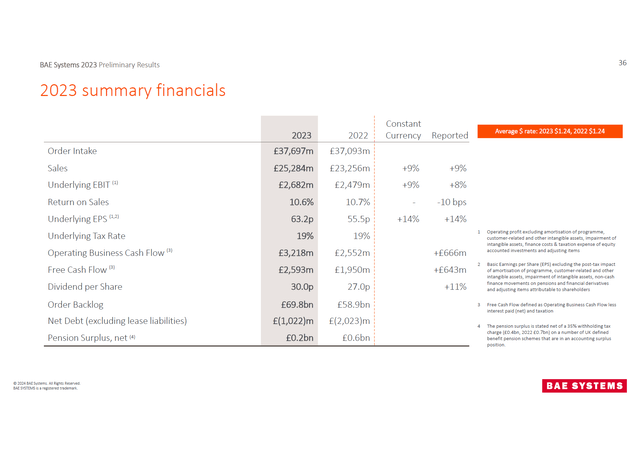

BAE Systems provides detailed earnings every six months, so we will discuss 2023 earnings in this report. Starting with order intake, it rose 1.6% to £37.7 billion. While this is not massive backlog growth, the 2023 order-to-order ratio is almost 1.5x, representing a strong opportunity for revenue growth driven by growing backlog and a backlog of nearly £70 billion. Sales rose 9% year-on-year to £25.3 billion, with margins somewhat stable. In December 2022, I pointed to the combination of revenue growth and higher margins as a driver of the company’s valuation and attractiveness. In fact, you can see that sales growth has occurred, but margin expansion has not yet occurred.

However, we did see solid free cash flow growth from £643 million to £2.6 billion, and that increase was consistent with operating cash flow. So while margins were stable, cash flow growth was outpacing both profit and revenue growth.

Electronic systems sales grew in line with revenue growth driven by strength in commercial aerospace and growth in electronic combat systems, but margins declined from 16.6% to 16.1%, resulting in EBIT of approximately £1.1 billion. Platform and services revenue grew 7%, falling short of company revenue growth, but segment margins increased from 8.8% to 9%. Sales were driven by combat vehicle volumes and ship repair volumes, with margins boosted by higher margins at Combat Mission Systems and its Swedish subsidiary.

Aviation sales rose 4.7% to £8.1 billion, driven by increased sales of the BAE Systems Tempest, a sixth-generation fighter jet being developed to replace the Eurofighter Typhoon. Additionally, typhoon support activities have increased and demand for missiles has increased. Margins increased from 11% to 11.8%, reflecting reduced program risk. Marine segment revenue increased 20% to £5.5 billion, driven by accelerated funding for the Dreadnought program and increased combat ship activity. Margins remained stable at 7.7%, resulting in EBIT of £425 million. Cyber and intelligence revenue rose 5% to £2.9 billion, but margins fell from 10.5% to 8.6%, reducing EBIT from £287 million to £248 million. The margin decline primarily reflects investments in space and networking capabilities.

So, if we look at all segments in the context of combining revenue growth and margin expansion, we can conclude that Aviation, Electronic Systems, Platforms and Services have been able to achieve this. That’s not a bad thing, but it shows that margin expansion remains difficult as expansion in some segments and areas is offset by stable or poor performance in others. However, what is noticeable is that strong cash conversion is taking place in all sectors.

Is Ball Aerospace now BAE Systems?

In August 2023, BAE Systems agreed to acquire Ball’s aerospace division for $5.6 billion. The transaction was completed in mid-February 2024 and Ball Aerospace is now part of the newly established Mission & Space Systems business, part of the Electronic Systems segment, and will add $100 million to free cash flow.

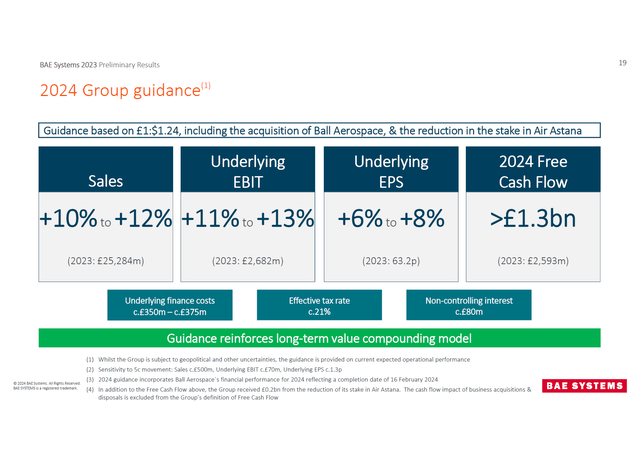

BAE Systems

BAE Systems expects sales to grow by 10-12% and EBIT by 11-13% in 2024. About half of its revenue and EBIT growth comes from Ball Aerospace. Electronic Systems sales are expected to increase by approximately one-third, driven by the acquisition and integration of Ball Aerospace, with margins down 15% from 16.1% last year, and this margin decline is also due to Ball Aerospace having lower margins compared to the segment. . Platform and services revenue will grow 5-7% with a margin of 10-11%, up from 9% a year ago. Airline sales are expected to increase 3-5% with stable margins, while ocean sales are expected to increase 6-8% with margins of approximately 8%. Cyber & Intelligence revenue growth is expected to increase 3-5% with margins in the 8-9% range compared to 8.6% in the previous year. So overall, the story is primarily about revenue growth combined with inorganic growth and not about segment margin expansion as much as I would have expected. There is also a 100bps revenue and EBIT headwind from the sale of the Air Astana stake. Free cash flow guidance for 2024 is over £1.3 billion, which in my view is a conservative guide and given the conservative three-year guidance that BAE Systems is providing for actual cash flow performance, free cash flow is expected to be around £3.2 billion. . And the growth rate was also observed.

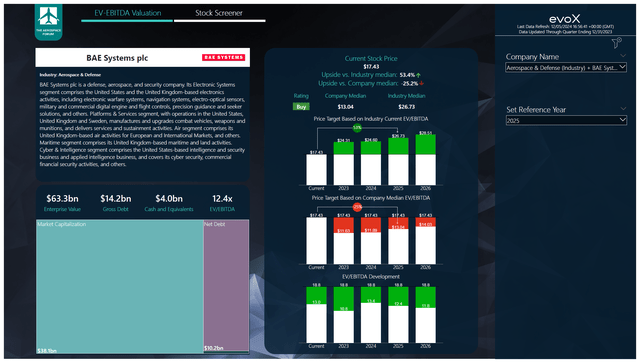

Aerospace Forum

Valuing BAE Systems stock is tricky. A median EV/EBITDA of 9x does not provide upside for the stock. However, the industry average offers significant upside of 53%. Given the current tailwinds in the commercial aerospace and defense sectors, we believe it is justified for BAE Systems to trade at an expanded multiple. Using an EV/EBITDA of around 14x, which is between the median of its peer group and BAE Systems, we arrive at a price target of $19.88, which provides an upside of 14% based on 2025 earnings.

Conclusion: BAE Systems stock remains a buy

BAE Systems has seen a fairly significant rise in its stock price, but we think there’s more room for upside. Unless the market thinks BAE Systems is worth its aerospace peer group valuation, it’s unlikely to be in the range of returns we’ve seen before. However, we believe the upside is attractive given that there is room for margin upside due to current sales growth and subsequent changes in the company’s margin mix. It will be interesting to see whether we see outright margin expansion at the segment level as well, which could lead to much higher upside. We are clearly seeing positive trends in the end markets and BAE Systems is increasing its exposure through investments and acquisitions to capitalize on market trends.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.