CMBI Research China and Hong Kong Stock Recommendations (March 2024)

CMB International Capital Corporation It is a wholly owned subsidiary of . China Merchants Bank (Hong Kong: 3968 /shaman: 600036 /OTCMKTS: chicky /OTCMKTS: CIHHF) – one of China’s largest banking groups and the largest privately owned bank. They consistently release free research pieces and post them on their website. china and Hong Kong Stock Recommendations (our first chapter To see the full list tag for us EM Stock Pick Tear Sheet)

Stocks covered this month March This post includes:

SANY International, BYD Electronic International, ZhongAn Online P&C Insurance Co, New Hope Service Holdings, DPC Dash, WuXi Biologics, BYD Company, AK Medical, Ping An, Weichai Power, Sichuan Kelun-Biotech Biopharmaceutical, Zhihu Inc, SenseTime, China Yongda Automobile Services Holding, BOE Varitronix, Glodon, Jiumaojiu International Holdings, FIT Hon Teng, Shanghai Henlius Biotech, Aac Technologies Holdings, Baozun, Greentown Management Holdings Company, Zhejiang Dingli Machinery, J&T Global Express Ltd, Geely Automobile Holdings, Pinduoduo, Tencent, ZTO Express, China Lilang Ltd, Akeso, WuXi AppTec, Kingdee International Software Group, Xiaomi Corp, Tencent Music Entertainment Group, XPeng, Tongcheng Travel Holdings, JOYY Inc, Shanghai INT Medical Instruments, Xtep, GigaCloud Technology, Shennan Circuits, AIA Group, Tuhu Car, Mobvista, Weibo Corp, Ke Holdings, 361 Degrees International, Horizon Construction Development, Intron Technology, ZTE, Bilibili, Prada SpA, JD.com, Yuexiu Transport Infrastructure, NIO Inc, Cloud Music, Hutchmed, Budweiser APAC and NetEase

They also put out monthly lists (and post them on their website). 20+ High Conviction Stock Ideas – i.e. Chinese stock recommendations (our In May, June, July, August, September, October, November, december & January – February A post summarizing this) However, this list doesn’t change much from month to month. Stocks Covered by CMBI March Here’s the list (including additions and deletions) and what’s included in this post, along with updated stats and charts:

Li Auto, Geely Automobile, Weichai Power, Zhejiang Dingli, CR Power, CR Gas, DPC Dash, JNBY, JS Global, Vesync, Kweichow Moutai, BeiGene, PICC P&C, Tencent, Alibaba, Pinduoduo, Amazon.com, Netflix, Kuaishou, GigaCloud, CR Land, FIT Hon Teng, BYDE, Luxshare, Innolight & Kingdee

As recently discussed post Investors who cover Korean stocks and are introduced in the book Warren Buffett Next Door: The World’s Best Investor You’ve Never Heard Ofi include Price/Book (most recent quarter) Yahoo! Financial statistics page in the post.

Some Chinese stocks in this post include: Price/Book Ratio Less than 1.00 – indicates (on the surface…) that it is or could be undervalued. Other stocks, including Chinese tech and EV stocks, have ratios not much higher than 1 (in sharp contrast to Tesla’s 8.73, etc.).

As previously discussed:

Strategy Tips

Rees has a warning for investors: Don’t confuse his tangible asset value with the book value figures commonly quoted on dozens of websites.include yahoo finance. Book value can be inflated by intangible assets such as goodwill or old inventory. “The book value is so unstable and soggy.” Reese says:

Nonetheless, these are quick and dirty statistics that can help you decide whether a stock is worth further investigation and perform some of the more complex tangible equity calculations performed by the investors featured in the book.

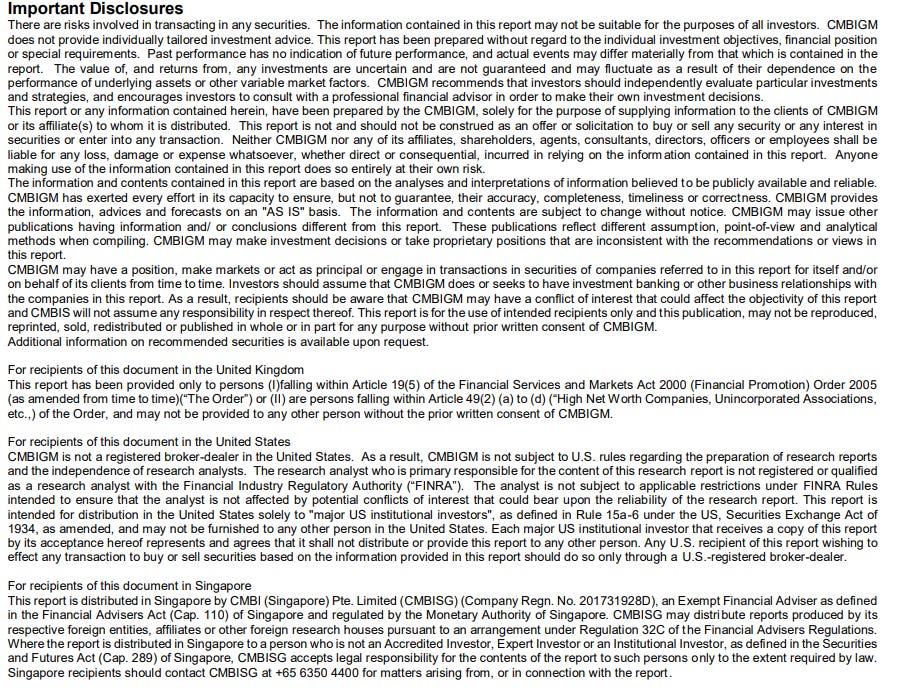

When you click on the CMBI website, you will see the following message: No pop-ups They ask me what type of investor I am or where I am located. However, at the end of each research report there is a disclaimer that readers should be aware of:

This post is no You must quote directly from the research paper itself (beyond giving a title to the linked research paper – keeping the disclosures above in mind).

To make your life easier, this post includes:

-

A title containing the stock name.

-

IR page link and Yahoo! This is a brief explanation of stock prices. Jae Won.

-

Link to Wikipedia page (for what it’s worth…)

-

This is the title of the report linked to the files page on the CMBI website regarding stock selection.

-

It is the price/book value (most recent quarter) ratio plus the forward or trailing P/E plus the dividend yield tied back to Yahoo! This is a financial statistics page.

-

The latest long-term technical chart resources linked back to Yahoo!

And as always, this post Provided for informational purposes only (And to make your life easier…). This does not constitute investment advice and/or recommendations…

SANY International or Sany Heavy Equipment International Holdings Company Limited (Hong Kong: 0631 / at: YXS /OTCMKTS: SNYYF) It is an investment holding company engaged in the manufacture and sale of mining equipment, logistics equipment, robots, smart mining products and spare parts. It operates in two divisions, mining equipment and logistics equipment. The company offers coal mining machinery products such as load headers including soft and hard rock load headers, integrated drilling, bolting and self-protecting machines. Mining equipment consisting of coal mining machines, hydraulic support systems, scrapers and armored surface conveyors, etc.; Non-coal mining machinery products consisting of tunnel road headers and mining machinery; Mining transportation equipment, including mechanical and electrically driven off-highway dump trucks, wide body vehicles and other related products. It also provides smart mining productsUnmanned operation, automated integrated mining, smart mine operation system, etc.; Container equipment consisting of front loaders, stacking machines, dock gantry cranes, etc.; Bulk material equipment consisting of grippers, lifting arms, etc.; General equipment including heavy forklifts, telehandlers, etc.; These include robotic system integration, mobile robots, electric forklifts, etc. The company also provides maintenance and other services and real estate development services. We operate in mainland China, the rest of Asia, the European Union, the United States and internationally.

BYD Electronics International Ltd. (Hong Kong: 0285) is the world’s leading intelligent product solutions provider, providing customers with new material R&D, product R&D, intelligent manufacturing, supply chain management, logistics and after-sales service. Ahead of the commercialization of 5G technology, BYD Electronics closely tracks market demand and industry hotspots, accelerates business transformation and upgrading, and develops four business areas: smartphones and NB PCs, new intelligent products, automotive intelligent systems, and medical devices. International large-scale automated production lines covering molding, metal, plastic, 3D glass, ceramic manufacturing and electronic intelligent manufacturing.

Jong-an (Hong Kong: 6060 / at: 1ZO) silver The first online-only insurance company In China. Headquartered in Shanghai and supported by the dual engine of “Insurance + Technology”, ZhongAn Online P&C Insurance Co., Ltd. features a branchless model and uses leading technology to reform the insurance value chain. They primarily operate in the health, digital lifestyle, consumer finance and automotive ecosystems, providing personalized and customized intelligent insurance products and risk management solutions.

As of the end of 2021, we served more than 5 million customers and issued a total of approximately 42.7 billion insurance products.

We are leveraging technology to innovate our own insurance business while exporting mature technological solutions and proven business models to the domestic and international insurance industry. In November 2016, we established a subsidiary, ZhongAn Information and Technology Services Co., Ltd. (ZhongAn Technology), with the goal of helping global partners pursue digital transformation. To date, ZhongAn has collaborated with more than 600 customers around the world on digital transformation. Major overseas customers include Sompo Japan Nipponkoa Insurance Inc., a Japanese non-life insurance company, Grab, a leading O2O platform in Southeast Asia, and NTUC Income, a Singaporean composite insurance company.