Buy Rating for TNA ETF (NYSEARCA:TNA) for Upcoming Small-Cap Breakout

Shahrir Maulana

Technology stocks have been grabbing a lot of the headlines during the massive bull market we’ve seen over the past two months or so, but in reality, the best-performing group of tech stocks are small caps. Major indices. It became small caps. Horrible On a relative basis over the years at this point, just about every other index has performed better, in most cases by huge margins. But those days may be just coming to an end.

One way to take advantage of this is through leveraged exposure if you prefer trading small caps. There are many ways to create leverage, but certainly the easiest is to own leveraged exchange-traded products, such as the subject of this article. Direxion Daily Small Cap Bull 3X Stock ETF (NYSEARCA:TNA).

TNA is an ETF that seeks 3x the daily return of the Russell 2000 Index. The Russell 2000 Index is comprised of 2,000 small-cap stocks that are very diverse in terms of number of holdings as well as industries. What TNA does is triple your daily returns. Therefore, an already volatile asset class is magnified in terms of volatility. Let me tell you up front that TNA is a bargain, not something you buy and forget about for a few years. A product that allows targeted exposure over a relatively short period of time to maximize return on invested capital. However, returns go both ways and involve a lot of risk.

Leveraged products are riskier than unleveraged products, so keep this in mind as you proceed with your setup here. If you’d like to learn more about how these products work and the risks associated with them, there are great resources available. Both FINRA and the SEC have resources to arm investors with the knowledge to trade these products. I won’t go into the content of the linked post, but I want to make it clear that whenever leverage is used, the risk increases.

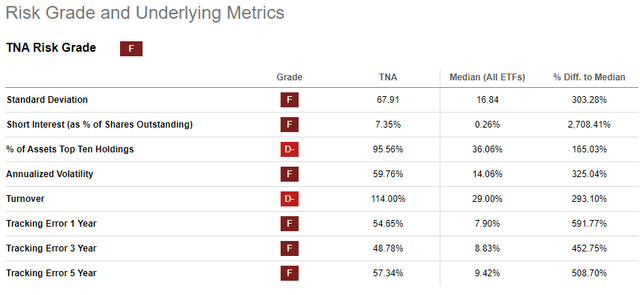

Seeking Alpha’s TNA rating includes an ‘F’ grade for risk.

pursue alpha

The annual volatility is ~60%That’s about five times the S&P 500. Small-cap stocks are inherently more volatile than the S&P 500, and the fund’s 3x leverage means they have a lot of movement.

Another point I made that fits very neatly into the points I made above about buying and not keeping this product are the three rows at the bottom about tracking errors. This is a somewhat ridiculous number considering how large it is, but it basically means that this fund doesn’t actually track the underlying index over time. That’s okay, because we know the same is true for leveraged funds. It’s about recognizing and not trying to hold on to this for long.

Despite all the disclaimers and reasons not to own this, why would you want Want to buy it? Simply put, if all goes well, there is tremendous upside potential in 2024.

Intensely bullish but extremely overbought

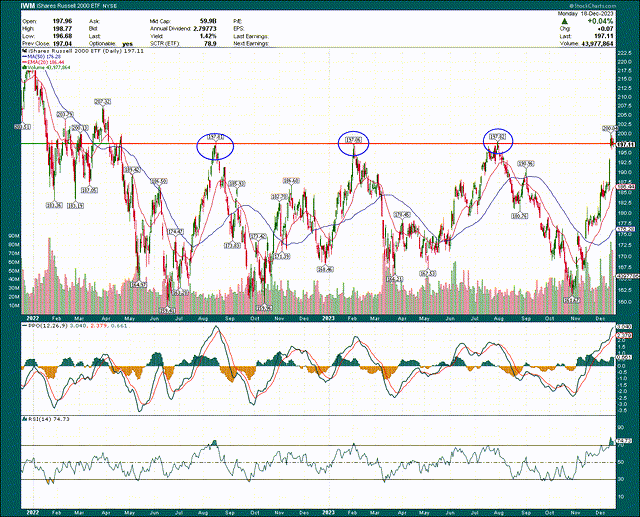

As mentioned earlier, small caps were terrible. Small-cap stocks have been stuck in their trading range while most of the rest of the developed world has been hitting new highs. The important thing to note here is that as of the close on the 18th, small-cap stocks are on the verge of breaking out of a trading range that has persisted for the past 18 months. It’s not a done deal by any means, but it’s looking increasingly likely that this trading range will finally find upside.

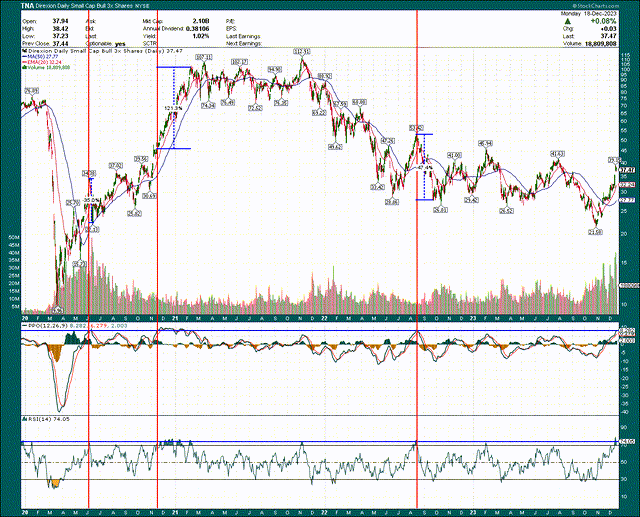

Below is the TNA chart for the past four years. You can see the trading range on the right, but here I want to highlight just how overbought TNA is at the moment. On three other occasions, like today, when PPO was overbought, I drew a red vertical line.

stock chart

The first was in June 2020, and that was before TNA suffered an immediate 35% decline. The second was in November 2020, which was completely ignored by investors and TNA rose further by over 120% on an overbought signal. The last outbreak was in August 2022, with TNA immediately decreasing by 47%. Overbought conditions are usually a sign of a bull market, and despite the 2020 decline, it has recovered in a reasonably short period of time and spawned a new rally that has seen TNA return hundreds of percent to shareholders. But these conditions are a warning sign when investors are this optimistic. Things could get frothy and that could lead to a sharp sell-off.

Nonetheless, I think I favor significant selling, base/consolidation, and a breakout before further upside. This is what the larger exponents have done, and I see no reason why small caps can’t follow suit. There is a lot of catching up to do here and money is flowing into penny stocks very quickly so I think this may actually be the end of the consolidation pattern that has formed over the past 18 months.

Now, to ignore the instability inherent in leveraged funds and look at the setup more clearly, let’s look at IWM, a pure Russell 2000 index fund.

stock chart

IWM is testing very important resistance around $197/$198. It reached that level a few days ago but then fell again. It is massively overbought, but unless a significant sell-off occurs this week, there doesn’t appear to be enough weakness to meaningfully push this price down. In other words, I think it is not a matter of if small-cap stocks will break through, but rather a matter of when.

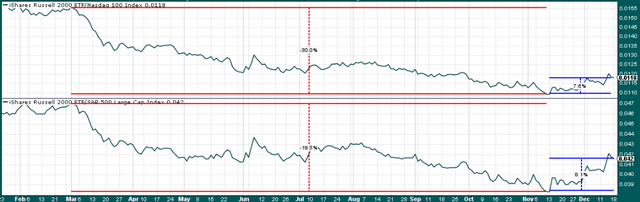

We’ve mentioned the chronic underperformance of small-cap stocks in recent years, and here’s a snapshot from 2023. IWM underperformed QQQ by 30% and SPY by 19% from March to November.

stock chart

But on a relative basis, since bottoming in November, small caps have outperformed the Nas by nearly 8% and the S&P 500 by a bit more. Does this mean that small-cap stocks should continue to outperform? No, of course not. However, if it breaks the massive triple top of $197/$198, look above on both an absolute and relative basis.

finish

I’m not here to argue or prove that I’m ‘right’ about this. I don’t care about any of that because I’m just trying to follow the price action. Right now, price action is telling us that the time to own small-cap stocks is now. Because small cap stocks are on the verge of breaking out of a large multi-year consolidation/fundamental pattern. Again, a breakout has not occurred yet, but if it does, the bull market is likely to be huge and prolonged. If I’m wrong and they refuse to resist again, so be it. But right now, the risk/reward of owning small-cap stocks is too great to give up, so I’m taking a long position.