Can Bitcoin Survive Mt.Gox’s $9 Billion Downturn?

Bitcoin traded earlier this week at Mt. It was sold due to a $9.6 billion transfer from Gox. Although some recovery has occurred, concerns about mass liquidation of BTC by October still remain.

In summary, Mt. Gox was the largest Bitcoin exchange platform over 10 years ago. Over 70% of Bitcoin transactions take place at Mt. It was done in Gox. In 2014, Mt. Gox announced that it had been hacked and lost approximately 800,000 BTC.

Compromised computers led to exploits that Exchange had overlooked for years.

At the time, it was worth about $460 million. After the exploit was revealed, Mt. Gox filed for bankruptcy. Since then, Mt. Gox’s cryptocurrency wallet was closely monitored. Any sign of BTC being transferred from the wallet caused a merciless reaction in the Bitcoin price.

Blockchain analytics platforms, including Dune and Arkham Intelligence, are part of Mt. Gox’s trade was captured and sent ripples throughout the market.

Source: Dune

According to on-chain data, Mt. Gox transferred approximately $9.6 billion, or 141,686 BTC, on May 28, 2024. The Bitcoin exchange asked creditors whether they would pay in fiat or Bitcoin.

Some fiat redemptions were made through PayPal in late 2023. The upcoming redemption could be for those looking to prepare with cryptocurrencies.

As news spread across social media that a significant amount of Bitcoin could be liquidated, the market reacted accordingly.

Source: Dune

The repayment deadline is October 31, 2024. The market is concerned that the repayments will be liquidated and prices will fall firmly. As a result, Bitcoin fell when this news became known to the market.

However, Mt. Is Gox the big bad wolf the mayor should fear?

Mt. Gox is not the big, bad wolf.

Bitcoin got hit by the hammer when the FBI seized 41,490 BTC from Silk Road, a black market operating on the darknet, and was scheduled to sell in 2023.

Court documents state:

‘On March 14, 2023, the government sold 9,861.1707894 BTC (out of 51,351.89785803 BTC) for a total of $215,738,154.98. Excluding transaction fees of $215,738.15, the net return to the government was $215,522,416.83.

‘Of the Bitcoin confiscated in the Ulbricht incident, approximately 41,490.72 BTC remains, which the government expects to liquidate in four more batches during the year.’

Source: Official court documents

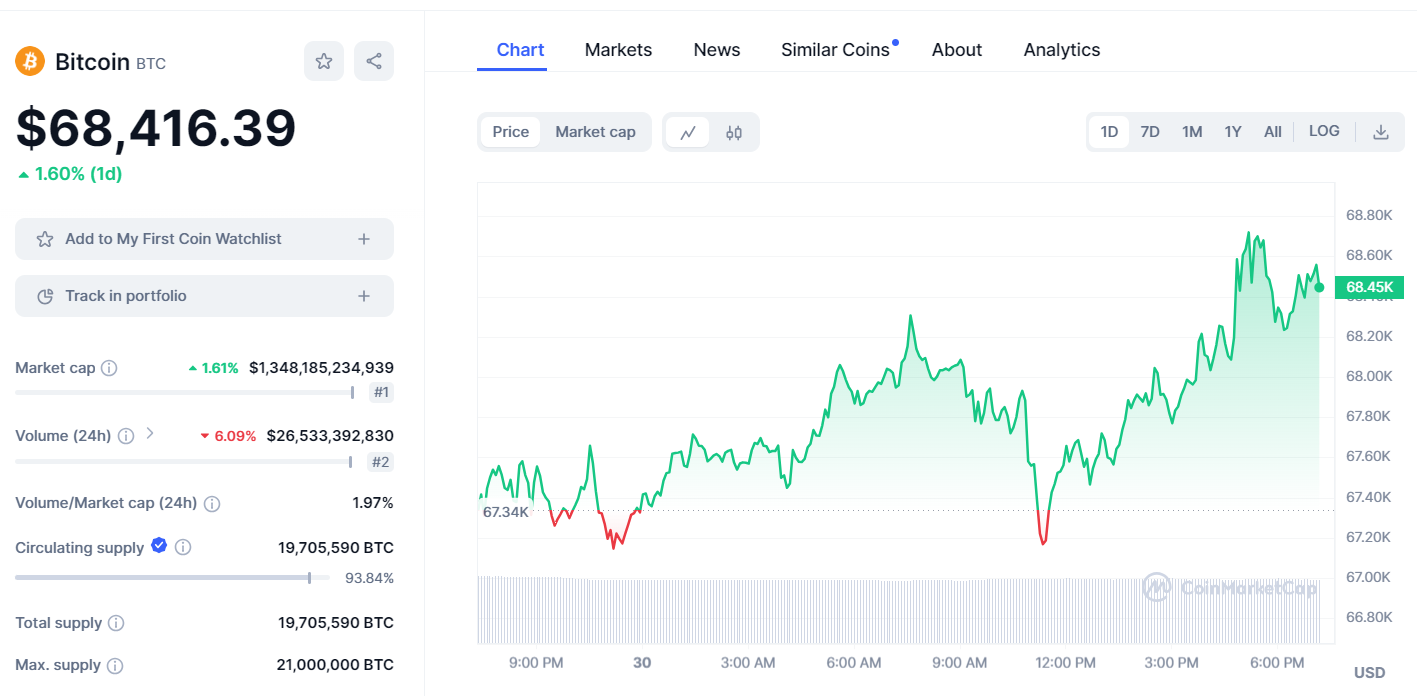

Despite the liquidation, BTC held firm throughout 2023. ‘Crypto winter’ never materialized. $9.6 billion is certainly larger, but the market conditions are different.

- Bitcoin’s market capitalization is $1.3T.

- Spot Bitcoin ETFs boosted inflows.

- More institutions may add spot BTC ETFs to their clients.

- Bitcoin daily trading volume exceeds $20 billion.

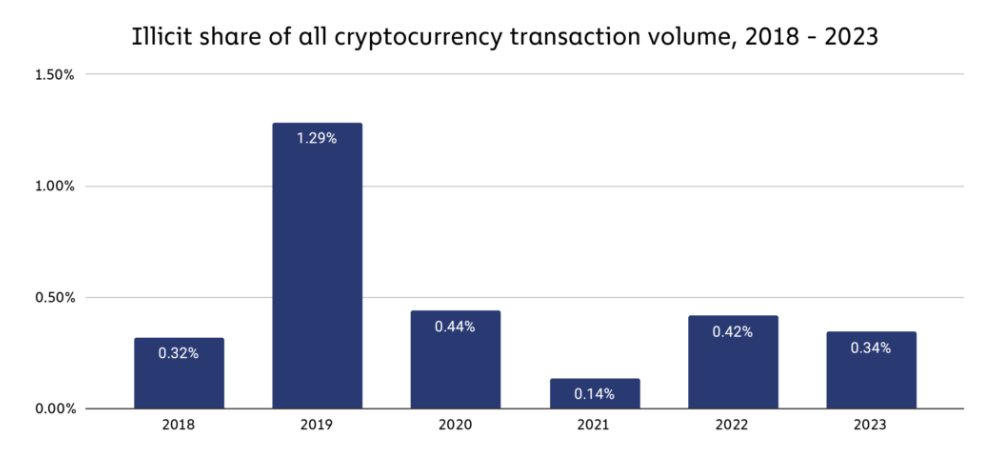

Bitcoin is more widely accepted by regulators than in the past. Chainalytic, a blockchain analytics platform, found that only 0.34% of cryptocurrency transactions in 2023 were related to crime.

Source: Chainalysis

In addition to the above, Bitcoin is now accessible on Decentralized Finance (DeFi) platforms. It can be used for on-chain borrowing and lending, provides liquidity, and is staked for annual returns.

While many people may choose to liquidate their BTC redemptions, some may choose to invest their BTC holdings. passive income.

Investment management and research firm Bernstein recently released its outlook for Bitcoin and Ethereum. Bernstein expects Bitcoin to reach $90,000 in 2024 and $150,000 in 2025.

Bitcoin and Ethereum ETFs are expected to grow to $450 billion, which could also have a positive impact. Solana.

Based on the above, not all Mt. Gox creditors may be in a hurry to sell.

US presidential election that will determine Bitcoin trends

The focus may shift to the US elections scheduled for November 5, 2024, rather than the redemption of Mt. Gox. Both Joe Biden and Donald Trump are changing their positions on cryptocurrencies.

In 2021, Trump said in an interview with Fox Business that cryptocurrencies were “potentially a disaster waiting to happen” and “could be fake.” ‘Who knows what it is?’

Source: Trump on Cryptocurrency 2021 – Fox Business, YouTube

As the cryptocurrency market continues to expand and Trump is re-elected, he has changed his views on cryptocurrencies. The Trump campaign announced this week that it will begin accepting donations in cryptocurrencies such as Bitcoin, Ethereum and Dogecoin.

In a recent post shared on Truth Social, Trump wrote:

‘I am very positive and open-minded about cryptocurrency companies and everything related to this new and fast-growing industry. Our country must become a leader in this field.’

Bloomberg reports that Elon Musk is advising Trump on cryptocurrency policy.

A US president who favors cryptocurrencies (unlike the US SEC) could have a positive impact on cryptocurrencies, especially Bitcoin, due to spot ETFs.

Cryptocurrency enthusiasts may conclude that only a Trump victory will be cheered. Biden is aware of Trump’s popularity among cryptocurrency investors, which means he is unlikely to sit on the fence.

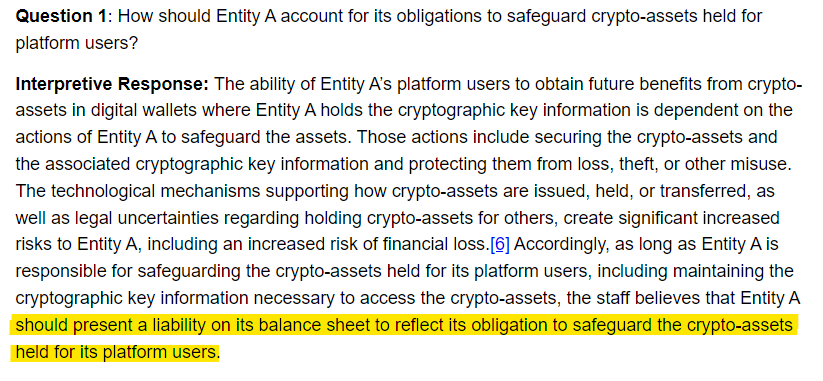

Battle over SAB 121

The U.S. Senate passed a bipartisan resolution two weeks ago on Staff Accounting Bulletin 121 (SAB 121), which would ban U.S. banks from providing digital asset custody services.

SAB 121 came into effect in 2022. This will require U.S. banks to add digital assets to their balance sheets. However, U.S. banks cannot provide custody services for digital assets because custodial assets are always off the balance sheet.

Source: SEC

Allowing banks to offer cryptocurrency services would be an important milestone for Bitcoin.

Biden plans to veto the SAB 121 resolution in support of the SEC. Due to Trump’s popularity among cryptocurrency fans, rejecting SAB 121 could portray Biden negatively.

According to recent reports, the Biden administration has reached out to key figures in the cryptocurrency industry to seek further guidance on the cryptocurrency community and policies. Biden and Trump are tied in Virginia, according to recent polls. Biden may need to consider pleasing the cryptocurrency community.

At this stage, it is unclear whether the bipartisan resolution will be rejected. If the veto is not exercised, Bitcoin could rebound as both presidential candidates soften their approach to cryptocurrencies. As a result, the bulls moved to Mt. Potential Bitcoin sales can be absorbed from Gox redemptions.

Which coins benefit from the Bitcoin bull market?

Source: CMC

Currently, most cryptocurrencies are associated with Bitcoin. When Bitcoin takes the next step higher, meme coin People like Pepe and Dogwifhat will naturally gain momentum.

Meme Coin pre-sale currently underway New Zealand Additional flows can be observed.

DeFi tokens can also be pushed to higher levels, but some may be pushed more than others. Solana could be in the spotlight because it has the potential to be the next cryptocurrency to appear in new spot ETF applications.

Ripple (XRP) could also be a worthy candidate once the issue is resolved by the US SEC.

The US core PCE price index, released on Friday, provides a glimpse into current inflation. Some volatility is expected as Bitcoin has not yet been fully ‘depegged’ from the S&P500. Cryptocurrencies are still affected by the Federal Reserve’s monetary policy, with inflation playing a significant role.