Carlyle Secured Lending: High Quality BDC But Trades At A Premium (NASDAQ:CGBD)

Richard Drury

Overview

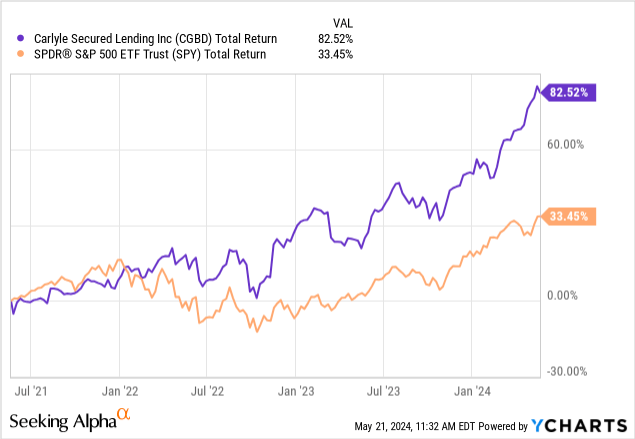

As a dividend investor, I really value the income produced from my portfolio. The income generated from my investments has the power to pay bills, fund vacations, or help take my family out for a nice meal. While many may see an emphasis on dividends as something that ultimately takes away from total return, I disagree. It’s important to remember that all investors do not have the same goals, objectives, or priorities. Sometimes this focus on income actually outperforms regular indexes like the S&P 500 (SPY) due to the consistent level of high distributions received. Business Development companies have been a great way to offset this higher interest rate environment that we’ve been in for the last two years.

Carlyle Secured Lending (NASDAQ:CGBD) operates as a business development company that earns its revenue by providing financing solutions to middle market companies. Their investments are primarily within the United States and they maintain a diverse portfolio spanning across many different industries and sectors. The higher interest rate environment has helped this BDC be able to grow and maintain its high dividend yield of 9%. The combination of its high dividend yield with a portfolio of debt investments that are primed to tackle rising interest rates has resulted in outperformance of the S&P over the last three years.

CGBD has a short history with an inception date in 2017. This business development company is externally managed and has a long history of very consistent price movement. However, CGBD has already risen by nearly 20% in price YTD so I also aim to provide insight on whether or not this makes for an attractive entry point. First, let’s dive into the different aspects of their portfolio and why I believe this to be a high quality BDC that can whether any future headwinds or interest rate changes.

Portfolio

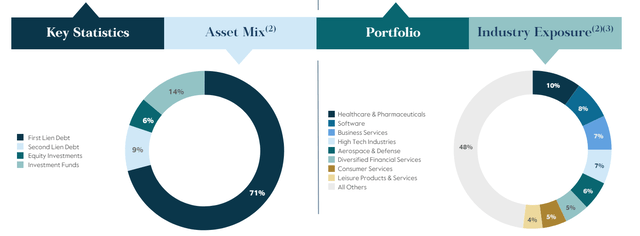

CGBD’s portfolio of debt investments remain highly diversified in industry and debt type. Their debt investments are within middle market companies that bring in an EBITDA total between $25M to $100M annually. They implement a very thought out underwriting process to make sure they obtain the highest quality of borrowers. The main objective of their investments is to generate a high current income and capital appreciation through these investments.

Their total investments at fair value are $1.78B and produces a weighted average yield of 12.6%. There are about 131 different individual portfolio companies within and their non-accruals remains extremely low, which I will cover later on in the risk portion of this article. Something that I like is the primary focus on first lien debt as this sits higher in the capital structure and provides an additional layer of security. First lien debt accounts for 71% of their portfolio. First lien debt has the highest priority for repayment in cases where portfolio companies may be going through a bankruptcy and liquidating assets.

CGBD Q1 Presentation

In addition, the portfolio is widely spread across many different industries with healthcare and pharma making up the largest weight at 10%. This is closely followed by an 8% exposure to the software industry and a 7% exposure to business services. This level of diversity eliminates any sort of concentration risk or vulnerabilities to any one specific industry. Throughout this diversity, the median company EBITDA within lies at $81M.

Lastly, these investments include an 100% exposure to floating rate debt. A rising interest rate is a good thing for a BDC with mostly floating rate debt, as they can effectively earn more interest income from the capital they provide. This is why CGBD has been able to efficiently grow their portfolio and increase earnings during these higher interest rates.

Financials

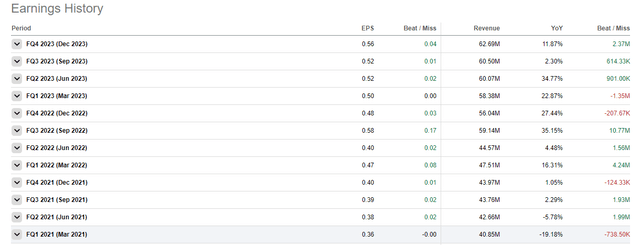

CGBD recently reported their Q1 earnings and the results were strong with NII (net investment income) coming in at $0.54 per share. We can really see the growth of higher interest rates when looking at the earnings history. For reference, the Fed started to rapidly raise interest rates around the mid-point of 2022 and coincidentally this is when NII per share started rising. Rates were at near zero levels in 2021 and we can see that Q1 of 2021 brought in a NII of $0.36 per share. This means that the NII has now increased by 50% to the current $0.54 per share level due to the higher rates.

Seeking Alpha

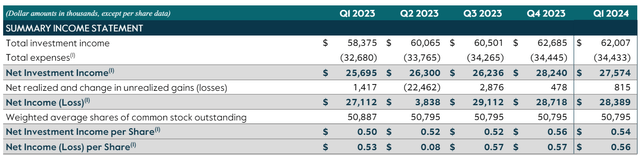

This higher level of NII was also accompanied by a slight uptick in the value of NAV (net asset value) per share. NAV for the quarter was $17.07 per share, representing a slight increase of 0.5% from $16.99 per share in the prior quarter. This growing NAV can also be attributed to the fact that CGBD has made efforts to continue growing their portfolio with new investments. For Q1, there was about $78M contributed towards new investments that can continue growing their portfolio and increasing NII and NAV. This is almost triple the amount of capital allocated towards new investments from the year prior, which only totaled $20.4M.

A growing NAV is a great indication that a BDC is able to cover distributions while simultaneously having enough capital left to efficiently reinvest back into its own growth. We can see that total investment income has also increased from the prior year’s Q1, amounting to $62M, while expenses very slightly decreased. Net investment income also grew up to $27.57M, up from the $25.69M reported in the prior year’s Q1.

CGBD Q1 Earnings

Liquidity also remains strong with the total of cash and cash equivalents growing year over year. Cash and cash equivalents now sit at $69.9M, up from the prior year’s total of only $42.8M. This is great to further reinforce CGBD’s ability to maneuver any potential headwinds as well as making up for any future rate cuts that may drop NII per share.

Risk Profile

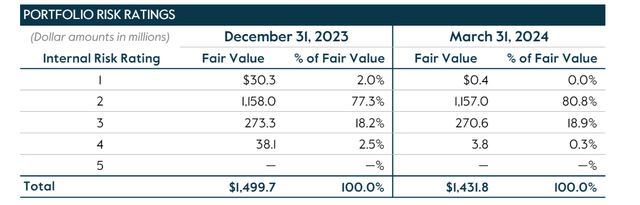

While liquidity remains strong, the credit quality of the investments within their portfolio remains a bit mixed. There were some slight improvements in quality but there were also some decreases in quality. CGBD uses an internal rating system that works on a numbered scale of 1 through 5. A rating of 1 shows that a borrower is performing above expectations and risk factors are favorable. A rating of 2 means that the borrower is performing according to original expectations.

Moving into the lower quality area, a rating of 3 indicates that a borrow is performing below expectations and risk has increased, although debt payments are still current. A rating of 4 means that the portfolio company is performing materially below expectations and loan payments are past due but not by more than 120 days. Lastly, a rating of 5 means that a borrow is substantially below expectations and a loss of initial cost basis is expected.

CGBD Q1 Presentation

Taking a look at the table provided, we can see that there was a large decrease in the percentage of portfolio companies that lie at a rating of 1. However, a majority of the investments sit at a rating of 2 which is pretty solid. There was a slight increase of investments that landed at a rating of 3. In the last quarter, 18.2% of investments sat at this 3 rating, but it has since increased to 18.9%. To offset this, we saw a healthy decrease in the amount of companies that sit at a 4 rating, decreasing down from 2.5% to 0.3%. Lastly, there are no portfolio companies sitting at a rating of 5, which reassures me of the underwriting process.

While higher interest rates can boost NII per share, it can also put stress on these borrowers. Since CGBD focuses on floating rate debt, the interest payments that these borrowers are required to pay increased alongside the federal funds rate. A prolonged period of higher rates has the potential to put additional strain on these debt investments and we may see non-accruals tick up after some time. Thankfully, this hasn’t been the case though since the non-accrual rate remains low at 0.2% at fair value. For reference, here are some of the non-accrual rates of some of the best BDCs out there.

- Ares Capital (ARCC): 1.3% non-accrual at fair value

- Golub Capital (GBDC): 1.1% non-accrual rate at fair value.

- PennantPark Floating Rate Capital (PFLT): 0.7% non-accrual rate at fair value.

Dividend

As of the latest declared quarterly dividend of $0.40 per share, the current dividend yield is 9%. As previously mentioned, NII per share came in at $0.54 for the quarter. This represents a healthy dividend coverage of 135% of the base distribution. In addition to the base distribution of $0.40 per share, CGBD also announced a supplemental distribution of $0.07 per share, bringing the total distribution up to $0.47 per share.

Even including the supplemental, the dividend is covered by NII at a rate of approximately 115%. This strong dividend coverage makes me believe there is no current threat to the dividend rate and the extra cushion leaves the possibility of the distribution remaining the same, even if interest rates get cut and NII slightly decreases.

Despite the yield already being high at 9%, the dividend growth has been a nice bonus. While this can be attributed to higher net investment income as a result of higher rates, the dividend raises are still an appreciated aspect when you consider that there are less efficient BDCs out there that wasn’t able to raise their distribution. For example, the dividend has increased at a CAGR (compound annual growth rate) of 4.32% over the last 3-year period.

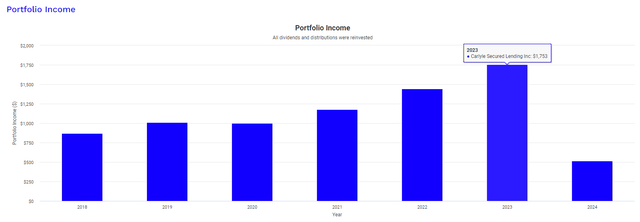

Portfolio Visualizer

This growth is evident when visualizing an original investment of $10,000 using Portfolio Visualizer. This graph assumes no additional capital was ever deployed after the initial position; however, it does include the reinvestment of dividends every quarter. In 2018, your original dividend total would have been $869 per year. This total would have now grown to $1,753 through dividends being reinvested, dividend increases, and supplemental dividends. Something to note is that the high income received from a BDC like this, is that it is usually classified as ordinary dividends, which are taxed at higher rates than qualified dividends.

Valuation

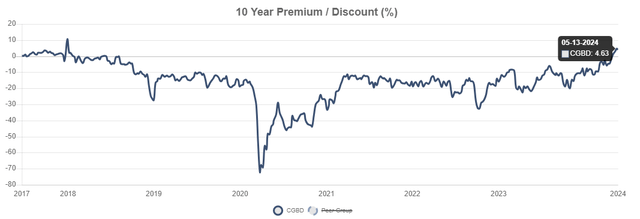

While I do like the portfolio construction, dividend history, and risk factors with CGBD, I do believe that the price is currently overvalued. Just for reference, we are now trading above the pre-pandemic price levels when rates were much lower. In addition, the price now trades at a slight premium to NAV of 4.6%. For the reference, the price has traded at an average discount to NAV of 14.85% over the last three-year period.

CEF Data

We can see that the price has rarely traded at a premium to NAV over the price history dating back to inception in 2017. Over the last three years, the discount reached as high as 33% while the premium reached as high as 5.2%. This means that the price currently sits near the all highest premium level ever over the last three years. I stay cautious at entering here as there’s a fair chance that NII per share drops when future rate cuts happen. Economists anticipate that there’s a chance interest rates start to get cut in September. While I’m not totally sure I agree with that sentiment based on the continued high levels of inflation and the strong labor market, I would like to remain a bit more defensive here to avoid initiating a position near highs.

If rates do get cut by the end of 2024, I would expect NII to drop. NII would decrease since lower rates directly translates to a lower amount of interest income that CGBD can pull in from their debt investments. If NII per share decreases, there’s a chance that NAV can also decrease, further causing the price to come down a bit. Therefore, I am choosing to remain on the sidelines and await a better entry. While there are other BDCs that consistently trade at a premium to NAV, CGBD’s much shorter price history makes me take a more conservative standpoint.

Takeaway

Carlyle Secured Lending has been a great BDC to offset this higher interest rate environment over the last two years. Shareholders have been rewarded with distribution boosts as well as supplementals. The total return of CGBD has outpaced that of the SPY due to the strong portfolio construction. Their portfolio’s primary focus on first lien floating rate debt has been the perfect way to combat and profit from these higher rates. The portfolio remains diverse across a wide variety of industries and management has allocated more cash into new investments to further fund growth.

However, I stay cautious on entering here as prices are at premiums. The price now trades at all-time high levels and sits at a slight premium to NAV. The price has rarely ever traded at a premium to NAV and I believe that a drop in NII caused by rate cuts may also present a more attractive entry opportunity. Therefore, I am rating CGBD a hold.