CEF Weekly Review: Are Discounts Good or Bad?

afternoon images

Welcome to another installment of the CEF Market Weekly Review. Here we discuss closed-end fund (“CEF”) market activity, both from the bottom up, highlighting individual fund news and events, and from the top down, providing an overview. of the wider market. We also try It provides some historical context as well as relevant topics that appear to be driving the market or that investors should keep in mind.

This update covers the period until the second week of May. Check out our other weekly updates covering the Business Development Company (“BDC”) and Preferred Stock/Baby Bond markets for perspective on the broader income space.

market activity

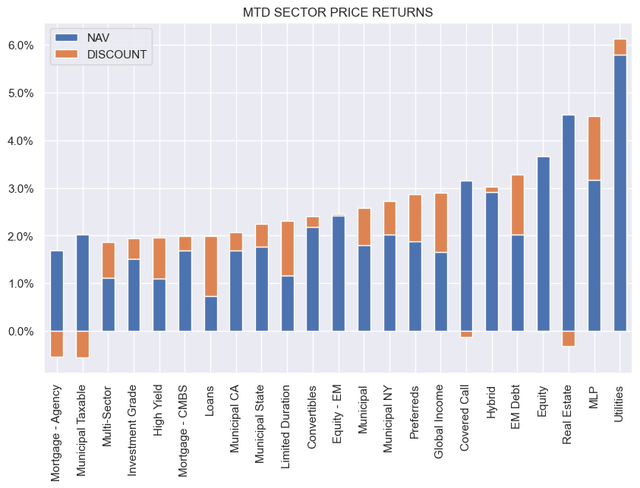

CEFs had a strong week with NAVs rising across all sectors. MLPs and utilities led the way. The month-to-date picture is strong on the back of broad gains. Both NAVs Discounts supported price gains.

systematic income

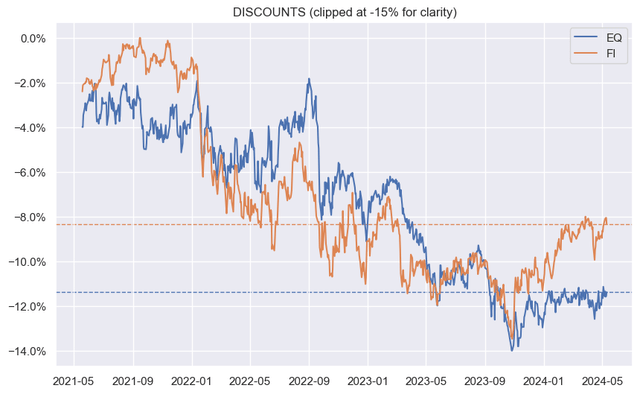

Discounts in the bond CEF sector are trading near their lowest levels in over a year. Equity CEF discounts remain further subdued.

systematic income

market theme

The past few months have seen a flurry of CEF activity, with asset managers such as Saba and Karpus accusing CEF managers of various wrongdoings as they attempt to wrest control of their boards of directors.

One criticism that CEF activists tend to levy at managers is that the target funds’ discounts are too wide. According to activists, their presence is evidence that managers are not good stewards of investor capital. But like everything else, we don’t have to take activists at their word. Let’s look at this in more detail.

The activist’s criticism is simple. Wide discounts are not a good idea because the wider the discount, the lower the price of a particular holding and the lower the value of the investor’s investment account.

But the discount question goes both ways. The wider the discount, the higher the level of implicit leverage the investor achieves with respect to his capital. This creates a type of margin dynamic trading without the risk of margin calls. Discounts also broaden the underlying rate of return on an asset portfolio and, if the discount is sufficiently wide, completely offset management fees, providing active management for free or at negligible cost.

Another way to think about the CEF discount is that it is the mathematical result of management fees and secondary market trading. This means that because the CEF manager is entitled to a fee on the basket of assets, that basket of assets must trade at a discount compared to the secondary market value of the fund wrapper. Of course, not all CEFs trade at a discount. However, fees are not the only driver of discounts driven by risk sentiment, fund alpha, leverage costs and other factors.

CEF activists can use the existence of the discount to suggest that a particular fund has no alpha. This may be true in theory. But the reality is that risk sentiment and recent performance typically trump alpha-related discount dynamics. One evidence of this is that all 71 CEFs in the municipal CEF sector are trading at a discount. It is unlikely that a single fund in the sector will have a net positive alpha.

What this suggests is that the mere existence of the discount is not the manager’s fault, but rather that the discount is simply a reality of the CEF structure that capitalizes fee annuities. If mutual funds are traded in the secondary market, they will most likely trade at a discount. Ultimately, we can support what CEF activists are trying to achieve, but we do not have to accept their explanation. Their main goal is to make money, and their moral displays are often smoke and mirrors.

market commentary

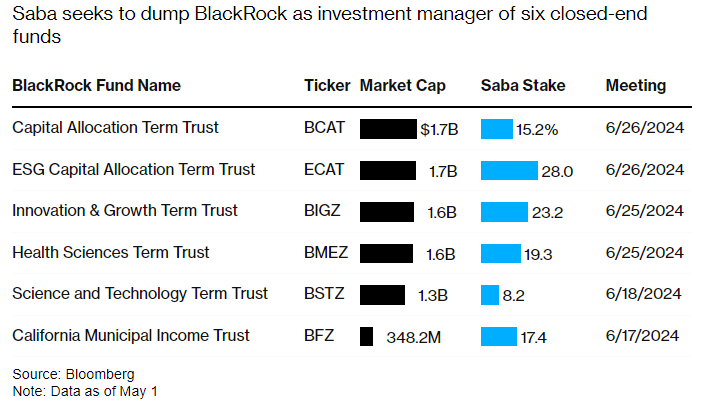

BlackRock and CEF activist Saba are pushing for this. Saba has launched a bid to remove BlackRock from managing six funds. These include BCAT, ECAT, BIGZ, BMEZ, BSTZ, and BFZ, with total assets exceeding $10 billion. Saba’s stake in them ranges from 8% to 28%. A proxy meeting is scheduled to be held at the end of June, where new directors could be elected to decide the fate of the funds. Both sides usually make a lot of moral displays. Saba claims that BlackRock is illegally preventing its candidates from getting elected, while BlackRock says it wants to acquire funds to generate fees, something Saba has already done several times.

black stone

Elsewhere, activity in the Muni CEF space highlighted a few weeks ago is starting to bear fruit. BlackRock Muni CEF (MUI) announced a tender offer for 50% of its shares at a 2% discount to NAV, conditional on the fund being convertible into an unlisted CEF, a fund that provides liquidity to investors. You purchase a certain number of shares on a regular basis.

As far as CEF’s response to activism goes, this is quite unusual. Public offerings, exits, or conversions to open-end funds are often seen, but conversions to unlisted CEFs are highly unusual. The biggest problem with this is that it’s bad news for most of the fund’s current shareholders, who likely won’t be very interested in owning an unlisted fund. The benefit for BlackRock is that it would make it harder for CEF activists to do their jobs because it would make it harder to acquire large shares in unlisted funds.

There are two potential tactical deals here. One is to buy the fund now at about a 7% discount when half the shares are likely to be repurchased at a 2% discount. This leaves some upside. The second is to purchase the fund once the public offering is completed. At that point, very few shareholders will be willing to hold it in private form (the remaining shareholders will either be tactical traders or disinterested shareholders, both of whom will be eager sellers). Even if liquidity is not high, it is likely to create an attractive holding environment for long-term buy-and-hold investors. First Trust announced that it has completed its MLP fund merger. Recall that MLP CEFs FEN, FEI, FPL and FIF were merged into ETF EIPI. Although this was a tax-free reorganization, some funds said they would need to adjust their NAVs slightly (FEN up and FEI down) before the merger.

The manager said there are likely to be further adjustments to NAV for CEFs as well as EIPIs leading to the merger. This may be related to the deferred tax assets and liabilities that are characteristic of MLP CEFs. The goals for the merger were daily portfolio transparency (minor benefit), elimination of discounts (beneficial for existing investors being merged into an ETF, not beneficial for new shareholders), and reduction in total expense ratio (EIPI of 1.1 doesn’t seem like a lot). % Management Fees – Very high for active ETFs and also high for CEFs.