Can Solana Price Recoup $200 After Morgan Stanley’s ETF Submission?

join us telegram A channel to stay up to date on breaking news coverage

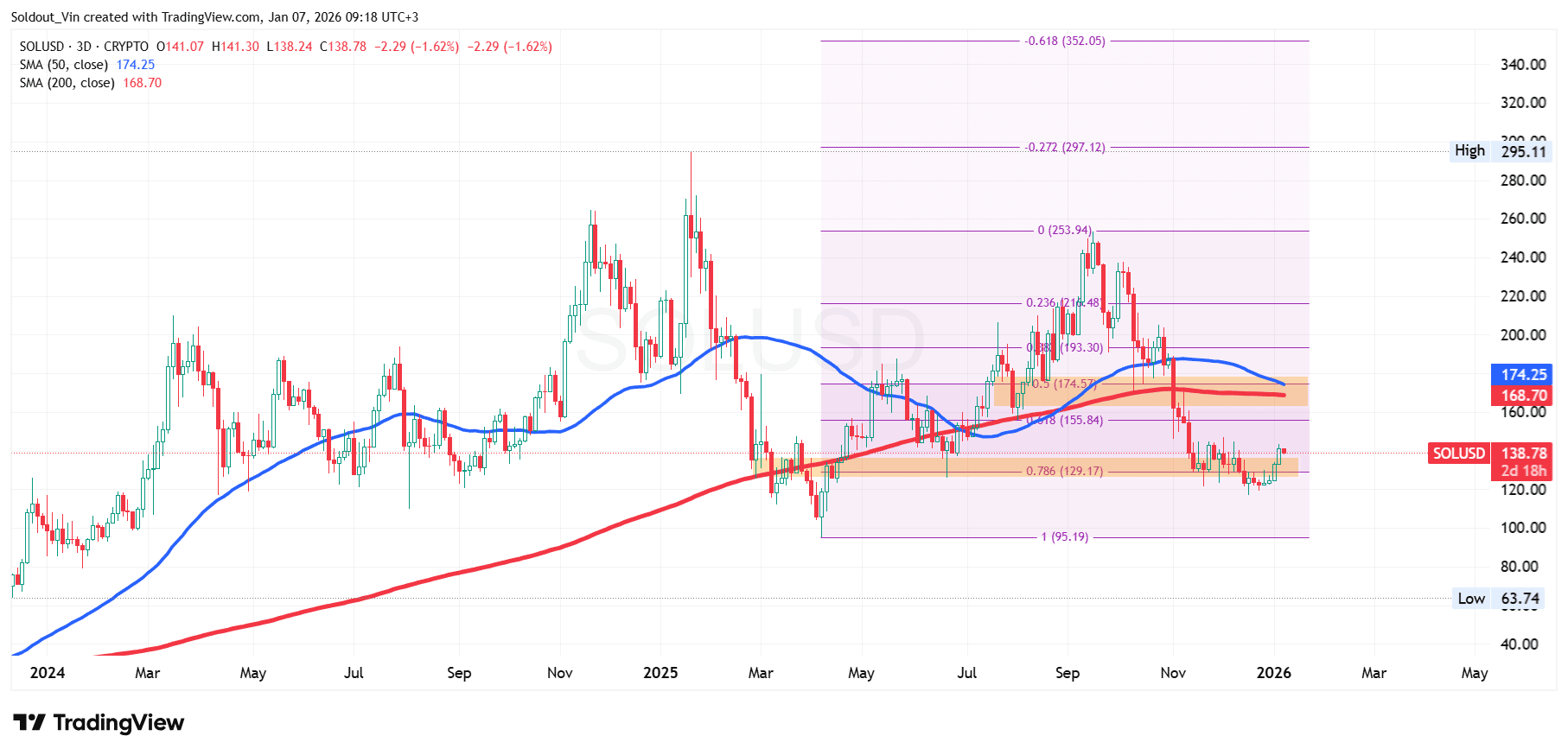

Solana price is facing resistance after breaking out of an extended consolidation zone within the $127 area. Despite a 10% surge last week, SOL prices have fallen a few percent over the past 24 hours and are trading at $138.78 as of 1:18 AM ET.

This slight decline comes just hours after Morgan Stanley filed a Form S-1 for Solana Trust with the U.S. Securities and Exchange Commission (SEC).

Solana’s weekly surge occurred during an early-year rally that saw Bitcoin prices climb back above the $93,500 region.

However, key historical patterns on the SOL 3-day chart suggest a potential recovery. Whenever Solana touches the support around $120, it continues to surge to recover losses. Can Solana tokens convey these emotions?

Morgan Stanley Files Solana ETF: Why This Could Be a Major Price Catalyst

Wall Street heavyweight Morgan Stanley has furthered its digital asset ambitions by filing a Form S-1 with the US SEC seeking approval for a physical BTC exchange-traded fund (ETF) and Solana Trust.

Shock: Morgan Stanley just filed for a spot Bitcoin and Solana ETF. H/T @The Block__ pic.twitter.com/AmYLeDTJBy

— Eric Balchunas (@EricBalchunas) January 6, 2026

The Morgan Stanley Solana Trust is intended to track the price of Solana and provide investors with exposure to SOL through traditional investment vehicles. This way you don’t have to manage tokens yourself.

According to SoSo value According to the data, the Solana fund has grown to over $1 billion in total net assets, with cumulative net inflows of nearly $800 million and total daily inflows of $9.22 million.

Historically, ETF reporting and approvals have played an important role in increasing institutional participation, as seen with the BTC Sports ETF.

Solana Price Analysis: Focus on Bullish Breakout

Analysis of the SOL price chart over a 3-day period shows that Solana has broken out of the $135 support level, which is consistent with the lower support area during the consolidation phase that limited the asset below the $168 resistance.

Key Fibonacci retracement levels to watch for the surge attempt are $155.84 (0.618 Fib level) and $174.57 (0.5 Fib level), while the 50-day and 200-day simple moving averages (SMA) are $174.25 and $168.70, respectively.

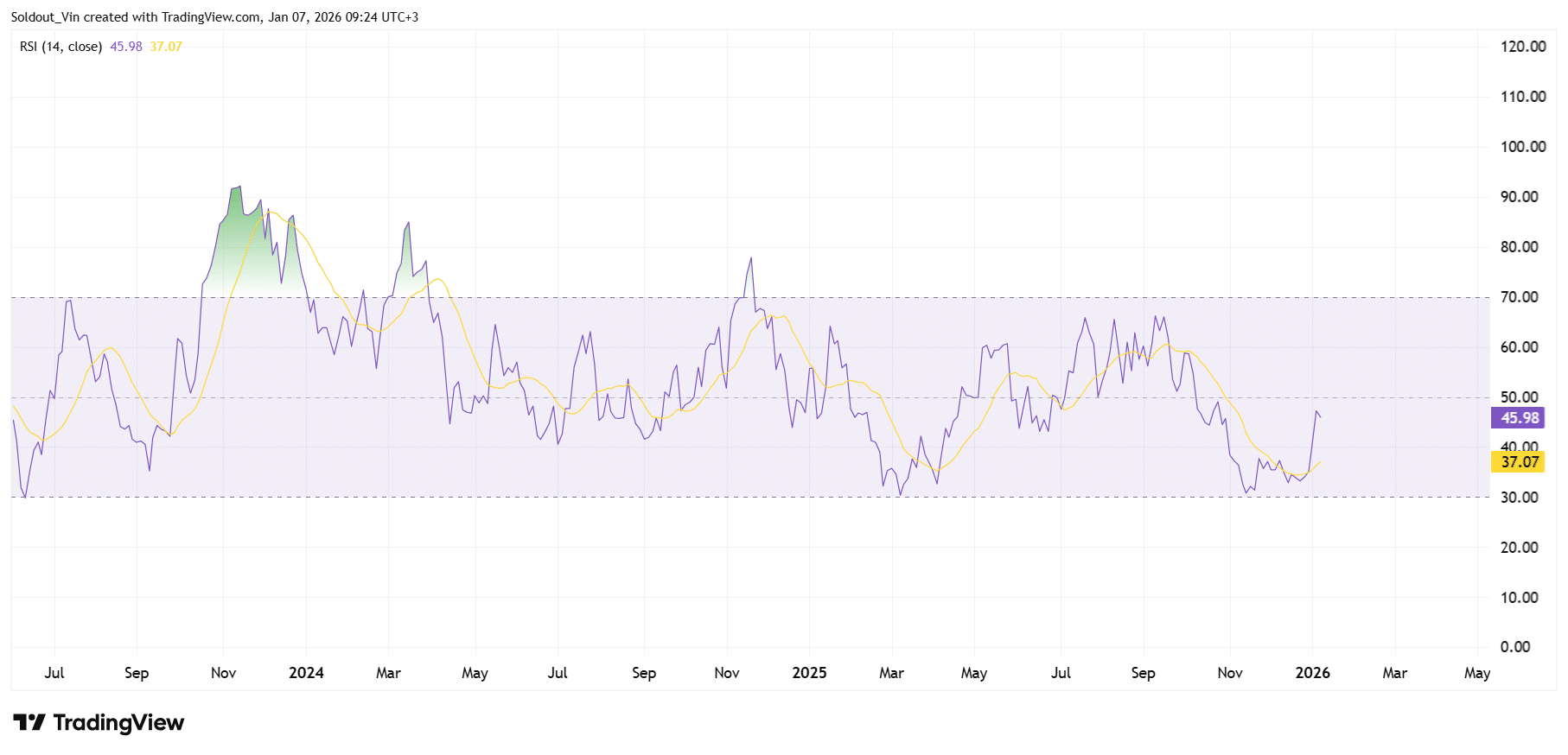

The Solana Relative Strength Index (RSI) is rising to 45.98, indicating that buying pressure is increasing but still within the equilibrium zone. There is some resistance in the 47.7 area, but a rise higher than this would give buyers complete control to push Solana price above the immediate resistance at $155.84.

Trading volume surged more than 14% in the last 24 hours to $6.26 billion, indicating a recovery in market activity. Nevertheless, Solana recently fell from the $143.09 level, as can be seen from the candles on the 3-day chart.

Could the price of SOL soar to $200?

Analysis of the SOL/USD chart shows that SOL price is poised to continue its current bullish breakout. Therefore, as long as Solana price continues to trade above $129.17 (0.786 Fib level), the $200 level is possible.

This could happen because since February 2024, Solana has seen massive recoveries every time its price has fallen back to the $120 level.

Investors remain cautious as the recent correction from the $143 level still poses a risk of the asset falling back to the $121.41 long-term support area.

Related news:

Best Wallet – Diversify your cryptocurrency portfolio

- Easy to use and highly functional cryptocurrency wallet

- Get early access to the upcoming token ICO

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake to win native token $BEST

- 250,000+ monthly active users

join us telegram A channel to stay up to date on breaking news coverage

12.jpg)