Can Bitcoin Recover After Germany Sells Most of Its BTC?

BTC sales in the German state of Saxony show signs of coming to an end as nearly 90% of Bitcoin holdings have been sold.

The state of Saxony has seized 50,000 BTC, worth about $2 billion, from the former operator of the pirate movie website movie2k. The operator converted the website’s profits into Bitcoin, which he believed at the time (2013) was untraceable and expected to appreciate in value.

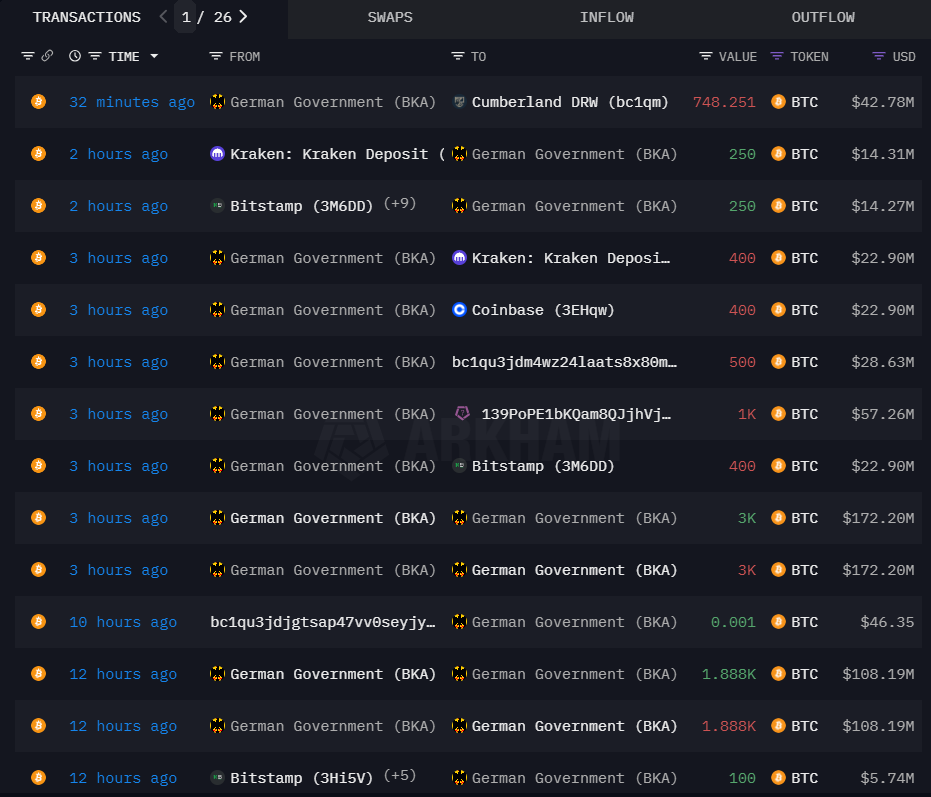

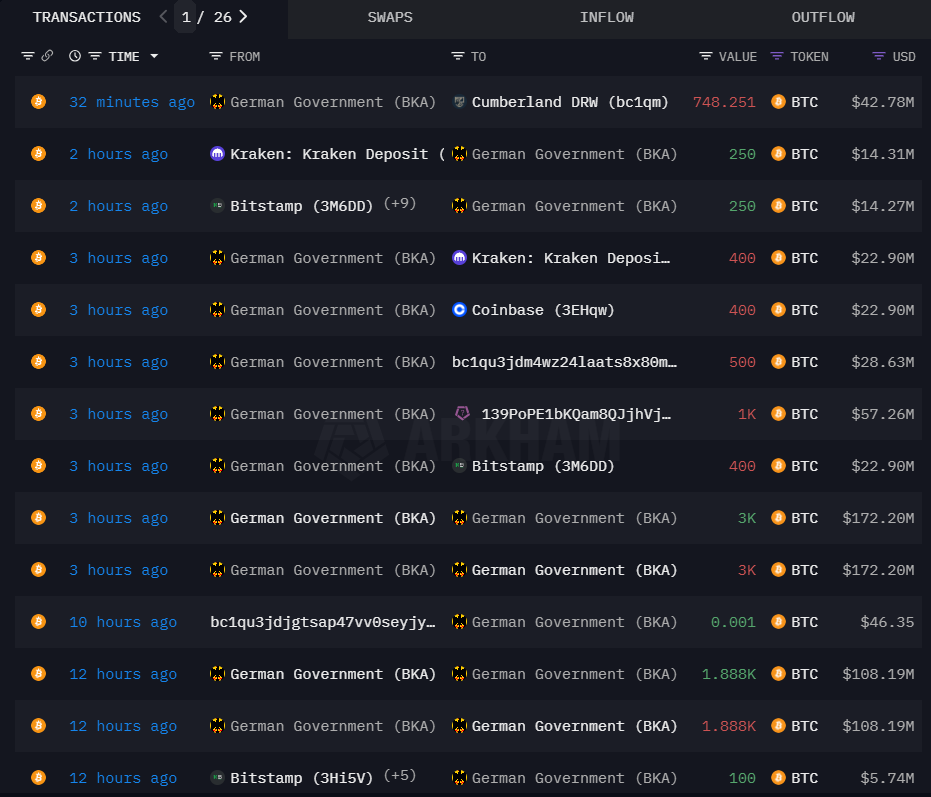

Selling pressure has contributed to the Bitcoin price decline. According to blockchain analytics platform Arkham Intelligence, there are only 6,146 BTC left out of 50,000, which is worth about $350 million. Selling continues as of this writing.

Source: Arkham Intelligence

Cryptocurrency exchanges Kraken and Coinbase have been used in recent transactions. According to Arkham Intelligence, the Bitcoin sent to German addresses is likely unsold BTC.

There is speculation that the remaining balance will be sold today. Once the German selloff is over and Bitcoin recovers, bargain hunters may try to buy Bitcoin at the lows.

Prior to the sell-off, BTC-related tokens SATS, STX, and ORDI had been showing moderate gains during the recent Bitcoin recovery.

Why ORDI, SATS, STX?

Ordinals (ORDI) is the native token of the Ordinals Protocol, which uses a portion of Bitcoin to mint or record NFTs and tokens.

The tokens engraved on the Ordinal are known as BRC-20 tokens. Initially, BRC-20 did not receive much exposure until Binance announced the BRC-20 Launchpad.

SATS is a meme coin from Ordinals that has shown strong resilience despite the BTC sell-off.

on the other side, sxstx is the native token of Stacks, a platform that allows users to build decentralized applications (dApps) on the Bitcoin blockchain.

In a recovery, BTC-related tokens could yield greater gains than Bitcoin.

It will also be interesting to see if the BTC recovery will have an impact on ongoing pre-sales, such as the upcoming 99Bitcoins from Ordinals.

Will Bitcoin Rebound? All Eyes Are on MicroStrategy

MicroStrategy is actively buying Bitcoin whenever the price drops. MicroStrategy holds approximately 226,331 BTC.

According to a Form 8k filed with the U.S. Securities and Exchange Commission (SEC), ‘On April 27, 2024 and June 19, 2024, MicroStrategy used the proceeds of the offering and excess cash on hand to acquire approximately 11,931 Bitcoins for approximately $786 million in cash.’

If Saxony liquidates all or most of its Bitcoin holdings, it will be interesting to see whether MicroStrategy steps in to “buy the dip.”

While there may not be an immediate official update when a large BTC transaction occurs, it may be enough speculation to facilitate a recovery.

MicroStrategy announced a 10-for-1 stock split on Thursday for those considering buying the stock.

Source: tradingview

From a technical perspective, the key resistance level on the 4-hour chart is around $59,250. A clear break of this level could lead to a larger upside.