Cboe Global Markets: This Countercyclical Stock Deserves A Place In Your Portfolio (CBOE)

Scott Olson

Introduction

Cboe Global Markets, Inc. (BATS:CBOE) is one of the world’s largest exchange operators. In this article, I’ll delve deeper into the company’s quarterly results and explain the growth drivers and competitive advantages I see that support the company being a great long-term investment.

Company Overview

Cboe Global Markets is an exchange operator that provides its constituents a marketplace to trade various financial assets such as equities, foreign exchange, digital assets, as well as derivatives and options on those securities. Founded in 1973, CBOE was formerly known as the Chicago Board Options Exchange, and was the initial exchange that allowed investors to use exchange listed options. As time progressed, it expanded the number of securities it allowed options trading on and also launched its own futures exchange. Soon after, it acquired several companies and expanded its presence to become the third largest exchange in the U.S. Today, it controls a third of the market in listed options as the largest options exchange in the U.S. and the largest stock exchange in Europe.

Recent Results

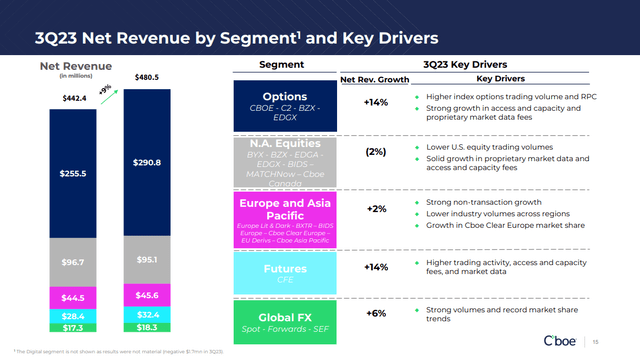

We can think of CBOE in terms of the six different segments it operates: Options, North American Equities, European and Asia Pacific Equities, Futures, Global FX, and Digital. Below, I’ll discuss how each segment performed for Q3 results announced in November:

- Options: For the third quarter, options revenue made up 60% of overall net revenue and was up 14% year over year coming in at $291 million. Higher transaction volumes and clearing fees were the primary drivers but we also saw decent growth in market data fees.

- North American Equities: Net revenues clocked in at $95 million (20% of total net revenues) and higher revenues from the Canadian operating segment were offset by lower transaction and clearing fees.

- European and Asia Pacific Equities: Net revenues came in at $46 million (9% of total net revenues) and were primarily driven by higher market data fees (up 2% year over year).

- Futures: Net revenues were $32 million (7% of total net revenues), and were up 14%. This was driven by higher net transaction and clearing fees, but also market data which was up 16%.

- Global FX: Net revenues came in at $18.3 million (4% of total net revenues), 6% higher on the back of 5% growth in transaction fees and 8% growth in average daily notional volume. Market share increased from 17.8% to 20.2%

- Digital: For the quarter, this segment reported a loss of $1.7 million.

For the quarter, management also revised revenue guidance upwards, forecasting total organic net revenue growth of between 7% and 9%. The company also now expects EPS for the full year of 2023 EPS estimate of $7.66 (previously $7.41) and 2024 EPS of $7.97 (previously $7.67).

Q3 Highlights (Investor Presentation)

Overall, I would consider CBOE’s results to be rather impressive for the quarter. CBOE makes money when there’s market volatility, and given that the VIX dropped 17.7% for the full year 2023, these results don’t seem bad at all with a record Q3 earnings number of $2.06, up 18% year on year.

The notable standouts in terms of segments here are the Options and Futures segments. For Options, this 14% growth is meaningful given that it makes up over 60% of the company’s total revenues and is a growth engine for the business. We’re starting to see more investors and traders use shorter duration options like zero days to expiration (0 DTE) which led to a favorable mix on SPX volumes, making up 48% of overall SPX volumes. Average daily volume on these products was up 33% year on year for the third quarter.

These products seem to be popular both among people who are looking to speculate on short-term trading as well as traders who use these options for more precision in risk management for activities like hedging, income generation or expressing a directional view on markets. The shift to shorter duration options like 0 DTE also means that revenues for Cboe is becoming more reoccurring, which leads to more stable and predictable cash flows. It also has the advantage of being less cyclical, since investors will use 0 DTE options irrespective of where the VIX is trading or where the market is at. On the earnings call management noted the following:

These options opened up a whole new risk premium for investors to capture namely intraday risk. And it’s uncertain to increase is regarding the longer term macro picture, interest in capturing shorter term trends and dislocations have led to a higher share going to zero DT options, now, comprising around 48% of all SPX volumes in the third quarter.

However, it’s important to note that while the zero DT options are making up a bigger part of the pie, the pie itself is growing, as well. Other expiries are also seeing high volume including our standard monthly SPX options contracts that expires in the third Friday of every month. We believe that bonus are being used less as we diversify our equity risk and investors are increasingly turning to options to help hedge their portfolios.

So it would seem that given management’s comments, they are optimistic on the developments and future outlook for the take up in 0 DTE options. With average daily trading volumes across these products up 60% year on year, I believe this also helps to explain why revenues were strong this quarter despite the VIX not moving much.

Investment Thesis

One of the biggest factors protecting Cboe’s competitive position is an agreement signed between the company and S&P Global (SPGI) which essentially gave Cboe exclusive access to offer exchange listed options on S&P products (S&P 500 Index, the S&P 100 Index, the S&P 500 ESG Index, and the S&P Select Sector Indices) for the next ten years until December 31, 2033. It also has similar agreements with MSCI and FTSE Russell lasting until April 1, 2030 and December 31, 2031, respectively.

In my view, this gives Cboe a leg up on the competition being one of the only providers of S&P options aside from its competitor the CME Group (CME). It’s a source of competitive advantage that’s protected by long-term contracts; contracts that can generate high margin revenues for the company.

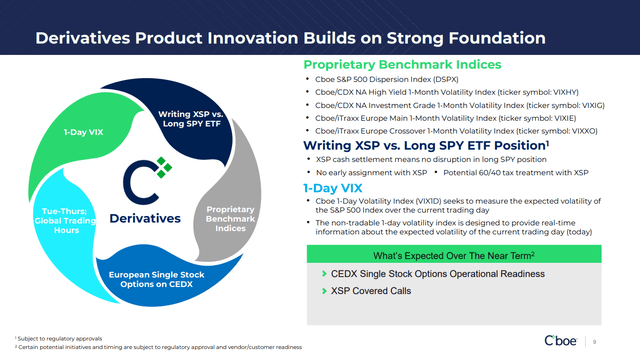

Another point that makes me bullish on the company’s outlook is the development of XSP options, which just got approved by FINRA last year. XSP options have been growing in popularity with investors because they are generally smaller than the standard SPX option contract at about 10% the size and let’s traders have more flexibility in managing risk at the portfolio level.

Given that the cash settlement for writing an XSP option has no bearing on long SPY positions and that there is no early assignment with XSP options, I believe this is attractive for traders. More favorable tax code treatment to XSP as opposed to the alternative is another reason why many traders are making the switch. I view this is significant because it solves a customer need in the market and contributes to the broader appeal and adoption of XSP options in the market – all things that bode well for Cboe.

XSP Options (Investor Presentation)

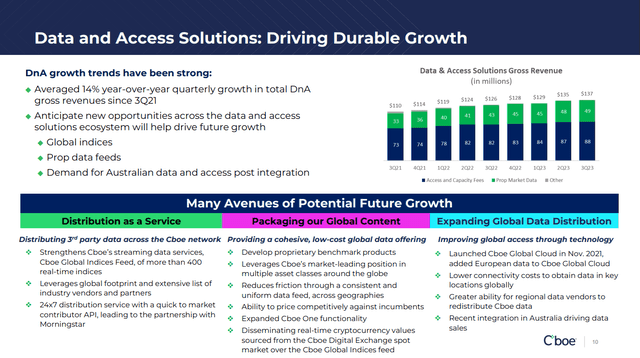

Finally, the last major catalyst I see is in the company’s Data and Access Solutions business which is growing quarter to quarter, despite market volatility. This is a stable part of the company’s revenue that is still putting up good growth of 14% year over year. As trading becomes increasingly more efficient and competitive, the data that Cboe sells becomes all the more valuable to large institutional traders, so this is a long term avenue for growth for Cboe.

With indications from management experiencing stronger demand in the APAC region, specifically in the Australian market for this data, I believe there’s likely an international opportunity to provide this data as a service to those outside the United States. I wouldn’t be surprised to see this business segment double or triple in size in the next five years should that be the case, along with organic growth from the existing domestic revenues.

Data and Access Solutions Business (Investor Presentation)

Valuation

Based on the 12 equity research analysts with one year target prices on Cboe’s stock, the average target price is $179.82, with a high estimate of $204.00 and a low estimate of $138.00. From the average this suggests upside of about 1.9%, suggesting shares are fairly valued. Keep in mind that equity markets have risen since Q3 results were announced in November, increasing the share prices of many stocks including Cboe as rates have dropped, so the stock hasn’t climbed in isolation.

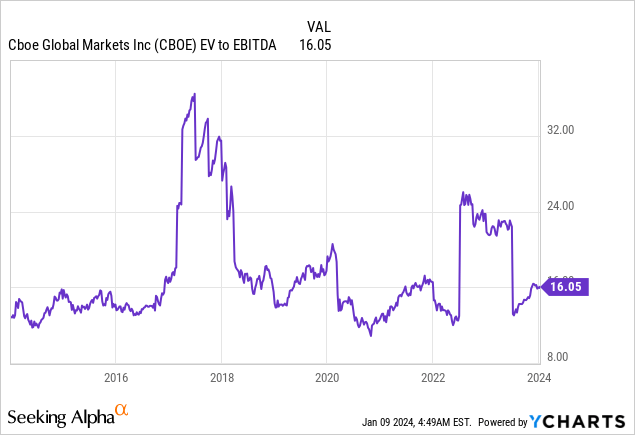

When looking at the valuation for Cboe, the company trades at a pretty reasonable valuation of 16.0x EV/EBITDA or at about 24.6x P/E (15.1x forward EV/EBITDA and 21.7x forward P/E). When looking at the historical EV/EBITDA range, the company seems to be trading in line with its historical valuation range. The large spikes in 2017 and 2022 are a reflection of low trading volumes which resulted in lower EBITDA (hence a spike in the EV/EBITDA multiple).

At 16.0x EV/EBITDA and 24.6x P/E, CBOE comes in at a slightly better valuation than its peer group of CME Group, Nasdaq (NDAQ), and Intercontinental Exchange (ICE) at 18.7x, 17.4x, 16.4x EV/EBITDA and 23.9x, 25.4x, 29.8x P/E, respectively. So on average, the company is trading about 1 turn cheaper on an EV/EBITDA basis and 2 turns cheaper on a P/E basis, which suggests that the company is slightly undervalued on a relative basis. With consensus estimates of 10.2% growth in 2023 and 7.1% growth in 2024, 16.0x EBITDA seems like a fair multiple to pay for a high quality business with minimal disruption risk.

Risks

In terms of the risks to the investment thesis here, a few notes are worth mentioning. Firstly, there’s been a few changes in key leadership at the management level. Last year in September, Edward Tilly resigned and was replaced by Frederic Tomczyk. Edward Tilly was forced to resign over failing to disclose previous personal relationships at the company and was at the company for over a decade. He played an instrumental role in diversifying the business away from just options into other areas of fintech and financial markets. One of his greatest accomplishments at the company was his role in the contract with S&P, which essentially lets Cboe have a monopoly on several S&P products. Some other notable management changes include David Howson becoming the company’s president in May 2022 and the former CFO Brian Schell leaving to pursue outside opportunities. He was replaced by Jill Griebenow, who was promoted inside the company. While I don’t think these management changes will steer the company in a new direction, it’s worth mentioning to monitor how management executes over time. In the case of Frederic Tomczyk, I think he’s fit for the job coming from TD Ameritrade and having been sitting on Cboe’s board since 2019.

Secondly, and perhaps the most important risk in my view, is the risk of lower market volatility. As revenues for Cboe tend to climb in periods of market volatility with more equity and options trading, the company could see margins decline as the majority of the company’s costs are fixed. Right now, the VIX is currently sitting at about 13, below the long-run average of about 21. So it would seem that the risk would be to the upside here. If volatility were to spike in the market, this would be good for Cboe as we tend to see trading activity increase, which means more high margin clearing fees and other service related revenues to Cboe.

Finally, the last risk here is fierce competition from other exchanges, in particular the Members Exchange and IEX. Regarding competition, we can infer that competition is something that management views as highly important to monitor given that they share market share for each of their segments and gains or losses quarter to quarter. For the most recent quarter, we saw market share gains in equities for Europe, Australia, Canada, and global FX, but we did see a decline in U.S. equities market share. It’s hard to get a pulse point in market share and know how to interpret it quarter to quarter but Cboe’s market share in its business segments have been steady over the years. To maintain and grow its market share, Cboe invests heavily into new and innovative technologies to maintain a competitive market position.

Conclusion

In summary, Cboe is expanding its offerings and market presence and has maintained its dominance in the exchange business. Its recent quarterly performance highlights this well, demonstrating decent growth across various segments, particularly in options and futures, contributing significantly to the company’s earnings. The development and increasing popularity of XSP options, coupled with exclusive agreements for offering exchange-listed options on prominent indices, present promising opportunities for revenue growth and sustained competitive advantage. In the Data and Access Solutions business, I wouldn’t be surprised to see international expansion 2x or 3x the segment’s revenues in the next five years, as the segment puts up 14% growth year on year, with revenues increasing every quarter. At an attractive valuation, it trades at a slight discount to its peers and its in line with its historical multiple so I believe investors today are paying a fair price for the growth here going forward.