Cleveland Cliffs Enhances Shareholder Value (NYSE:CLF)

Slobodan Miljevic

Cleveland-Cliffs (New York Stock Exchange: CLF) delivered an outstanding FY23 with excellent guidance for eFY24. Despite driving flat production in eFY24, I believe the company will experience strong tailwinds as it continues to eliminate costs and improve its hydrogen-reduced steel manufacturing process. Maintain previous recommendations. A Buy recommendation is placed on CLF, with a target price of $27.65 per share.

US Steel (X) Merger Update

CLF/USS Logo

The deal isn’t over until it’s over. What this means is that Nippon ( OTCPK:NISTF ) and U.S. Steel are still awaiting antitrust approval before the deal can be finalized. CEO Lourenco Goncalves and CFO Celso Goncalves were adamant that the deal was likely to fail as foreign buyers attempted a third acquisition.rd The country’s largest producer in terms of production volume is 15.5 mm tons, followed by Nucor (23 mm tons) and Cleveland Cliffs (16.4 mm tons). what i believe What Mr. Goncalves was alluding to was Japanese steel market, especially Nippon, which has historically dumped steel into the market, and by inviting foreign companies into the domestic system, U.S. Steel could potentially avoid U.S. tariffs by dumping steel into the market under Nippon. If so, I believe this could potentially lead to risky business practices that could result in major disadvantages for domestic steel producers, leading to a poor business environment or potentially bankruptcies and forced mergers. Although this is my view from the outside, such anti-competitive behavior cannot be ignored, no matter how unlikely it is. If this happens, I believe it will be similar to other market crashes where we only know about it in hindsight and it is too late to take action.

This is just speculation on my part and should be taken with a grain of salt, but I believe that if the US Steel and Nippon deal falters under US antitrust laws, the offer Cleveland Cliffs brings to the table will be slightly diminished as a result. .

“That deal is no longer possible and is no longer a backup against failure. “If they can’t close – I don’t know where they are now – the offer is gone and no longer exists.”

Lorenco Goncalves CEO

Listening to the Q4 2023 earnings call, it was clear that management’s attitude toward the transaction was that not only did they believe their proposal was the strongest and that the U.S. Steel & Cleveland Cliffs merger should pass, but they also firmly believed that this merger was the one. He had the support of the USW union, emphasizing that the union would have significant influence in determining the outcome of the merger. Following the earnings release, JP Morgan suspended coverage ratings for both Cleveland Cliffs and U.S. Steel, potentially implying that a merger between the two companies is still on the table and potentially more likely to occur.

operate

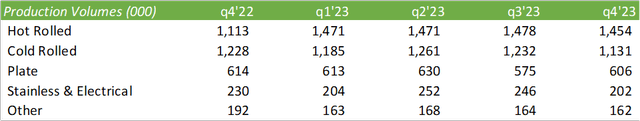

Steel shipments from Cleveland Cliffs reached a new record high of 16.4 mm tonnes in FY23. So Cleveland Cliffs saw no slowdown in auto sales due to the UAW strike in late 3Q23/early 4Q23, and increased service center steel sales as service centers looked to replenish inventory. As we have known since Q3 ’23, steel purchases have been slowed due to the strike as service centers anticipate building up inventory. As a result, steel prices rose and steel inventories were replenished at higher prices.

corporate report

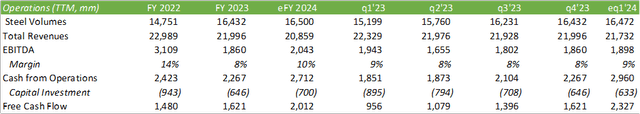

Management focused on improving margins, resulting in total cost savings of $80 per ton of steel at an annual operating rate of $1.3 billion. Management anticipates savings of an additional $30 per net ton throughout 2024 as a result of coal and alloy supply contract negotiations, reduced natural gas hedging, and scale-based economies. These cost savings amount to approximately $500 million in additional EBITDA.

corporate report

Capex in FY24 is expected to remain in the range of $675 million to $725 million, slightly up from FY23. I expect Cleveland Cliffs to experience some margin expansion through cost-cutting measures and, as a result, additional strength in free cash flow. Although we expect revenue to be slightly lower compared to FY23, we expect the company to be able to generate stronger cash flow once cost-cutting measures are implemented. The company saw a slight improvement in its working capital balance, with cash conversion reduced from 83 days to 72 days, a result of lower days payable and inventory levels. With few headwinds expected in 2024, the company should be able to generate significant free cash flow, ~50% of which would be allocated to debt repayment and the remainder to share buybacks. Overall, I believe this will be a positive indicator for shareholders as management has successfully managed its debt load in the prior quarters.

I believe Cleveland Cliffs will experience significant pricing opportunities as Cliffs H2 as it pursues decarbonization of its steel manufacturing process. Hydrogen hubs are slowly emerging and could have a stronger presence in the late 2010s. With DOE’s $7 billion in development funding, I believe the availability of hydrogen will become an increasingly important source of electricity and, in the case of the Cleveland Cliffs, an oxygen reducer. Management identified that Cliffs H has been adopted by all automotive customers and has allowed the company to maintain industry steel prices at a stable pace during eFY24. Management has hinted at significantly higher surcharges for Cliffs H2 if it can be deployed. Mr. Goncalves noted in his fourth quarter 2023 earnings call that $10 million has been deployed to build a hydrogen pipeline that will connect to a hydrogen hub under construction in Indiana with funding from the DOE. The pipeline is therefore being prepared with the start of trials with promising results from the second furnace.

debt

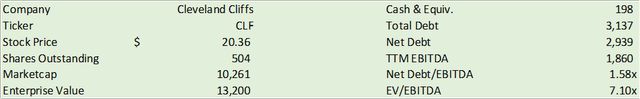

Cleveland Cliffs recently shifted its focus from a capital raise that leverages most of its free cash flow to a focus on stock buybacks. Additionally, the company had funded all outstanding debt under its ABL credit facility as of December 31, 2023 and ended the year with net debt of $2.9 billion. liquidity.

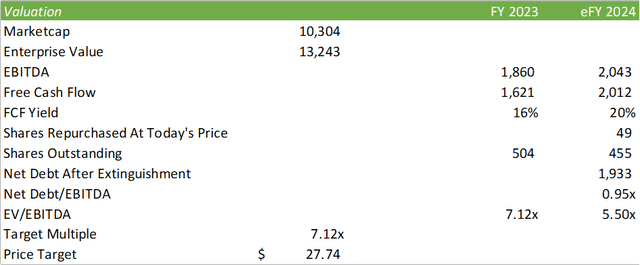

Assuming Cleveland Cliffs utilizes its full 50% free cash flow allocation for debt reduction, net debt in eFY24 would be KRW 1.9 billion for a net debt/EBITDA ratio of 0.95x, assuming the company does not take on additional debt. I expect it to be dollars. . Cleveland Cliffs doesn’t mature until 2026, giving management the flexibility to repay more expensive bonds on its books.

Valuation and shareholder value

corporate report

CLF has an enterprise value of $13 billion and trades at 7.10x EV/EBITDA. We expect the stock to improve significantly going forward as management moves forward with its ~50/50 capital allocation plan for 2024 to reduce debt and buy back shares. Assuming all free cash flow is allocated, we believe Cleveland Cliffs could repurchase 49mm of shares in eFY24 and reduce net debt to $1.9bn, creating a significant tailwind for the company’s valuation.

Cleveland Cliffs repurchased $152 million of outstanding shares during FY23, reducing its total share count by 10.4 million. Management discussed that it will reallocate free cash flow from 85% starting in the first quarter of 2024 to reduce debt to 50/50 for debt reduction and share repurchases. The initial reaction from shareholders appears to have been positive for the stock price following the results. However, the stock price has remained relatively flat since then as management drove flat production growth in eFY24.

As shown below, assuming the same trading multiple of 7.10 EV/EBITDA through share buybacks and debt reduction, we can conclude a target price of $24 per share.

corporate report

I believe this stock price is very achievable, and given the prospect of a hydrogen surcharge, I believe Cleveland Cliffs will experience significant growth as its steel continues to differentiate itself from the commoditized products produced by competing mills. I give CLF a Buy recommendation with a price target of $27.65 per share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.