China Emerges as Surprising Source of Bitcoin Demand

The following is an excerpt from the latest edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. Subscribe now to be the first to get these insights and other on-chain Bitcoin market analysis delivered to your inbox.

Last week I put into context the massive buying pressure coming to Bitcoin. But another (perhaps the biggest) source of potential demand is entering the field.

We already know that Bitcoin ETFs, MicroStrategy issuing more shares to buy more Bitcoin, and Tether’s continued purchases and halvings will be the main sources of demand this cycle. For example, in the first two weeks of trading alone, ‘Newborn9’ accumulated 125,000 BTC. So far, this has been offset by GBTC outflows, but it is unlikely that all GBTC holders will be exclusive sellers who will get out as quickly as possible. These outflows should begin to decline in the coming weeks.

Somewhat unexpected developments are occurring throughout China. Readers of my content here and at bitcoinandmarkets.com will be no stranger to what’s been happening in China over the past few years. They are experiencing the end of an economic model transition. China, we learned, was built on debt, producing goods for heavily indebted foreign customers. They are highly dependent on globalization and a highly resilient monetary environment. That era is coming to an end, and the collapse of the Chinese real estate market and now the stock market are visible signs of the end of that paradigm.

In ~ january On the 24th, China Asset Management Company (China AMC), a large Chinese fund manager and ETF provider, suspended trading in the Nasdaq 100 and S&P 500 ETFs to prevent flows of funds from other funds into U.S.-related funds. I did. On Tuesday, another US-linked ETF in the Chinese market opened its limits and was at a 21% premium to NAV. The flight to safety is also affecting China-based Japanese ETFs. On Tuesday, China AMC’s Nomura Nikkei 225 ETF rose more than 6% to a 22% premium.

Chinese investors are panicking and authorities are shutting down. It is only a matter of time before more Chinese investors start leveraging Bitcoin for value storage and portability. Many Chinese people are already familiar with Bitcoin. China was the dominant source of Bitcoin demand until the Chinese Communist Party (CCP) banned Bitcoin in 2021.

Although Bitcoin is officially banned in mainland China, investors can still use exchanges like Binance or OKX. You can also make purchases OTC, person-to-person, or through offshore bank accounts. Last year, Hong Kong very publicly opened up its support for Bitcoin. They are hot on the heels of US regulators officially approving Bitcoin in Hong Kong. It is unlikely that Hong Kong authorities will publicly push to legalize Bitcoin and then ban it next year.

This morning, Reuters confirmed this story of capital flight, citing a senior executive at a Hong Kong-based Bitcoin exchange. “Investing on the mainland is risky, uncertain and disappointing, so people are looking to allocate their assets overseas. (…) Almost every day we see mainland investors entering this market.”

The source added, “Chinese securities companies that are experiencing sluggish stock markets, sluggish demand for initial public offerings (IPOs), and other business contractions need a growth story to convey to shareholders and the board of directors.”

We have been talking about Bitcoin offering a parallel world of green sprouts and now it is being recognized everywhere.

Flows from China will be a huge source of demand this cycle, and the approval of a Bitcoin spot ETF in the US would create the perfect synergy by allowing sophisticated foreign investors to purchase Bitcoin and US-based assets simultaneously. .

The shaky European market cannot be left out. Europe is likely already in recession. By December, EU factory activity had contracted for 18 consecutive months. Germany has barely escaped a technical recession, despite its GDP being negative at -0.2% in 2023. In a world of capital flight and negative growth, Bitcoin’s relative attractiveness is very high. Many Bitcoin investors are concerned that a recession will cause the stock market to crash and cause Bitcoin to sell off like it did in March 2020, but the opposite may be true this time. Bitcoin’s unique blend of attributes of innovative technology, fixed-supply asset, and economic growth potential will become a place for capital to escape as investors realize that existing systems are stagnant and in decline.

Bitcoin price update

Bitcoin’s price performance since the launch of the ETF has been disappointing. However, the price has held up very well in the context of the FTX receivership selling $1 billion worth of GBTC and other large entities selling GBTC to convert to lower capital fees in new ETFs.

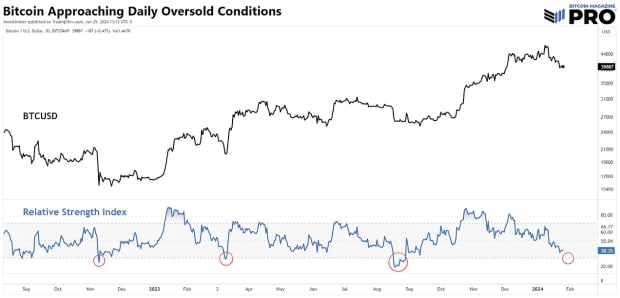

RSI is one of the most widely used indicators and therefore has a Schelling point effect. People and bots are watching the daily RSI reach oversold. Therefore, it is unlikely that the price will rise significantly until RSI breaks above 30. We’re already close to 30, so one more sale of support will get us there. A less likely possibility is that the price may form a hidden bullish divergence where it makes slightly higher lows but the RSI makes lower lows. We do not anticipate any significant declines due to the confluence of demand described above. We are in a temporary stalemate.

If you keep the daily chart below and zoom in, you can see that the 100 DMA is currently providing support. I am also observing the $37,877 level. Important prices starting in November. The decline that puts RSI in oversold condition may not end below that.

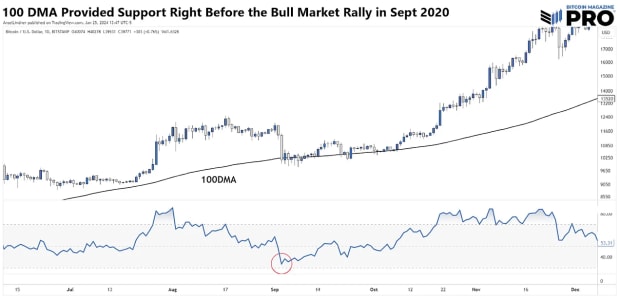

The 100-day period generally does not provide much support for Bitcoin, with the 50-day and 200-day moving averages being the most influential. However, below is September 2020, right before the monster bull rally to end the year. At that time, 100 days was the trend. It is possible to hold for 100 days and then rebound by temporarily stopping selling GBTC. Another interesting thing about that period in 2020 is that RSI caught many people off guard by reaching for the moon without any fear of being oversold. It’s not my base case, but it’s a priority.

In conclusion, we are seeing huge new sources of demand for Bitcoin from ETFs and now Chinese capital flight. Although the dynamics of the ETF launch were complex, prices remained relatively stable by all accounts. It’s only a matter of time before demand manifests itself in price.