CDW Corporation: Two Key Growth Catalysts (NASDAQ:CDW)

Luis Alvarez

Investment summary

I am CDW Corp. (NASDAQ:CDW) We recommend a Buy despite near-term weakness as CDW has two strong catalysts ahead that will fuel accelerated growth as we move through FY24. In particular, near-term catalysts include: 2H24 will be a PC refresh cycle, and in the medium to long term, demand for AI PCs and AI-related implementations will support growth.

business overview

CDW sells IT products and services to businesses of all sizes. According to the factsheet, CDW offers more than 100,000 products from more than 1,000 brands, including both hardware and software products. By segment, revenue is divided into three major segments: CDW’s overall sales to businesses are its largest revenue contributor (52% of revenue). The public, which includes government and healthcare customers, is the second largest revenue contributor (35% of revenue). Others represent 13%.

Very difficult macro environment in the short term

I expect the difficult macro environment to continue to put pressure on CDW’s near-term performance. This dynamism is clearly evident in our first quarter 2024 performance. Total revenue fell 4.5%, marking the sixth straight quarter of declines in revenue across all segments. This marks the third consecutive quarter that CDW has missed consensus expectations, suggesting that underlying conditions are much worse than the market expects. My view is that the current macro overhang will continue, resulting in longer sales cycles and longer project rollouts as customers prioritize cost-savings initiatives and faster return on investment (ROI). Additionally, management guidance clearly reflects these macro headwinds as it lowered FY24 EPS growth to low single digits compared to previous guidance for mid-single digit growth.

But the bright side is that CDW is not seeing any project cancellations, just an increase in budget scrutiny and project push. I think this will lead to pent-up demand, which is good news for CDW. Because going through this downcycle could mean a strong acceleration of growth for the company. The question is when will the cycle change, and I believe there are two key catalysts that will fuel this recovery.

Two powerful catalysts

The first catalyst is the PC recharge cycle, which is expected to occur around the second half of 2024. The impact on CDW is that each additional PC (business workstation) creates multiple sales opportunities for CDW, as users require specific computer peripherals (mouse, cables, keyboard, etc.) and software (business applications, cybersecurity, etc.). is to create. Go with it. In fact, there are already early signs that this is happening, as CDW said PC demand in the first quarter was stronger than expected across all end markets due to replacement of aging devices and Win 11 upgrades.

Moreover, this recharge cycle has another fundamental catalyst that can further fuel its growth: the increased availability of AI PCs. I think it’s only a matter of time before AI PCs make up the majority of the market (IDC estimates 60% of global PC shipments by 2027), especially the majority of business use cases. We conduct business to improve productivity and efficiency. The constraint today is availability. Microsoft announced its first batch of Copilot Plus AI PCs a few days ago. As availability increases, this could create demand for AI PCs at higher price points than traditional PCs (a pricing tailwind for CDW).

We expect PC renewal momentum to continue beyond 2Q24, with demand for AI PCs supporting medium-term growth prospects.

The second catalyst is also related to AI. I believe the world is still in the early stages of generative AI opportunities. What this means is that we are in an experimentation phase where customers are testing whether Gen AI can actually meet their use cases. The risks of dealing with Gen AI will be a barrier for companies to invest in this emerging technology. Especially when it comes to data security risks (80% of companies say data security is their biggest concern). Added to this are macro uncertainties. This means that it is unlikely that this latent demand will be converted into revenue anytime soon.

A world seen through data

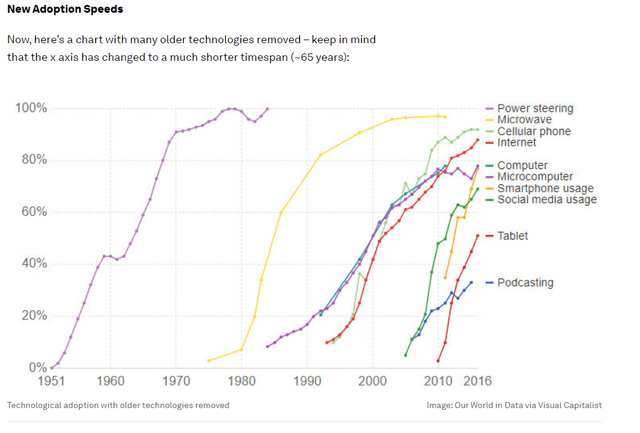

However, I believe these issues will be sorted out quickly, similar to previous emerging technologies that are eventually adopted (the Internet is a good example). In fact, general AI can significantly improve the productivity of businesses, and we believe every business owner will find a way to take advantage of it. A recent CIO Technology Survey conducted by Foundry found that while budgets remain tight, AI is a major focus. Therefore, given CDW’s broad portfolio of products and solutions (a search for “AI” on the CDW website returns over 500 results related to services, software, services, storage, etc.), generative AI will ultimately help customers move from evaluation to implementation. As we move, there is a tailwind for growth.

The difficulty is pinpointing the point of inflection. I am confident that this will not help drive CDW growth over the next few quarters, but I see this as a major growth driver in the medium term.

evaluation

Source: Author’s calculations

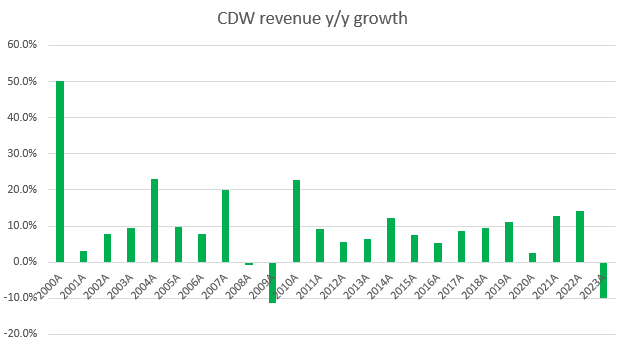

In the near term, the difficult macro environment will continue to put pressure on CDW growth, meaning FY24 is likely to be a negative year as well. However, with the PC replacement cycle starting in 2H24 and more AI PCs being launched, growth will remain positive in FY25/26, driven by a recovery in macro conditions (inflation rates are currently moving in the right direction). Beyond FY25/26, businesses preparing to deploy AI-related solutions and hardware will need to continue supporting growth. If you look at CDW revenue growth historically, we’ve never seen more than two consecutive years of declining growth, and we think that’s consistent with our expected timeline for growth to recover in FY25.

My expectations for CDW are -5% y/y growth in FY24, +5% y/y growth in FY25, and 10% y/y growth in FY26. The rationale for this outlook is that while the macro picture is clearly unfavorable for FY24, the 2H24 PC recharge schedule will alleviate some of these headwinds. Therefore, FY24 growth should be less than FY23. Growth is expected to recover gradually in FY25 as some of the macro headwinds may spill over. FY26 will see a full recovery in growth to the historical ~10% range.

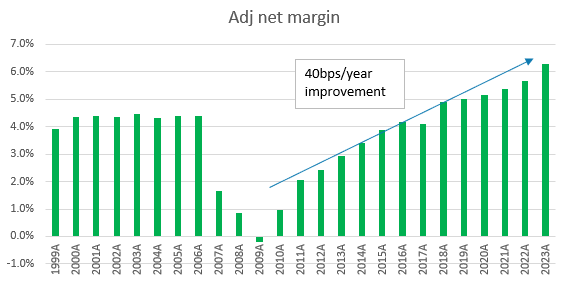

Source: Author’s calculations

In terms of earnings expectations, I used adj earnings because management is using that as a guide and the market is valuing CDW based on adj earnings (at the time of writing, CDW’s current stock price is $231.57 and forward adj( Normalized) EPS estimate is $231.57, which corresponds to $10.12 (~23x). To be conservative, we assumed flat margins as we expect revenue growth to be negative in FY24 (although net income improved in FY23 despite -10% growth). In FY25 and FY26, net profit margins are expected to grow by 40 bps per year, at the same rate as over the past decade.

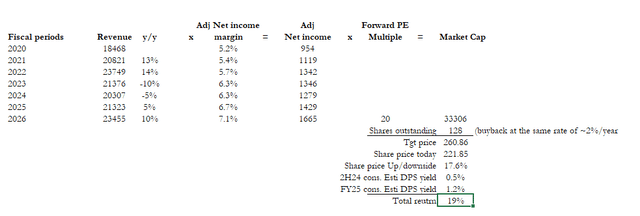

Source: Author’s calculations

The market currently values CDW at a forward P/E of 21x (CDW’s +1 stdev above its five-year trading range), which we believe is due to the expected recovery in FY25. My model assumes that CDW will trade at a forward P/E of 20x, which is the average over the past five years. That’s because we don’t expect growth to accelerate beyond 10%. Adding this multiple brings the implied market capitalization to approximately $33.3 billion.

Because CDW has returned capital to shareholders through share buybacks and dividends over the past few years, we also include return on capital in our total return calculations. Using the same buyback rate (2%/year) and consensus expected DPS yield, we expect a total return of approximately 19% (stock price upside of 17.6% and dividends of approximately 1.7%).

danger

The biggest risk is the timing of growth recovery. This is because the current macro headwinds could last much longer, putting more pressure on companies’ willingness to increase their technology spending budgets. The larger implication is that PC refresh cycles are likely to fall behind schedule as businesses strive to burn more of their current assets.

Another thing that scares me is the amount of debt CDW has on its balance sheet. As of the first quarter of 2024, the net debt of this business amounts to approximately $4.8 billion. In a worst-case scenario, if a decline similar to what CDW experienced in FY09 (a 22% decline in EBITDA) occurs again (which could be due to a number of reasons, including a major global recession in the event of a full-blown conflict in the East), CDW would see its leverage ratio decline As it rises, share buybacks and dividends may need to be cut.

conclusion

Overall, despite the short-term headwinds in the macro environment, I would buy CDW due to two key catalysts. The first is the PC refresh cycle expected in the second half of 2024, and the second is the demand for generative AI. Although the exact timing of this inflection point is uncertain, we believe CDW’s broad product portfolio is well positioned to capitalize on both of these catalysts. The main risk in this paper is the possibility of a prolonged economic downturn that delays PC renewal cycles and CDW’s debt levels.