CBDC and cryptocurrency –

What is a central bank digital currency?

Kookmin Bank digital currency is a digital token issued by the central bank. It can be compared digitally to cryptocurrencies. It has a value directly proportional to the value of the country’s fiat currency. Many countries are working to build CBDCs, and several of them have started using CBDCs. As many countries are investigating different approaches to transitioning to digital currencies, it is important to understand what these currencies are and what they mean for society.

Understanding digital currencies issued by central banks (CBDCs)

The term “fiat currency” refers to currency issued by a government but not backed by a tangible commodity such as gold or silver. It is a fiat currency that can be used for transactions to buy or sell goods or services. Banknotes and coins were the traditional forms of fiat currency. However, technological advancements have enabled governments and financial institutions to augment physical fiat money through credit-based models where balances and transactions are recorded digitally.

However, the use of physical cash has declined significantly in some wealthy countries, a trend that has deepened since the COVID-19 pandemic. Nonetheless, physical currency is still commonly traded and accepted.

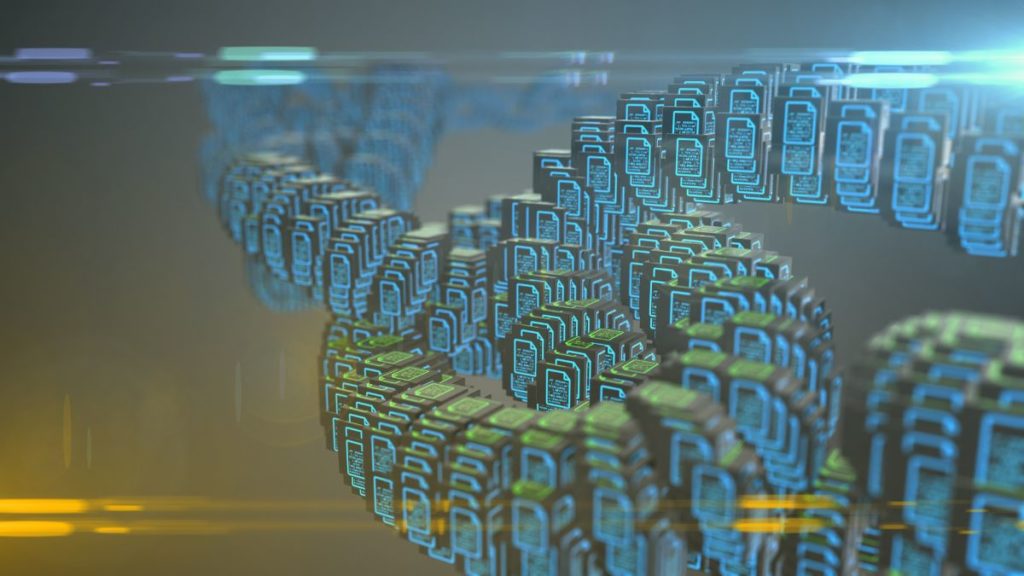

Recently, with the development and spread of blockchain technology and cryptocurrency, interest in a cashless society and digital currency is increasing. Accordingly, governments and central banks around the world are investigating the possibility of using government-supported digital currency. Like fiat currencies, these alternative currencies, when distributed, will have the full trust and support of the governments that created them.

Central bank goals for digital currencies

Many people in the United States and other countries do not have access to financial services. Only 5% of the U.S. adult population does not have a bank account. Even if they have a bank account, an additional 13% of individuals in the United States use more expensive alternatives, such as money orders, payday loans, and check cashing. The main purpose of a CBDC is to provide privacy for businesses and customers while promoting transferability, ease of use, accessibility, and financial stability. CBDCs can reduce the maintenance required for complex financial systems, reduce international transaction costs, and provide an affordable option for individuals who currently use alternative remittance methods.

Additionally, if central banks issue digital currencies, it will be less risky to use digital currencies in their current form. The value of cryptocurrency is constantly changing and subject to significant volatility. This volatility can place a significant financial burden on many households and impact the economy as a whole. CBDC provides a reliable way to transfer digital currency to households, consumers, and businesses. They will be supported by the government and managed by the central bank.

Can CBDC be considered a decentralized digital currency?

Although cryptocurrencies and blockchain technology have inspired the concept of central bank digital currencies (CBDCs), CBDCs are not the same as cryptocurrencies. CBDCs, on the other hand, are supervised by central banks. This is in contrast to cryptocurrencies, which are generally decentralized in nature and cannot be regulated by a single authority. On the other hand, a single entity manages all cryptocurrency transactions.

CBDC and cryptocurrency

The ecosystem surrounding cryptocurrencies offers a glimpse into alternative currency systems where onerous restrictions do not control individual transaction terms. They are protected by consensus procedures that make them difficult to copy or forge, and difficult or impossible to tamper with. Central bank digital currencies are expected to operate in a similar way to cryptocurrencies. Nonetheless, it is unlikely to require the utilization of blockchain technology or consensus processes.

Additionally, there is no central authority or regulation of the cryptocurrency market. Their value is determined by what investors think about them, how often people use them, and how interested people are in using them. It is a volatile asset better suited for speculation and therefore unsuitable for use in financial systems that require stability. This is because the system requires stability. CBDCs are designed to replicate the value of fiat currencies and aim to be stable and risk-free investments.

CBDC is not a threat to cryptocurrencies.

Binance’s CEO said that CBDCs and cryptocurrencies have their place in the industry and that he does not believe these trends pose a threat to his company or the industry.

Binance CEO Changpeng “CZ” Zhao appears to have softened his stance on central bank digital currencies (CBDCs). He insisted in a recent conference that he does not believe CBDCs pose a risk to his company or the cryptocurrency industry as a whole. On November 2, CZ gave a presentation on CBDC and its role in cryptocurrency at the Web Summit in Lisbon.

The Binance CEO said that CBDC will validate blockchain technology and increase trust among individuals concerned about the technology. He said: “I think the more we have, the better.” He also said the government’s adoption of blockchain technology would be seen as a positive development, according to Reuters. However, he said blockchain technology is not the same as cryptocurrencies and described it as “deflationary.” Compared to his previous attitude toward CBDC, CZ has moderated his opinions. Last year, he said it would never be able to offer the same freedoms as cryptocurrencies like Bitcoin or Ethereum. At that moment, he said, “it is likely that most central bank digital currencies will have control tied to it.” Central banks around the world are racing to research, test, and eventually deploy their own CBDCs. Some see China as leading in this race.

But concerns persist that programmable digital currencies will give central banks unparalleled power over how civic groups can use them and what goods and services they can purchase. Cointelegraph noted that citizens who prefer less of a government role in their personal finances may have issues with CBDCs. A political commentator named Peter Imanuelsen a month ago called the level of control governments will have over national finances “global communism.” Imanuelsen expressed concern about the level of control the government will have over people’s finances.

He hypothesized that CBDCs linked to digital identities could be used to crack down on dissidents or limit spending on environmentally friendly products. According to sources, Turkey plans to build a digital ID-linked CBDC in 2023.

According to the Atlantic Council, CBDC pilot programs are currently underway in 15 countries, including China, Kazakhstan, Thailand, Saudi Arabia, South Africa, and Russia. Nigeria, Jamaica, the Bahamas and eight other Caribbean island nations also operate CBDCs. The United States lags behind the rest of the world as it still discusses a digital dollar, and Americans’ reactions to the prospect of holding a digital dollar are generally mixed. The International Monetary Fund (IMF) last October highlighted the program’s potential as a quality CBDC that could lead to “financial inclusion.” On the other hand, the opposite may also be true.

Allegory cryptocurrency news aggregator will keep you up to date with the latest developments in the cryptocurrency world and CBDC developments. Here is a link to our tool: https://algory.io/?type=news