Cashwood goes to a discount. There is a stock that she just purchased from DeepSeek Dip.

Cathie Wood has just spread stocks with one special technology artificial intelligence (AI) stock.

Over the past few years, the stock market has told a huge positive story surrounding the prospects of artificial intelligence (AI). In particular, the driving force that technology stocks supplied fueled by 2025 until the party music suddenly stopped until about two weeks ago.

China’s AI startup, called DeepSeek, has announced a model similar to a model built by Chatgpt or Perplexity. However, Deepseek claims to unlock a new method of training the AI model using an old and less sophisticated architecture. Investors thus worryed that the US technology business could be overly enthusiastic, with billions of dollars in expensive chipware. Undoubtedly, the stock price of large technology, especially “magnificent 7”, is differentiated in a epic way.

Nevertheless, a famous technical investor does not seem to be persuaded by the DEEPSEEK drama. Of course, I’m talking about Ark Invest CEO Cathie Wood. He almost always seems to show optimism about new technologies.

I can see why the seven magnificent seven stock trees have just spread and think that her decision is a versatile movement.

Did Cathie Wood buy seven magnificent stocks?

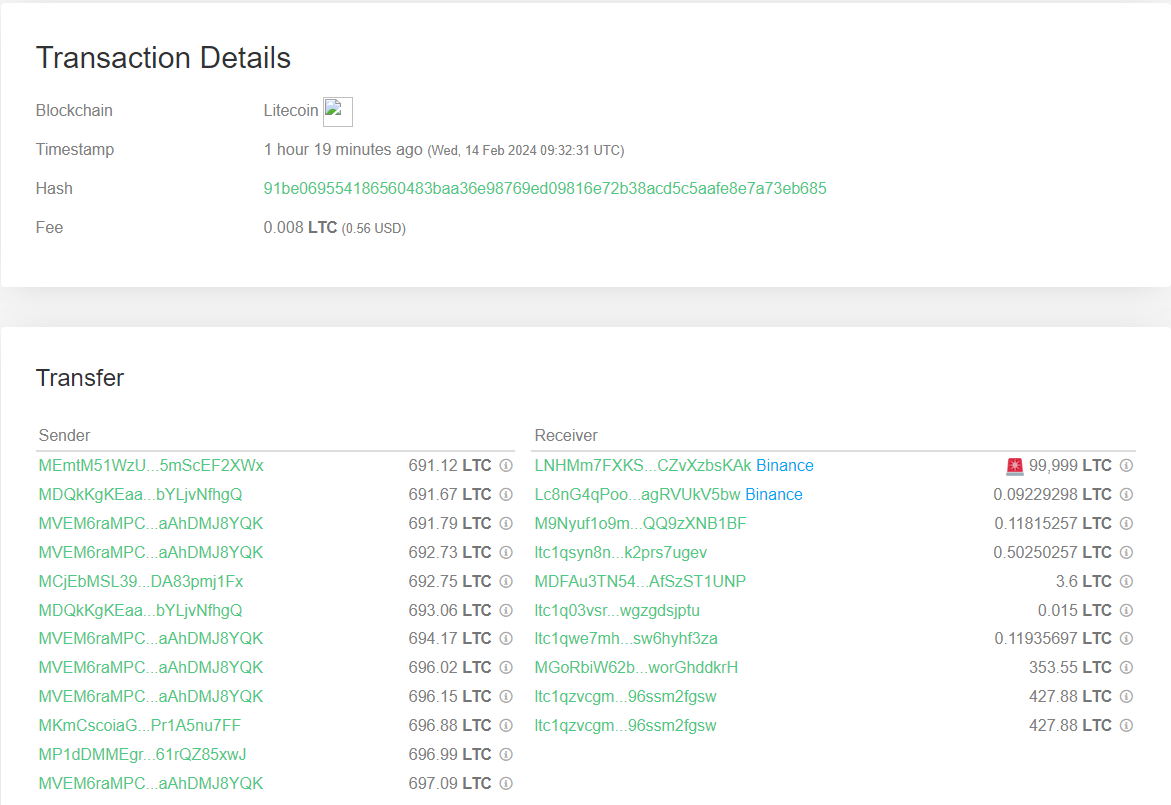

One of the good things about Ark Invest is that the fund publishes a daily transaction record. In general, investors must wait until the end of the quarter to see what kind of stock they bought and sell. Wood’s transparency is helpful because you can get a glimpse of the stocks you monitor to investors in real time.

On January 24, I first started listening to Chirps about DeepSeek and started posting a headline for financial news programming. The chart shows stocks Amazon (Amzn -1.65%)) As more news about DeepSeek began to collapse, it began to slip on the last day of January.

YCHARTS Amzn Data

Wood recorded this movement. Between January 27 and February 7, Wood added more than $ 28 million from $ 28 million in ETF (Exchange Traded Fund). Next -generation Internet,,, Ark innovation,,, ARK Fintech Innovation,,, Ark autonomous technology and roboticsand Ark space exploration and innovation.

| date | Amazon stock purchased by Ark Invest |

|---|---|

| January 27th | 7,461 |

| January 28th | 41,338 |

| February 6th | 153 |

| February 7th | 72,457 |

Data Source: ARK Invest.

In addition to the initial selling of DeepSeek, Wood doubled the conviction in Amazon due to the purchase of the company’s fourth quarter and 2024 income calls on February 6.

After the report, Amazon shares are expected to exceed $ 100 billion in 2025 due to the company’s CAPEC (CapEC) plan. Some investors believe that DEEPSEEK’s initial claims have booked this level of expenditure. For this reason, some investors seem to be sour in large technology.

Image Source: Getty Image.

Is it a good time to buy Amazon stocks?

As an Amazon investor, I don’t personally worry about how many investments are investing in the AI infrastructure. Rather, I am focusing more where The company is spending.

In a recent import phone, Amazon’s CEO Andy Jassy said, “Most of CAPEX spending is in AWS’s AI.”

Data Source: Investor relationship.

If you look at the financial profile, it is difficult to argue about JASSY’s vision. Over the past two years, Amazon has invested $ 8 billion in AI startups called Anthropic, which has been closely integrated with the cloud computing platform, Amazon Web Services (AWS). At this point, AWS accelerated sales and profit growth, resulting in an increase in operating income nearly 50%, with annual sales of more than $ 100 billion.

Amazon’s investment in AI infrastructure is already paid. For this reason, I think the company’s 2025 CAPEX budget is a good sign that more growth can get lost.

Nevertheless, Amazon is much lower than the current price of 75, P/FCF, which is much lower than the average 5 -year average of 104.

Many investors are so closely polished to Amazon’s expenditures, and I don’t think that the company has not provided enough credit for the growth that has already been witnessed for the past two years (after AI is the main focus).

I think that the idea of WOOD to buy dip in Amazon is now incredibly smart. Investors in the long -term time considering the lead of WOOD, while the stock is maintained at a historical discount while the company embodies some of the company.

John Mackey, former CEO of Amazon’s subsidiary, who is a member of MOTLEY FOOL, is a member of the MOTLEY FOOL. Adam spatacco is in charge of Amazon. MOTLEY FOOL is located and recommends Amazon. The MOTLEY FOOL has a public policy.