CEF Weekly Review: Beware of CEF Sector Designations

darren415

Welcome to another installment of the CEF Market Weekly Review. Here we discuss closed-end fund (“CEF”) market activity, both from the bottom up, highlighting individual fund news and events, and from the top down, providing an overview. of the wider market. We also try to provide Some historical context is included as well as relevant topics that appear to be driving the market or that investors should keep in mind.

This update covers the period until the second week of January. Check out our other weekly updates covering the Business Development Company (“BDC”) and Preferred Stock/Baby Bond markets for perspective on the broader income space.

market activity

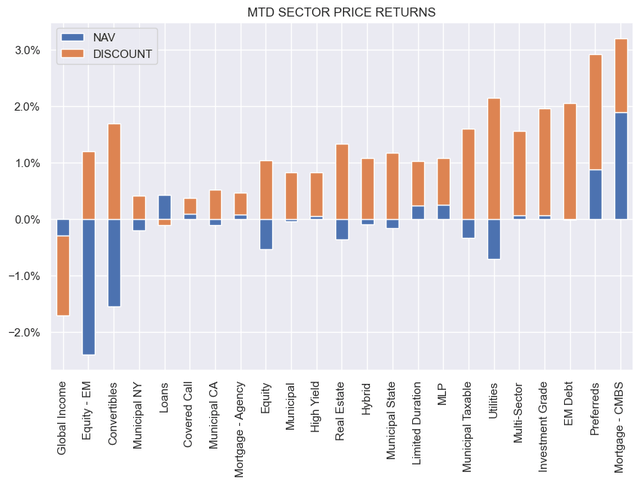

Most CEF sectors rose this week as both stocks and Treasury bonds rebounded. However, month-to-date NAV performance has been mixed. CMBS has had its best returns to date. Relative performance turnaround in 2023. However, discounts strengthened in all but one sector, indicating a return to investor confidence in the sector.

systematic income

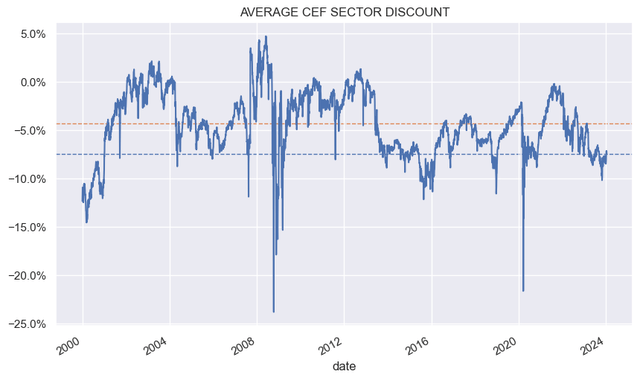

By industry, the discount rate has decreased by a few percentage points since the lowest point last year.

systematic income

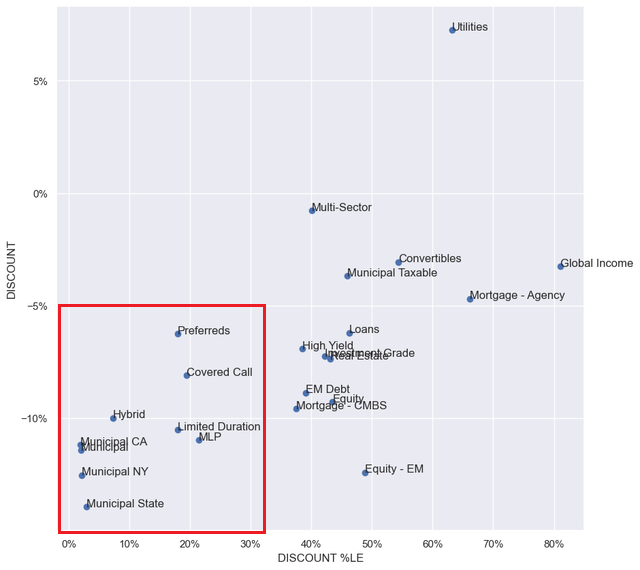

Sectors such as Munis, Hybrids and Preferreds continue to trade at double or high single-digit discounts. They also trade at low discount percentiles. This means their discounts are wider than they have been in the past.

systematic income

market theme

The CEF sector designation appeared on the service this week. In particular, there have been questions about why funds such as the DoubleLine Income Solutions Fund (DSL) are placed in the Multi-Sector category of the CEF tool while they are in CEFConnect’s Global Income.

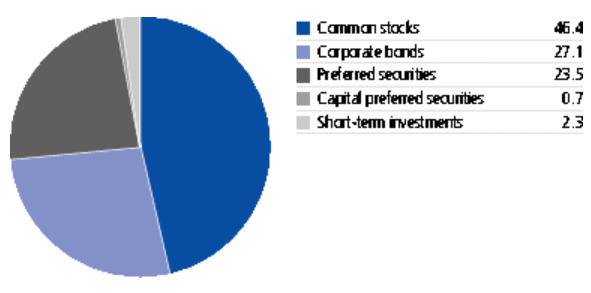

In reality, there are many differences between our sector placement and CEFConnect’s sector placement. This is roughly because there are easy cases and difficult cases. For example, funds such as the John Hancock Premium Dividend Fund (PDT) deploy in CEFConnect’s priority sector, while we deploy in the hybrid sector. PDT is an easy case. The allocation is nearly half to common stocks, and preferred stocks make up less than a quarter of the portfolio. There is no way to assign to priority sectors.

J.H.

There are also difficult cases, such as the Ares Dynamic Allocation Fund (ARDC). The allocation was roughly evenly split between fixed and floating rate assets. For example, in 2019 it was 40% fixed, increased to 50% fixed in mid-2021, and is now 45% fixed. While CEFConnect deploys funds in the lending sector, we hold it as a multi-sector CEF.

Loan sector placement is clearly questionable as investors will be comparing it to funds that are primarily allocated to loans. While multi-sector is not perfect, it is arguably the right place to be, as many multi-sector CEFs tend to allocate to different types of credit sectors, such as ABS, institutional, investment grade and high-yield corporate bonds, Treasuries, Treasuries and Treasuries. Other – These are assets that ARDC mainly avoids.

Back to DSL – what sectors are suitable for the fund? DSL is another difficult case in our view. The reason we do not see Global Income as a suitable sector for the fund is because it tends to be a proxy for non-U.S. developed market bonds, which DSL does not hold in large numbers.

Broadly speaking, the global fixed income sector is comprised of three segments: the U.S., developed markets outside the U.S., and emerging markets. Funds primarily allocated to EM bonds such as EDFs and EDDs are, as expected, located in the EM CEF sector. Funds allocated to high or medium quality bonds from G7 (and similar) countries tend to be placed in the Global Income sector.

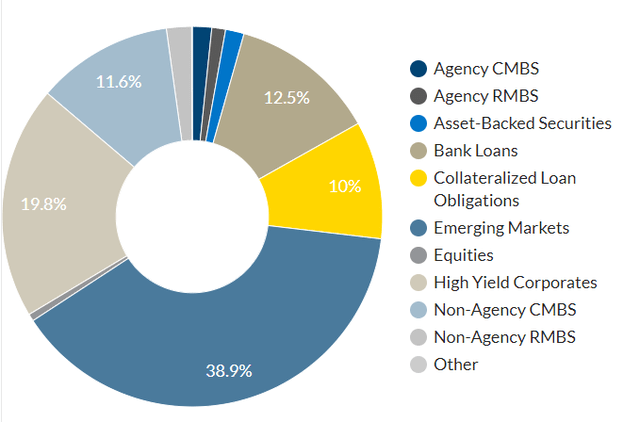

Depending on its allocation, DSL is likely to be positioned in the emerging markets sector rather than Global Income, which tends to be synonymous with developed markets outside the United States. However, EM allocation is less than 40%. This means it is better described as a multi-sector fund, as it holds many other credit sectors, particularly loans, ABS, MBS and CLOs. This point is obviously debatable, but either Multi-sector or EM is a better fit for DSL than Global Income.

double line

There are two consequences of this discussion. First, there are arguably only a few CEFs that can be perfectly placed in the sector. Some sectors, such as Munis and Equity, are fairly “clean” from this perspective, but many credit funds are not. Second, this means that comparing funds within a sector is tricky because both performance and valuation can be affected by changes in allocation. When evaluating a particular fund’s allocation profile and metrics, investors should be aware of how that fund differs from the sector’s allocation profile.

market commentary

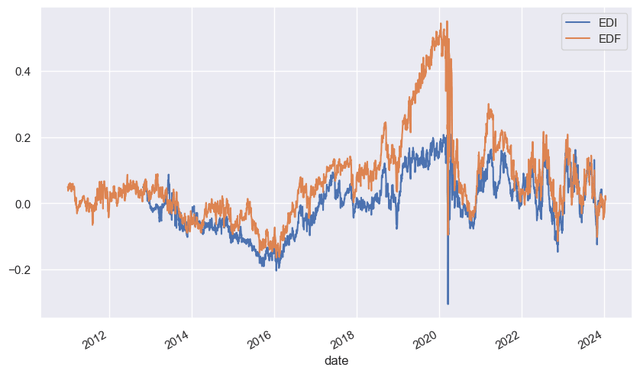

Last month, two Virtus Stone Harbor Emerging Market Debt CEFs (EDI) and (EDF) merged, making the latter the surviving fund. Both funds have become profitable antiques in this space for several reasons.

First of all, they tended to trade at very high premiums, spending most of their time at double-digit levels and rarely trading at a discount. This is despite very poor returns. For example, EDF’s 5-year total NAV return is approximately 0, while its 10-year total NAV CAGR is approximately 1%. A big part of this has to do with difficulties in the fund’s broader sectors (hard currency and local emerging market debt), but some of it is clearly due to the fund’s lack of alpha.

Second, because the fund’s emerging market debt holdings are relatively high, successive forced deleveraging has caused the fund to sell low and buy high, damaging its NAV.

Third, the low circulation highlighted the fact that the high circulation rates were unfounded. Poor long-term total NAV returns, serial deleveraging and low distribution coverage eventually led the fund to cut distributions several times, lowering premiums and locking holders in permanent economic losses.

Another strange thing is that despite being almost identical funds, they tend to trade at very different valuations. This had to do with a very strange distribution where EDF’s NAV distribution rate was much higher than EDI’s distribution rate for no good reason. This has resulted in EDF consistently trading at a premium to EDI, sometimes as much as 25% higher than EDI.

systematic income

Apparently this was eventually completely corrected with the merger announcement, further punishing investors who thought they were getting higher returns.

Position and implications

The recent uptick in CEF performance has been nice to see, but we don’t chase rallies. That said, we continue to see value in funds such as the CLO equity-focused Carlyle Credit Income Fund (CCIF), credit and energy-focused PIMCO Dynamic Income Strategy Fund (PDX), and the Flaherty family of preferred CEFs (PFOs). there is. Valuation has soared to double digits. Once the Federal Reserve begins cutting policy rates, PFO and its sister funds should begin reversing previous distribution cuts.

Editor’s note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.