China & Hong Kong Stock Picks (March 2025)

Right-wing media often talks about Trump Derangement Syndrome (TDS) making people do destructive things; but now we have Tariff Derangement Syndrome causing entire countries to do the same:

First of all, everyone knows Nike et al branded products being sold for hundreds of dollars probably only cost a few dollars to $30 to make in foreign sweatshops factories. I remember this being widely protested by activists at university campuses in the late 1990s before they moved onto to new things to protest.

However and IF true, I am surprised that luxury European brands are being made in China as, well, I just assumed they are made in France, Italy, Switzerland, etc. That’s why I consider them to be luxury and so expensive. So it seems like Tariff Derangement Syndrome is causing the Chinese to do the most damage to European luxury goods makers – NOT (overpriced…) American branded goods makers…

(Note: Perhaps traditional European, Japanese and American craftsmen who are not outsourcing production to China will be well positioned to fill the hole the Chinese are blowing in the luxury and branded goods markets…)

However, the Chinese revealing all the “secrets” seems to be a game of mutually assured destruction. While the Chinese can try to cut out ALL the middlemen (aka the brands, etc.) and go direct to foreign customer (Temu and Shein has done this to a lesser extent), foreign post offices and delivery services (UPS, Fedex, DHL, etc.) don’t have to deliver the goods (or can be told to not deliver by foreign governments or get slapped with tariffs).

And I doubt many foreign customers are going to visit China just to do some shopping (and then get hit by customs duties when they fly back home on their suitcases full of goodies…)…

As for the western companies making their branded or luxury goods in China, if seeing these videos does not convince them to get out now and find alternative places to make them, I don’t know what else will…

Meanwhile, ZeroHedge has this piece with a number of useful tables or slides concerning Chinese stocks with US or Hong Kong listings who could face delisting in the USA:

💻 “The Nuclear Option”: Here’s What Will Happen When Trump Orders Delisting Of Chinese Stocks (ZeroHedge) 🗃️

Last week, Charlie Gasparino started a firestorm rumor that as part of the US assault against China’s capital markets – all part of the ongoing trade war – the Trump admin would respond to Beijing’s sales of Treasuries by delisting Chinese stocks.

Again, this would be mutually destructive for all parties involved…

Finally, there are also a few recent podcast interviews worth highlighting starting with why China may not be ticking all of the boxes for Japanification from China-focused Asia economist (EastAsiaEcon.com):

🎥 Is China Falling Into Japanification? Here’s the Score (Paul Cave) 22:46 Minutes (March 2025)

… In this first video, I go through the seven demand-side factors. China is ticking some of these boxes, but not all of them, and there are only two where the parallels are particularly strong. In the next video I go through the second and third buckets, which is where the differentiation with China today is even bigger.

The quantification in the end is subjective. Nonetheless, with so many people wanting to compare China with Japan, it is useful to have some sort of framework. It also gives me more conviction to argue that China isn’t likely to be following the same path that Japan followed. That has direct relevance for investors. As an example, if China is different from Japan, then it is highly likely that the recent drop in interest rates in China has gone far enough.

0:00 – Introduction to Japanification I’m Paul Cavey from East Asia Econ, let me introduce the “Japanification” debate for China.

0:31 – Yields as Warning Signs Falling Chinese bond yields (1.5-1.6%) spark comparisons to Japan’s zero-rate era.

1:30 – Japan’s Stagnation vs. China’s Future How Japan’s post-1989 malaise raises questions about China’s trajectory.

2:19 – The Analyst Divide Why few experts bridge Japan and China, complicating the Japanification debate.

3:57 – Bank of Japan’s Checklist Using the BOJ’s report to score China’s Japanification risk, starting with demand.

5:37 – Demand-Side Breakdown Introducing 7 demand-side factors to compare China and Japan.

7:22 – 1. Asset Markets Collapse (2/2) China’s property crash mirrors Japan’s bubble burst in impact.

9:28 – 2. Financial System Instability (1/2) Bank pressures exist in China, but lending hasn’t tightened like Japan’s did.

11:56 – 3. Firms Stop Investing (1/2) Real estate credit crunched, but manufacturing investment surges in China.

14:15 – 4. Companies Become Savers (0/2) Unlike Japan, China’s firms keep borrowing, not saving.

15:38 – 5. Productivity Declines (0/2) China’s R&D and investment defy Japan’s productivity slump.

18:07 – 6. Slow to Adapt to Globalization/IT (0/2) China thrives in tech and exports, unlike Japan’s 1990s lag.

19:44 – 7. Demographics (2/2) China’s aging crisis echoes—and may exceed—Japan’s.

21:19 – Summary: 6/14 Demand Score China scores 6/14 on demand-side Japanification risks.

22:15 – Next Up: Supply Side Teaser for the next video on supply-side and idiosyncratic factors.

🎥 8 Supply-Side Factors Proving China Isn’t Like Japan In The 90’s (Paul Cave) 17:54 Minutes (March 2025)

… Overall Assessment and Implications: Wrapping up, I score China at just 30% similarity to Japan’s 1990s woes across 15 factors. While China has its challenges—like property and consumption, I don’t see it heading for Japan’s no-growth fate. For markets, I think this means China’s interest rates may have bottomed out, unlike Japan’s endless decline. Subscribe for more of my regional economic insights Visit EastAsiaEcon.com to download the data and charts I reference here!

Chapters:

00:00 – Introduction by Paul Cavey from East Asia Econ

00:15 – Comparing China Today to Japan in the 1990s

00:54 – Recap of Demand Side Issues from Previous Video

01:22 – Introduction to Supply Side and Idiosyncratic Issues

01:43 – Scorecard #1: Currency Appreciation (Japan vs. China)

04:10 – Scorecard #2: Offshoring and Global Market Share

05:44 – Scorecard #3: Import Competition

06:59 – Scorecard #4: Supply-Side Driven Fall in Prices

08:25 – Introduction to Idiosyncratic Cultural/Institutional Factors

08:46 – Scorecard #5: Expensive vs. Cheap Economies

10:26 – Scorecard #6: Labour Market Regulation

12:47 – Scorecard #7: Preference for Employment Over Wages

14:32 – Scorecard #8: Falling Wages and Deflationary Equilibrium

15:54 – Overall China Japanification Score (30% Similarity)

16:39 – China’s Economic Challenges vs. Japan’s Stagnation

17:23 – Market Implications and Interest Rates

17:34 – Closing Remarks and Subscription Call

Alexander Stahel though is more bearish about China:

🎥 Is China’s Economy a House of Cards? | With Alexander Stahel (Maggie Lake Talking Markets) 50:10 Minutes (March 2025)

We’ve heard a lot about the compelling bull case for China recently on Talking Markets… but our job here is to bring you the smartest, most nuanced takes from both “sides.” In this special Talking Markets episode, Maggie Lake chats with Alexander Stahel, founder, chairman, and CIO at Burggraben Holding AG, and author of The Commodity Compass Substack, about the China bear case. Up for discussion: the troubled real estate market and what it might do to the commodities complex, why Alex believes China is in “a balance sheet recession,” why the official debt figures may be significantly lower than reality, and a ton more. Recorded: March 4, 2025

01:03 – Introduction: Maggie Lake & Alexander Stahel

01:31 – The West’s Misunderstanding of China’s Economy

03:07 – Xi Jinping’s Economic Vision: More Control, Less Growth

05:50 – The End of Free Market Aspirations in China

07:04 – Is China’s Economy Strong or on the Brink?

13:29 – China’s Real Estate Ponzi Scheme Exposed

19:31 – How China’s Real Estate Collapse Will Impact the World

22:48 – The Myth of China “Working Through” Its Debt Crisis

30:00 – China’s True Debt Levels: What Investors Miss

33:49 – Is China Entering a Deflationary Death Spiral?

36:00 – How China’s Economic Struggles Could Impact Global Growth

40:16 – Trump, Tariffs, & The Future of US-China Trade

44:21 – Copper, Oil, & The Future of Chinese Demand

46:38 – The Death of the Chinese Economic Miracle

49:04 – Final Thoughts & Where to Follow the Discussion

Stocks covered by a couple of equity research providers in the rest of this post:

(Note: On desktop browsers, an autogenerated table of contents will appear on the left side linked to each stock. I will add those links below after publishing/emailing this post…)

Li Ning, InnoCare Pharma, Carote Ltd, DPC Dash, Innovent Biologics, EHang Holdings, Guangzhou Automobile Group, Great Wall Motor, Sinotruk Hong Kong Ltd, Xunfei Healthcare Technology, China Resources Mixc Lifestyle Services, China Yongda Automobile Services Holding, Maoyan Entertainment, China Life Insurance, BOE Varitronix, Giant Biogene Holding, Weichai Power, Haidilao International Holding, Atour Lifestyle Holdings, Wuxi Biologics, Nongfu Spring, 3SBio Inc, SenseTime, China MeiDong Auto Holdings, Shenzhen Dobot Corp Ltd, BYD Electronic International Co Ltd, Zoomlion Heavy Industry, China Taiping Insurance Holdings, Jinmao Property Services, Sichuan Kelun-Biotech Biopharmaceutical, Sunny Optical, Kuaishou Technology, Minth Group, BYD Company, Xiaomi, CR Beverage, BaTeLab Co Ltd, ZhongAn Online P & C Insurance Co, Ping An Insurance, Hansoh Pharmaceutical Group Company, Baozun, CGN Mining, Meituan, NIO Inc, VSTECS Holdings Ltd, China Lilang Ltd, Aac Technologies Holdings, Geely Automobile Holdings, PDD Holdings, Tongcheng Travel Holdings, Tuhu Car, Hutchmed, Nexteer Automotive Group Ltd, ANTA Sports Products, Shanghai INT Medical Instruments, Dmall Inc, Tencent, ZTO Express, Xtep, WuXi AppTec Co, KE Holdings, Kingdee International Software Group, XPeng, Tencent Music Entertainment Group, TK Group Holdings, China Hongqiao Group, Haitian International Holdings, XtalPi Holdings, AIA Group, China Tower Corp, Q Technology (Group) Company, Topsports, Li Auto, Shennan Circuits, Foxconn Interconnect Technology, Weibo Corp, 361 Degrees International Limited, Zhejiang Leapmotor Technology, JD.com & BeiGene

Hong Kong stocks:

(Note: Access to some DBS Insights Direct pieces might be restricted depending on your location or browser.)

Wing Tai Properties Ltd, BOC Hong Kong Holdings, China Overseas Land & Investment Ltd, Prudential PLC, China Overseas Grand Oceans Group Ltd, K. Wah International Holdings Ltd, Nissin Foods Co Ltd, Link Real Estate Investment Trust, Kerry Properties, WH Group Ltd, ESR Group, DFI Retail Group Holdings Ltd, Prosperity Real Estate Investment Trust, Henderson Land Development Co Ltd, Stella International Holdings, CK Asset Holdings Ltd, HK Electric Investments Ltd, Swire Properties Ltd, SF Real Estate Investment Trust, Far East Horizon Ltd, Sunlight Real Estate Investment Trust, Samsonite International SA, Cathay Pacific Airways Ltd, Wharf Real Estate Investment Company Ltd, Henderson Land Development Co Ltd, Hongkong Land Holdings Ltd, MTR Corp Ltd, Hutchison Port Holdings Trust & United Energy Group

CMB International Capital Corporation, a wholly owned subsidiary of China Merchants Bank (SHA: 600036 / HKG: 3968 / OTCMKTS: CIHKY / OTCMKTS: CIHHF), has a monthly list of 20+ high conviction stock ideas – namely Chinese stock picks (see our 2023 – May, June, July, August, September, October, November & December; 2024 – January-February, March, April, May, June, July-August, September, October, November & December; 2025 – January & February posts summarizing those) BUT these lists do not change too much from month to month. Stocks covered by the CMBI February 2025 list (including additions and deletions) and included in this post with updated stats and charts include:

Trip.com, Geely Automobile Holdings, XPeng, Zoomlion Heavy Industry, China Hongqiao Group, ANTA Sports Products, Luckin Coffee, Yum China, Proya Cosmetics, China Resources Beverage Holdings (CR Beverage), BeiGene, WuXi AppTec Co, China Pacific Insurance (Group) Co, PICC Property and Casualty Co Ltd, Tencent, NetEase, Alibaba, Greentown Service Group Co, Xiaomi, Foxconn Interconnect Technology (FIT Hon Teng), BYD Electronic International Co Ltd, Will Semiconductor Co Ltd, NAURA Technology Group & Zhongji Innolight Co Ltd

And as always, this post is provided for informational purposes only (and to make your life easier…). It does not constitute investment advice and/or a recommendation…

🔬 Research analysis (including articles/blog posts from fund managers, etc.); 🎥 Video; 🎙️ Podcast; 🎬 Webinar; 📰 Newspaper/magazine article; 📯 Press release; 💻 Substack/blog/website article; ✅ Our own posts; 🗃️ Archived article; ⏰ Upcoming webinar or event; ⚠️ Disclosures or restricted access e.g. based on your location, investor status, etc.; 🇼 Wikipedia page; 🏷️ Tagged links to other posts about the stock.

🔬Li Ning (2331 HK) – Conservative guidance but quite expected (CMB International) 03-31-2025 ⚠️

-

🌐 Li Ning (HKG: 2331 / FRA: LNLB / LNL / OTCMKTS: LNNGY / LNNGF) 🇰🇾 – Founded by former Olympic gymnast Li Ning. Professional & leisure footwear, apparel, equipment & accessories. 🇼 🏷️

-

Price/Book (Current): 1.40

-

Forward P/E: 13.07 / Forward Annual Dividend Yield: 5.56% (Yahoo! Finance)

🔬 InnoCare Pharma (9969 HK) – Orelabrutinib-led growth with strategic pipeline advancements in oncology and autoimmune (CMB International) 03-31-2025 ⚠️

-

🌐 InnoCare Pharma (SHA: 688428 / HKG: 9969 / FRA: 33C / OTCMKTS: INCPF) 🇰🇾 – Commercial stage biopharmaceutical company. Treatment of cancers & autoimmune diseases. 🏷️

-

Price/Book (Current): 2.55

-

Forward P/E: N/A / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

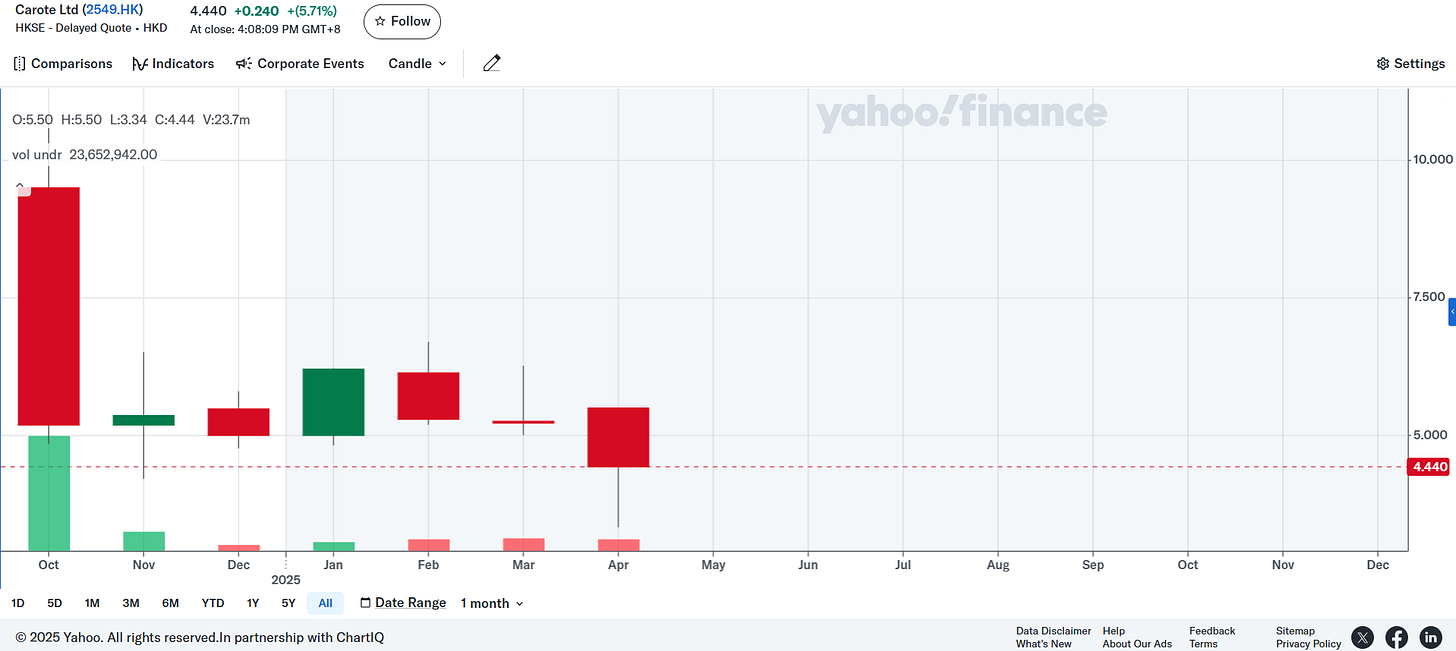

🔬 Carote Ltd (2549 HK) – Still subject to numerous macro risks (CMB International) 03-31-2025 ⚠️

-

🌐 Carote Ltd (HKG: 2549) 🇰🇾 – Carote Cookware maker & other kitchenware products. 🏷️

-

Price/Book (Current): 1.74

-

Forward P/E: 6.58 / Forward Annual Dividend Yield: 3.35% (Yahoo! Finance)

🔬 DPC Dash (1405 HK) – Long-term story intact but let’s just play safe (CMB International) 03-31-2025 ⚠️

-

🇨🇳 DPC Dash (HKG: 1405 / FRA: X12 / OTCMKTS: DPCDF) 🇻🇬 – Domino’s Pizza’s exclusive master franchisee in China, Hong Kong & Macau. 🏷️

-

Price/Book (Current): 5.44

-

Forward P/E: 116.28 / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

🔬 Innovent Biologics (1801 HK) – Entering sustainable profitability with a global innovation engine (CMB International) 03-31-2025 ⚠️

-

🌐 Innovent Biologics (HKG: 1801 / FRA: 6IB / OTCMKTS: IVBXF / IVBIY) 🇰🇾 – R&D, CMC (Chemistry, Manufacturing & Controls), clinical development and commercialization capabilities. Oncology, metabolic disease, immunology & other major therapeutic areas. 🏷️

-

Price/Book (Current): 6.00

-

Forward P/E: 178.57 / Forward Annual Dividend Yield: N/A (Yahoo! Finance)