Case Study: Activating Bitcoin as a Medium of Exchange at the Bitcoin Asia Conference in Hong Kong

The Bitcoin Asia Conference, held in Hong Kong on May 9 and 10, 2024, marked an important milestone in the adoption of Bitcoin as a legitimate medium of exchange.

This article outlines the strategies and technologies implemented to facilitate seamless Bitcoin transactions for goods and services over a two-day period leveraging self-custodial payment processing capabilities through BTCPay servers.

summary

During the event, 212 Bitcoin transactions were processed with 4 vendors participating, for a total of 7,714,253 sats (equivalent to 36,974.63 HKD).

The average trading volume was about 36,560 sat (about 175 HKD). In particular, the system maintained full operational uptime with no errors in Bitcoin Base Chain or Lightning Network transactions.

What is a BTCPay server?

For banks, there is no option between self-storage or custodial payment processing.

For example, running a self-storage business with fiat currency requires operating a business that only accepts cash payments, which poses a high risk of theft when capital is concentrated in one place. This also limits your customer base.

To extend economic support beyond the local economy, we have created a payment network and payment processor that allows digital transactions.

But what are the results of implementing a managed payment system over time? Why can’t we have a digital self-managed payment processor? What innovation, freedom, and data do customers and businesses have to sacrifice because of custodial payment processing? What happens if my digital payment method (e.g. credit card, Apple Pay, Venmo) is declined even though I have funds in my account? Now, what valuable data, financial and personal, is being given away for free by these services?

BTCPay servers allow you to digitally facilitate a cash-like transaction experience. In other words, you can make digital payments in a peer-to-peer manner. The transaction requires no personal information from the payer and no intermediaries are required. This eliminates the risks that arise from cash transactions and reliance on intermediaries.

BTCPay servers are free to use and completely open source. In other words, BTCPay servers are not companies, they are simply code.

BTCPay Server is a Bitcoin payment processor that allows businesses and individuals to receive payments directly without relying on third-party services.

Unlike traditional payment processors, BTCPay servers store funds and do not charge transaction fees.

BTCPay Server is a highly adaptable payment processor. APIs enable integration into existing systems, allowing both individuals and businesses to tailor the payment processing experience to their specific needs, integrating seamlessly into their operational framework.

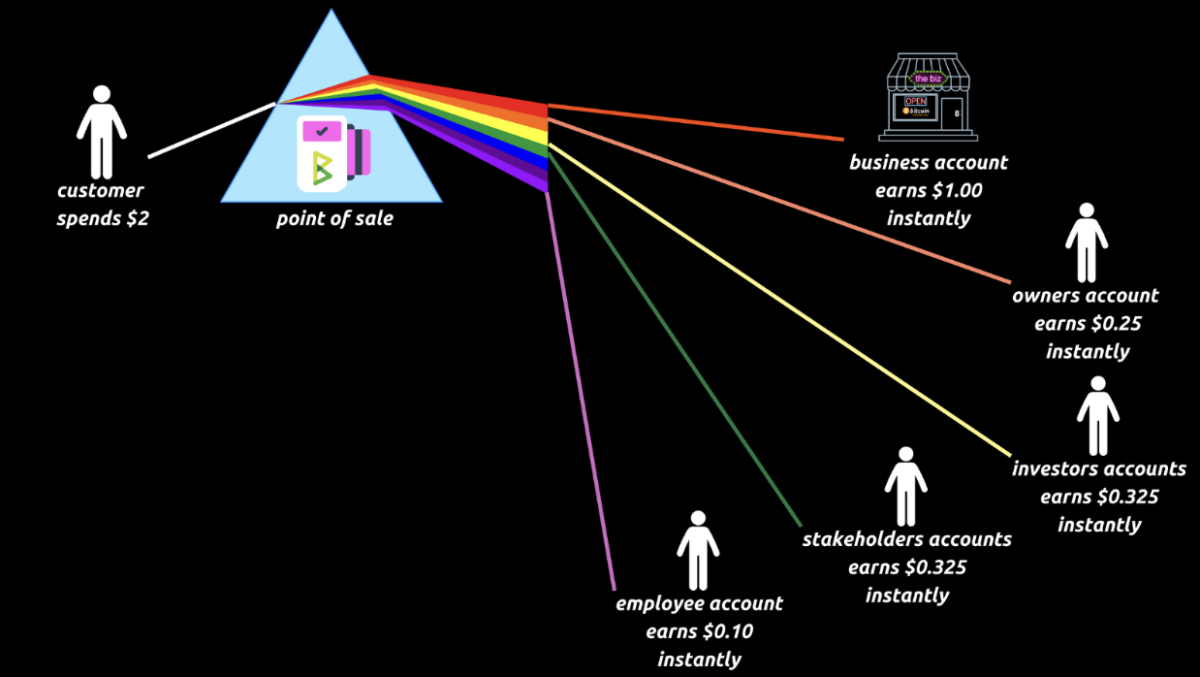

In addition to the features listed above, BTCPay servers also support Prism Payments.

This feature allows you to distribute funds trustlessly across multiple accounts at the time of sale. This innovative approach fundamentally rethinks the flow of money, enabling real-time rewards for stakeholders and employees.

How to use BTCPay server

Step 1: Set up BTCPay server

For a comprehensive guide to setting up a BTCPay server, see the full step-by-step tutorial on YouTube.

Step 2: Ensure liquidity and price stability

As of this writing, the Lightning Network is the only Bitcoin scaling solution that maintains Bitcoin’s cash-like properties when paying with BTC.

The Lightning Network facilitates instant payments, requires no KYC, and offers non-existent fees similar to the cash experience.

The Lightning Network requires liquidity to function. Providing liquidity often means running and managing nodes yourself, but BTCPay servers do this.

The BTCPay server nodes at the conference worked flawlessly with Blink, which acted as the liquidity provider for the conference, ensuring that no payment failures occurred.

In addition to utilizing additional liquidity providers, we also used a price hedging solution in case Bitcoin price fluctuations occurred during the conference.

Suppliers who accepted Bitcoin at the conference had to address this risk because they wanted to be paid in their local currency after the conference.

A bearish scenario for a vendor would be to receive $10 in Bitcoin at the time of sale while the price of Bitcoin is high, and then see the price of Bitcoin fall 50% during the conference.

In this situation, when you have to perform a settlement in local currency for your supplier, you only receive $5 in local currency, which is unacceptable.

To mitigate this risk, we used “stablesats”, a Blink feature that allows instant conversion to a synthetic version of a stable currency (e.g. the Hong Kong dollar) at the point of sale.

Additional information about Blink features and services here.

Step 3: Deploy a physical POS system

Despite the digital nature of Bitcoin transactions, physical point-of-sale (POS) machines were deployed to provide attendees and merchants with a friendly payment experience.

We used Bitcoinize’s POS machines. These devices also facilitated the issuance of physical receipts upon request.

Step 4: Simplify Bitcoin Access with Bolt Card

The conference also utilized the Vault Card to facilitate seamless Bitcoin transactions.

This custom “Bitcoin Asia” edition card allowed attendees to convert fiat currency to Bitcoin for use within the event. This card allows you to simply tap NFC on your POS device.

Step 5: Training for vendors and employees

A training session was held prior to the conference to familiarize vendors with how to use the BTCPay server.

The 10-minute session was effective with minimal questions from participants.

We have set up a group chat for support, but it has been mostly disabled due to the smooth operation of our payment system.

You can view the full video of the training session here.

conclusion

Thanks to free and open source software like BTCPay Server and innovative solutions from companies like Blink, trading Bitcoin at the Bitcoin Asia conference was surprisingly easy.

The success of using BTCPay servers at the Bitcoin Asia conference demonstrated the potential for broader adoption of Bitcoin in everyday commerce.

Try these solutions at your next event or within your local economy.