Canopy Grows Away (NASDAQ:CGC) After Failed Stock Sale

kadmy/iStock via Getty Images

I last reviewed one of the most popular cannabis stocks in the world on Seeking Alpha: Canopy Growth (NASDAQ:CGC) said almost a year ago in late January that it was not a good stock for cannabis investors. stock Since then it has fallen 82.6%, well above the market. The New Cannabis Ventures Global Cannabis Stock Index has fallen 19.6% since then.

When I reviewed the company, I noted that the company was executing a plan to transform the business into a U.S. cannabis operator by closing certain acquisitions that were unlikely to benefit the stock, while also maintaining its Nasdaq listing. Failure to do so, he suggested, would leave investors stuck with underperforming companies at high valuations. This is an issue that hasn’t been resolved yet, but the stock price has fallen much more than when I dropped it by 48%. prediction.

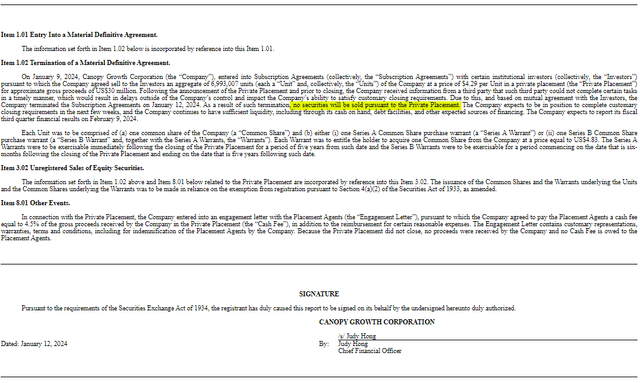

The stock fell 4.8% last week and is set to fall 11.5% in 2024. The Global Cannabis Stock Index is up 4.9% year to date. The reason for the drop was the initial public offering announced Tuesday morning, in which the company sold 7 million shares to institutional investors in a private placement for $4.29. Very late after Friday’s close, Canopy Growth said the deal had been canceled, at least for now.

SEC filing

In this quick review, we discuss why investors should continue to avoid the stock.

The Basics

Canopy Growth continues to experience financial difficulties. The 8-K above states that the third quarter is expected to end 12/31 on February 9th. Analysts expect revenue to reach $75 million, down nearly 25% from a year ago, according to Sentieo. Adjusted EBITDA is expected to be -$14 million.

The outlook is still very bleak, as analysts expect FY24 revenue to decline 18% to C$329 million, with adjusted EBITDA of -C$101 million. For FY25, revenue is expected to increase 2% to C$336 million (adjusted EBITDA of -C$16 million). In the article a year ago, the FY25 outlook was for C$619 million in revenue with adjusted EBITDA of -C$84 million, so things are moving in the direction of lower revenue and lower losses.

Operations were poor, but that wasn’t the biggest problem. The company’s balance sheet remains a major problem. After the second quarter, the company reported tangible book value of C$517 million. It had cash of CA$270m but debt of CA$681m. The company used C$227 million in operating funds in the first half of the year.

Canopy Growth has been trying to maintain its Nasdaq listing as it closes its acquisitions of Acreage Holdings (OTCQX:ACRHF), Wana Brands and Jetty, but has yet to make any progress on the exchange. As I said a year ago, this won’t save the company because U.S. cannabis operators will pursue upward strategies whenever possible.

evaluation

The number of stocks has increased significantly. The company recently reverse split 10 shares into 1 share. When they filed their 10-Q in the second quarter, they actually held 83 million shares. The total number of RSUs and PSUs is 84.5 million. This is an increase from 72 million three months ago. The market capitalization of C$6.01 is C$507 million, which is its actual book value. A year ago it was trading at 1.3X. The three Canadian LPs in my model portfolio all have better balance sheets and trade at a discount to tangible book value.

The enterprise is valued at C$918 million, or 2.7 times expected sales for FY25, ending March 31. This is not attractive at all! My favorite cannabis stock, Organigram (OGI), trades at just 0.7 times tangible book value, has a market capitalization of C$189 million and an enterprise value of C$155 million. This is only 0.8x FY25 projected revenue. Unlike Canopy Growth, Organigram expects positive adjusted EBITDA.

Despite the price crash, I still see the stock as a selloff. Constellation Brands (STZ) is so deep in investments that it could step in and buy, but the company’s current situation as it seeks to remain listed while finalizing its U.S. acquisitions stands in the way. The stocks I think are Considering large debt, ongoing operating losses, and cash flow utilization, it is expected to trade at around 50% of its tangible book value. If it were trading there now, it would fall another 50% to C$3.06, or US$2.28.

Chart

Canopy Growth hit an all-time low of $3.74 in mid-July, and closed at an all-time low of $3.74, which could be tested from my perspective.

Charles Schwab

September’s rise was a mistake by investors excited about the possibility of a rescheduling in the United States. On the chart, $3.75 is potential support and $6.00 is resistance.

conclusion

Although I generally like to buy dips, I have absolutely no interest in adding Canopy Growth to my Beat the Global Cannabis Stock Index model portfolio. I think the stock should be trading 50% lower. There is a lot of debt and operating cash flow is negative.

Share sales that are necessary to improve financial condition and that are likely to occur in the near future have been cancelled. Perhaps the stock price will bounce on this news, giving shareholders a chance to exit at a higher price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.