Carry opportunities abound with current coupons… But let’s not get kicked out

Andriy Dodonov

By Behnood Noei, CFA and Andrew Okronly, CFA

summary

- Even after the recent rise in interest rates, agency-backed securities (MBS) remain attractive from both fundamental and technical perspectives and offer attractive levels of yield/income. When compared to other bond asset classes

- A segment of the market that has recently been gaining attention is newly issued MBS, or current coupon mortgages.

- Although coupon mortgages may currently offer higher levels of income than other groups in the market, investors should be aware of the risks inherent in these bonds, namely prepayment and liquidity risk.

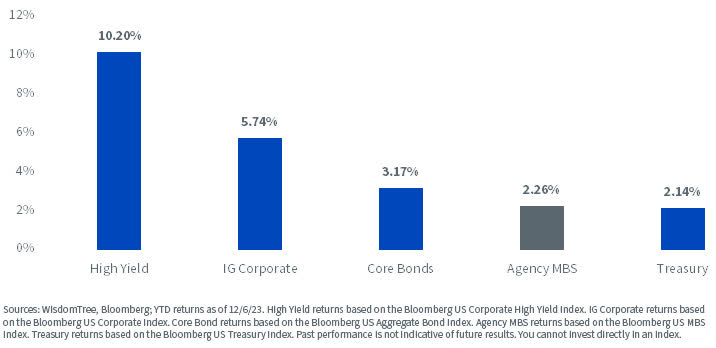

As discussed in a previous post, agency mortgage-backed securities (agency MBS) have lagged other fixed income asset classes in performance this year. This poor performance was caused by several factors, including rising interest rates, increased interest rate volatility, and concerns about supply and demand imbalances.

YTD returns across bond sectors as of December 6, 2023

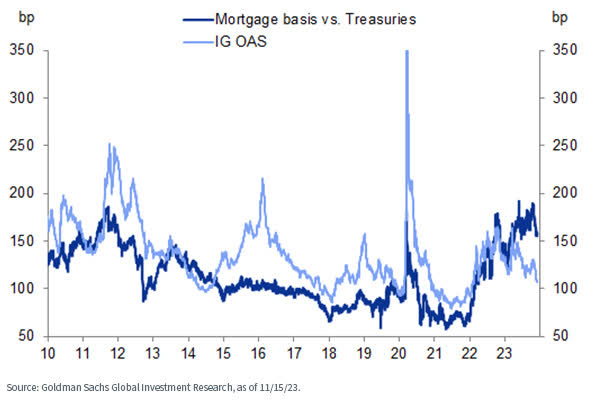

Even after the recent decline in interest rates, the spread of agency MBS versus government bonds remains at the highest level in several years.

With attractive valuations and a potentially improving fundamental and technical environment, we believe long-term investors can benefit from allocating to the asset class.

Mortgage benchmarks (current coupon mortgage rates – 5-year/10-year Treasury rates) and IG OAS

A segment of this market that has garnered attention this year is the recently issued MBS (now coupon mortgages). Simply defined, a current coupon bond is a bond that is sold at or near par value. These bonds tend to be recently issued bonds.

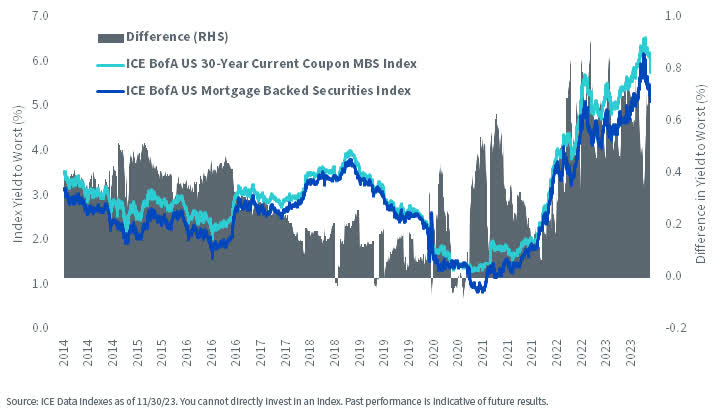

The broad institutional MBS index is comprised of mortgages with various coupons and vintages, or years in which each MBS was issued. Current coupon mortgages tend to offer higher yields compared to broader indices.

In fact, over the past decade there have only been a few days when the yield on current coupon mortgages was lower than the overall index.

Difference between worst and worst returns: current coupon MBS vs. broad MBS index

As you can see in the chart above, the yield gap between current coupons and the overall index has widened significantly since the Federal Reserve began its historic quantitative tightening process in 2022.

Investors have now noticed that they can obtain higher levels of yield/return from instruments with the same credit risk as the broader index.

But most smart market participants know that there is no good opportunity without risk. Therefore, investors are wise to understand the risks inherent in current coupon mortgages, namely increased prepayment and liquidity risk.

prepayment risk

Like most mortgages, current coupon mortgages carry prepayment risk. From an investor’s perspective, this carries the risk of receiving principal back earlier than planned and having to reinvest that principal at a lower interest rate.

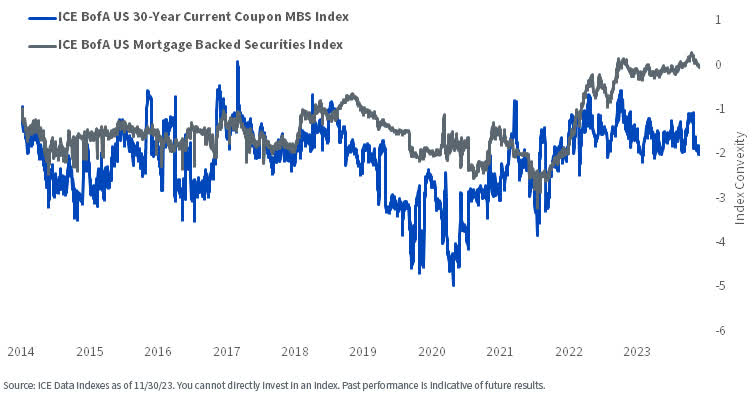

The level of prepayment risk can be quantified by a fixed income risk metric called convexity. Convexity refers to the curvature in the relationship between bond prices and interest rates.

It reflects the rate at which the duration of a bond changes as interest rates change. Mathematically, convexity is the second derivative of the change in bond price compared to the change in interest rates.

Agency MBS mostly tend to have negative convexity. This is because mortgage borrowers have the option to prepay the outstanding balance when interest rates fall (refinance the mortgage at a lower interest rate).

As a result, when interest rates fall, MBS investors will not enjoy the same price appreciation as investors in Treasury bonds of similar duration.

However, as you can see in the chart below, the broader MBS index currently has some positive convexity, something that hasn’t happened for many years.

Differences in Index Convexity: Current Coupon MBS and Broad MBS Indexes

This positive convexity for the broader institutional MBS index occurs because mortgage borrowers have little or no incentive to refinance their mortgages. To put it in more technical terms, a prepaid option sold by an investor to a borrower is out-of-the-money.

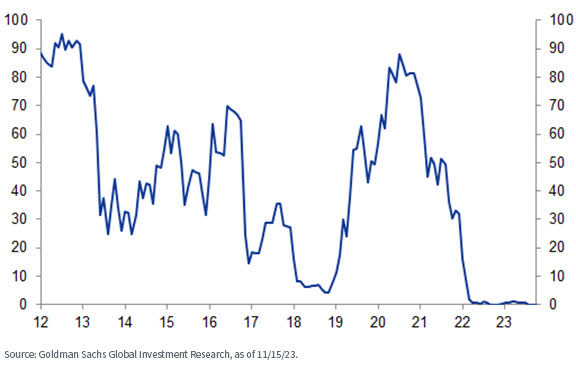

As you can see in the chart below, the percentage of lenders offering interest rate incentives of 50bps or more for mortgage refinances is close to zero.

Percentage of borrowers receiving refinance incentives of 50 bps or more

On the other hand, this cannot be said for borrowers who have recently taken on mortgages at today’s high interest rates, which are mainly mortgages backed by current coupon MBS.

This segment of the agency MBS market remains negatively convex. As a result, if interest rates fall in the near future, current coupon investors are more likely to suffer the prepayment/reinvestment risk associated with negative convexity and may consequently underperform the broader institutional MBS index.

liquidity risk

Another important risk to consider with current coupon mortgages is the liquidity of the bond if interest rates fall and borrowers refinance their debt at lower interest rates.

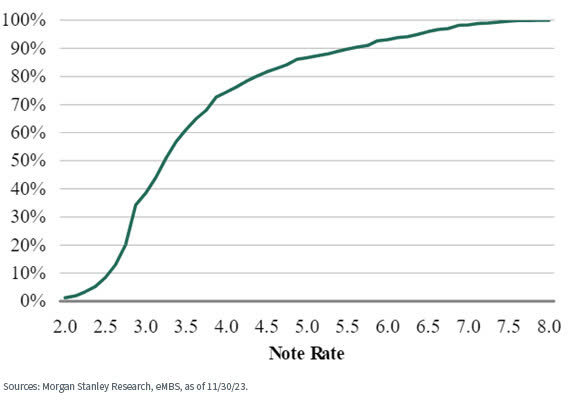

More than 98% of the existing fixed-rate agency MBS universe has mortgage rates below 7%. That means coupon mortgages currently only make up about 2% of the universe.

And, as explained above, these mortgages are most susceptible to prepayment risk. Therefore, a decline in interest rates could result in significantly fewer current coupon mortgages outstanding, potentially creating liquidity issues that could further impact market prices.

Proportion of existing borrowers below a given interest rate

conclusion

Currently, coupon agency MBS offers attractive rates of return compared to the rest of the MBS market, and even compared to other highly rated AAA companies.

However, prepayment and liquidity risks may also increase in a declining interest rate environment.

Cautious investors need to be aware of these risks before being seduced by the lure of higher returns that this market sector offers.

Behnood Noei, CFA, Associate Director, Fixed Income

Behnood Noei serves as Associate Director, Fixed Income at WisdomTree Asset Management, where he develops the firm’s fixed income and foreign exchange traded funds and improves existing investment processes. Behnood has 11 years of investment experience in portfolio management and quantitative research. Before joining WisdomTree in 2022, Behnood was a portfolio manager and developer of several fixed income ETFs at JPMorgan Asset Management, where he was directly responsible for managing more than seven fixed income ETFs and several SMAs with over $13 billion in assets. . He holds a Master’s degree in Finance from The Ohio State University and holds the CFA designation.

Andrew Okronly, CFA, Model Portfolio Director

Andrew Okrongly joined WisdomTree in 2022 as a Director of the Model Portfolio team. He is responsible for the design and ongoing management of model portfolios and custom solutions for portfolio managers and advisors. Andrew is also a member of the WisdomTree Asset Allocation and Model Portfolio Investment Committee. Prior to joining WisdomTree, Andrew served as a Director on Commonfund’s Outsourced Chief Investment Officer (OCIO) team, where he was responsible for macroeconomic analysis and advised institutional clients on strategic and tactical asset allocation. Andrew began his career at BlackRock, where he held various fixed income and multi-asset investment roles. Andrew holds a BBA degree from the University of Michigan and he is a Chartered Financial Analyst.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.