China accelerates rollout of policy support amid mixed data

never

by Lin Song

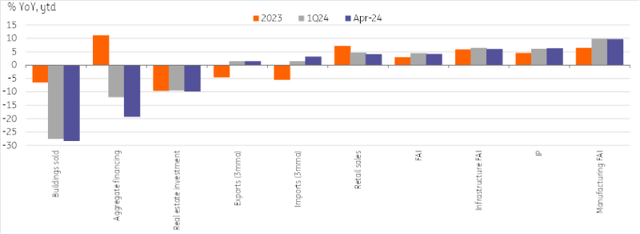

Weak self-confidence continued to hinder growth

China has had a mixed performance in terms of data releases over the past month, with most indicators underperforming market expectations.

This month’s key topic is Both the private sector and households are cautious. Credit data showed that gross financing fell for the first time since 2005 and M2 growth fell to a record low. After a strong 2023, credit contracted sharply in 2024. In our view, we believe real interest rates remain too high for the current state of the economy and the likelihood of monetary easing will increase in the coming months.

Consumers also remain cautious in retail sales, which hit a new post-pandemic low of 2.3% year-on-year. Consumers avoided expensive purchases in favor of the “eat, drink, play” category.

Fixed asset investment also showed disappointing results this month, falling 4.2% year-on-year due to sluggish private sector investment, which grew a meager 0.3% YoY. With real estate prices plummeting and developer sentiment hitting new lows in April, it’s no surprise that real estate investment maintained a large overhang at -9.8% YTD.

China’s high-tech transformation is hopeful

The silver lining may be the shift to high-tech developments that continue to drive strong growth.

One aspect of this transition can be seen in the recovery of industrial activity. Industrial production in April increased 6.7% compared to the same period last year, led by high-tech manufacturing (11.3%), electronic equipment such as computers and communications (15.6%), and automobiles (16.3%). Manufacturing PMI data for May gave conflicting signs of upcoming momentum, with the official PMI contracting noticeably to 49.5, while the Caixin PMI hit a seven-month high of 51.7. Both surveys indicated a slowdown in new orders.

Import volume also exceeded expectations, recording 8.4% YoY, as imports of automatic data processing equipment, integrated circuits, and advanced technology products increased due to increased AI-related demand. As China’s economic transformation continues, these sectors will continue to see relatively robust growth.

China’s growth imbalance this year

CEIC, ING

The drive to stabilize growth accelerated policy rollout.

The policy announcement swept China’s data dump day. Policymakers have stepped up support measures to stabilize the real estate market, and the central government has begun issuing 1 trillion yuan of ultra-long-term bonds.

New measures over the past month have included eliminating the mortgage interest rate floor, lowering down payment rates, eliminating purchase restrictions and announcing direct home purchases to help absorb excess inventory. Banks have continued to provide support to ailing property developers.

Increasing aggressiveness in policy support has supported markets over the past month, signaling greater commitment to stabilizing growth. There is growing optimism in the market that house prices in Tier 1 and 2 cities will bottom out in the coming months. This is arguably the most important step forward in stabilizing domestic trust, but it is also a first step and much more remains to be done. The third plenary session in July is expected to provide more details on long-term policy directions, with the goal of further deepening reforms and promoting China’s modernization. Xi said the meeting could include measures on property, employment and childcare support.

Content Disclaimer

This publication has been prepared by ING for information purposes only and without regard to the means, financial situation or investment objectives of any particular user. The information does not constitute an investment recommendation and does not constitute investment, legal or tax advice, or an offer or solicitation to buy or sell any financial product. read more

original post