BXSY: Monster Discount Continues to Grow (OTCMKTS:BXSY)

Incredi VFX

Written by Nick Ackerman and co-produced by Stanford Chemist.

Last time we covered Bexil Investment Trust (OTCPK:BXSY), the fund was called The Dividend and Income Fund and had a “DNIF” ticker.

The fund name changed on January 2, 2024. Dividend and Income Fund to Bexil Investment Trust, stock symbols DNIF to BXSY and net asset value symbols XDNIX to XBXIX.

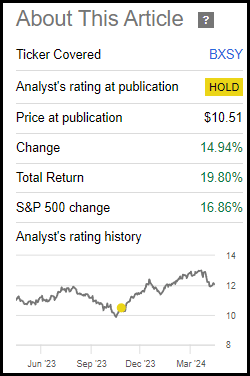

Aside from the name and stock changes, the fund performed quite well during this period. In fact, it outperformed the S&P 500 index on a total return basis.

BXSY performance since previous update (alpha exploration)

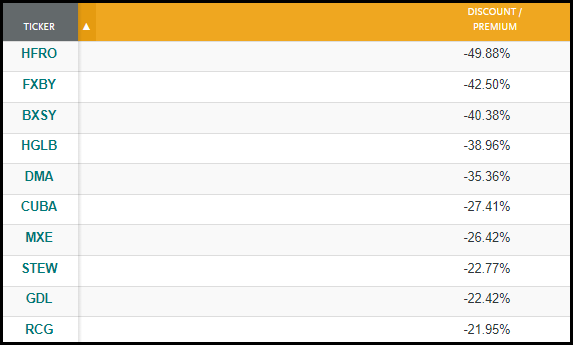

In retrospect, it would have been better if the ‘Hold’ rating had been a ‘Buy’ rating. However, one of the most important factors when determining ratings is closed-end fund discounts. The principle is relative discounting, not absolute discounting. In this case, the discount In fact, it continues to expand further and is now at over 40%! This makes the fund the third-largest discounted fund.

CEF (CEFConnect) with the highest discount rate

This fund continues to show interesting prospects. The fund’s president and portfolio manager have also been buying as recently as March, which is generally positive.

BXSY Basics

- One-year Z-score: -2.87.

- Discount: -40.38%.

- Distribution yield: 8.30%.

- Expense ratio: 1.39%.

- Leverage: 10%.

- Assets under management: $274 million.

- Structure: Permanent.

BXSY’s primary goal is “high current income”, with the secondary “capital appreciation” goal. To achieve this, the fund will invest “under normal circumstances at least 50% of its total assets in income-producing equity securities.”

The fund “targets solid operating companies that exhibit excellent return on equity and return on assets at reasonable valuations. Typically, the fund focuses on profitable, growing, conservatively valued companies across a variety of industries.” Purchase and hold creation equity securities.”

The fund is moderately leveraged and has a fairly average expense ratio compared to other equity CEFs.

Discounts get deeper

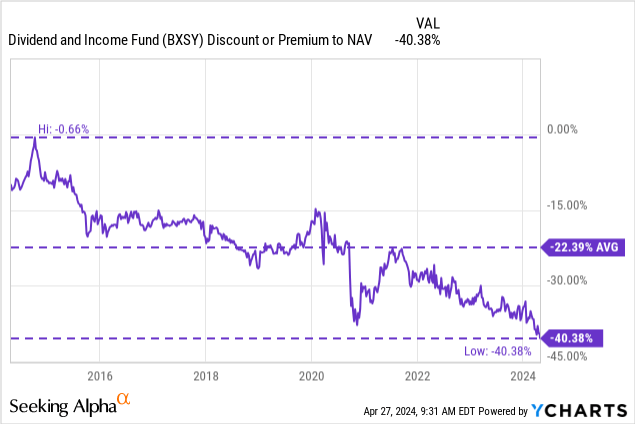

As discounting has deepened recently, the one-year z-score has also fallen over this period, now approaching -3. This now makes the fund a much more interesting prospect, but the current trajectory shows the discount on this fund continuing to widen, so it’s still a tough question that would force me to assign a ‘buy’ rating.

At some point, something has to give, and investors need to stop forcing discounts. However, because it is an over-the-counter transaction, the number of buyers is limited. Discounts have been widening except for a few periods over the past 10 years. This led to the COVID-19 pandemic, where prices began to narrow, but began to decline before recovering from the COVID-19 panic selling and slowly grinding into wider discounts once again.

Y chart

Activist group Saba Capital Management says it needs to do better for shareholders and says it uses funds with discounts of around 10-15%, but won’t even participate in funds with discounts of more than 40%. Bulldog Investors had previously begun efforts to build positions, but these seemed to last only a short time before selling out.

Earned decent returns but low distributions

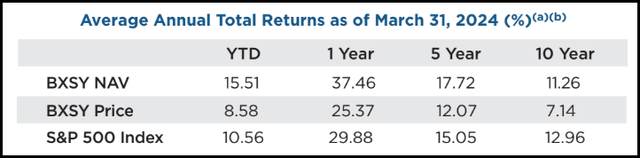

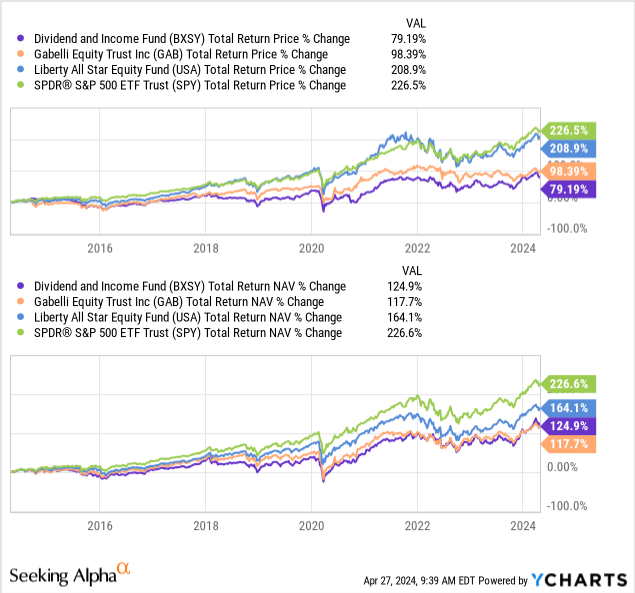

Interestingly, although you might think this fund’s performance could be problematic, its historical returns are quite satisfactory. That hasn’t been the case since we last funded it. When it comes to highlighting outstanding performance on a total return basis, this wasn’t just lucky timing. We also take into account the discount being extended by up to 5 points since the last update.

They have outperformed the S&P 500 Index over the past one and five years on a total NAV return basis. They have had decent returns, but their returns have lagged over the past decade.

BXSY Annual Performance (Bexil)

In general, total return does not necessarily seem to be an important factor in determining how most CEF investors value a fund. You can see below how the fund compares to its performance against some popular vanilla stock fund peers.

Y chart

In this case, the fund outperformed Gabelli Equity Trust (GAB), which was trading near its NAV (-0.19% discount). Both funds underperformed Liberty All-Star Equity Fund (USA). In the US, only a -0.29% discount is offered. All three of these funds underperformed the SPDR S&P 500 ETF Trust (SPY), but what GAB and US have in common is a 10% managed distribution plan.

For GAB, more specifically, it is a 10% minimum managed distribution policy that maintains a certain level of payouts but adjusts them at the end of the year if necessary to achieve goals. The US adjusts payments quarterly based on 2.5% of NAV.

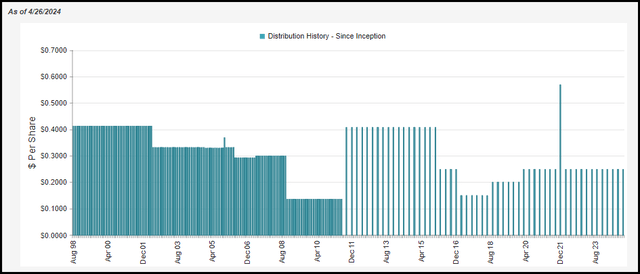

With a NAV distribution of 4.95%, this is where BXSY really ‘lags’. However, thanks to the fund’s significant discount, actual shareholders can earn a distribution yield of 8.30% at current prices.

BXSY Deployment History (CEFConnect)

I believe that increasing the payout could go a long way in providing more interest for this fund. It doesn’t have to be that important. If you set the NAV ratio to 6%, the quarterly distribution goes up to $0.30, but the share price distribution goes up to almost 10%. A small increase in NAV levels to 6% would still likely see an upward trend over time.

Some investors have requested CEFs that maintain or increase their NAV from the beginning. In reality, this is very rare in funds that have been around for a significant period of time. The fund launched with a NAV of $14.96 and the latest NAV was $20.21. So this fund really checks those boxes and pays somewhat sustainable distributions.

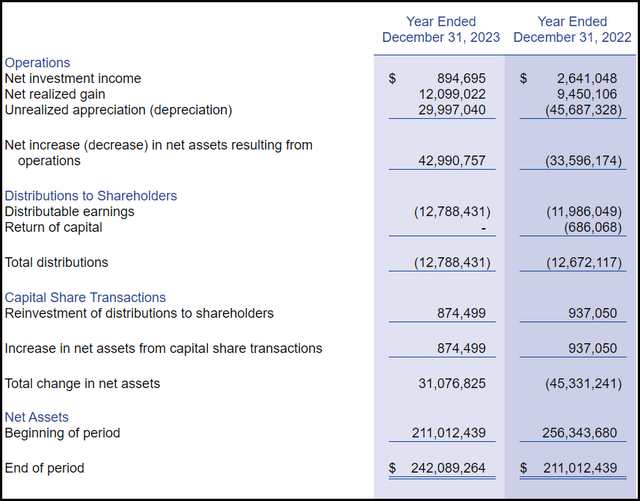

Like almost all stock funds, BXSY requires capital gains to fund distributions. However, if the NAV increases over time or the NAV becomes flat, it means that covering the payments has not been a problem.

BXSY Annual Report (Bexyl)

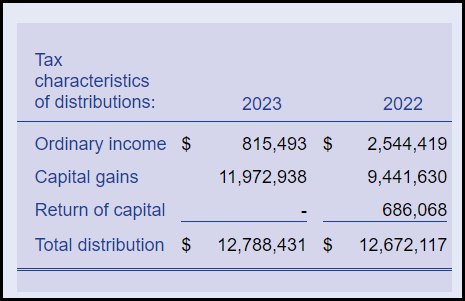

For tax purposes, distributions were primarily long-term capital gains over the past three years. This can make your taxable accounts more tax-friendly.

BXSY distribution tax text (Bexil)

BXSY’s Portfolio

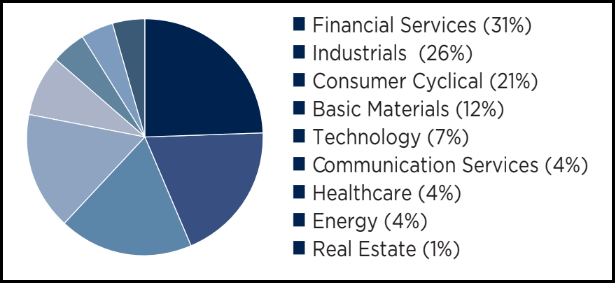

The fund’s portfolio leans heavily toward a more value-oriented approach. Financials and industrials account for the largest portion, accounting for more than 50% of the fund’s total assets.

BXSY Top Sector Allocation (Bexil)

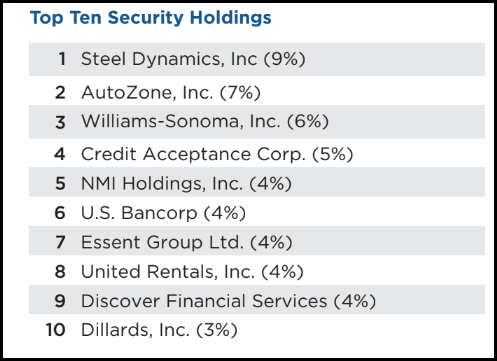

This isn’t all that surprising when you start looking at the fund’s top 10 holdings. They are fairly concentrated, with top holders accounting for a significant portion of the allocation. Steel Dynamics, Inc. (STLD) has a 9% weight, AutoZone, Inc. (AZO) has 7%, and Williams-Sonoma, Inc. (WSM) has 6%. %, these three alone account for approximately 22% of the portfolio’s investments.

BXSY Top 10 Holdings (Bexil)

The higher your concentration, the more likely you are to achieve results. But this also means the risk is higher because only a few names can underperform significantly and so can the fund. As of the last annual report, the fund held a total of 44 stocks, including 108.34% in stocks, 0.04% in corporate bonds, 0.44% in MLPs, and 1.25% in preferred stocks.

Sector weights and top 10s are as of March 31, 2024, the most recent factsheet. Using this in relation to previous updates, you will notice some changes in sector weightings. The basic materials sector was the fund’s second largest sector, accounting for 21%, but has now fallen to 12%. Westlake Corporation (WLK) and Asbury Automotive Group, Inc. (ABG) previously held the largest shares.

Since WLK is a materials company, the fact that the fund is no longer in the top 10 is likely one of the reasons its basic materials allocation is not as large. UnitedHealth Group Incorporated (UNH) was also a former holding, which may at least partially explain its healthcare exposure moving from 9% to 4% now.

New names in the top 10 include NMIH (NMIH), United Rentals, Inc. (URI), and Discover Financial Services (DFS). NMIH and DFS helped maintain an overweight financial allocation to financial sector stocks. The fund’s weighting has actually increased slightly from 29% previously. URI is classified as an industrial sector stock, which may help explain why its industrial allocation has increased from its previous 20% allocation.

conclusion

BXSY is trading at a huge discount on an absolute and even relative basis. The hard part is betting when the discount won’t get any bigger. It currently offers the third-largest discount among all CEFs, but if this is a guide, the fund could see its discount decline even further.

On the other hand, BXSY has far fewer red flag issues than Highland Opportunities and Income Fund (HFRO). One of these problems is that HFRO’s portfolio makes most of its private investments. This means that the valuation of the security may be questioned. So there are some distinct differences, and the valuation of the BXSY portfolio shouldn’t really be an issue at all, the overwhelming majority of which are Level 1 securities.

Of course, these funds don’t necessarily have the most shareholder-friendly management. At least historically so. I mentioned some issues in my previous article. Going OTC was a negative thing for shareholders, offering dilutive shares in the past was another. They currently still limit the ability of individuals to own more than 4.99% of the fund without trustee approval, which is another reason why no activist can really move.

Overall, the fund’s monster discount presents an interesting opportunity for anyone willing to bet on this fund. There are certainly other, much riskier funds that can take positions.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.