Can Temu Take on Amazon.com & the Rest of the World?

Even if you don’t want to invest in a Chinese tech or eCommerce stock, you need to keep an eye on them along with other non-US tech and eCommerce stocks. Last year, I wrote about some non-US-based eCommerce or delivery platform stocks:

Making Sense of Delivery Platform Stock Metrics and Financials

Delivery platform stocks Grab, GoTo, Sea Group, DeliveryHero, Uber, DoorDash, Pinduoduo & Meituan use different financial and reporting metrics – making it hard for investors to make sense of them.

The one Chinese stock that needs to be watched in particular is PDD Holdings (NASDAQ: PDD) which owns and operates a portfolio of businesses, including Pinduoduo and Temu. The latter acts as an eCommerce marketplace in North America allowing Chinese vendors to sell their products directly to US consumers – cutting out middlemen. In other words, Temu is challenging Amazon.com (NASDAQ: AMZN), among other behemoths who sell online, on their home turf.

In addition, Temu is expanding into SE Asia – the territory of Alibaba (NYSE: BABA) controlled Lazada and Sea Limited (NYSE: SE)’s Shopee. I have never used Chinese fast fashion retailer Shein which Temu copied, but they are also rapidly expanding into new markets.

Why Should You Care About Chinese Tech Stocks?

- What’s Wrong With American Big Tech and American-Western Corporate Culture?

- The Politicization of EVERYTHING in the West is Killing Innovation…

Temu.com

- My Temu Order #1

- My Temu Order #2

My Amazon.com Order

My Shopee Orders & Lazada

- Shopee Order #1

- Shopee Order #2

SOME FINAL THOUGHTSThe growing dysfunction of American Big Tech, corporate America or Western corporate culture, and the politicization of everything in the West that is stifling innovation and creativity are among the reasons you should care about Chinese tech stocks and why there is an opening for them – or for that matter, anyone who does things differently…

I am a huge fan of Telegram (founded by a Russian now based in Dubai) and use it far more than WhatsApp, Facebook, or Instagram because it’s a far superior app and I hate being shown content based on algorithms. And while I have never used TikTok, users or rather creators on there say it is also far superior to American Big Tech alternatives (and no doubt a reason why it may soon be banned in the USA…).

Likewise, I have seen reports that Chinese EVs run on software that is far better or rather more user-friendly than the software Tesla or other Western EVs are using. This is a reason why Tesla is at a disadvantage in China and no doubt why there is pressure on Western governments to put up trade barriers to keep Chinese EVs out.

Then there is this post the founder of Telegram recently posted on his Telegram channel:

This begs a question: What is wrong with American Big Tech and corporate America in general and why can’t they increasingly keep up with and innovate like their foreign counterparts?

One explanation again comes from Pavel Durov, the founder of Telegram, who posted this on his channel a few months ago:

This begs another question: What do the 999 additional Facebook employees per one Telegram employee do all day?!! After all, Telegram is constantly finetuning and improving its product (see Du Rove’s Channel where he posts about these improvements…) while its American counterparts never seem to change or improve all that much for users or content creators.

A now-fired Twitter employee had posted (a now removed but reposted and made fun of by everyone…) clip of a “day in the life of a Twitter employee” which sheds some light on what American Big Tech employees might be or not be doing all day…:

Tucker Carlson also recently interviewed Durov who had told Jack Dorsey that Twitter could be run with 20 to 30 employees. He then asked Dorsey why he didn’t do that. Dorsey replied that Wall Street would panic and think there was something wrong if he started firing 80% of his employees like Musk later did… (… And why there were a bunch of ex-intelligence agency employees on the Twitter payroll is another story that I won’t speculate on…).

SIDE NOTE: In the recent Tucker Carlson interview, Durov said he had met Mark Zuckerberg to exchange ideas because the social media businesses they were managing were not directly competing with each other (This was when Durov was still managing the social media company in Russia that he was eventually forced out of…). Within weeks of the meeting, Zuckerberg (in typical Zuckerberg fashion…) had copied the ideas Durov had discussed with him as well as started competing with his site in Russia… 🙄

Here is what else is also going on: American Big Tech is so flush with cash that they can do what I have seen being done in oligopolistic industries in emerging markets like the Philippines – they OVERHIRE to get people off the market and prevent them from working for competitors or from starting start-ups that can threaten the oligarchs in the future. Then they don’t give these overhires much real work to do…

I have even heard that Google is particularly notorious for hiring top 20 engineering school graduates and putting them to work tweaking Adsense which must be mind-numbingly boring for such people (but hey, they and their parents get to brag about working for or having a kid working for Google…). Again, they over-hire to get these people off the market so they can’t threaten Google’s dominance…

Then there is the state of corporate America or Western corporations in general summed up by this piece in the Wall Street Journal from some years ago:

📰 So Busy at Work, No Time to Do the Job (WSJ) June 2016 $ 🗃️

The executive at the North American arm of conglomerate Royal DSM RDSMY -0.71%▲ has more than 100 direct and indirect reports and several job titles, including general counsel. So jam-packed is his calendar that Saturday meetings aren’t unusual, and employees sometimes line up seven deep outside his office for a moment of face time. Even his assistant, weary of juggling his schedule, recently left him to work with a smaller group in the company.

Plenty of managers feel like Mr. Welsh these days. As companies flatten hierarchy and preach collaboration among their ranks, a growing share of bosses’ time is spent coordinating, directing traffic and overseeing employees who may or may not report directly to them. Managers and executives complain that the push for teamwork, innovation and speed has left them little time to do real work.

And:

Managers and knowledge workers, such as consultants, now spend 90% to 95% of their working hours in meetings, on the phone and responding to email, according to Mr. Cross, a University of Virginia professor who’s studied network connections in about 300 organizations; 10 years ago, managers spent around 60% to 65% of their time on those tasks, he said.

There were some comments on the article that also hit the nail on the head:

(Or having ice Matchas from “the Perch,” playing Fuzzball with friends, and having wine “available on tap” at the end of the day like the now ex-Twitter employee was doing…)

(The article also reminds me of my university days and I guess life at pre-Elon Musk Twitter…)

The person profiled in the article was also a general counsel. In other words, NOTHING at this company gets done and nobody can make decisions without (cover your behind type of) legal advice or approval from the in-house general counsel…

Now let’s take a look at Chinese Big Tech and corporate culture with these insights covered by past Monday posts:

📰 Why Chinese Apps Are the Favorites of Young Americans (WSJ) March 2023 $ 🗃️

Four of the five hottest apps in the U.S. in March were forged in China. Algorithms are often cited as their secret sauce. An often overlooked facet is how cutthroat competition for users at home has given Chinese firms a leg up over Western rivals.

Much like during China’s rise to manufacturing dominance a few decades ago, Chinese tech companies have harnessed a labor pool of affordable talent to constantly fine-tune product features.

The nonstop drive to get better even has a term in China’s tech industry: “embroidery.”

“Everybody works on improving their craft, stitch by stitch,” said Fan Lu, a venture-capital investor who invested in TikTok’s predecessor Musical.ly.

This is a lengthy and must-read article from Singapore based Momentum Works to better understand Temuand it’s culture:

📰 Inside Temu: the fiery culture and a perpetual efficiency machine (Momentum Works) April 2023

The reason why these two companies have made such aggressive goals in parallel may be that they see an important window: currently, Amazon is busy raising its average order value, letting go of the vast ‘sinking markets’ 下沉市场 (i.e.: lower-income-segments of the population) with an average order value of less than $40. For Chinese cross-border ecommerce players, this is a rare opportunity.

At the same time, SHEIN, TikTok, Shopee, Alibaba, and others have joined the fray of cross border ecommerce. The “Amazon ecommerce siege war” is quietly beginning, and Temu is leading the charge.

In China, Pinduoduo relied on internal competition to gradually eat away the market share of Taobao and JD.com (NASDAQ: JD). Now, history is repeating itself in the overseas market, with Amazon as the new opponent.

In addition:

In May 2022, Pinduoduo sent a team to set up an office directly opposite SHEIN’s office building in Panyu, Guangzhou.

The purpose of Pinduoduo’s move was simple: to poach employees and suppliers from SHEIN.

To lure SHEIN’s employees, the Temu team went to great lengths…

Meanwhile, over in Silicon Valley…:

📰 ‘When Rules Don’t Apply’: Did Silicon Valley tech giants learn from no-poaching antitrust case? (The Mercury News) May 2019

Documentary revisits hiring-practices scandal involving Apple, Google and others amid tech backlash

The Justice Department once accused Silicon Valley tech giants of conspiring not to poach employees from one another, and eventually they agreed to pay more than $400 million to settle a class-action lawsuit related to those accusations. Now, as Silicon Valley grapples with antitrust talk and challenges to its dominance, a new documentary revisits the almost decade-old case — and its relevance to today.

I had recently listened to an interesting podcast interview with tech CEO and start-up founder Andrew Crapuchettes who had been managing a small data-as-a-service type of company that was printing money for investors:

At around the 30-minute mark, Crapuchettes observed how there was a significant shift in 2016 when other CEOs, who would otherwise never ask him much about his political beliefs, started questioning (or rather interrogating) him about his politics (and not liking the honest responses they were getting from him…).

By 2020, these same CEOs were using their company emails and email lists to tell people who to vote for. And even though Crapuchettes was printing money for the Board and the private equity investors during COVID, they seemed to have no interest in that and started asking him more and more questions about his positions on hot-button social issues.

Finally, the Board and private equity investors told him, “We did not see a public statement from you about George Floyd…” Crapuchettes replied that’s because he did not make one. The Board told him he needed to make one because all the other CEOs were making them. He said it’s not his place as a SaaS company CEO to make public statements on hot-button social issues that might anger a certain percentage of customers and oh, here is my balance sheet (showing them how much money he and the business were making for them…).

But increasingly the Board and the private equity investors did not care about Crapuchettes’ balance sheet or performance. He found himself slowly being fired for refusing to publicly support or get involved in the hot-button social issues they cared more about.

Finally, Crapuchettes told the Board they could either:

-

Fire him (and most of his key employees would also be quitting with him…)

-

Back down and deal with any social pressures they were under by themselves (and leave him and his company out of it…)

-

Let him find a buyer whose values were more aligned with his or just not interested in being involved in the hot-button social issues…

The Board took option #3 – even though the business was printing money for everyone…

Unfortunately for Crapuchettes, his preferred buyer was outbid by KKR’s ESG fund which was so flush with ESG cash, that they could outbid everyone by $100 million as they had a write-off (the failing competitor) to write-off. They bought the Company and he was out of a job as the fund named the CEO who was managing the failing competitor as the new CEO (as he probably also held right positions on hot-button social issues…)…

However, Crapuchettes has since started RedBalloon – a so-called “woke-free job board & talent connector” where businesses and employees who have the same values (as in everyone wants to focus on their work rather than politics or social justice type issues) can find each other.

Meanwhile, I have sometimes listened to Iranian-American entrepreneur Patrick Bet-David’s podcast or have heard clips of them. At a time when the typical insurance agent was an older white man, he found that young Hispanic women could bring in new business from new customers who would otherwise not be buying life insurance. He then started and sold a successful life insurance company who’s agents were mostly from minority demographics.

But when it came time to sell the business, I heard Bet-David say that buyers did not seem all that interested in the business’s financial numbers or that it was a great business to be buying. They were more interested in buying the business for its large number of minority agents who could improve their ESG scores…

Keep the above in mind as we take a look at ordering from Temu, Amazon.com, Shopee, and Lazada OR if anyone tells you the Chinese, etc. cannot innovate and successfully compete with the West…

While Amazon has built a massive network of warehouses or distribution facilities around the USA, Temu’s basic business model for the USA is to pack orders from their low-cost facilities in China and use air cargo and any other available (and cheap…) delivery option to get it as quickly as possible to American customers. Shein has tweaked this model a bit as I think they have or plan to have some distribution facilities in the USA.

As covered in previous Monday posts, the rise of both Temu and Shein also benefits air cargo stocks:

🌏 West’s love for Shein and Temu drives ecommerce boom for air freighters (FT) $ 🗃️

Logistics groups see sustained demand for fast delivery of goods from China to western markets

🌏 There’s Something About Air Cargo (Smart Karma) December 2023 $

FT article (West’s love for Shein and Temu drives ecommerce boom for air freighters) uncovers other contributors to surging air freight rates—Chinese online brands Temu and Shein are flooding Western nations with fast fashion and inexpensive e-commerce goods

The biggest beneficiaries are Chinese carriers with significant air cargo exposure, and Cathay Pacific (Swire Pacific Limited (HKG: 0019 / HKG: 0087 / OTCMKTS: SWRAY / OTCMKTS: SWRAF)). This presents a potential catalyst for an earnings beat and a boost to the share price.

Carriers from Taiwan and South Korea will benefit from supply tightness to the U.S.. Logistics providers are unlikely to benefit much due to tight margins and volatile high freight rates

🇨🇳 There’s Something About Air Cargo (Part II) (Smart Karma) January 2024 $

Air cargo rates from Hong Kong and Shanghai have plunged in the past week, as spot demand dries up post-Christmas rush and reverts to previous (lower) contractual rates

Sea freight rates surged due to the Red Sea/Suez situation, with further increases expected. China to Europe air freight is highly competitive, potentially prompting a shift from sea freight

Chinese air carriers and Cathay Pacific (Swire Pacific Limited (HKG: 0019 / HKG: 0087 / OTCMKTS: SWRAY / OTCMKTS: SWRAF)) will record stronger than expected 2H23 performance on air freight, and we think air freight should continue to be firm in 1Q24

What is it like ordering from Temu in the USA? Over the holidays when corporate advertisers were boycotting Elon Musk’s Twitter, the latter started running ads for interesting products with inflated prices from so-called dropshippers. This gave me an excuse to check for the items on Temu for much better pricing. Likewise, it’s getting harder to find little odds and ends that you might need at brick-and-mortar stores in the USA while free shipping with Amazon is usually for orders $25 or more.

This was my experience ordering from Temu late last year:

Ordered: Around Thursday, Nov 30, 2023

Original order:

Sometimes having the eCommerce site do things a little slower has its benefits as one nice feature about Temu is how they give you time to add things to your original order before it gets packed and shipped out from China.

Added to the order:

This is Temu’s current shipping policy which may be different from over the holidays last year:

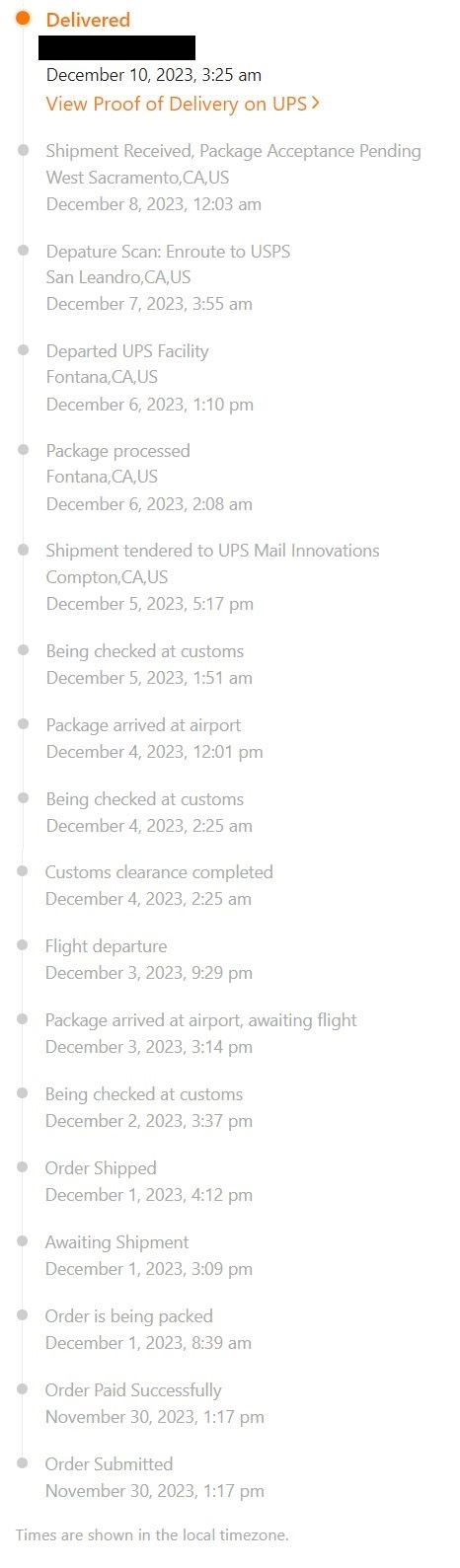

Note: The dates-times are skewed as they reflect my current location – not California time…:

As you can see from the box the handheld water flosser came in (although the contents were not damaged), the packaging should have been much better protected:

The bottom of the plastic lemon squeezer also arrived partially broken:

Some other thoughts about the odds and ends that I ordered on Temu:

-

I have other arch supports that I wear with flip-flops or use inside shoes. The arch supports from Temu did not seem thick enough for my high arches and bothered my knees when I wore them while wearing work boots outside (I probably wore them for longer than I should have though). However, they were at least worth trying for the Temu price and leaving behind to use when visiting my parents.

-

The zipper repair kit did not work on what I intended to use it on as I think I got that zipper to finally work right plus you would think zippers would be a standard size or gauge but of course they are not. I think we ended up getting one to work on something my mother had, but it was not as good as an original zipper. Nevertheless, it’s worth trying for the Temu price as I have seen some considerably more expensive sets being advertised plus it’s better than replacing a clothing item whose only problem is with the zipper.

-

The zipper pulls are handy. Before a zipper breaks (especially on luggage), it’s the pull that usually breaks – meaning it’s good to have some around.

-

I have given up on Waterpik water flossers due to their BAD or FLAWED designs which eventually allow water to seep into where the motor and batteries are. Yes, you are supposed to remove the batteries after each use (according to the directions) and make sure the compartment is dry, but this is a hassle to do every night. I had also bought a knockoff Waterpik with a better design (the water compartment was away from the motor and batteries), but the lithium battery or motor lasted less than a few months (then it started producing a much slower water flow…). The hand-operated water flosser from Temu may not produce as strong of a jet as a battery-operated one, but it’s proven to be a much better value, works reasonably well, and is travel-sized.

-

Stores in the USA typically sell big tubes of shoe glue that would be a much better value than the small tube I bought on Temu. However, I don’t need a big tube as I just wanted to fix one old pair of hiking shoes. A big tube will also dry out in tropical humidity and heat after it’s opened.

-

Although the plastic lemon squeezer arrived damaged, it still worked – until my mother put a hard lemon end from our tree into it and broke another part of it off… In other words and between Temu shipping and hard lemon ends, I should have bought a metal lemon squeezer… Nevertheless, the product itself works great for adding lemon to tea or other items. In fact, I have seen pictures of catered dinners where they have one by every place setting so you don’t get lemon juice all over your hands trying to squeeze lemon over your fish, etc. And they are much cheaper to order on Temu than from dropshippers who were advertising them on Twitter for closer to $10…

-

The neck gaiter was NOT that warm or thick compared to one I had bought on either Shopee or Lazada some years ago, but it was suitable to wear when doing work outside in a mild California winter during the daytime. It would not be warm enough for me to wear any place colder. This is another reason to be leery of ordering ANY clothing item online.

Note: The dates-times are skewed and reflect my current location – this was delivered early afternoon California time…:

Luckily, there was no damage to the mobile phone holder despite the bent condition of the box it was in:

The same can be said of the pomegranate peeling set:

As for the pomegranate peeling set, the old tree in my parent’s yard produces some monster pomegranates (the one in this picture is unusually BIG) which get picked once they have cracked open (unlike store-bought ones…):

The mallet the set came with might work better on smaller store-bought pomegranates that are not as ripe as those fresh off a tree. Otherwise, running the pomegranate over the sharp edge (covered by the mallet in the above picture) is safer than using a big knife plus you can knock or loosen the seeds into the bowl below it – making it slightly less messy to eat one.

Note that the pomegranate peeling set along with some of the other items I bought were probably not items I would have otherwise bought – except for the super low prices they were selling for on Temu. Prices tended to be much higher on Amazon and outrageously high from so-called dropshippers…

THE VERDICT:

-

😐 Reviews: OK, but not detailed enough for items like electronics…

-

😍 Price: CHEAP!!! Worth ordering from and saving money on IF you are not sure of what you will get (quality, etc.) OR if what you are ordering will work as intended e.g. the zipper repair kit…

-

🆗 Delivery: Figure 2 weeks (from China to the West Coast) so very SLOWWWW… But I can’t complain about the delivery speed given the super low prices…

-

☹️ Packaging: Not nearly enough for any remotely breakable or damageable items… Penny wise, pound foolish!

-

😬 Exchanges: Would be a nightmare and not worth the hassle at these prices…

I am pretty agnostic about computer brands – I just care about price, features, and reliability. I also buy laptops in the USA because they are always significantly cheaper there.

I had previously owned laptops from Taiwan-based Acer Inc (TPE: 2353 / FRA: AC5G / OTCMKTS: ACEYY) that I would consider to be good workhorses with only the usual minor problems (e.g. hard drives always fail eventually, etc.). I then bought a laptop from China-based Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF) who had bought the personal computer division of IBM some years ago.

Laptop models always seem to have one defect that you can figure out by reading customer reviews. As long as it’s not the motherboard or the screen, then it’s probably something I can live with.

From reading customer reviews, I was aware that the first Lenovo laptop model I bought had issues with the wi-fi cards. Sure enough, mine stopped working when I got back to Malaysia. Fortunately, they honored the international warranty – it just took a while (maybe a week if I recall correctly to get it fixed). Otherwise, the laptop lasted long enough for me to get my money’s worth out of it and buy another one from them.

On the other hand, the next Lenovo laptop I bought (Lenovo IdeaPad S340 81QF0008US 15.6″ Notebook) in 2019 has been nothing but trouble. A few months after COVID started, the bios chip on the motherboard failed.

When I took it to a Lenovo store in Malaysia, the first thing I was asked was whether it was a refurbished laptop or whether it had been worked on before due to a wrong-sized screw being in the back of it. I don’t know if that was a sign that Staples or Lenovo had sold me a refurbished laptop passed off as new or whether there was bad quality control at the Lenovo factory.

The bigger problem was that my so-called international warranty was not so international for this particular model only sold in the USA. It would have cost me several hundred Ringgit and taken months for them to get a new motherboard in Malaysia.

No problem. I would just get it fixed under warranty when I visited the US that summer… Then Malaysia locked down for COVID and I was stuck with a brick for nearly two years… When I finally was able to visit the USA (after paying to extend the international warranty…), they did send a technician to my parent’s house to replace the motherboard (as I was NOT going to do this via mail).

The laptop then worked fine for a while until the touchscreen started flickering last year every time it was used for a while… Then it started flickering all the time… And I had not renewed the not-so-international warranty…

The good news is that a replacement screen can still be ordered in the USA, but then I would need to pay someone to install it (cheaper to do in Malaysia). And if I bought the wrong screen or if there was another problem, I would be out more money…

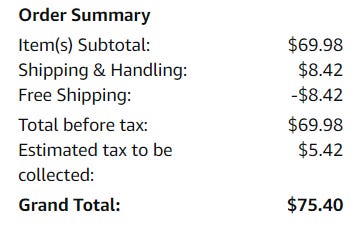

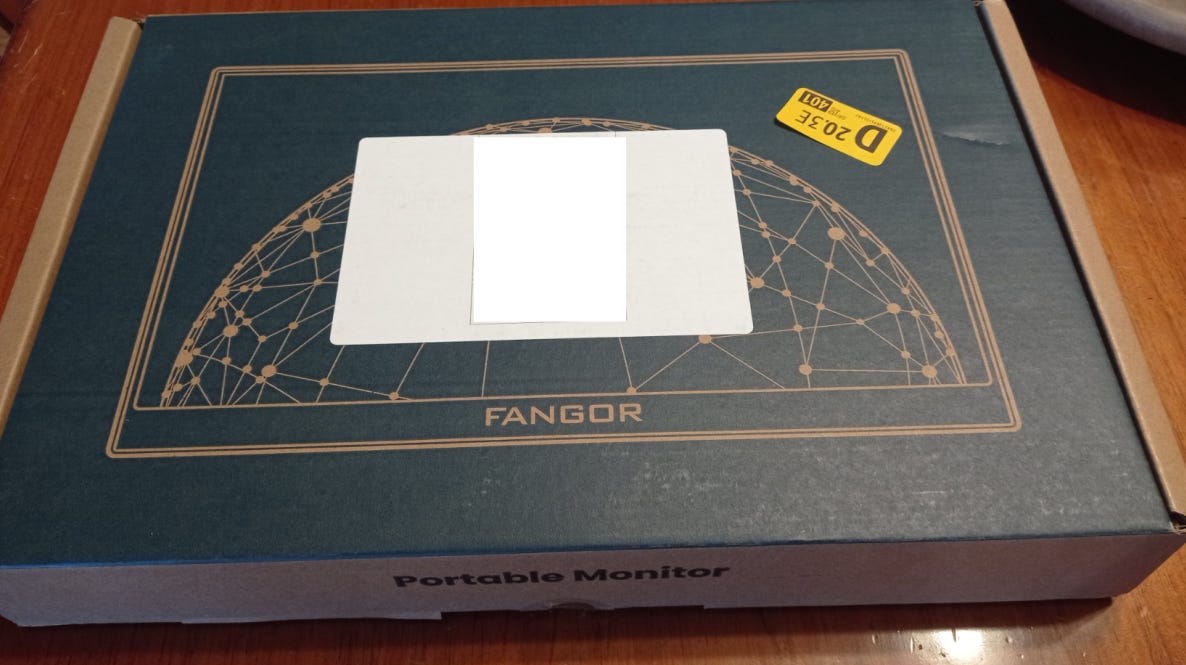

Fortunately, I found a good solution with a FANGOR Portable Monitor that can also be used with other devices:

Note that it was cheaper to buy just a few months ago in early January right after the holidays:

As I recall, I ordered it on a Wednesday (likely in the evening). Using the cheapest slowest and cheapest method (I think at $75.40, shipping is going to be free unless you want it in a hurry), it was supposed to come the following Monday. Instead, it came Friday afternoon – I don’t know if it came that early because the US economy is poor (fewer people have money to spend after the holidays) or because Amazon just did not have that many deliveries to do in the area. Either way, it was not worth paying extra to get it a few days early when it showed up early anyway…

One annoyance when ordering from Amazon: When I ordered the item, I thought I selected to have it placed in plain packaging in case they left it on the front step without the truck being heard (The driver did take and send me a photo of the item on the front step). It arrived like this just as I was walking up to the front door from doing work outside:

That’s probably NOT something I would want left on a front step of a house NOT in a less populated rural area…

However, Amazon also happens to have lockers in town (about a 5-minute drive from my parent’s home); but you need to use their app or something to open them. I am not keen on downloading more apps, but that’s a better option if you live in a non-rural area where there are porch pirates or if you know you won’t be home when they deliver something.

I also think Amazon lockers can be used for product exchanges, but that’s something that I would need to confirm. If so, that’s much easier than dealing with the mail.

I am not sure what the Amazon lockers look like, but InPost (LON: 0A6K / FRA: 669 / AMS: INPST) is Europe’s leading out-of-home delivery partner and the operator of the largest automated parcel locker network in Poland (the preferred method among Poles to receive and return online purchases) that’s expanded to other countries:

I would imagine Amazon lockers are the same concept…

Otherwise, the screen I ordered fits perfectly over my faulty laptop screen with the only drawbacks being the extra wires along with the need to use one of only two USB ports on the laptop:

THE VERDICT:

-

🙂🤨 Reviews: Very thorough with the ability to send questions to others who bought the product (although I did not get a response to the question I had posted). HOWEVER, I am well aware of the fake review problem and take reviews with a grain of salt…

-

🙂 Price: I can’t complain about paying $75 total for the specific item I ordered, but the types of items I ordered from Temu were more expensive on Amazon. Note that Temu was also selling similar screens BUT they were unbranded or generic (although they all probably come from the same factories) – making it difficult to ascertain what I would be getting and the potential defects…

-

🙂 Delivery: 2-5 days with the free shipping option to a rural area… Shipping to an Amazon locker is probably faster…

-

😐 Packaging: Packed is okay as long as it’s not mishandled or dropped by anyone. There was an option for placing an item in plain packaging, but I am not sure if I or Amazon made a mistake in my case as it arrived in the original box…

-

🙂 Exchanges: Should be relatively painless as I think Amazon lockers can also be used instead of the mail..

For Malaysia, there are two main eCommerce options for consumers: Lazada and Shopee.

Rocket Internet-founded Lazada is now controlled by Alibaba (NYSE: BABA) while Singapore-based and NYSE-listed Sea Limited (NYSE: SE) would be familiar to global investors and has three core businesses:

-

Garena – a leading global online games developer and publisher.

-

Shopee – the largest pan-regional e-commerce platform in Southeast Asia and Taiwan.

-

SeaMoney – a leading digital payments and financial services provider in Southeast Asia).

Frankly, I don’t see much of a difference between either eCommerce site as both have roughly the same products, often the same sellers and have sales and special deals around all the major festivals in Malaysia.

I had also chatted with an ex-Shopee employee maybe a year ago. He said that Shopee has come to the conclusion they cannot outspend Lazada, etc. when it comes to online advertising. Thus, their advertising strategy is to do ads that are as annoying as possible to get people to remember them… And yes, I have seen some extremely annoying ads from them with equally annoying tunes or jingles!

Otherwise and as I recall, Lazada would not take my foreign credit card in the past – a reason I don’t order from there anymore. My last Lazada order was for replacement curtains because I needed a very specific color, size, and rod type and the sellers on Shopee did not have what I needed. I ordered it cash on delivery and this was a pain since the delivery day ended up being on a weekend with a wide delivery time range when I had gone somewhere in the afternoon (although I think I got a message when the delivery person was in the area).

As for Shopee, they give you plenty of time to pay cash at 7-Eleven or Speedmart (which are everywhere) via a QR code. I refuse to use or download yet another app and just screenshot the receipt to take to a store on my mobile to scan and pay cash.

However, my annoyance is with multiple shipping fees e.g. if you order three inexpensive items with each item coming from different sellers, you will likely get charged a delivery fee for each item and this can quickly add up. This means if you are often ordering many inexpensive items, you might want to stick to ordering from a big seller with a wide-ranging inventory.

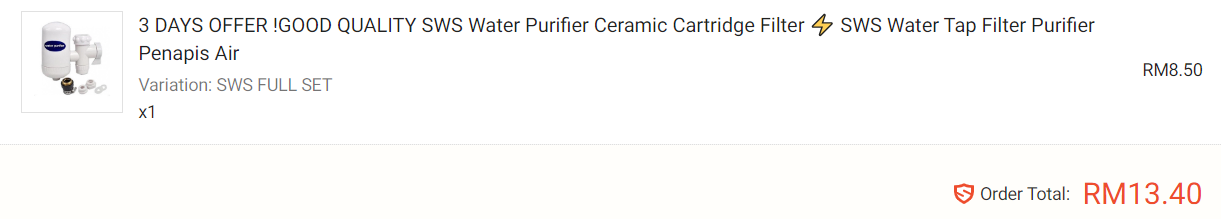

A few months ago, I went to a couple of MR DIY Group M Bhd (KLSE: MRDIY / OTCMKTS: MDIYF) stores, the largest home improvement retailer in the region, to buy the same water filter I have been buying there for years.

However, I like to call Mr DIY “Mr Do Not Have” since they never seem to have what I am looking for (a hole-in-the-wall Chinese hardware store nearby often does have what I need) and it appears they have stopped carrying these filters.

The last time I bought one from “Mr Do Not Have,” I paid almost RM20. Shopee had one for RM8.50 plus shipping:

Not only was it significantly cheaper to buy the entire set on Shopee, but it also looks like I can buy just the ceramic filter (which eventually cracks and gets very stained due to hard water) rather than replace the entire fitting (although the plastic had cracked on my last fitting necessitating a complete replacement of the set).

Last year, I had done too much walking in humidity for multiple weekends exploring Putrajaya after the new MRT line opened. I started having problems with mild Folliculitis and boils which should have been easy to clear with a correct dosage of antibiotics. However, a dermatologist overdosed me on penicillin and (inadvertently…) told me about an ointment that works (and only costs RM13 and does not require a prescription here…).

I thought I had completely cleared any lingering infection by late last year and had not ordered some Chinese medicinal patches that I read about in The Jungle is Neutral (they are supposed to draw out infections and were used by guerrillas in the jungle fighting the Japanese):

However, just before Ramadan, I decided to try out the ear cleaner syringe I had ordered on Temu. I put filtered water and some hydrogen peroxide in it (just like a doctor does) and did not squirt that much water into my ears. Unfortunately, it seemed like right after that I got a mild sinus infection. And since it was also hot again with my immune system down, I got a boil or two.

No problem. I now had a reason to order and try the Chinese medicine patches which I could not find being sold in any local pharmacy or nearby Chinese medicine hall (I had also asked about them on a Malaysian Facebook group and was told what they are – although the packaging had changed):

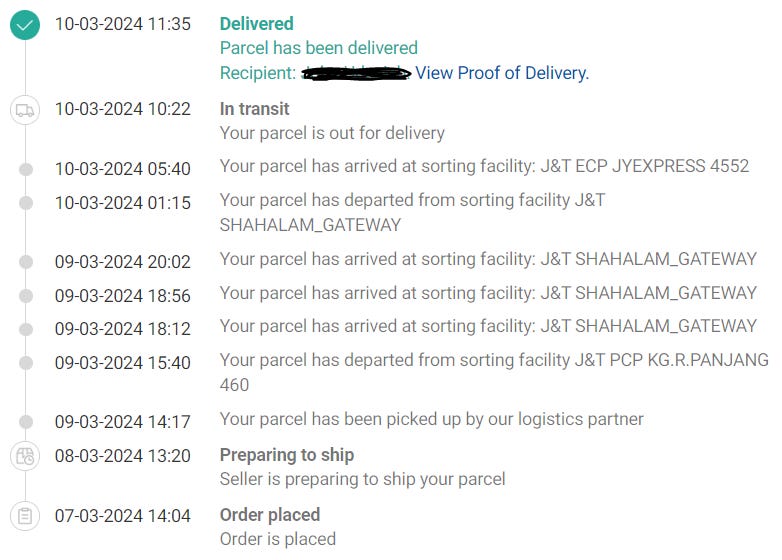

However, I placed the order near the end of the week before the start of Ramadan when things already had started to slow down – it took a little longer to get sent out…:

Unlike with Temu, note how Malaysian sellers love to overpack things and this is a typical example of this:

By the time I got the plaster, the boil was mostly gone…

However, I ended up with another boil during Hari Raya and tried the plaster on it before it opened. That was a big mistake and it got huge. And since Hari Raya fell during the middle of the week, all the doctor clinics were closed.

I finally went to the doctor I normally go to for a proper ear cleaning and a longer but lower dose of penicillin which will hopefully clear any underlying infection for good.

As for the plaster, I do think it might work on a boil that is already open or a wound to help draw out the infection. I have found that messy turmeric paste helps on an open boil while Tiger balm from Singapore-based Haw Par (SGX: H02 / OTCMKTS: HAWPF) is hit or miss on trying to get one to open as it can make things worse depending on the skin where the boil is.

Otherwise and while eCommerce orders in denser Chinese cities can be fulfilled within hours, Shopee has not yet reached the Chinese point of efficiency and probably never will – at least not in Malaysia. But that is not their fault (although their business model is that of a marketplace) as Kuala Lumpur is just too spread out and the traffic can be bad.

THE VERDICT:

-

😐 Reviews: This might be a Malaysian cultural thing, but most reviews seem to be focused more on the seller and delivery aspects rather than the product itself. Then again, this is what one would expect from a “marketplace” type platform where trust is always going to be an issue…

-

🙂 Price: The prices are usually reasonable or rather reflect the local market. But again, my annoyance is with shipping fees when ordering items from multiple sellers. This can quickly add up for low-priced items…

-

🙂 Delivery: Generally, you can search for, see, or select the state, East or West Malaysia, or overseas for the location of sellers. I will NOT buy an item being shipped from China as it will take weeks and involve more risks of the item not arriving… Items from either Shopee or Lazada or both can also be shipped to Mail Boxes Etc locations (and I think other such places) for those who don’t live in condo complexes. In other words, they don’t need to go through the trouble and cost of setting up a locker network…

-

🙂 Packaging: Green activists may not like this, but Malaysian sellers seem to love packaging and overpacking everything…

-

😐 Exchanges: I have never tried to exchange something. I think Mailboxes Etc. and other such places can be utilized…

Here are some quick thoughts or conclusions:

-

eCommerce has become commoditized. As I noted earlier, I don’t see much of a difference between Shopee and Lazada – except for how I prefer to pay for something. The same can be said in the US e.g. Amazon.com, Walmart.com, Bestbuy.com (for electronics), etc. In the past, I have preferred to use Walmart.com, etc. for expensive electronics as you can also have them delivered to a store for pickup (I think the same can be done for Bestbuy, etc). But Amazon.com now has lockers which would be more convenient as you don’t have to wait for a clerk to find your item in the back of the store. This means ordering online increasingly boils down to price. And in a high inflation environment like the USA right now, price is what matters…

-

Temu has room for improvement. IF you are price-conscious, you will not care about waiting for up to two weeks to receive your order in the USA. However, they NEED to improve the packaging. They don’t need to overpack items like in Malaysia, but I won’t be ordering anything remotely breakable or expensive from them until they start packing things better.

-

Temu feels a bit impersonal. Both Shopee and Lazada seem to allow individual sellers and customers to get to know each other and build up loyalty with each other and not just to the platform. For example, if I have a question about a product, I can message and chat with the seller and the time it takes for them to respond is used for an overall response rating. With Temu, the sellers probably don’t know English and would need a translator like WeChat to communicate with American customers. I also felt like the individual Temu sellers did not have much of a personality or brand. Then again, I was mainly using the site to get the lowest possible price for some particular items I needed or had seen advertised on Twitter. I had little interest in checking out an individual seller’s store to see what else they were selling.

-

Underestimate Temu (and Shein) at your peril. Given how Temu has come out of nowhere and the competitive culture in China that fosters innovation and creativity (versus the stagnant politicized or “woke” culture of American Big Tech and corporate America), I’m confident they will make any necessary improvements and move up the value chain.

-

Amazon.com will regret giving up the “sinking markets” (less than $40 orders) to the Chinese. A $40 order might be a small order for Amazon in the USA, but that’s an almost RM200 order in Malaysia which is a bit more significant. Temu and Shein are also rapidly grabbing market share around the world in markets that Amazon might otherwise enter or expand in. For example:

-

IF Temu and Shein become a serious threat to Amazon.com et al in the USA, the latter will get the US government to ban it (aka they will “TikTok it…”). Remember, Jeff Bezos owns the Washington Post. It won’t be hard to demonize anything Chinese plus middlemen Amazon sellers who start to get squeezed count as a political constituency. However, Amazon will have more trouble trying to get other countries where it operates to ban Temu and Shein.

-

Temu could give Shopee and Lazada some trouble in SE Asia. However, those platforms in SE Asia already have sellers based in China who cut out the local middlemen. Customers who are already comfortable with the risk and the wait when it comes to ordering from China might order from Temu, but the latter should have no significant price advantage given the presence of China-based sellers on the other platforms.

-

How to fix broken American Big Tech and corporate culture is beyond the scope of this Substack. Innovation is still possible and is occurring in the West. It’s just that innovation is increasingly getting forced to occur outside of oligopolistic Big Tech and big corporations, and it’s not getting done by the people they hire for political, diversity, or ESG reasons. Crapuchettes and his RedBalloon site (along with Substack itself…) demonstrate there are still HUGE opportunities in all sorts of so-called “sinking markets” that are getting ignored. As for eCommerce, Amazon may not want to deal with me for my below $25 orders of stuff whose prices even they cannot match. That’s fine. I was happy to give Temu a try and will use them again. Why? Because I know Temu is focused on managing their business and will continuously improve things (like packaging…) to stay competitive. They are NOT focused on politics, taking positions on or pushing hot-button social issues, or on improving their ESG scores...

If you have ordered from or have any other insights about other eCommerce platforms (whether in China or elsewhere), feel free to leave a detailed comment.

Finally, here are some quick stats and charts to consider:

PDD Holdings (NASDAQ: PDD)

-

Price/Book (Most Recent Quarter): 6.56

-

Forward P/E: 14.66 / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

Sea Limited (NYSE: SE)

-

Price/Book (Most Recent Quarter): 5.46

-

Trailing P/E: 253.08 (no forward P/E) / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

Amazon.com Inc (NASDAQ: AMZN)

-

Price/Book (Most Recent Quarter): 9.10

-

Forward P/E: 41.67 / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Can Temu Take on Amazon.com & the Rest of the World? was also published on our website under the Newsletter & EMS Analysis categories.